This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-59

for the current year.

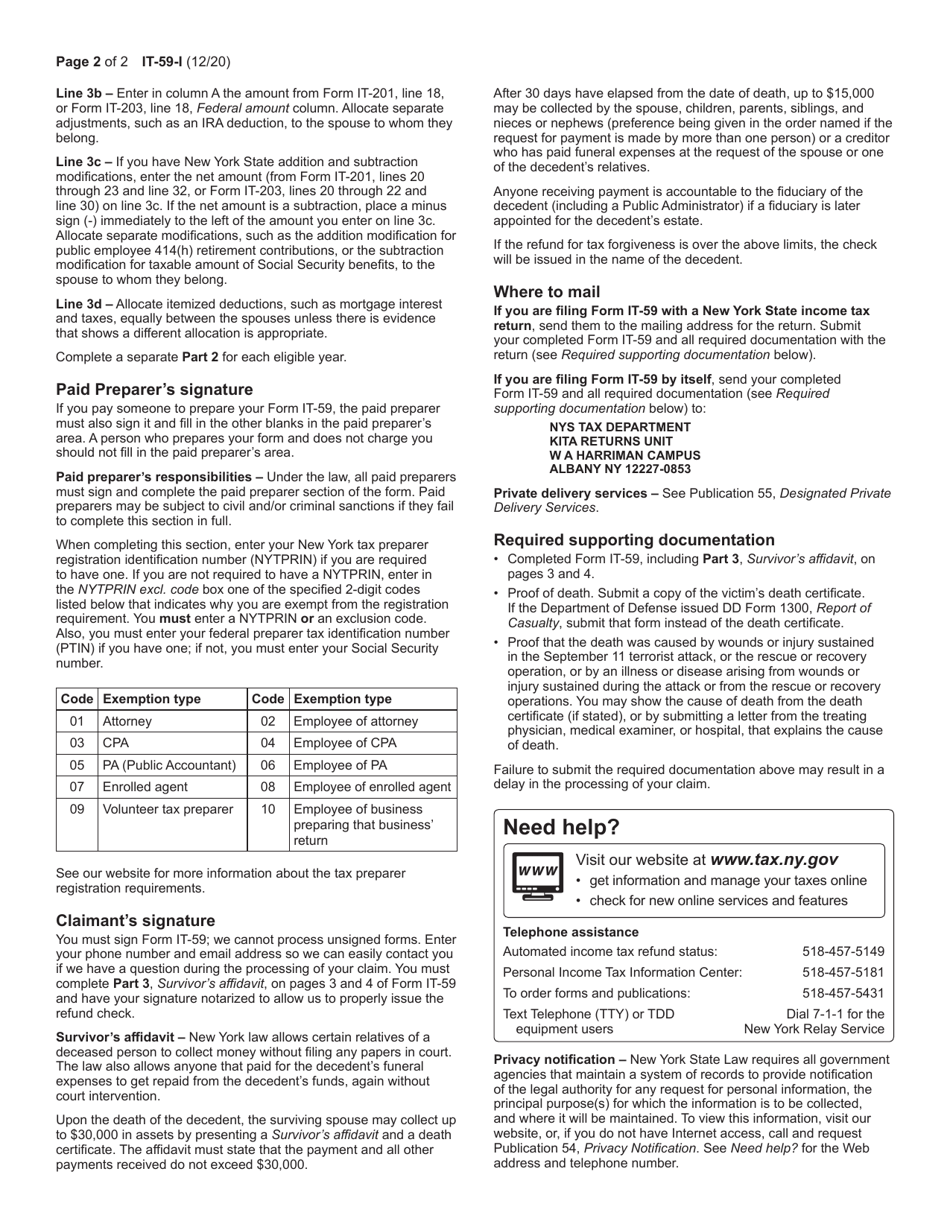

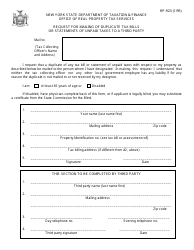

Instructions for Form IT-59 Tax Forgiveness for Victims of the September 11, 2001 Terrorist Attacks - New York

This document contains official instructions for Form IT-59 , Tax Forgiveness for Victims of the September 11, 2001 Terrorist Attacks - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-59 is available for download through this link.

FAQ

Q: What is Form IT-59?

A: Form IT-59 is a tax forgiveness form specifically designed for victims of the September 11, 2001 terrorist attacks in New York.

Q: Who is eligible to file Form IT-59?

A: Individuals who were physically injured in the September 11, 2001 attacks or the subsequent rescue efforts, as well as family members of those who died as a result of the attacks, may be eligible to file Form IT-59.

Q: What is the purpose of Form IT-59?

A: The purpose of Form IT-59 is to provide tax forgiveness to eligible individuals who were directly affected by the September 11, 2001 attacks in New York.

Q: What types of taxes are eligible for forgiveness through Form IT-59?

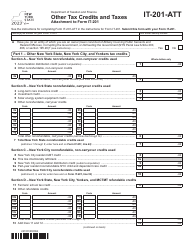

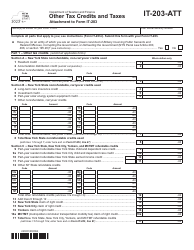

A: Form IT-59 covers New York State and New York City personal income taxes, New York State business franchise taxes, and New York City unincorporated business taxes.

Q: Are there any time limits for filing Form IT-59?

A: Yes, Form IT-59 must be filed within one year from the last day of the calendar year in which the attack occurred.

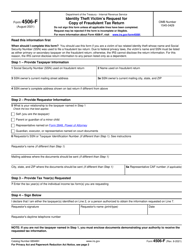

Q: What documentation is required to file Form IT-59?

A: Documentation such as medical records, death certificates, and proof of residency may be required to support the claim for tax forgiveness. The specific documentation needed will depend on the individual's circumstances.

Q: Are there any additional forms or attachments required with Form IT-59?

A: In some cases, additional forms or attachments may be required to accompany Form IT-59. These additional forms will be specified in the instructions provided with the form.

Q: Is there a deadline for filing Form IT-59?

A: Yes, Form IT-59 must be filed within one year from the last day of the calendar year in which the attack occurred.

Q: Are there any special provisions for military personnel?

A: Yes, military personnel who were injured in the September 11, 2001 attacks or the subsequent rescue efforts may be eligible to file Form IT-59, even if they were not New York residents at the time of the attacks.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.