This version of the form is not currently in use and is provided for reference only. Download this version of

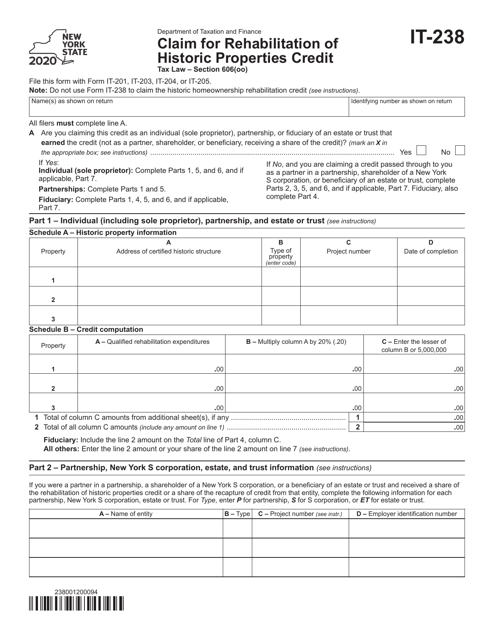

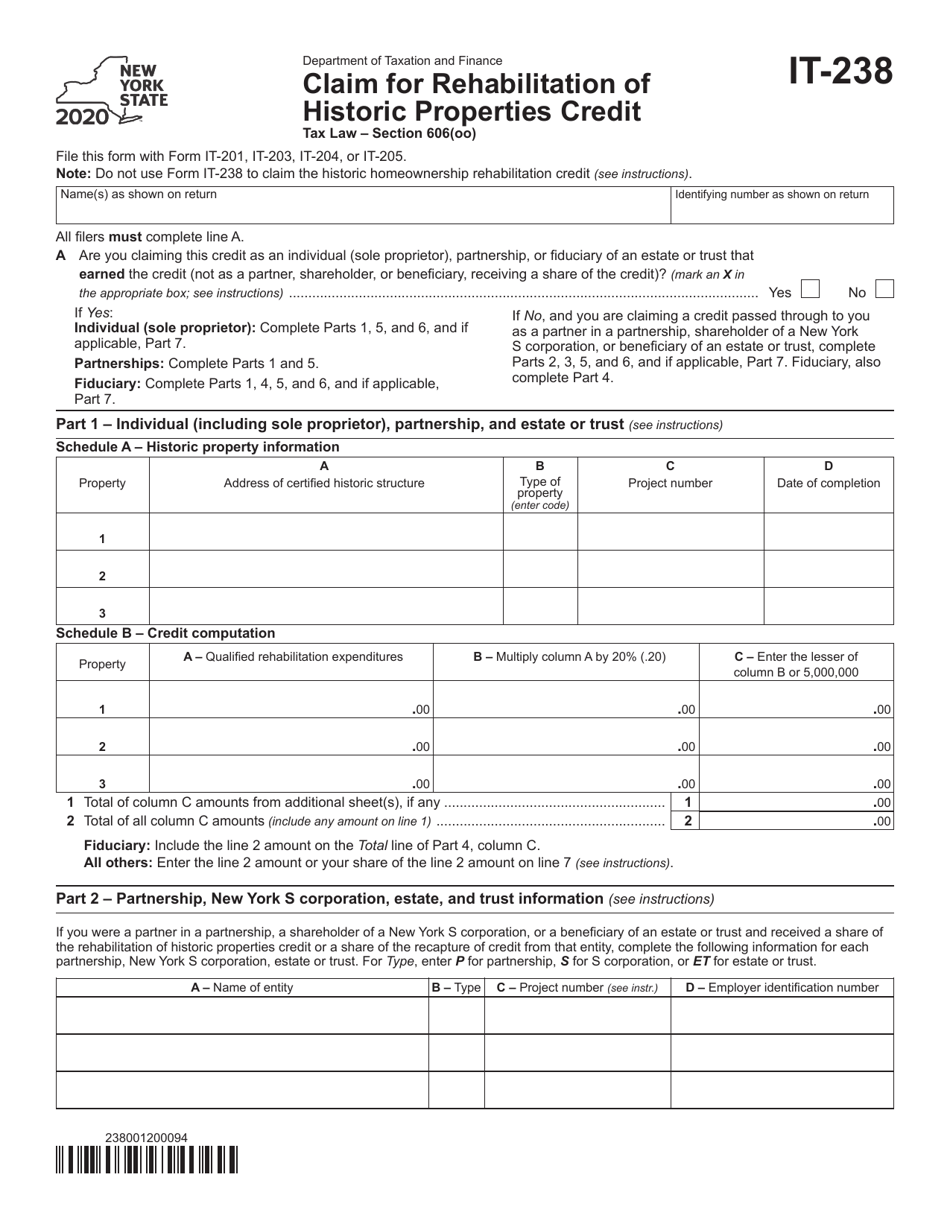

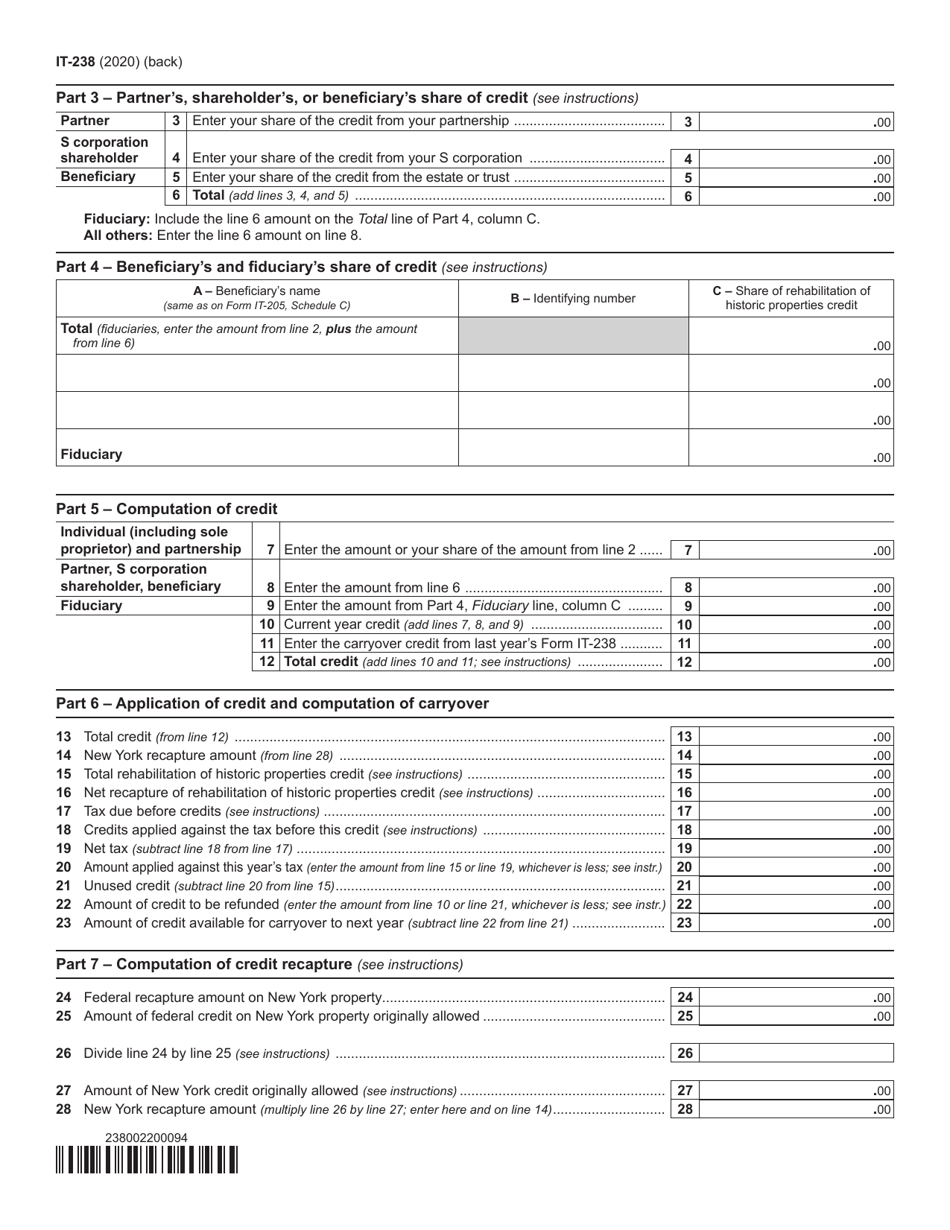

Form IT-238

for the current year.

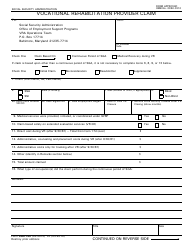

Form IT-238 Claim for Rehabilitation of Historic Properties Credit - New York

What Is Form IT-238?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-238?

A: Form IT-238 is a tax form used to claim the Rehabilitation of Historic Properties Credit in New York.

Q: What is the Rehabilitation of Historic Properties Credit?

A: The Rehabilitation of Historic Properties Credit is a tax credit provided to individuals, estates, and trusts who undertake qualifying rehabilitation work on eligible historic properties in New York.

Q: Who is eligible to claim the credit?

A: Individuals, estates, and trusts who undertake qualifying rehabilitation work on eligible historic properties in New York are eligible to claim the credit.

Q: What types of properties are eligible for the credit?

A: Eligible properties include buildings listed on the National Register of Historic Places or located in a historic district listed on the National Register.

Q: What expenses qualify for the credit?

A: Expenses related to the rehabilitation work, such as labor, materials, and architectural and engineering fees, may qualify for the credit.

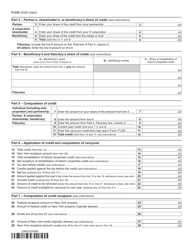

Q: How much is the credit?

A: The credit is equal to 20% of the qualified rehabilitation expenses, up to a maximum credit of $5 million per property.

Q: How do I claim the credit?

A: To claim the credit, you must complete and file Form IT-238 with your New York State tax return.

Q: Can the credit be carried forward or refunded?

A: Yes, any unused credit can be carried forward for up to 5 years or refunded as provided by law.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-238 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.