This version of the form is not currently in use and is provided for reference only. Download this version of

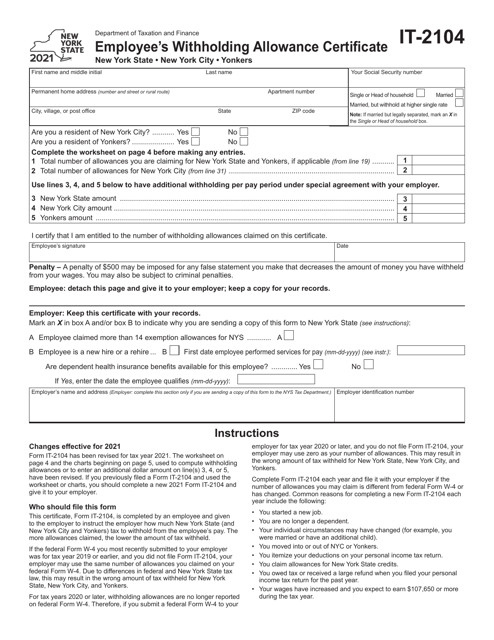

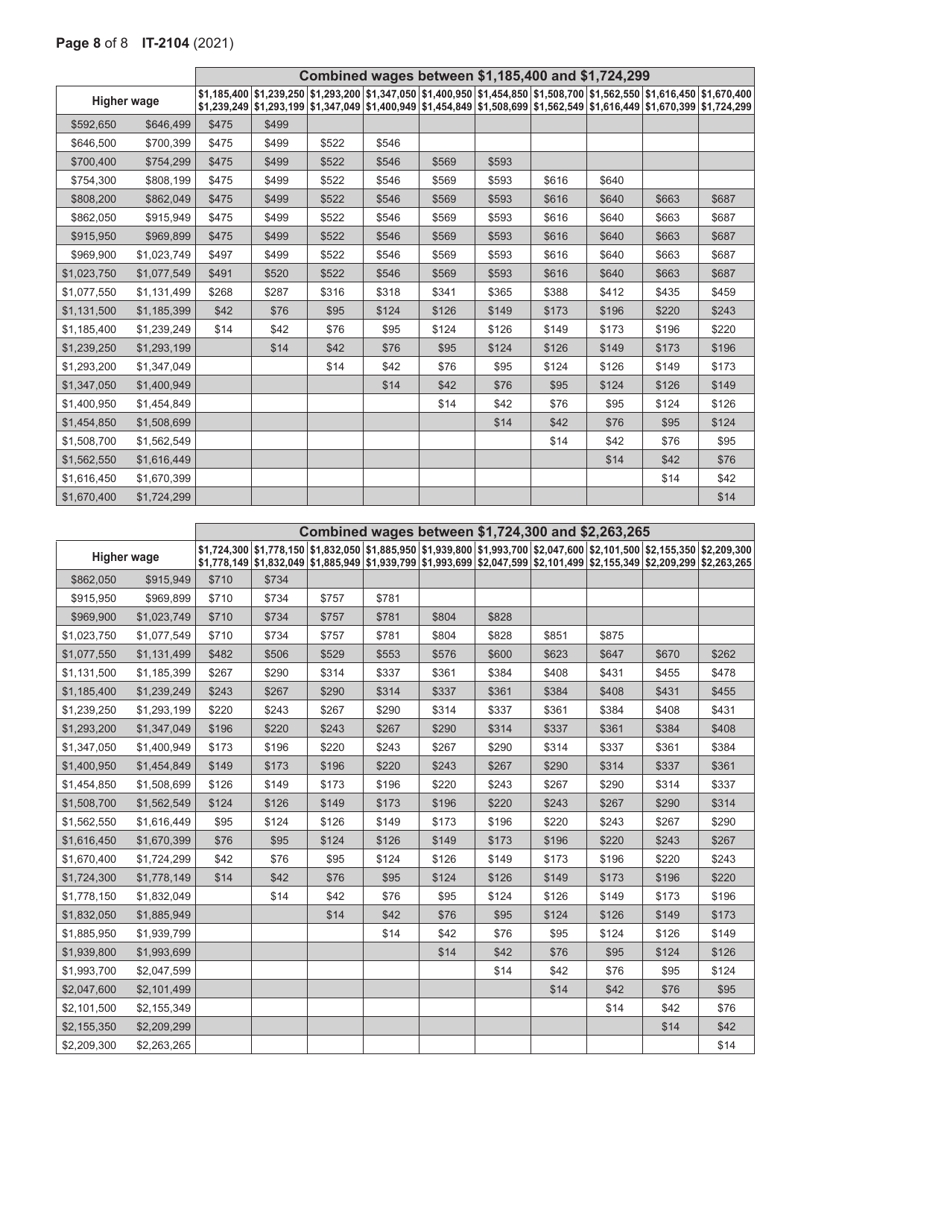

Form IT-2104

for the current year.

