This version of the form is not currently in use and is provided for reference only. Download this version of

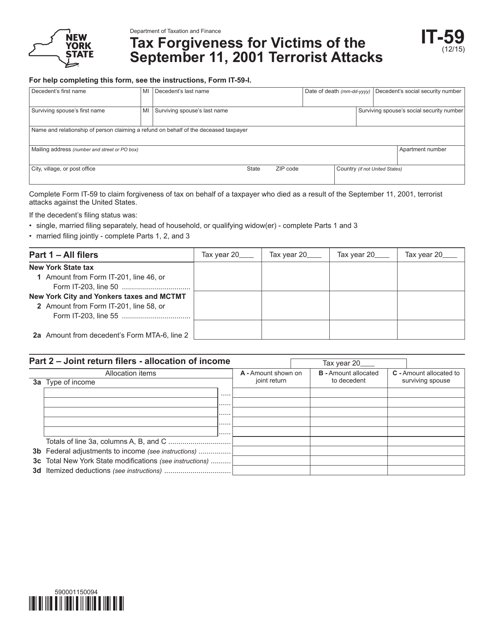

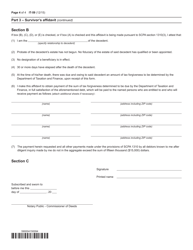

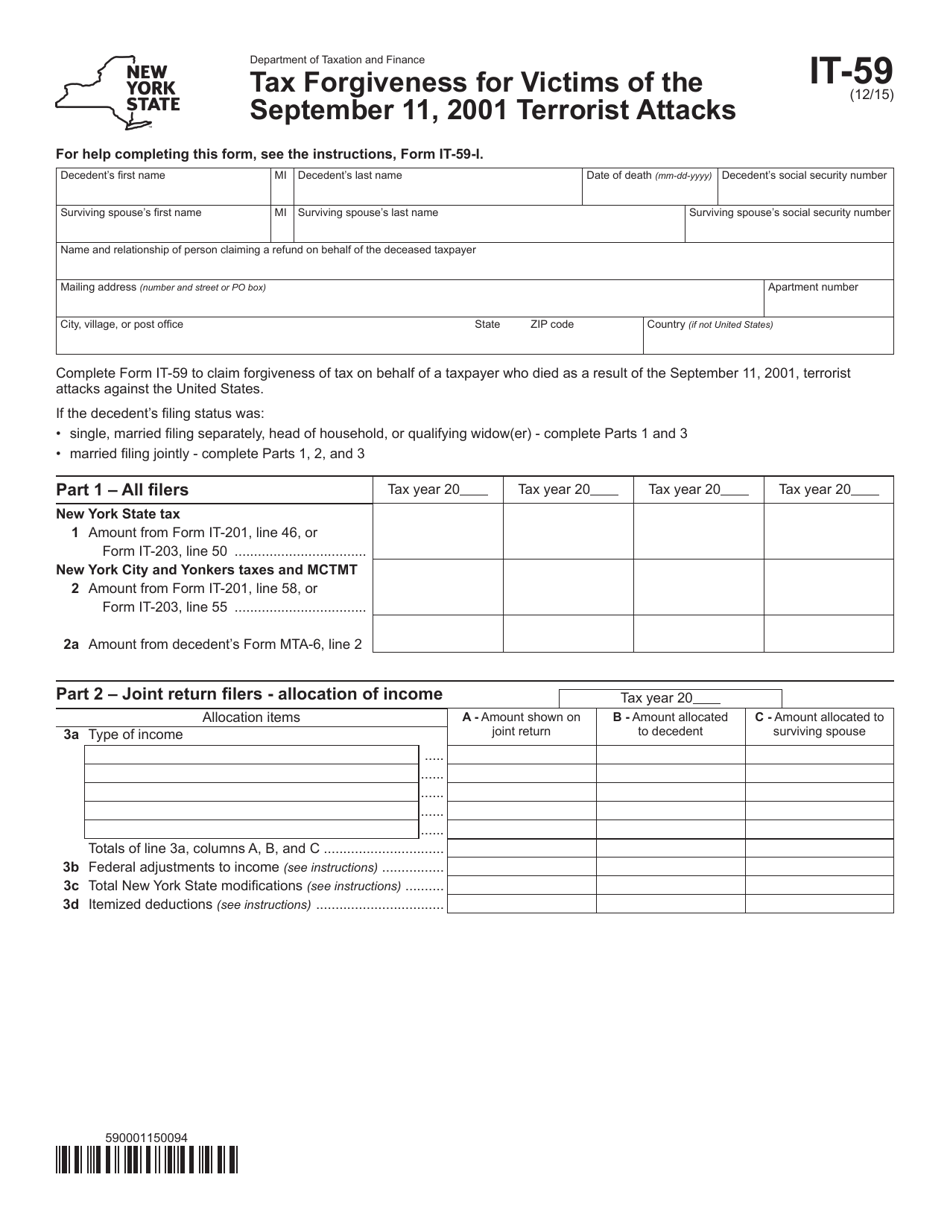

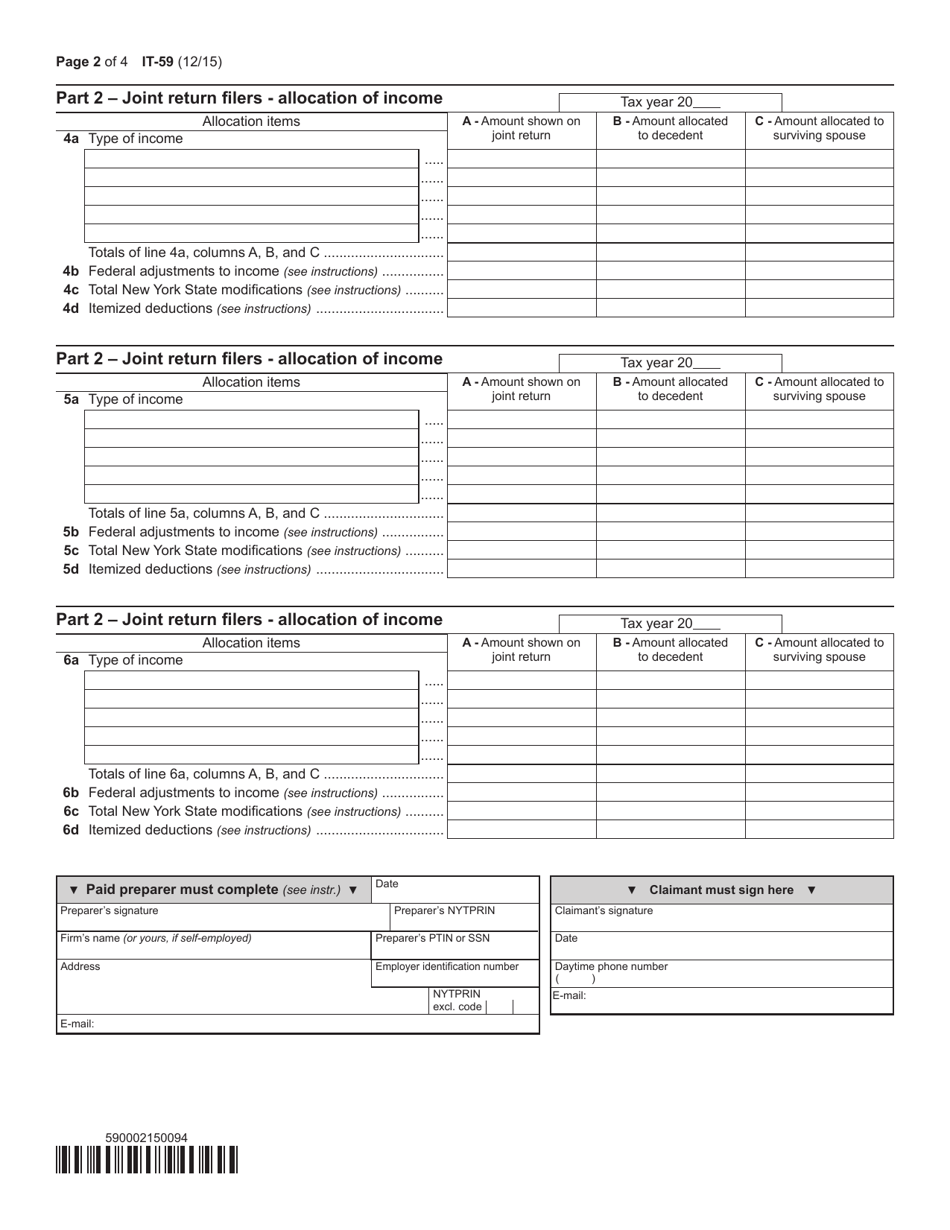

