Solar Energy System Templates

Are you interested in harnessing the power of the sun to reduce your carbon footprint and save on energy costs? Look no further than our collection of documents on solar energy systems, also known as solar energy systems or solar power systems.

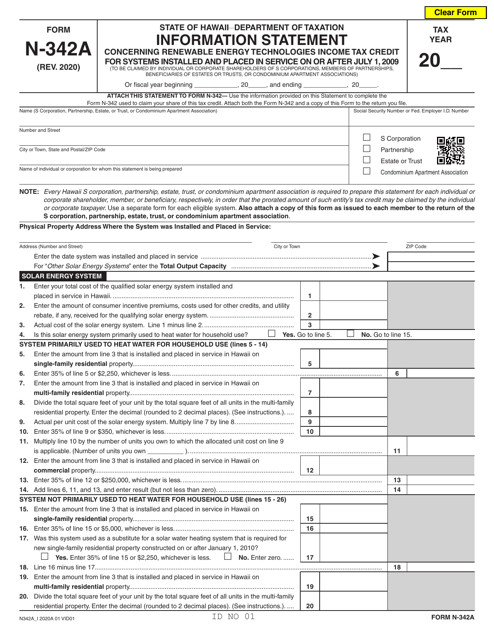

These documents cover everything from tax credits and deductions for the installation of solar energy systems to claim forms for equipment credits specific to certain states. Whether you're a homeowner looking to take advantage of residential energy credits or a business owner interested in the benefits of solar energy, our collection has you covered.

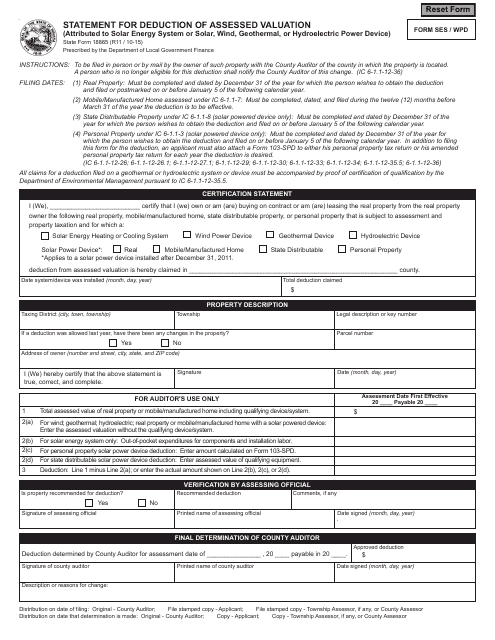

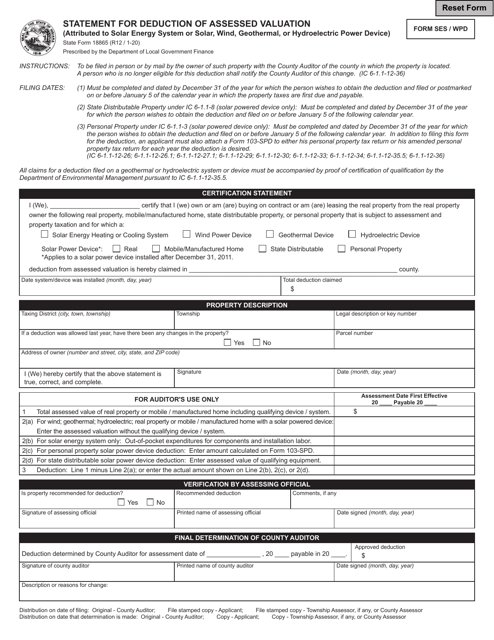

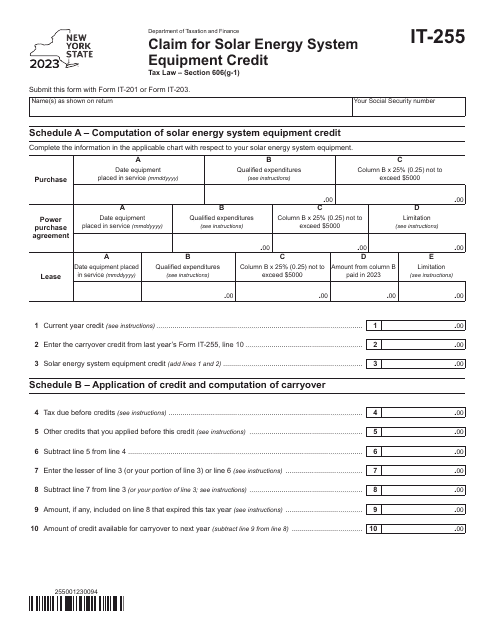

For example, you'll find forms like the Form SES/WPD (State Form 18865) Statement for Deduction of Assessed Valuation, which applies to solar energy systems as well as wind, geothermal, or hydroelectric power devices in Indiana. In New York, there's the Form IT-255 Claim for Solar Energy SystemEquipment Credit, offering a credit for qualifying solar energy system equipment.

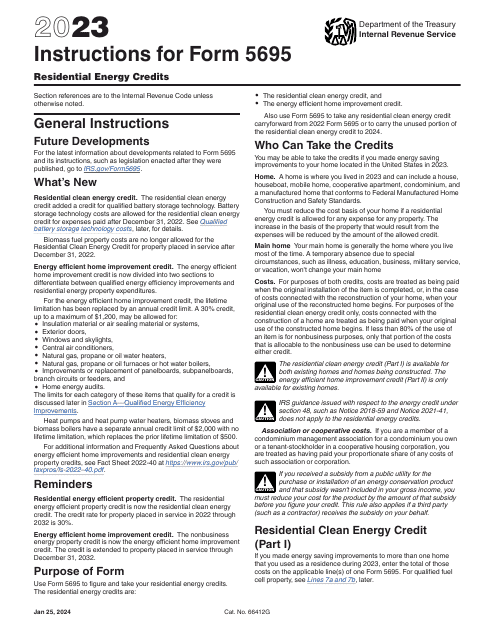

To ensure you stay compliant with IRS regulations, we also provide instructions for IRS Form 5695 Residential Energy Credits, which provides guidance on claiming residential energy credits for solar energy systems.

