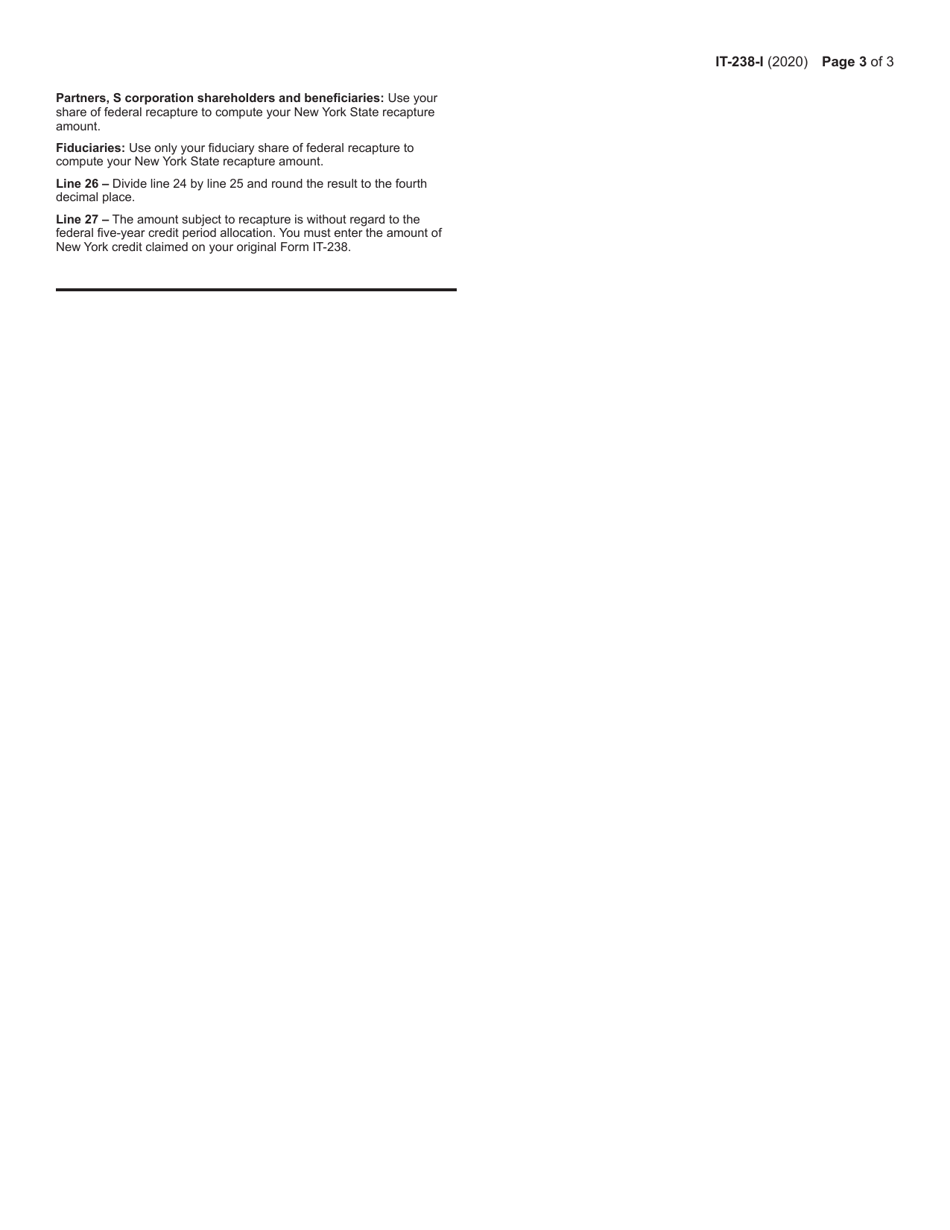

This version of the form is not currently in use and is provided for reference only. Download this version of