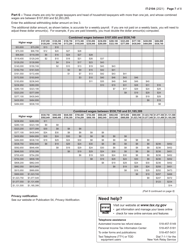

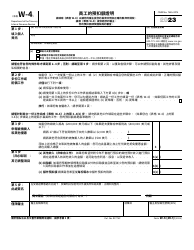

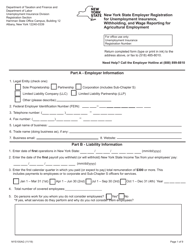

Form IT-2104 Employee's Withholding Allowance Certificate - New York

What Is Form IT-2104?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

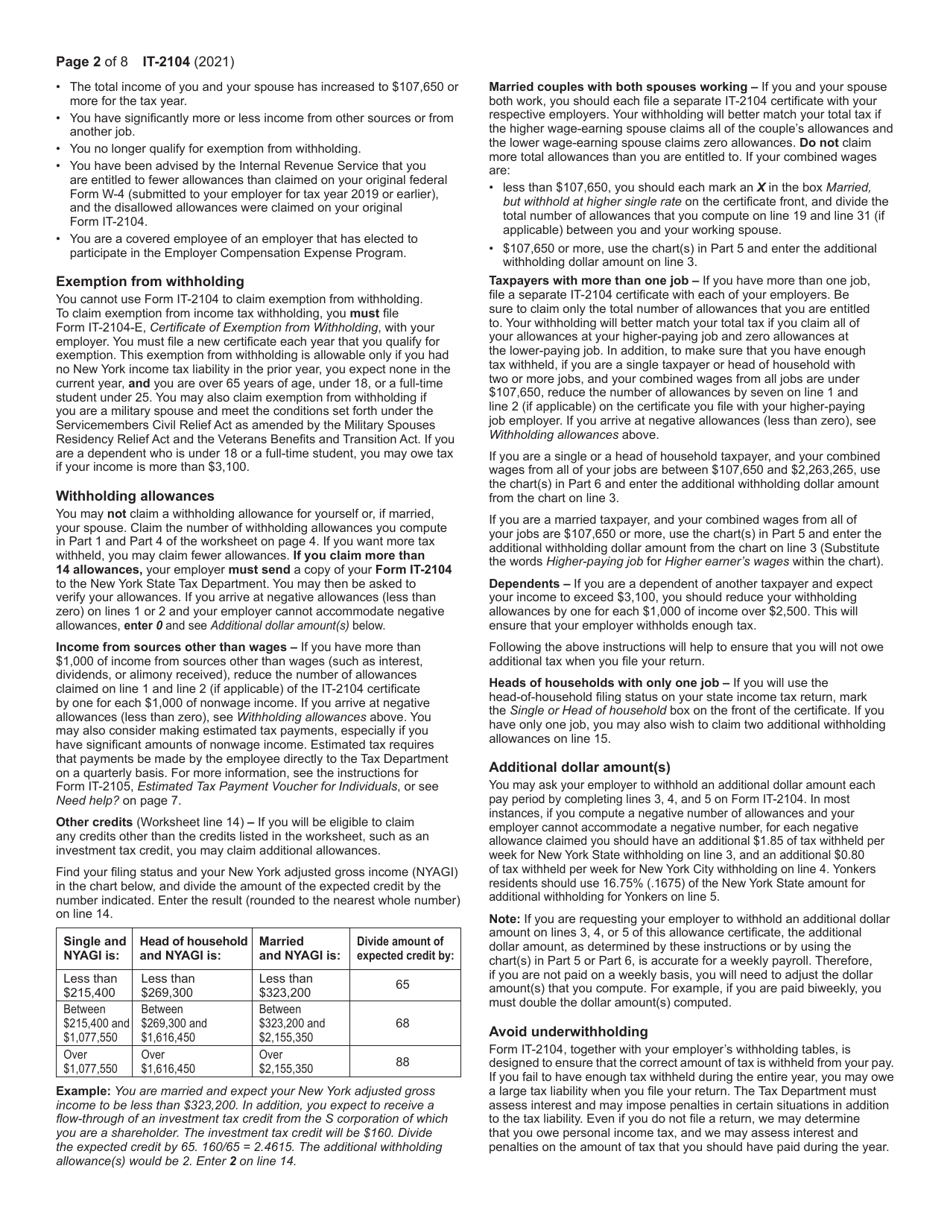

Q: What is the Form IT-2104?

A: The Form IT-2104 is a certificate that employees in New York use to determine the amount of income tax to withhold from their paychecks.

