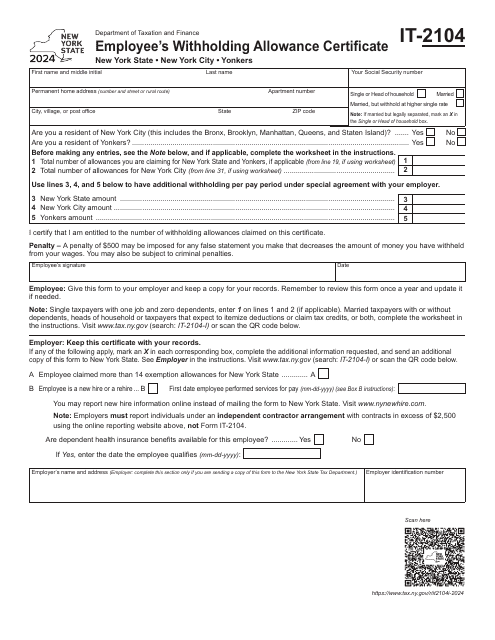

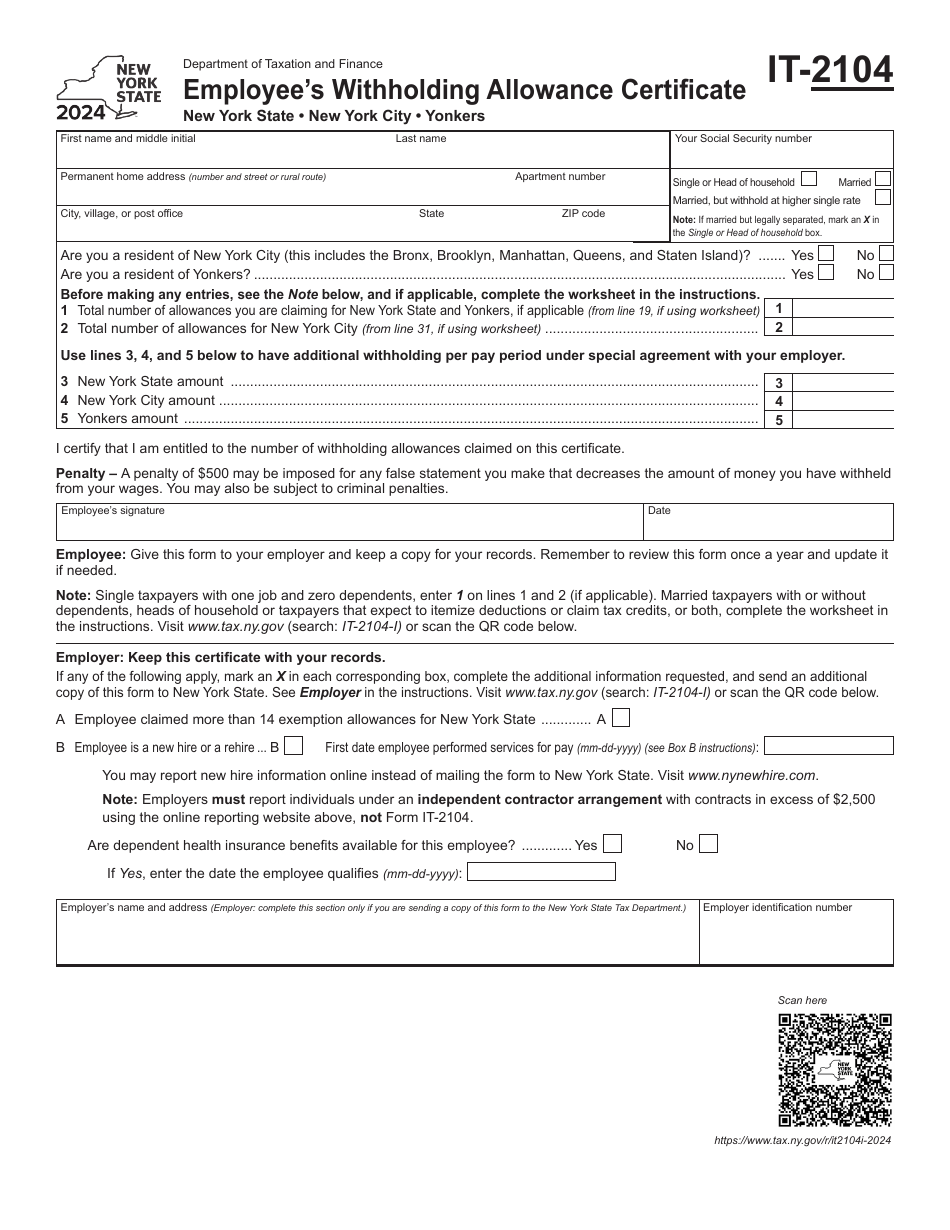

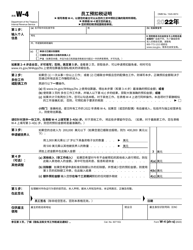

Form IT-2104 Employee's Withholding Allowance Certificate - New York

What Is IT-2104?

Form IT-2104, Employee's Withholding Allowance Certificate , is a document developed by the New York State Department of Taxation and Finance (NYS Tax Department) . The purpose of the application is to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer. The document should be completed each year for reasons listed in the attached IT-2104 instructions. These instructions include:

- The applicant is no longer a dependent;

- The applicant's individual circumstances have changed (for example, a marriage or having a baby);

- The applicant has started a new job;

- The applicant is a covered employee of the employer that has elected to participate in the Employer Compensation Expense Program;

- The applicant no longer qualifies for exemption from withholding;

- The applicant made contributions to a New York Charitable Gifts Trust Fund.

The form was last revised in 2020 . An IT-2104 fillable form is available for download below.

How to Fill Out IT-2104 Form?

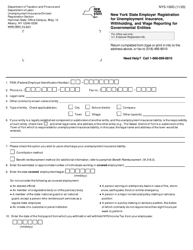

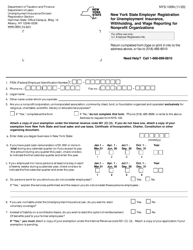

The application is presented as a one-page document followed by seven pages of instructions with an attached worksheet. The worksheet is supposed to help the applicant count their IT-2104 allowances. If the applicant uses inaccurate and invalid information during the completion of this form to decrease the amount of money they withheld, they can be subject to penalties.

-

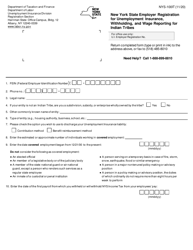

