This version of the form is not currently in use and is provided for reference only. Download this version of

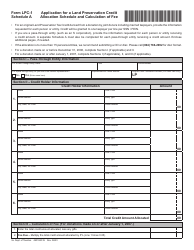

Form LPC-1

for the current year.

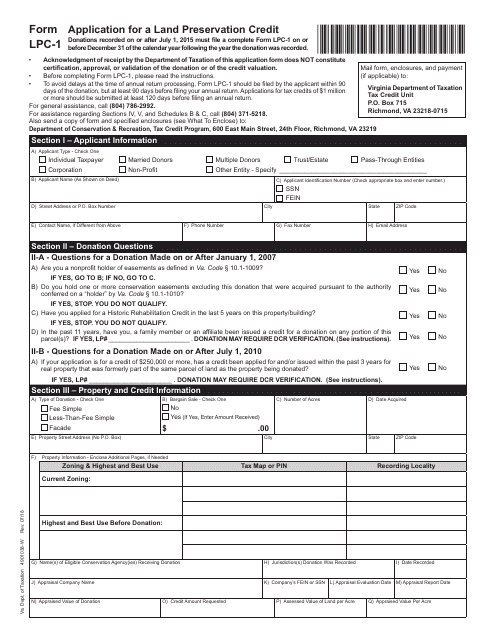

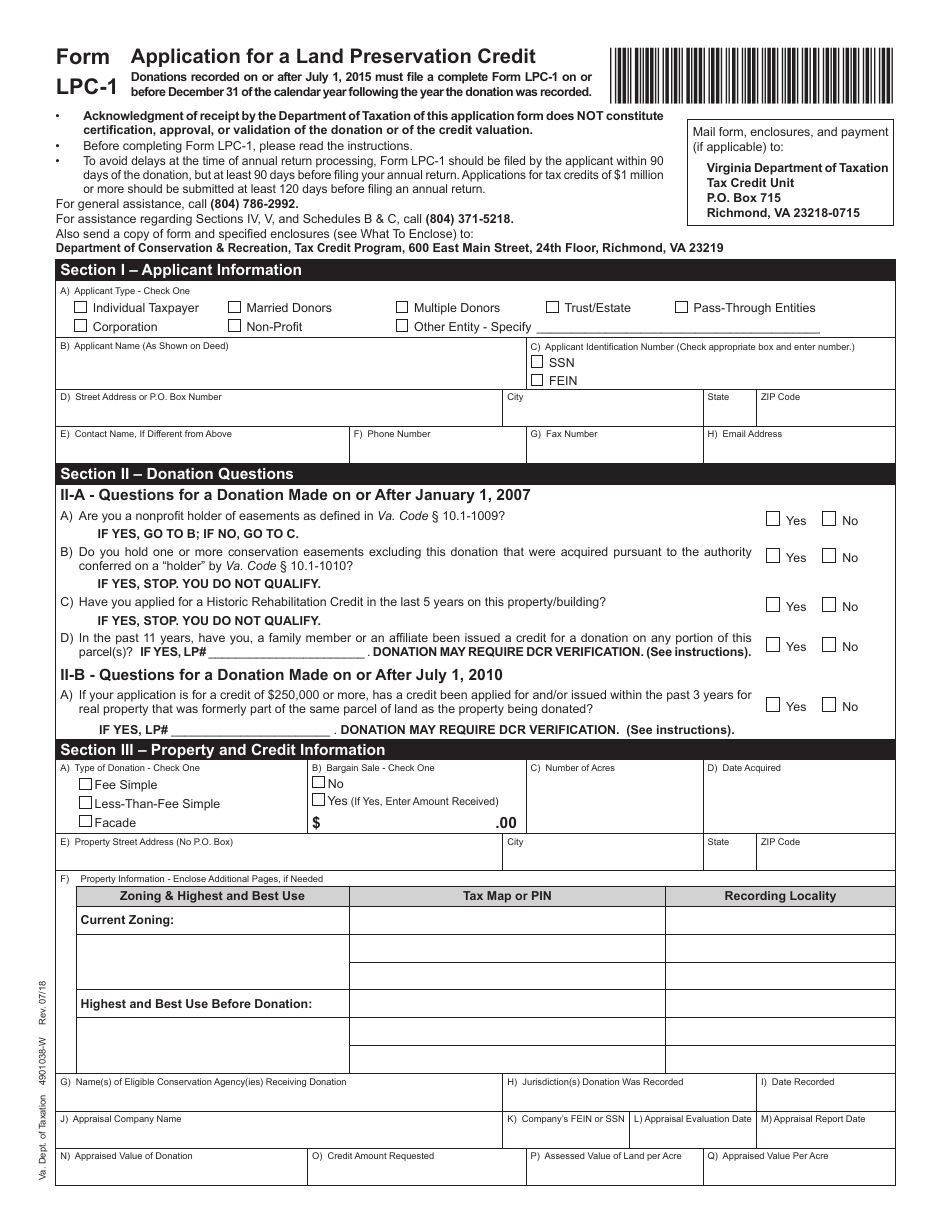

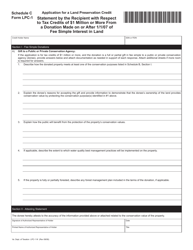

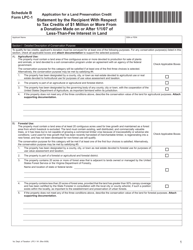

Form LPC-1 Application for a Land Preservation Credit - Virginia

What Is Form LPC-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the LPC-1 Application for a Land Preservation Credit?