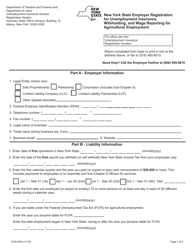

Q: Why do I need to fill out the Form IT-2104?

A: You need to fill out the Form IT-2104 so that your employer can withhold the correct amount of income tax from your wages.

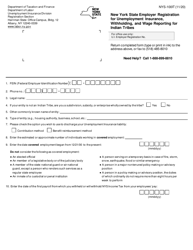

Q: How often do I need to fill out the Form IT-2104?

A: You should fill out the Form IT-2104 when you start a new job, and you can update it anytime there are changes to your tax situation.

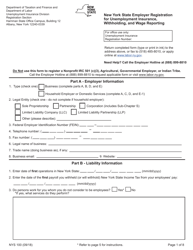

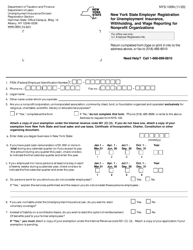

Q: What information do I need to provide on the Form IT-2104?

A: On the Form IT-2104, you'll need to provide your personal information, your filing status, the number of allowances you are claiming, and any additional withholding you want.

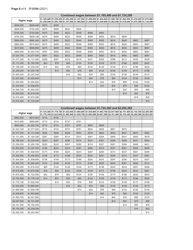

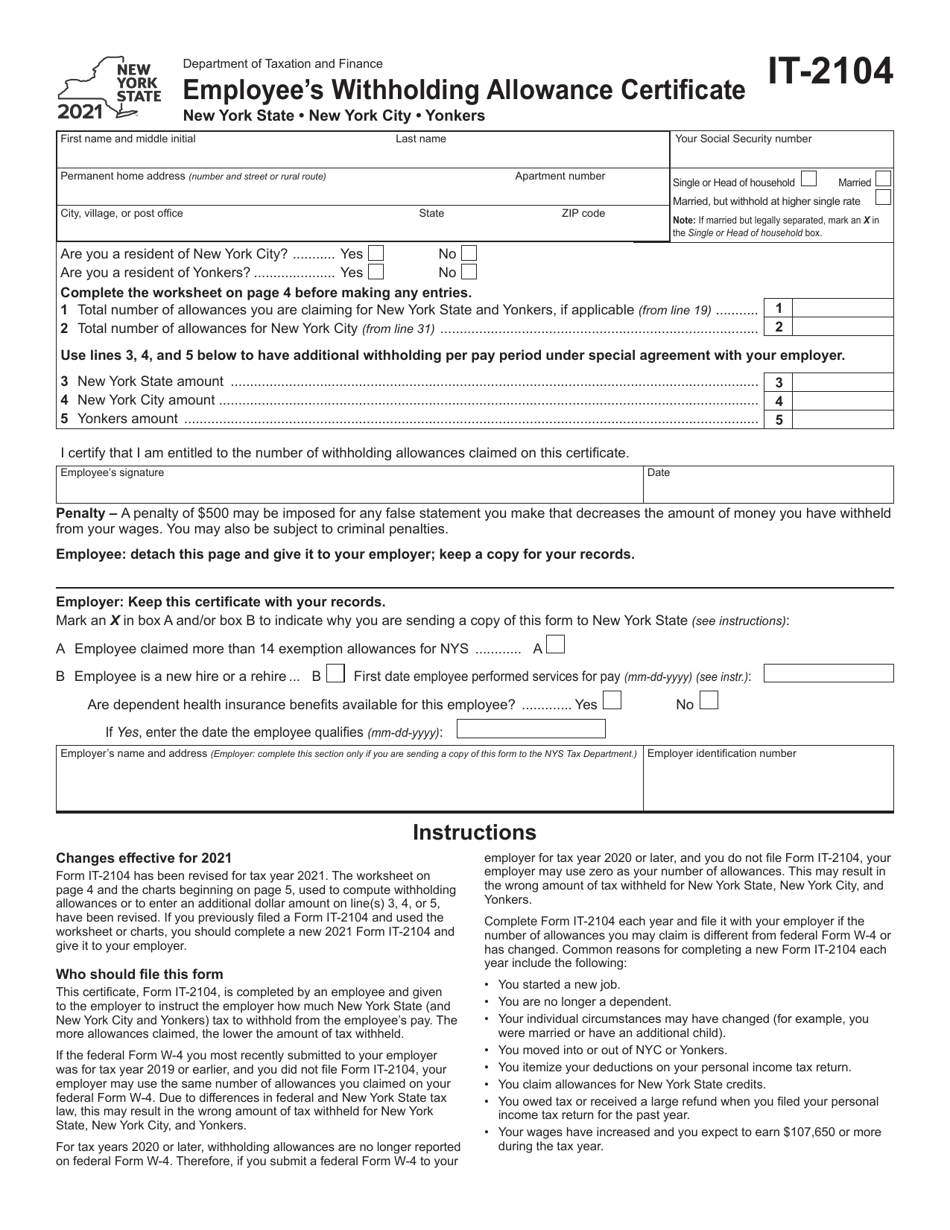

Q: How do I know how many allowances to claim on the Form IT-2104?