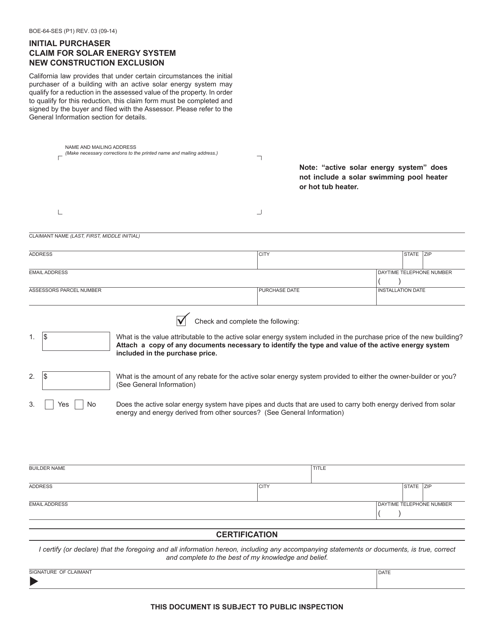

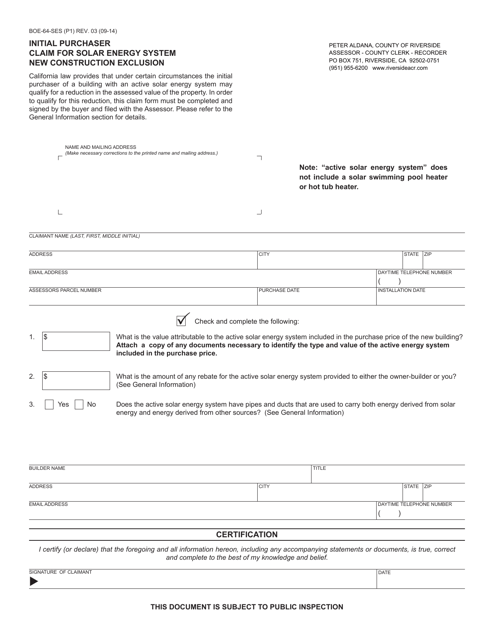

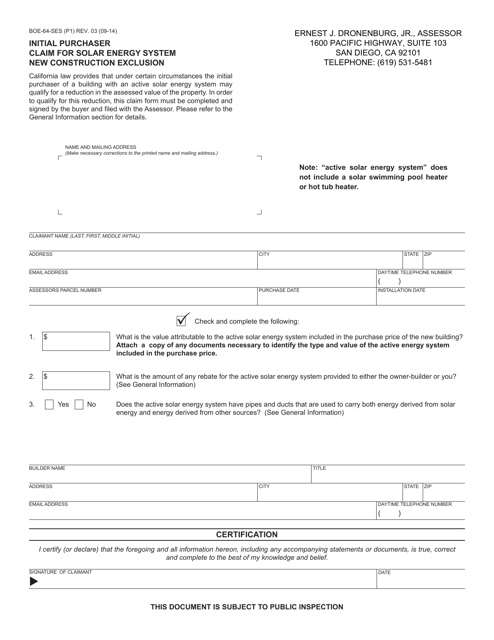

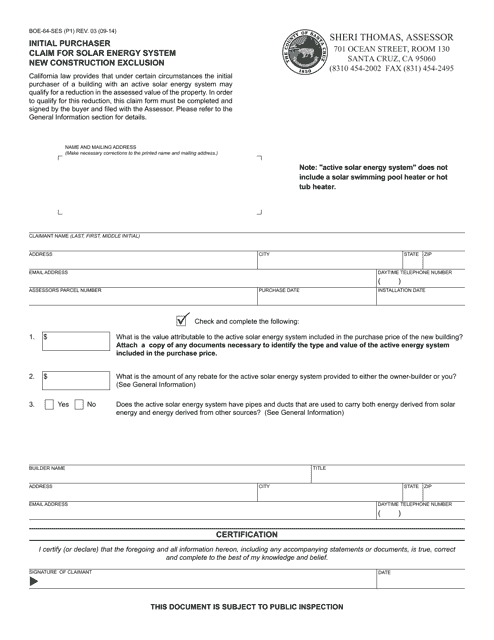

If you're located in California or the County of Santa Cruz, California, you'll find forms like the Form BOE-64-SES Initial Purchaser Claim for Solar Energy System New Construction Exclusion. These documents allow initial purchasers to claim an exclusion for the assessed value of newly constructed solar energy systems.

With our comprehensive collection of documents on solar energy systems, you'll have all the information you need to navigate the world of solar power and maximize your energy savings. Start exploring today!

Documents:

9

This form is used for submitting a statement to request a deduction in the assessed valuation of property due to the installation of a solar energy system or wind, geothermal, or hydroelectric power device in Indiana.

This form is used for deducting the assessed valuation of a solar energy system or other renewable power devices in the state of Indiana.

This form is used for making an initial purchaser claim for a solar energy system new construction exclusion in California.

This form is used for making an initial purchaser claim for the solar energy system new construction exclusion in Riverside County, California. It is specifically used for claiming tax exemptions related to solar energy systems in new construction projects.

This Form is used for claiming the new construction exclusion for solar energy systems in San Diego County, California.

This form is used for the initial purchaser to make a claim for the solar energy system new construction exclusion in Santa Cruz County, California.