The application consists of two parts. In the first part of the application, the applicant must fill out the identifying information, such as full name, social security number, permanent residential address, and marital status. The applicant must also indicate if they are a resident of New York City or Yonkers. After completing the worksheet, the applicant must designate the total number of allowances they are claiming for New York State, Yonkers, and the city of New York.

-

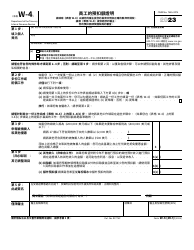

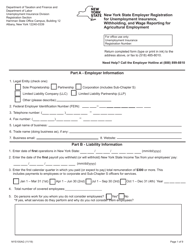

The second part of the document is supposed to be filled out by the employer to mark the reason they are sending the certificate to the NYS Tax Department. They should designate necessary information, such as:

- Did the applicant claim more than 14 allowances?

- Is an employee a rehire or a new hire? If so, then the employer must state the first date employee performed services for pay;

- Are there any dependent health insurance benefits available for the applicant? If yes, then the employer must state when the applicant qualifies for them.

-

The employer must also state their name and address, as well as their Employer Identification Number. This section needs to be filled out only if the employer is sending the certificate to the NYS Tax Department.

-

According to IT-2104 instructions, if the applicant claims more than 14 allowances, their hirer must send a copy of their application to the NYS Tax Department. The department might request an employee to verify their allowances, since the more allowances claimed, the lower the amount of tax withheld.

-

If the applicant has several jobs, they must submit a separate certificate with each of their hirers.

-

It's important to mention that the applicant cannot claim an exemption using an IT-2104 Form. To do so, they need to fill out and submit Form IT-2104-IND, Certificate of Exemption from Withholding, which was developed especially for this purpose.