This version of the form is not currently in use and is provided for reference only. Download this version of

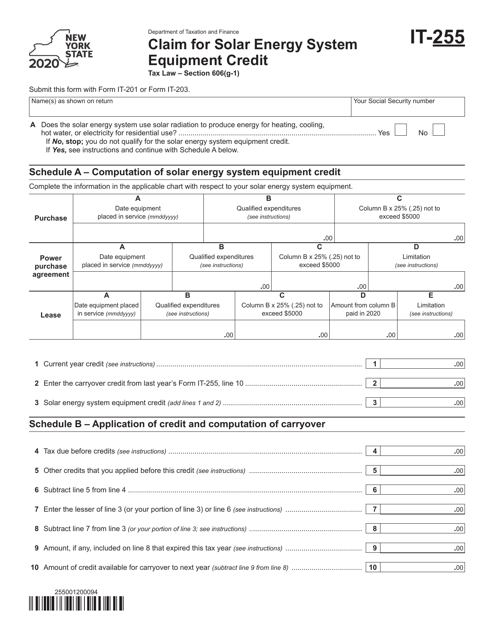

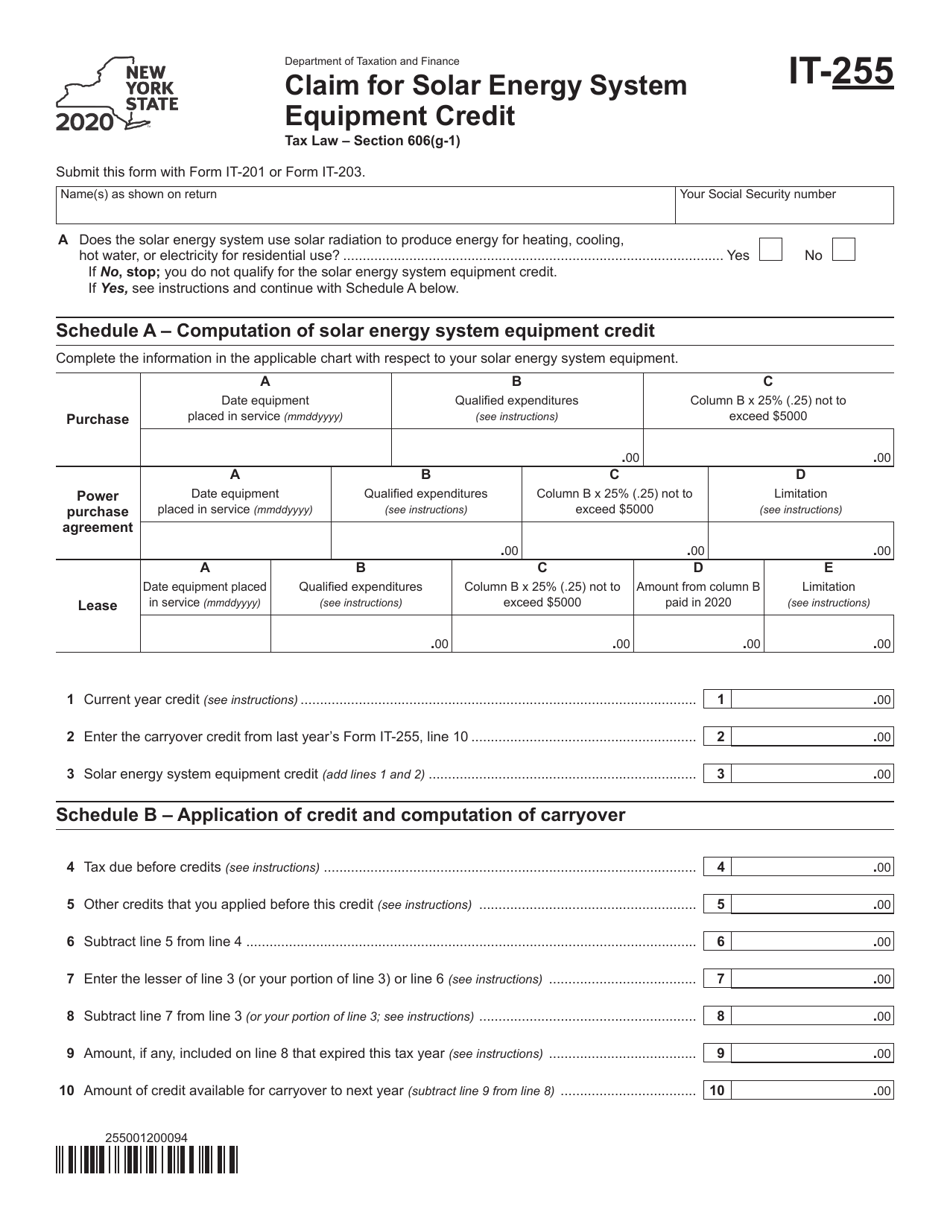

Form IT-255

for the current year.

Form IT-255 Claim for Solar Energy System Equipment Credit - New York

What Is Form IT-255?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form IT-255?

A: Form IT-255 is a claim form for the Solar Energy System Equipment Credit in New York.

Q: What is the Solar Energy System Equipment Credit?

A: The Solar Energy System Equipment Credit is a tax credit in New York that allows individuals and businesses to claim a credit for the purchase and installation of solar energy system equipment.

Q: Who is eligible to claim the Solar Energy System Equipment Credit?

A: Individuals and businesses in New York who have purchased and installed solar energy system equipment are eligible to claim the credit.

Q: What types of solar energy system equipment are eligible for the credit?

A: Solar panels, solar hot water heaters, and solar pool heaters are among the types of solar energy system equipment that are eligible for the credit.

Q: How much is the Solar Energy System Equipment Credit?

A: The credit is calculated as 25% of the eligible costs, up to a maximum credit of $5,000 per tax year.

Q: How do I claim the Solar Energy System Equipment Credit?

A: To claim the credit, you must complete and submit Form IT-255 along with your New York state tax return.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are limitations and restrictions on the credit. It cannot exceed the taxpayer's total tax liability for the tax year, and any unused credit cannot be carried over to future years.

Q: Is there a deadline for filing Form IT-255?

A: Yes, the deadline for filing Form IT-255 is the same as the deadline for filing your New York state tax return, which is usually April 15th.

Q: Can I claim the Solar Energy System Equipment Credit for multiple years?

A: Yes, you can claim the credit for multiple tax years as long as you meet the eligibility requirements and have not reached the maximum credit amount.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-255 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.