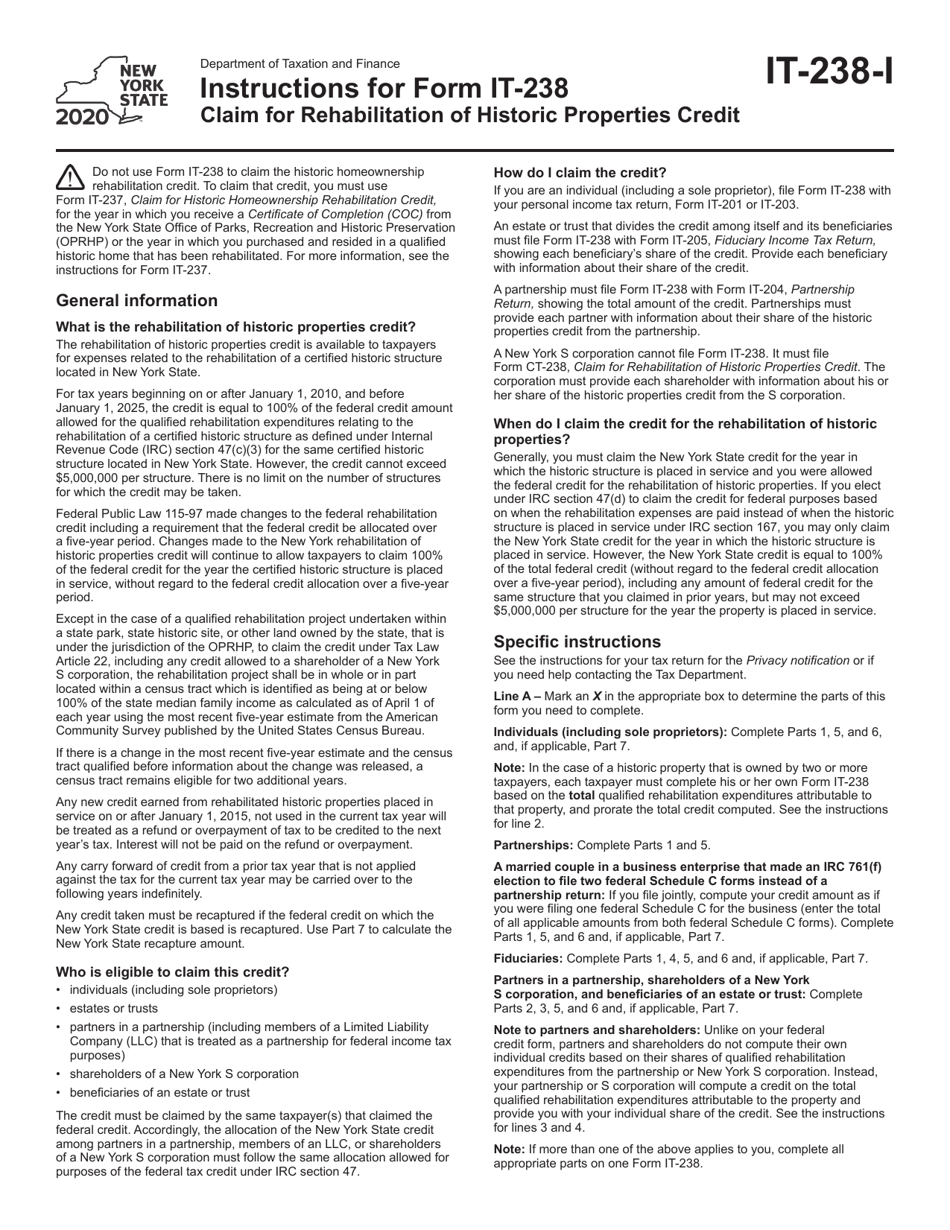

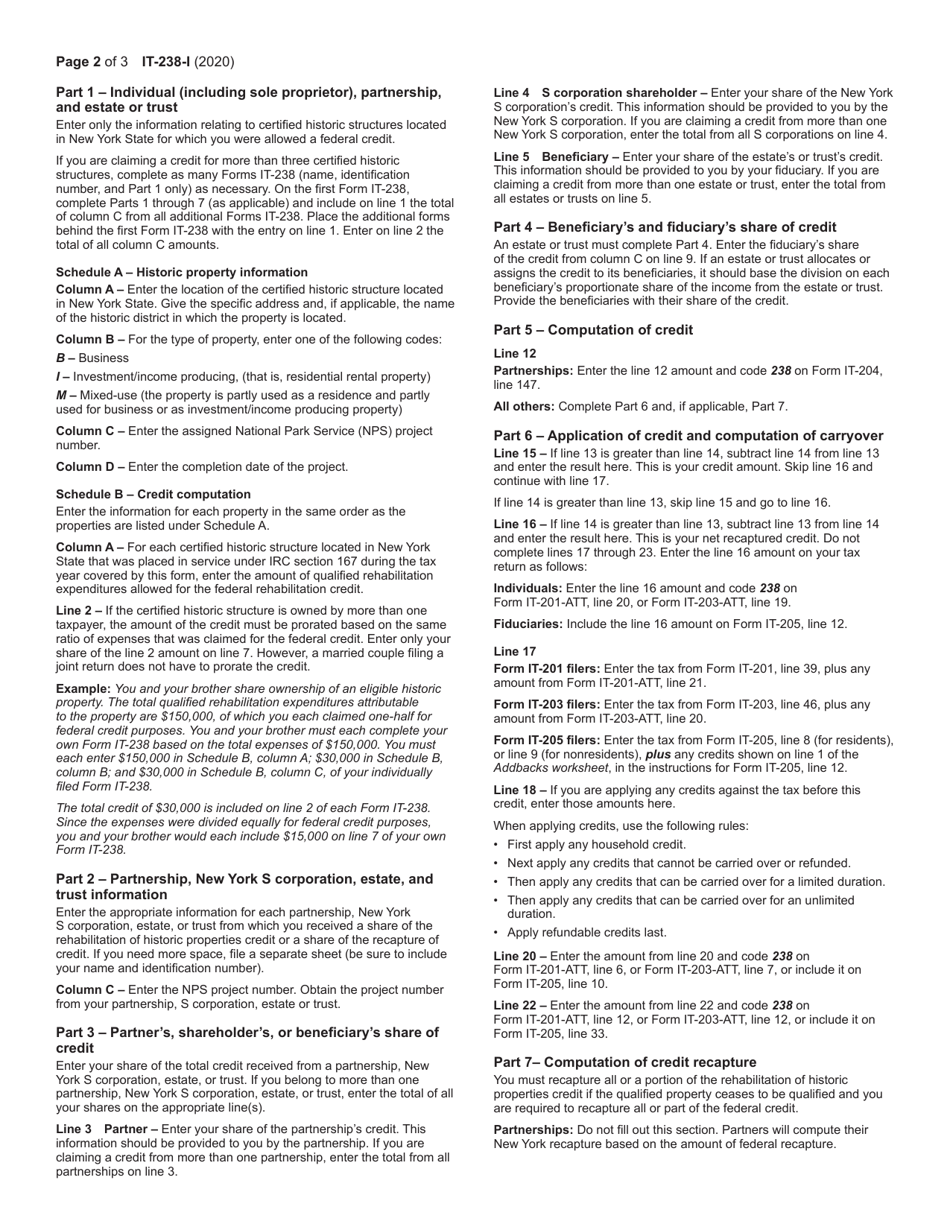

Instructions for Form IT-238

for the current year.

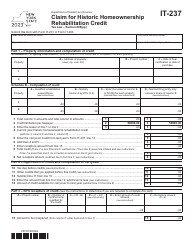

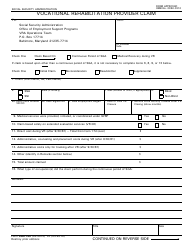

Instructions for Form IT-238 Claim for Rehabilitation of Historic Properties Credit - New York

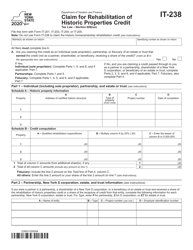

This document contains official instructions for Form IT-238 , Claim for Rehabilitation of Historic Properties Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-238 is available for download through this link.

FAQ

Q: What is Form IT-238?

A: Form IT-238 is a tax form used in New York to claim the Rehabilitation of Historic Properties Credit.

Q: What is the Rehabilitation of Historic Properties Credit?

A: The Rehabilitation of Historic Properties Credit is a tax credit available in New York for expenses incurred in the rehabilitation of certain historic properties.

Q: Who is eligible to claim this credit?

A: Property owners who have incurred expenses for rehabilitating eligible historic properties in New York may be eligible to claim this credit.

Q: What expenses can be claimed under this credit?

A: Qualifying expenses include costs related to the rehabilitation of the historic property, such as labor, materials, and certain fees.

Q: How much is the credit?

A: The credit amount is generally 20% of the qualifying expenses, up to a maximum of $5 million per project.

Q: How is the credit claimed?

A: The credit is claimed by completing and filing Form IT-238 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for claiming the credit?

A: Yes, the credit must be claimed within three years from the end of the tax year in which the expenses were incurred.

Q: Are there any additional requirements or restrictions for claiming the credit?

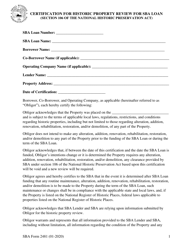

A: Yes, there are additional requirements, such as certification by the New York State Historic Preservation Office and compliance with certain preservation standards.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.