A: The LPC-1 Application for a Land Preservation Credit is a form used for applying for a land preservation credit in Virginia.

Q: Who can use the LPC-1 Application?

A: Any landowner or entity that qualifies for a land preservation credit in Virginia can use the LPC-1 Application.

Q: What is a land preservation credit?

A: A land preservation credit is a tax benefit provided to landowners who voluntarily preserve their land for conservation purposes.

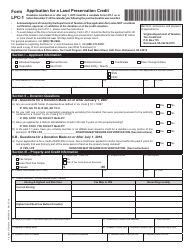

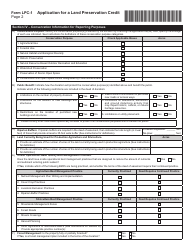

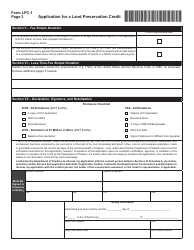

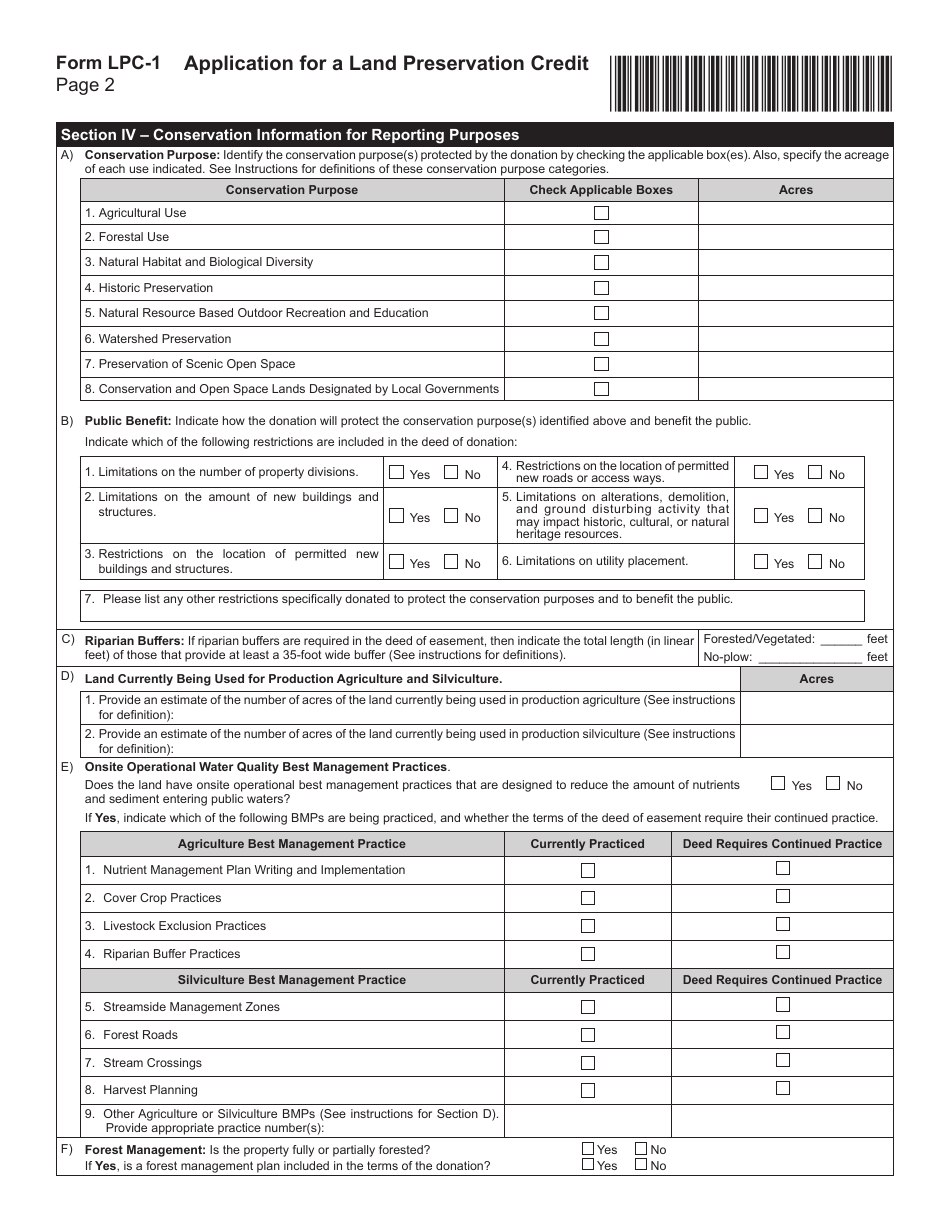

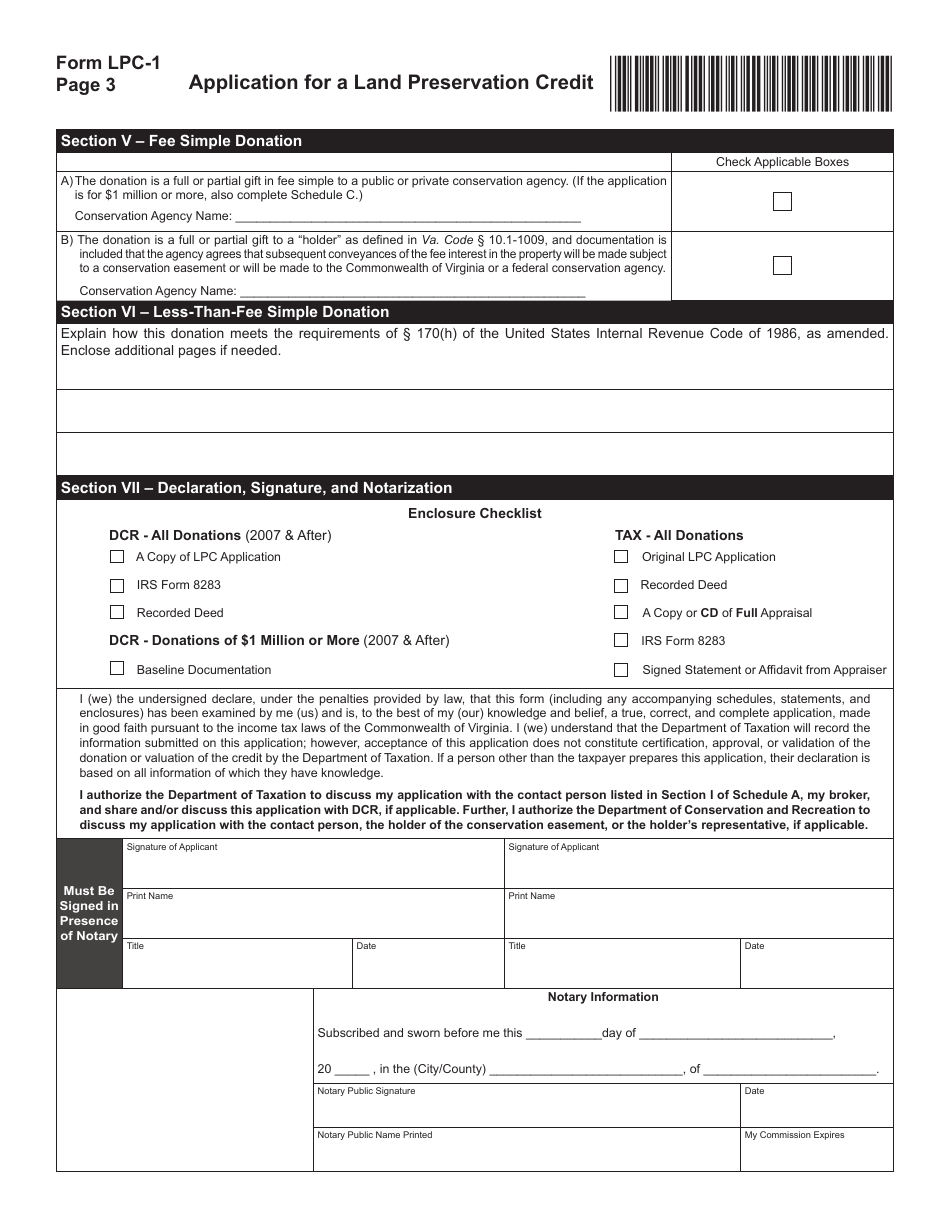

Q: What information is required on the LPC-1 Application?

A: The LPC-1 Application requires information about the landowner, the property being preserved, and the terms of the preservation agreement.

Q: Are there any deadlines for submitting the LPC-1 Application?

A: Yes, the LPC-1 Application must be filed with the Virginia Department of Taxation by December 31st of the calendar year in which the credit is being claimed.

Q: What documents should be included with the LPC-1 Application?

A: The LPC-1 Application should be accompanied by a certified copy of the conservation easement or other preservation agreement.

Q: How long does it take to process the LPC-1 Application?

A: The processing time for the LPC-1 Application can vary, but it typically takes several weeks to a few months.

Q: Can I claim land preservation credits for multiple properties on one LPC-1 Application?

A: Yes, you can claim land preservation credits for multiple properties on a single LPC-1 Application, as long as they meet the eligibility criteria.

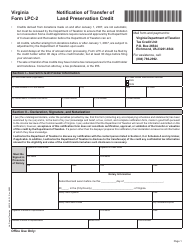

Q: What happens after the LPC-1 Application is approved?

A: Once the LPC-1 Application is approved, you will receive a land preservation credit certificate, which can be used to reduce your Virginia state tax liability.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LPC-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.