This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8863

for the current year.

Instructions for IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits)

This document contains official instructions for IRS Form 8863 , Education Credits (American Opportunity and Lifetime Learning Credits) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8863 is available for download through this link.

FAQ

Q: What is IRS Form 8863?

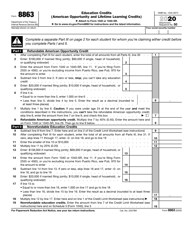

A: IRS Form 8863 is the form used to claim education credits, such as the American Opportunity Credit or the Lifetime Learning Credit.

Q: What are education credits?

A: Education credits are tax credits that can help offset the cost of higher education expenses.

Q: What is the American Opportunity Credit?

A: The American Opportunity Credit is a tax credit that can be claimed for qualified education expenses for the first four years of post-secondary education.

Q: What is the Lifetime Learning Credit?

A: The Lifetime Learning Credit is a tax credit that can be claimed for qualified education expenses beyond the first four years of post-secondary education.

Q: Who is eligible to claim education credits?

A: Eligibility for education credits depends on various factors, such as income, educational expenses, and enrollment status.

Q: How do I fill out IRS Form 8863?

A: You should follow the instructions provided on the form and provide accurate information about your education expenses and any eligible dependents.

Q: When is the deadline to file IRS Form 8863?

A: The deadline to file IRS Form 8863 usually aligns with the regular tax-filing deadline, which is typically April 15th.

Q: What should I do if I have questions about IRS Form 8863?

A: If you have specific questions about IRS Form 8863 or need assistance, you can contact the IRS directly or consult a tax professional.

Q: Can I claim both the American Opportunity Credit and the Lifetime Learning Credit?

A: No, you can only claim one education credit per student per year.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.