This version of the form is not currently in use and is provided for reference only. Download this version of

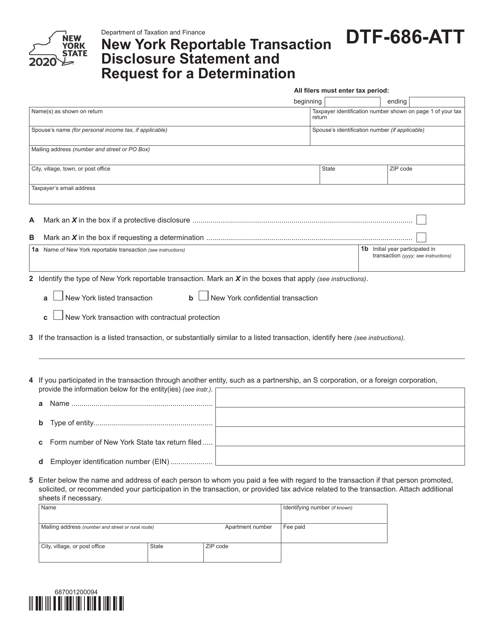

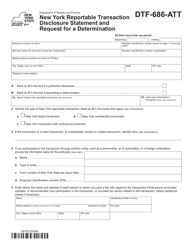

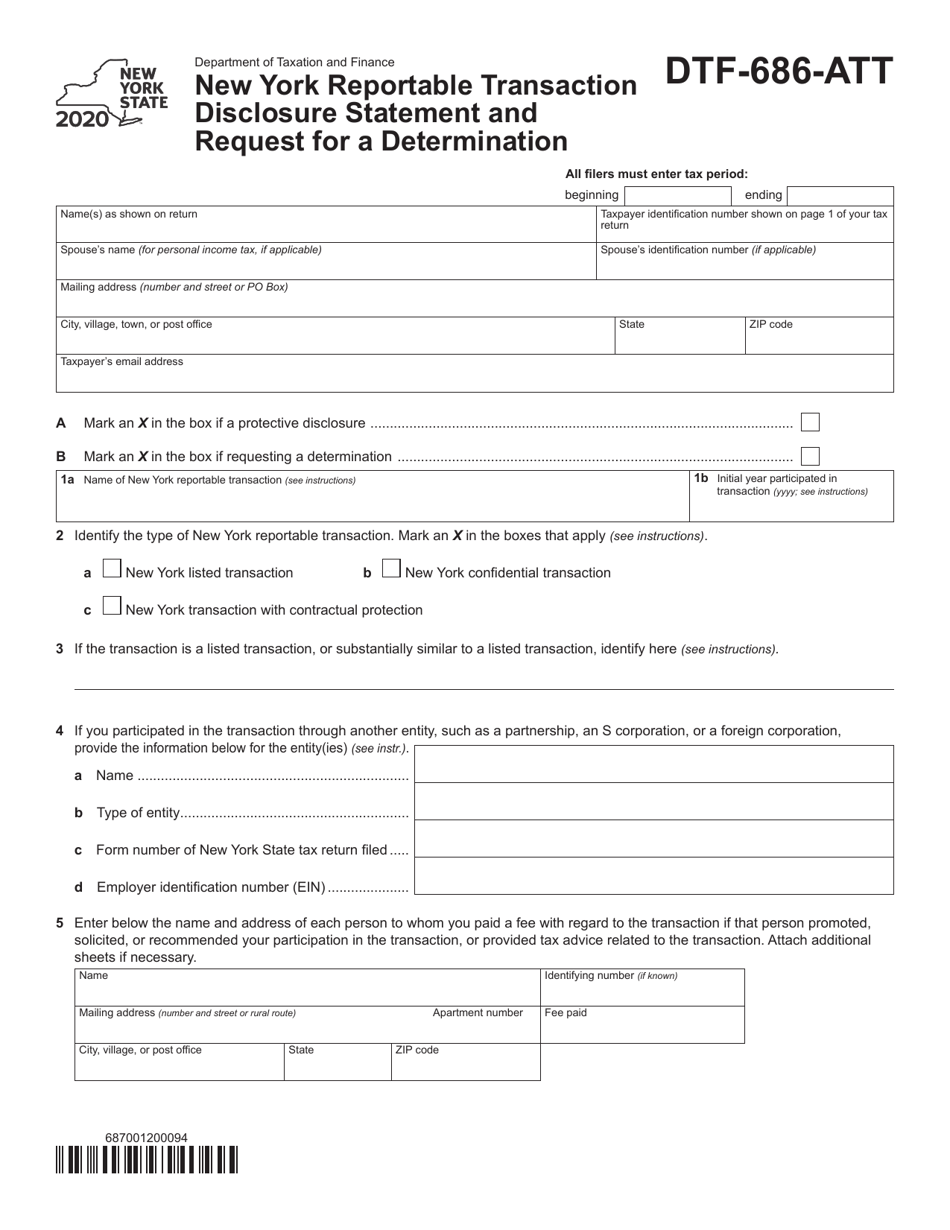

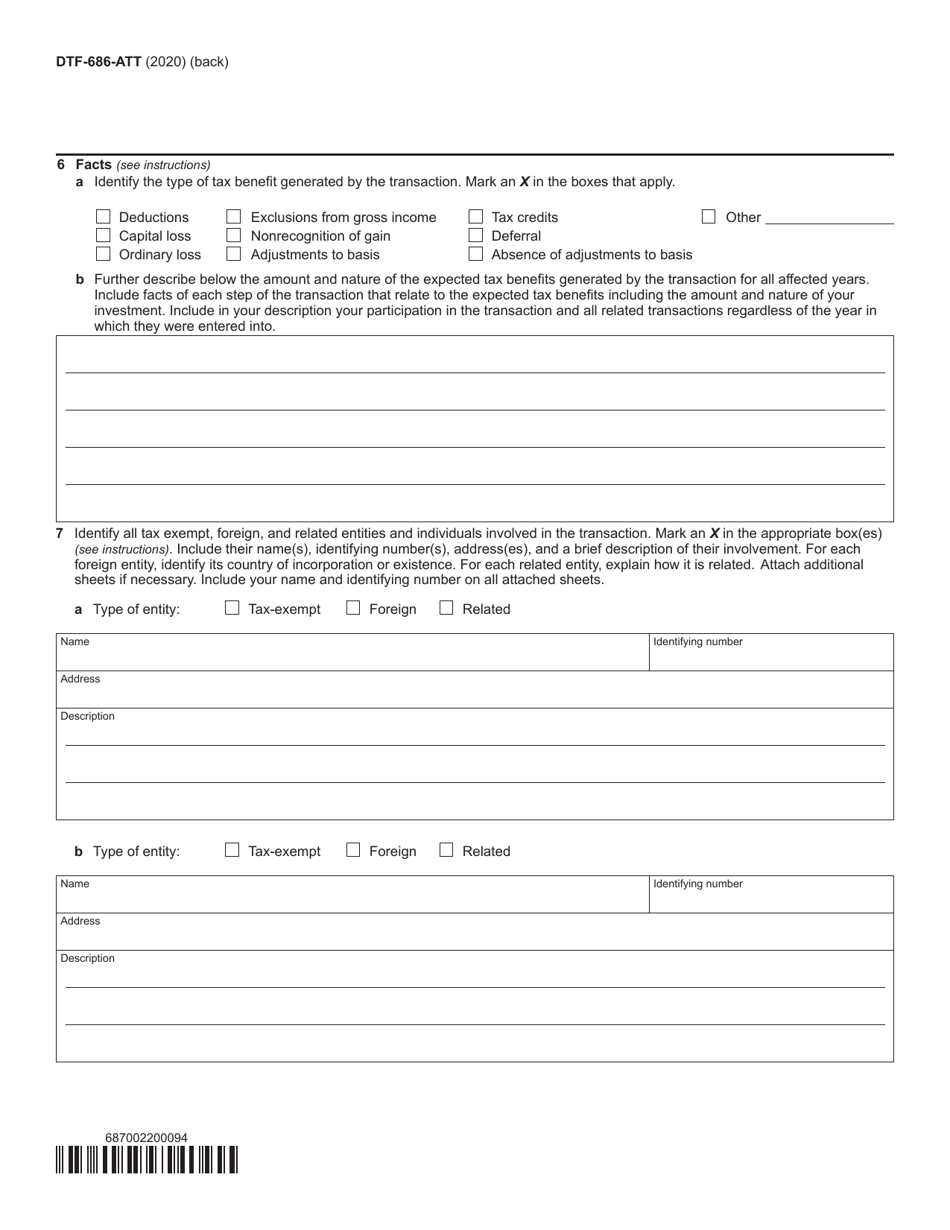

Form DTF-686-ATT

for the current year.

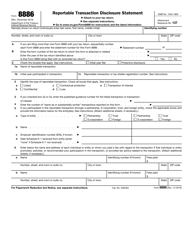

Form DTF-686-ATT New York Reportable Transaction Disclosure Statement and Request for a Determination - New York

What Is Form DTF-686-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-686-ATT?

A: Form DTF-686-ATT is the New York Reportable Transaction Disclosure Statement and Request for a Determination form.

Q: What is the purpose of Form DTF-686-ATT?

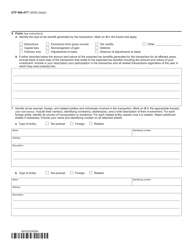

A: The purpose of Form DTF-686-ATT is to disclose reportable transactions and request a determination from the State of New York.

Q: Who needs to file Form DTF-686-ATT?

A: Individuals or entities engaging in reportable transactions in New York State must file Form DTF-686-ATT.

Q: What are reportable transactions?

A: Reportable transactions are certain types of transactions that must be disclosed to the State of New York.

Q: Is there a deadline for filing Form DTF-686-ATT?

A: Yes, Form DTF-686-ATT must be filed within 30 days after the transaction is completed or entered into.

Q: Are there any penalties for not filing Form DTF-686-ATT?

A: Yes, failure to file Form DTF-686-ATT or filing an incomplete or inaccurate form can result in penalties and interest.

Q: Is there a fee for filing Form DTF-686-ATT?

A: No, there is no fee for filing Form DTF-686-ATT.

Q: Can I request a determination from the State of New York using Form DTF-686-ATT?

A: Yes, Form DTF-686-ATT allows you to request a determination from the State of New York regarding the tax treatment of the reportable transaction.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-686-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.