This version of the form is not currently in use and is provided for reference only. Download this version of

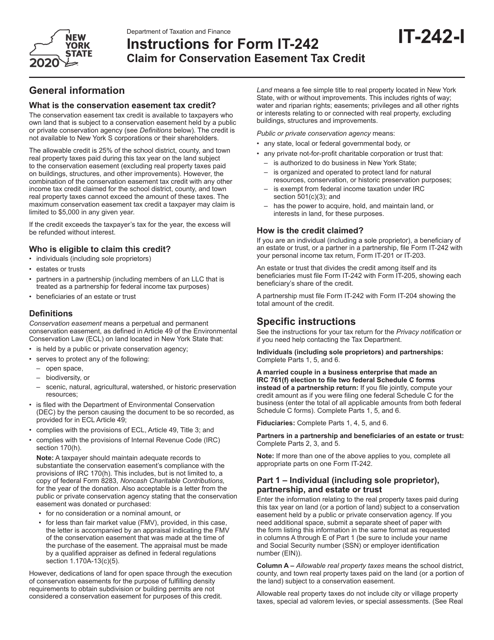

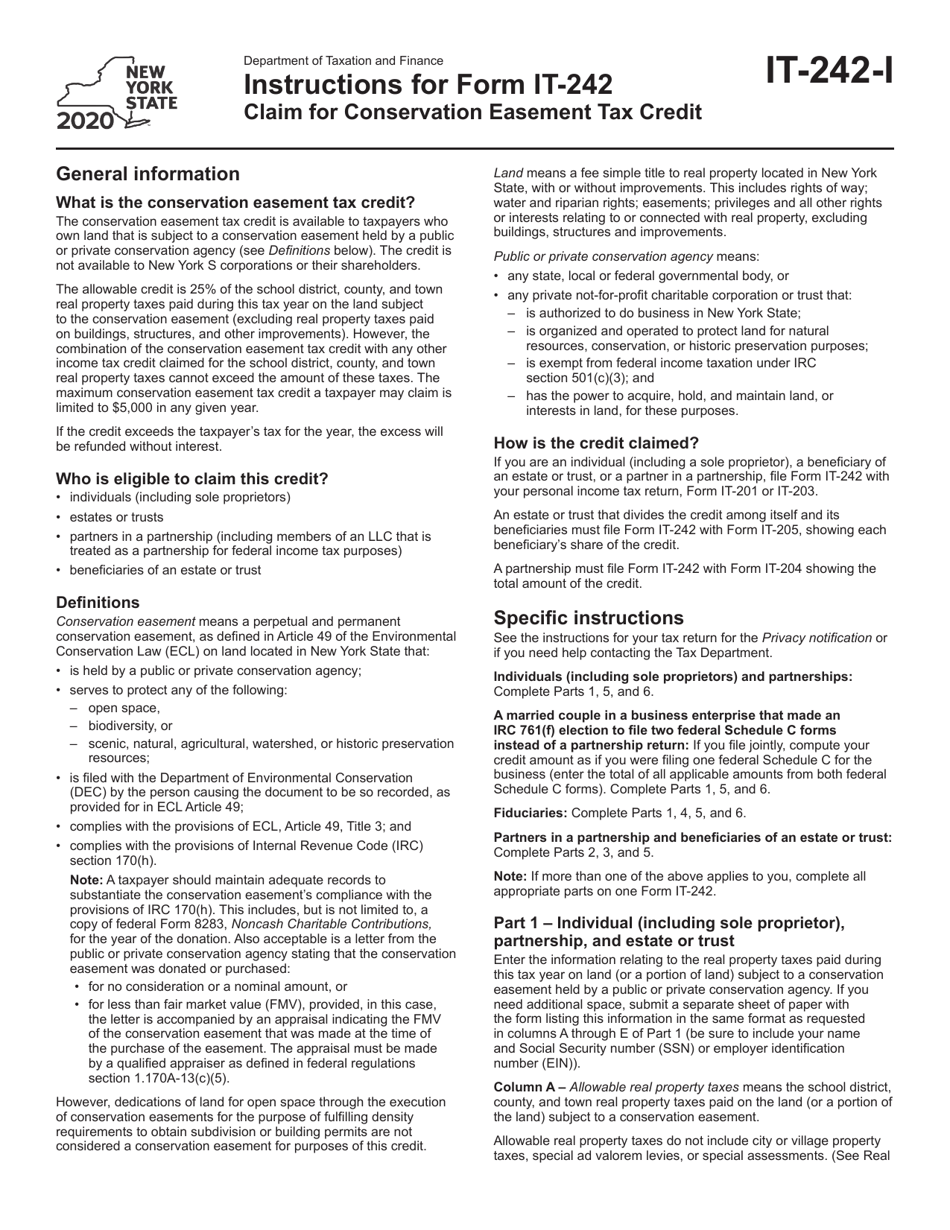

Instructions for Form IT-242

for the current year.

Instructions for Form IT-242 Claim for Conservation Easement Tax Credit - New York

This document contains official instructions for Form IT-242 , Claim for Conservation Easement Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-242 is available for download through this link.

FAQ

Q: What is Form IT-242?

A: Form IT-242 is the form used in New York to claim a Conservation Easement Tax Credit.

Q: What is a Conservation Easement?

A: A Conservation Easement is a legal agreement in which a property owner voluntarily restricts the development or use of their property to preserve its natural, scenic, or open-space features.

Q: Who can claim the Conservation Easement Tax Credit?

A: Property owners in New York who have donated or sold a qualified conservation easement to a qualified organization.

Q: How much tax credit can be claimed?

A: The tax credit amount is 25% of the appraised value of the donated easement, up to $5 million.

Q: What documentation is required to claim the tax credit?

A: Documentation required includes a copy of the executed easement agreement, appraisal report, and other supporting documentation.

Q: When should Form IT-242 be filed?

A: Form IT-242 should be filed within three years after the date the easement was donated or sold.

Q: Are there any additional requirements or considerations?

A: Yes, there are additional requirements and considerations. It is recommended to consult the instructions for Form IT-242 or seek professional advice for detailed information.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.

![Document preview: Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

![Document preview: Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)