This version of the form is not currently in use and is provided for reference only. Download this version of

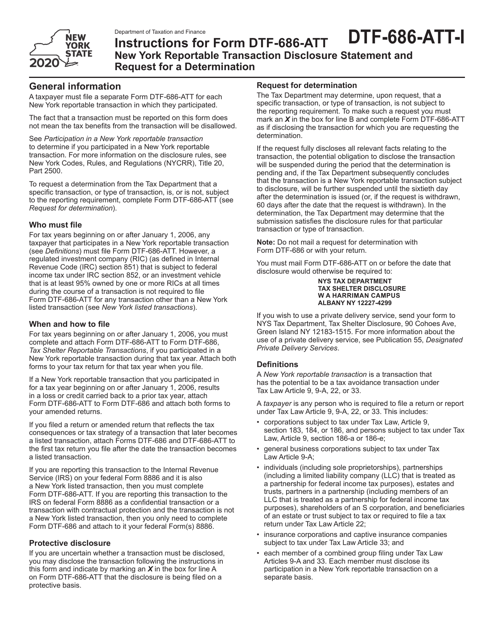

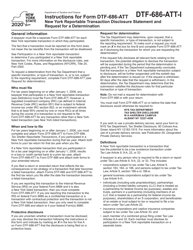

Instructions for Form DTF-686-ATT

for the current year.

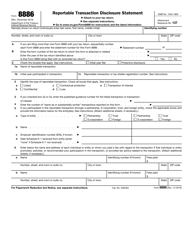

Instructions for Form DTF-686-ATT New York Reportable Transaction Disclosure Statement and Request for a Determination - New York

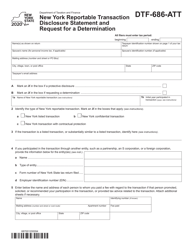

This document contains official instructions for Form DTF-686-ATT , New York Reportable Transaction Disclosure Statement and Request for a Determination - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form DTF-686-ATT is available for download through this link.

FAQ

Q: What is Form DTF-686-ATT?

A: Form DTF-686-ATT is the New York Reportable Transaction Disclosure Statement and Request for a Determination form.

Q: What is the purpose of Form DTF-686-ATT?

A: The purpose of Form DTF-686-ATT is to disclose reportable transactions to the New York State Department of Taxation and Finance and to request a determination.

Q: Who needs to file Form DTF-686-ATT?

A: Taxpayers who have engaged in reportable transactions as identified by the New York State Department of Taxation and Finance need to file Form DTF-686-ATT.

Q: What is a reportable transaction?

A: A reportable transaction is a specific type of transaction that must be disclosed to the New York State Department of Taxation and Finance, as outlined by their guidelines.

Q: When should Form DTF-686-ATT be filed?

A: Form DTF-686-ATT should be filed within the time period specified by the New York State Department of Taxation and Finance.

Q: Are there any penalties for failing to file Form DTF-686-ATT?

A: Yes, there may be penalties for failing to file Form DTF-686-ATT, as determined by the New York State Department of Taxation and Finance.

Q: Can I request a determination before filing Form DTF-686-ATT?

A: Yes, you can request a determination before filing Form DTF-686-ATT by submitting the relevant information and documents to the New York State Department of Taxation and Finance.

Q: Is there a fee for submitting Form DTF-686-ATT?

A: There is no fee for submitting Form DTF-686-ATT to the New York State Department of Taxation and Finance.

Q: Can I use Form DTF-686-ATT for transactions in other states?

A: No, Form DTF-686-ATT is specifically for reporting transactions in the state of New York.

Instruction Details:

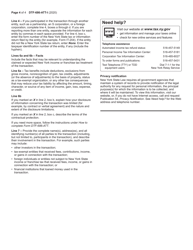

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.