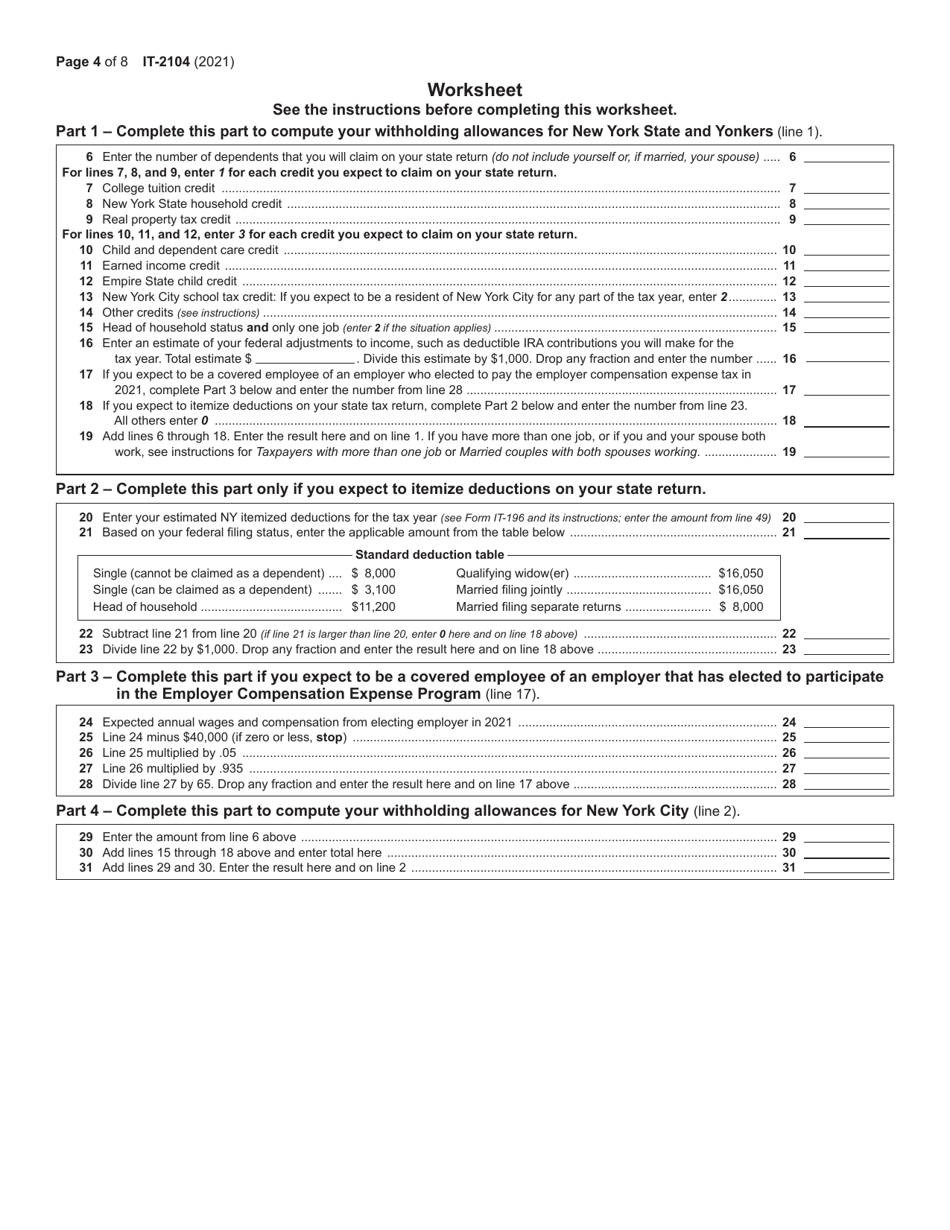

A: The number of allowances you should claim depends on various factors, such as your marital status, dependents, and other deductions. The form includes a worksheet to help you calculate this.

Q: Can I change my withholding allowances during the year?

A: Yes, you can update your Form IT-2104 and change your withholding allowances at any time when there are changes in your tax situation.

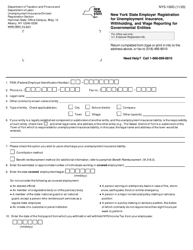

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2104 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.