This version of the form is not currently in use and is provided for reference only. Download this version of

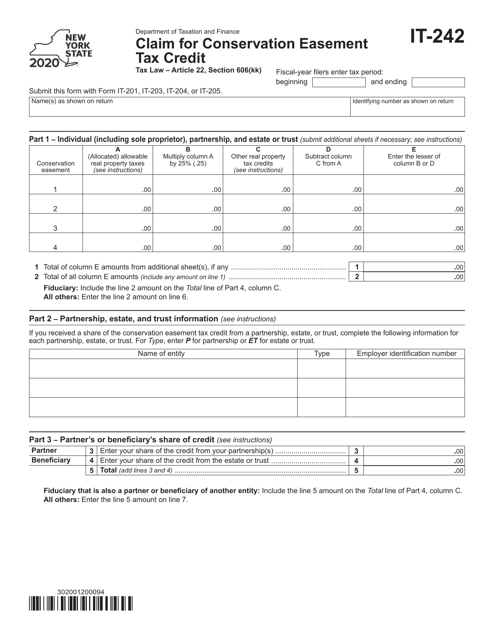

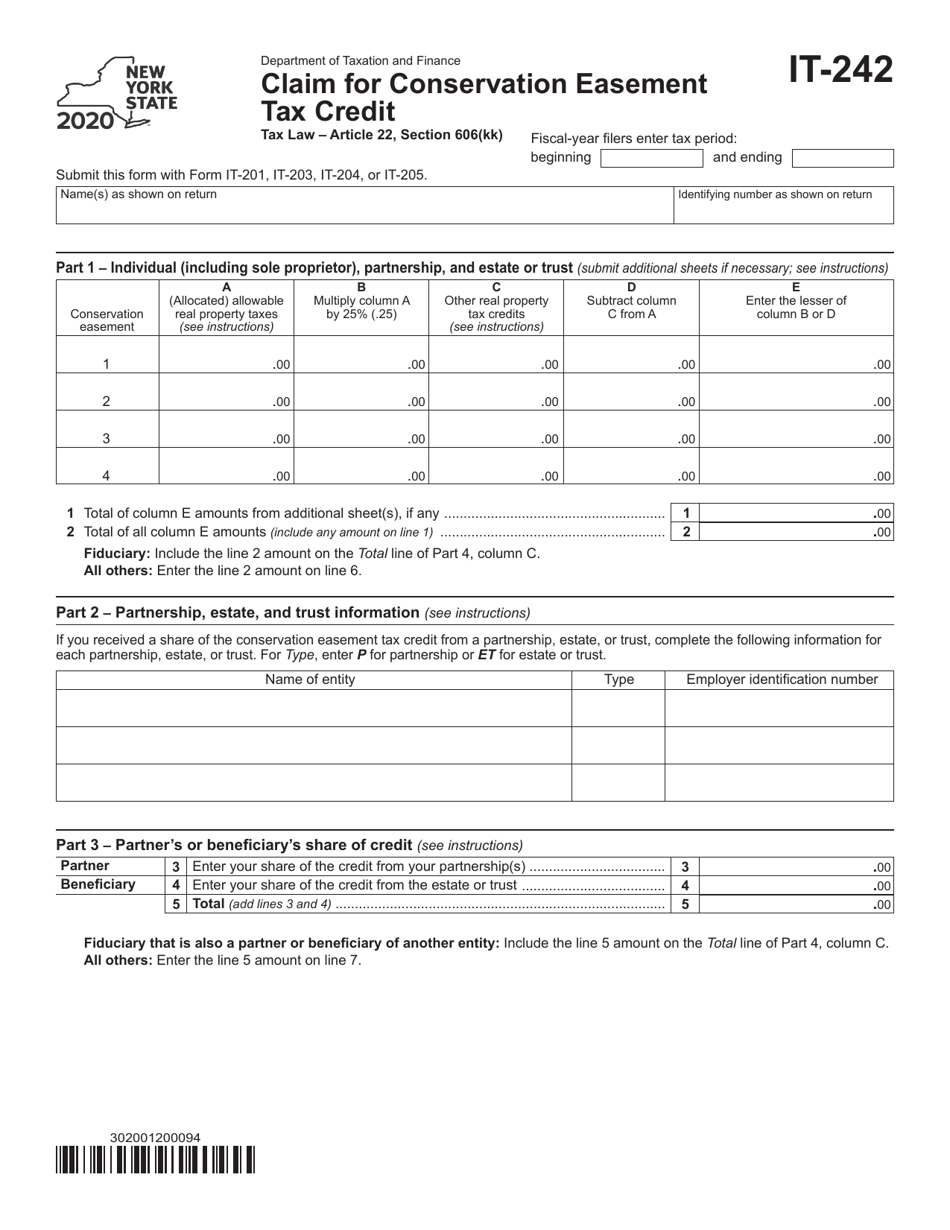

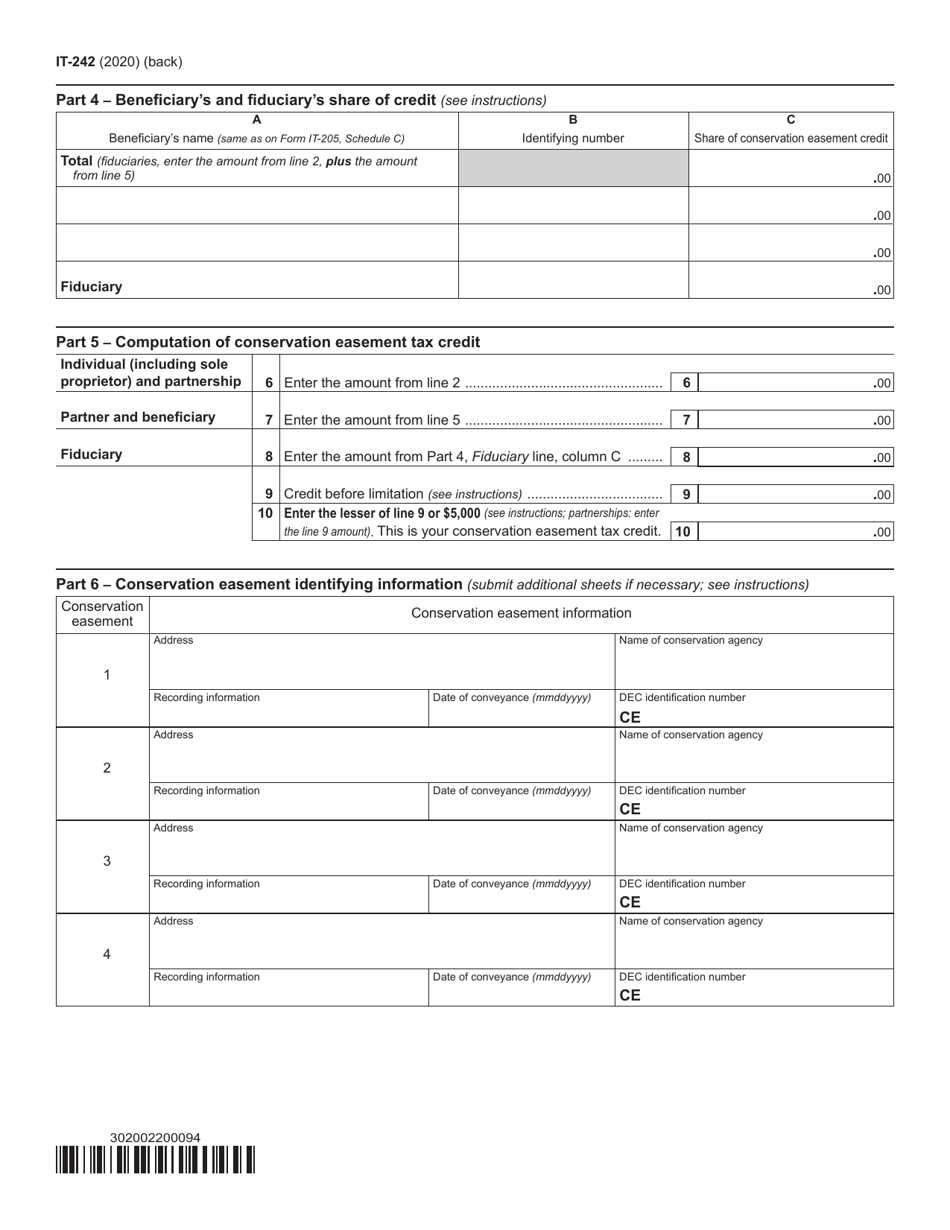

Form IT-242

for the current year.

Form IT-242 Claim for Conservation Easement Tax Credit - New York

What Is Form IT-242?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form IT-242?

A: Form IT-242 is the Claim for Conservation Easement Tax Credit form in New York.

Q: What is the purpose of form IT-242?

A: The purpose of form IT-242 is to claim the Conservation Easement Tax Credit in New York.

Q: Who can use form IT-242?

A: Individuals and corporations who have donated a qualified real property interest for conservation purposes in New York can use form IT-242.

Q: What is a conservation easement?

A: A conservation easement is a legal agreement between a landowner and a land trust or government agency that restricts the development or use of the land for conservation purposes.

Q: What are the requirements to claim the Conservation Easement Tax Credit?

A: To claim the Conservation Easement Tax Credit, the donated property interest must be valued at $500,000 or more and meet other specified criteria.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-242 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

![Document preview: Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)