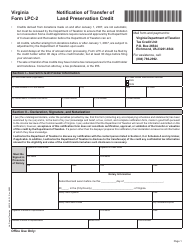

This version of the form is not currently in use and is provided for reference only. Download this version of

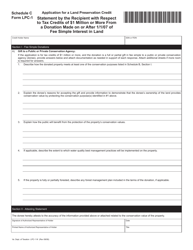

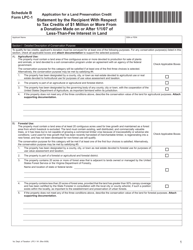

Instructions for Form LPC-1

for the current year.

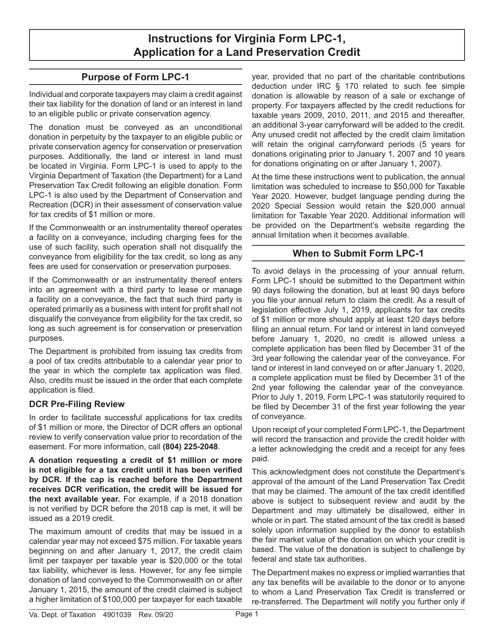

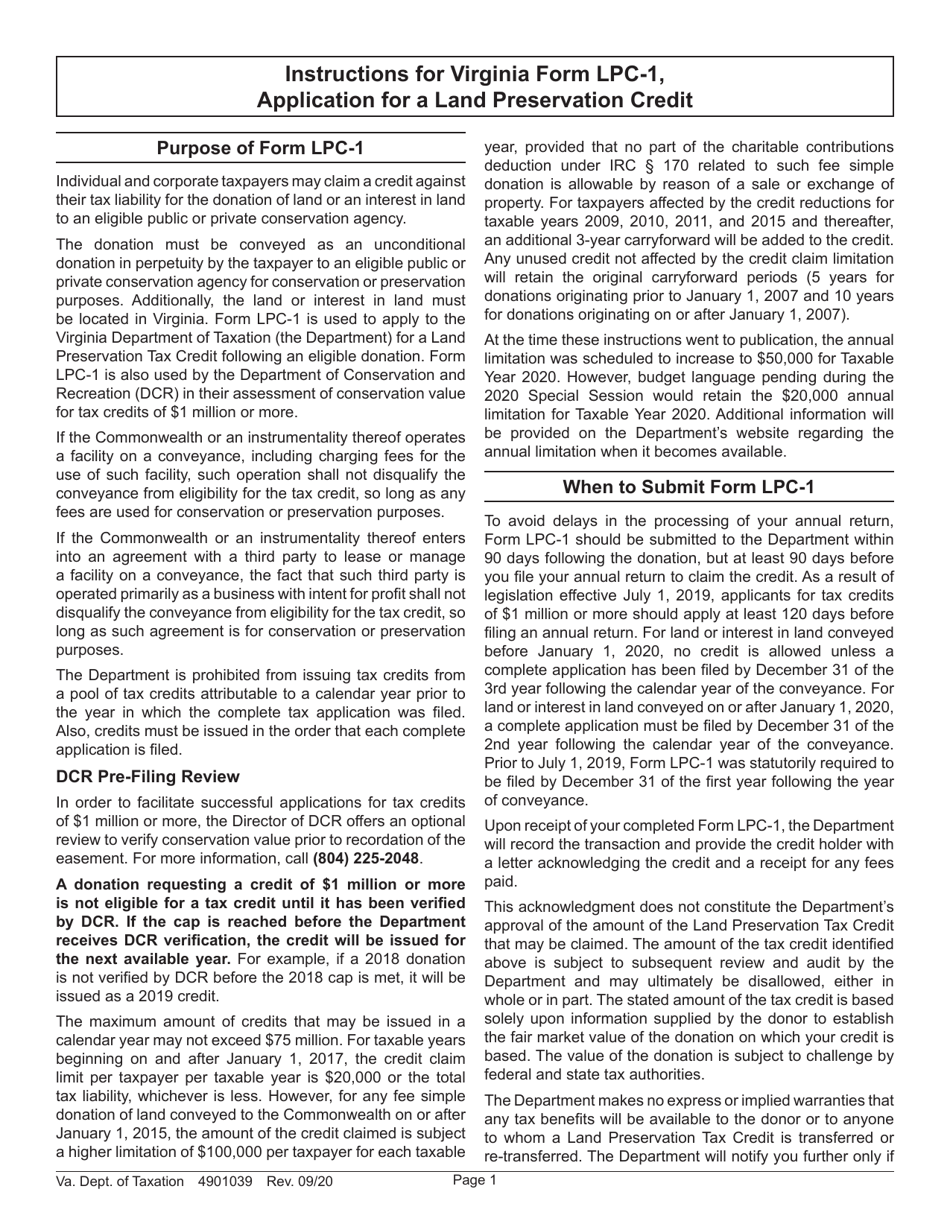

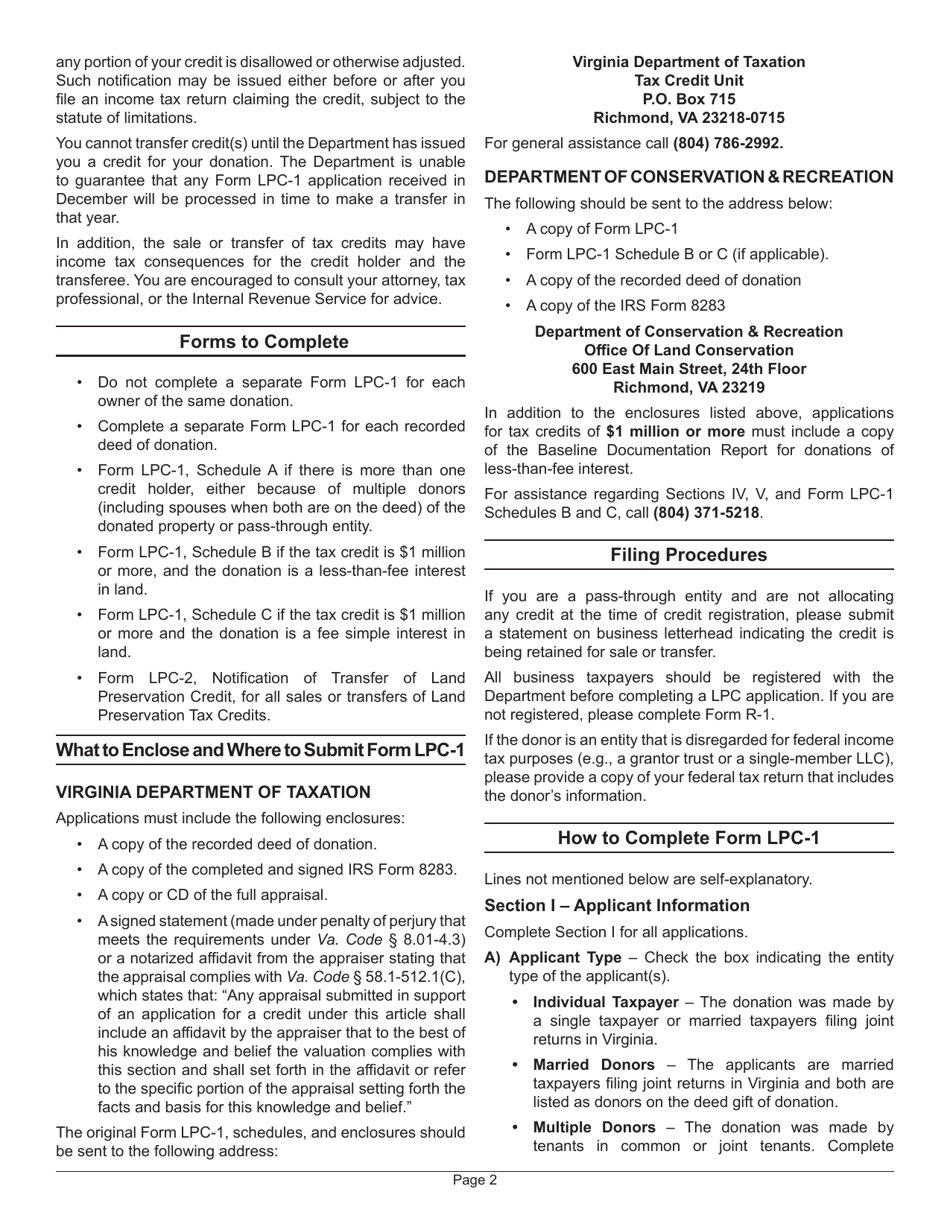

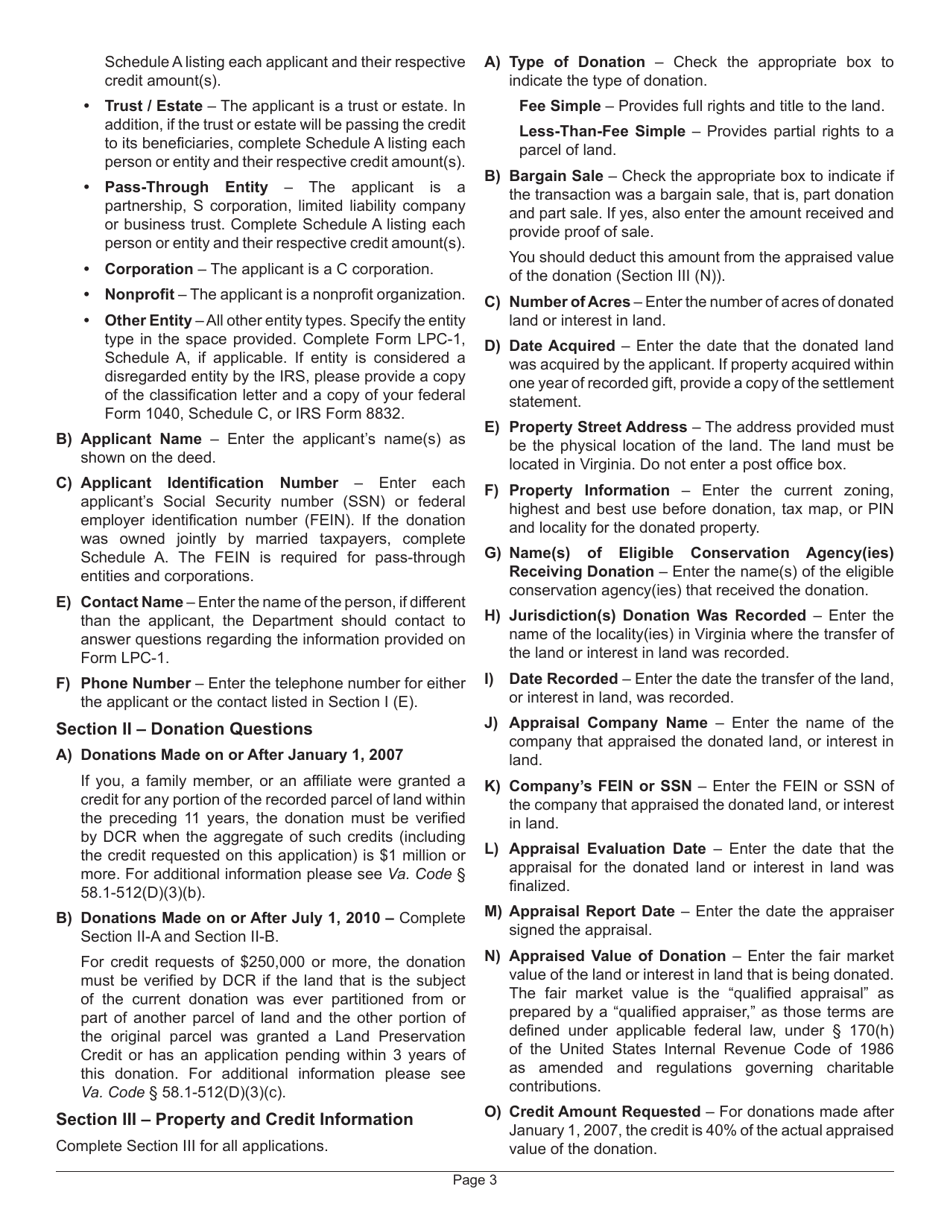

Instructions for Form LPC-1 Application for a Land Preservation Credit - Virginia

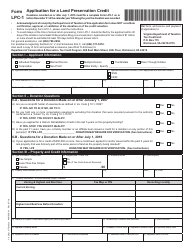

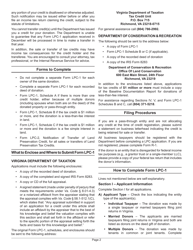

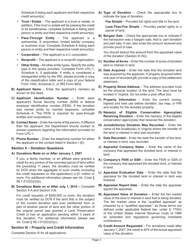

This document contains official instructions for Form LPC-1 , Application for a Land Preservation Credit - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form LPC-1 is available for download through this link.

