This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5500-EZ

for the current year.

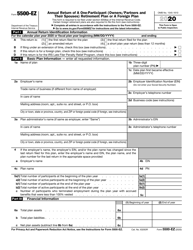

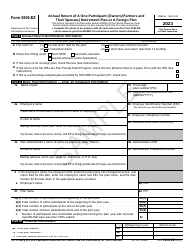

Instructions for IRS Form 5500-EZ Annual Return of a One-Participant (Owners / Partners and Their Spouses) Retirement Plan or a Foreign Plan

This document contains official instructions for IRS Form 5500-EZ , Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or a Foreign Plan - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5500-EZ is available for download through this link.

FAQ

Q: What is IRS Form 5500-EZ?

A: IRS Form 5500-EZ is an annual return form for one-participant retirement plans or foreign plans.

Q: Who needs to file IRS Form 5500-EZ?

A: Owners/partners and their spouses who participate in a one-participant retirement plan or a foreign plan need to file IRS Form 5500-EZ.

Q: What is the purpose of filing IRS Form 5500-EZ?

A: The purpose of filing IRS Form 5500-EZ is to report information about the plan's financial activities and ensure compliance with tax regulations.

Q: Are there any exceptions to filing IRS Form 5500-EZ?

A: Yes, if the plan's assets are $250,000 or less at the end of the plan year, the plan is exempt from filing IRS Form 5500-EZ.

Q: What information is required to be reported on IRS Form 5500-EZ?

A: IRS Form 5500-EZ requires information such as plan sponsor details, plan assets and liabilities, contributions, distributions, and any other pertinent financial information.

Q: When is IRS Form 5500-EZ due?

A: IRS Form 5500-EZ is generally due by July 31st of the year following the plan year, unless an extension is granted.

Q: What are the consequences of not filing IRS Form 5500-EZ?

A: Failure to file IRS Form 5500-EZ or filing it late can result in penalties imposed by the IRS.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.