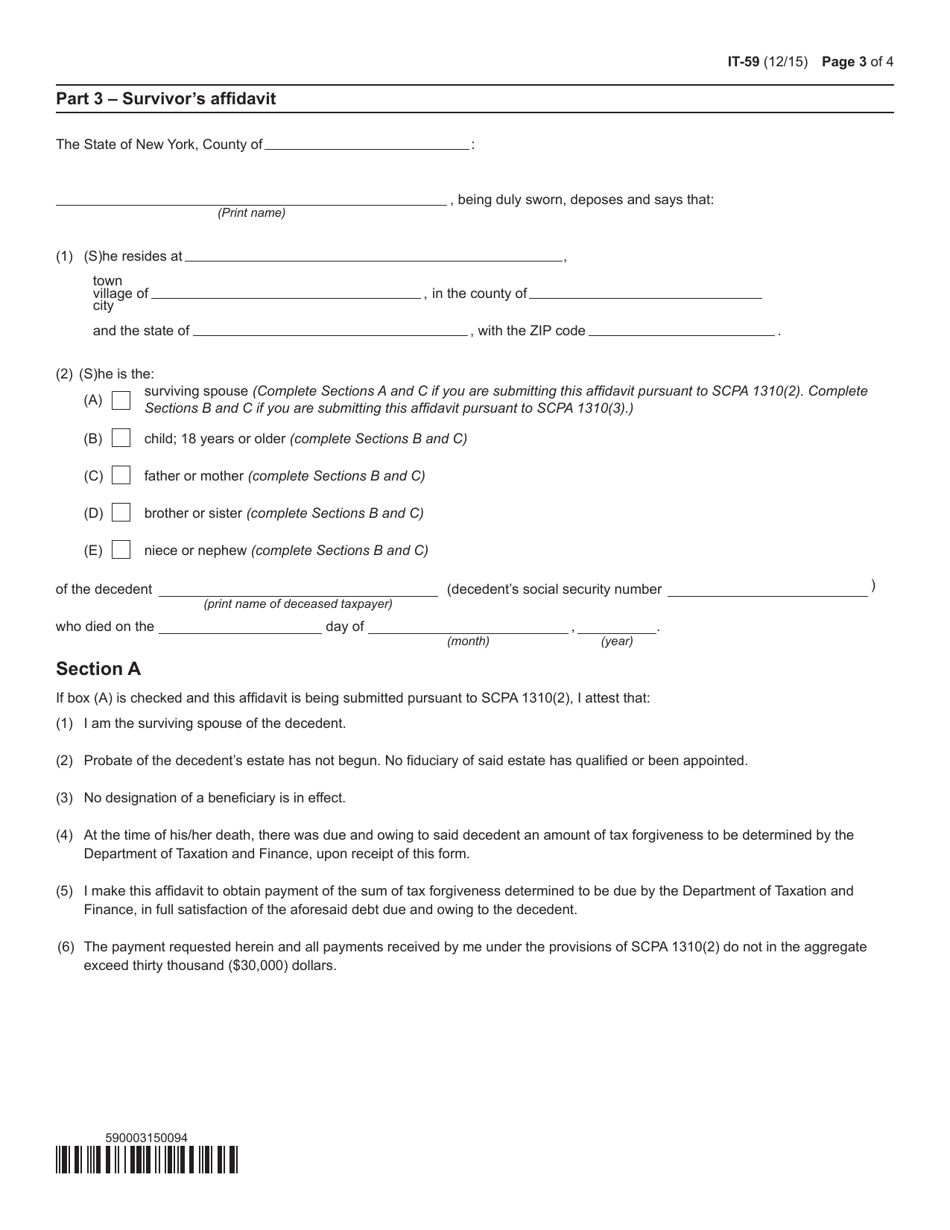

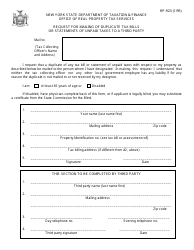

Form IT-59

for the current year.