FAQ

Q: What is Form LPC-1?

A: Form LPC-1 is an application for a Land Preservation Credit in Virginia.

Q: What is the purpose of Form LPC-1?

A: The purpose of Form LPC-1 is to apply for a Land Preservation Credit in Virginia.

Q: What information do I need to provide on Form LPC-1?

A: You need to provide information about the property, including its location, acreage, and conservation easement details.

Q: Are there any fees associated with submitting Form LPC-1?

A: Yes, there is an application fee that must be submitted with Form LPC-1.

Q: How long does it take to process a Form LPC-1 application?

A: The processing time for a Form LPC-1 application can vary, but it typically takes several weeks.

Q: What is a Land Preservation Credit?

A: A Land Preservation Credit is a tax credit offered to property owners who voluntarily place their land under permanent conservation easements to protect it from development.

Q: Who is eligible to apply for a Land Preservation Credit?

A: Property owners in Virginia who place their land under permanent conservation easements are eligible to apply for a Land Preservation Credit.

Q: What is a conservation easement?

A: A conservation easement is a legal agreement between a landowner and a land trust or government agency that places restrictions on the use and development of the land to protect its natural, scenic, or historic features.

Q: Can I claim a Land Preservation Credit on my federal taxes?

A: No, the Land Preservation Credit is specific to Virginia and cannot be claimed on federal taxes.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.