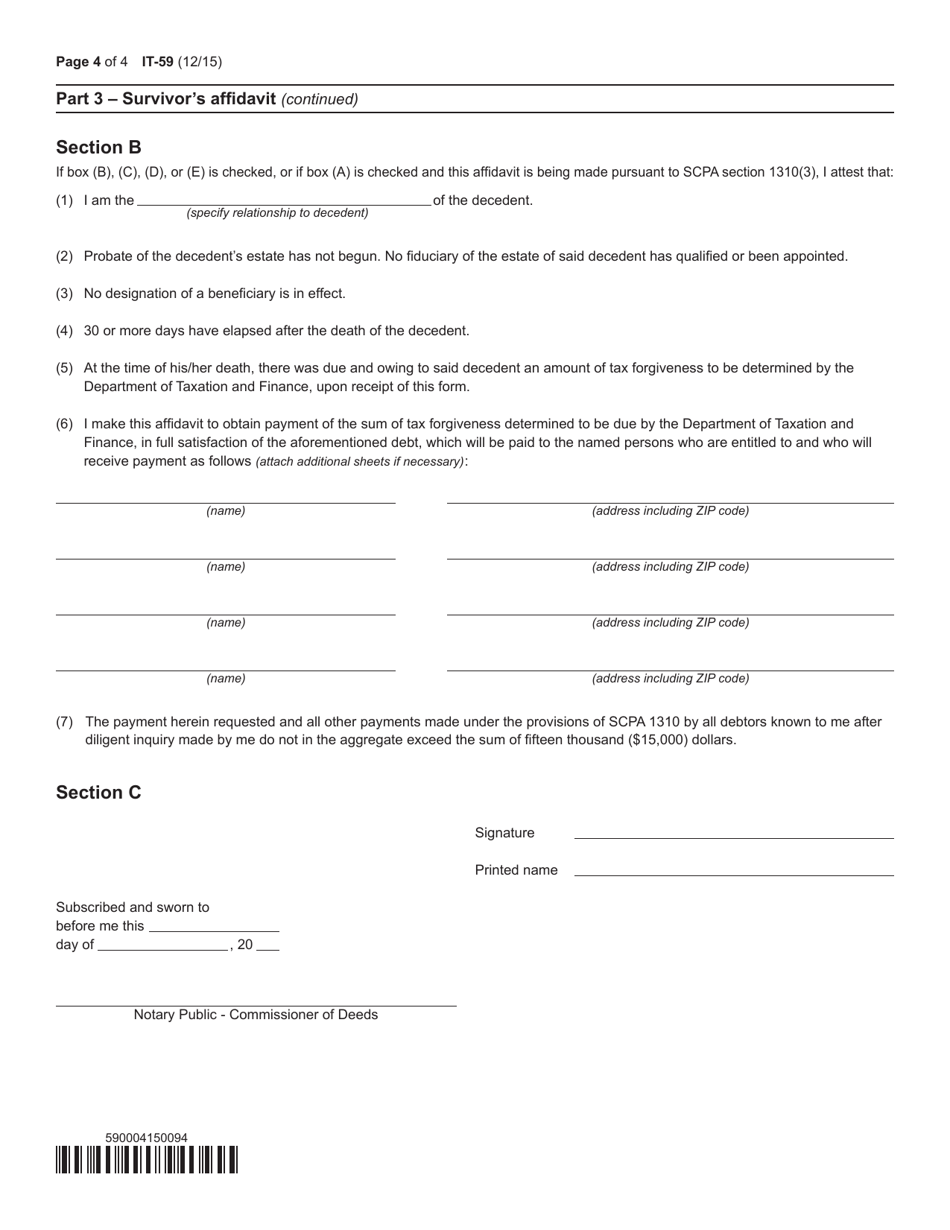

Form IT-59 Tax Forgiveness for Victims of the September 11, 2001 Terrorist Attacks - New York

What Is Form IT-59?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-59?

A: Form IT-59 is a tax form for tax forgiveness for victims of the September 11, 2001 terrorist attacks in New York.

Q: Who is eligible to use Form IT-59?

A: Victims of the September 11, 2001 terrorist attacks in New York are eligible to use Form IT-59.

Q: What is the purpose of Form IT-59?

A: The purpose of Form IT-59 is to provide tax forgiveness for victims of the September 11, 2001 terrorist attacks.

Q: Are there any deadlines for filing Form IT-59?

A: Yes, there are deadlines for filing Form IT-59. It is important to check the specific deadlines provided by the New York State Department of Taxation and Finance.

Q: What documentation is required to complete Form IT-59?

A: To complete Form IT-59, you may need to provide documentation related to your status as a victim of the September 11, 2001 terrorist attacks.

Q: Are there any fees associated with filing Form IT-59?

A: There are no fees associated with filing Form IT-59.

Q: Is Form IT-59 only applicable for New York residents?

A: Yes, Form IT-59 is specifically for victims of the September 11, 2001 terrorist attacks in New York.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-59 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.