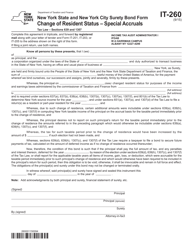

This version of the form is not currently in use and is provided for reference only. Download this version of

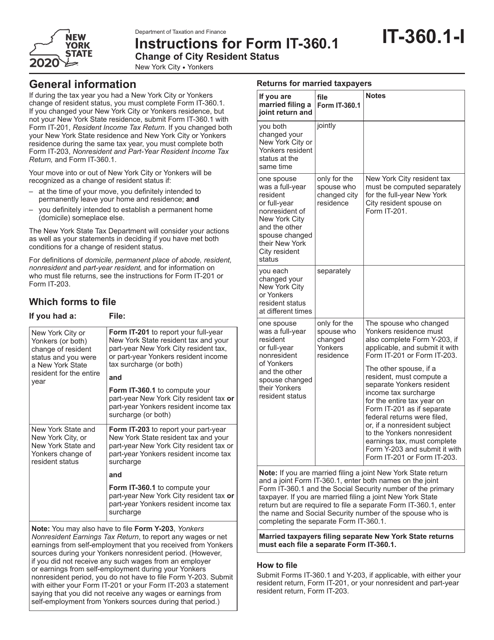

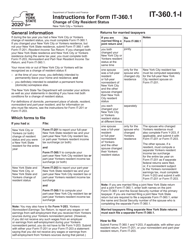

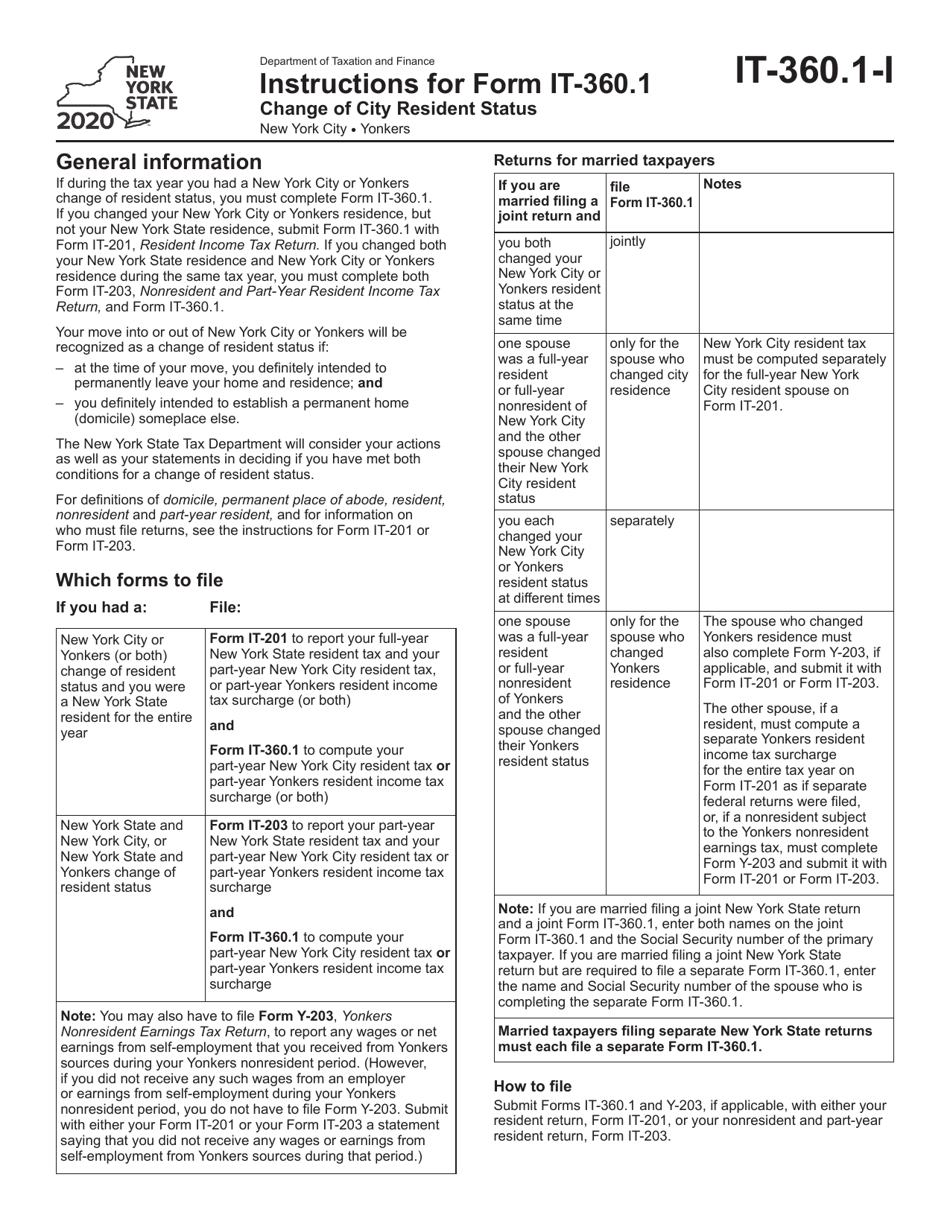

Instructions for Form IT-360.1

for the current year.

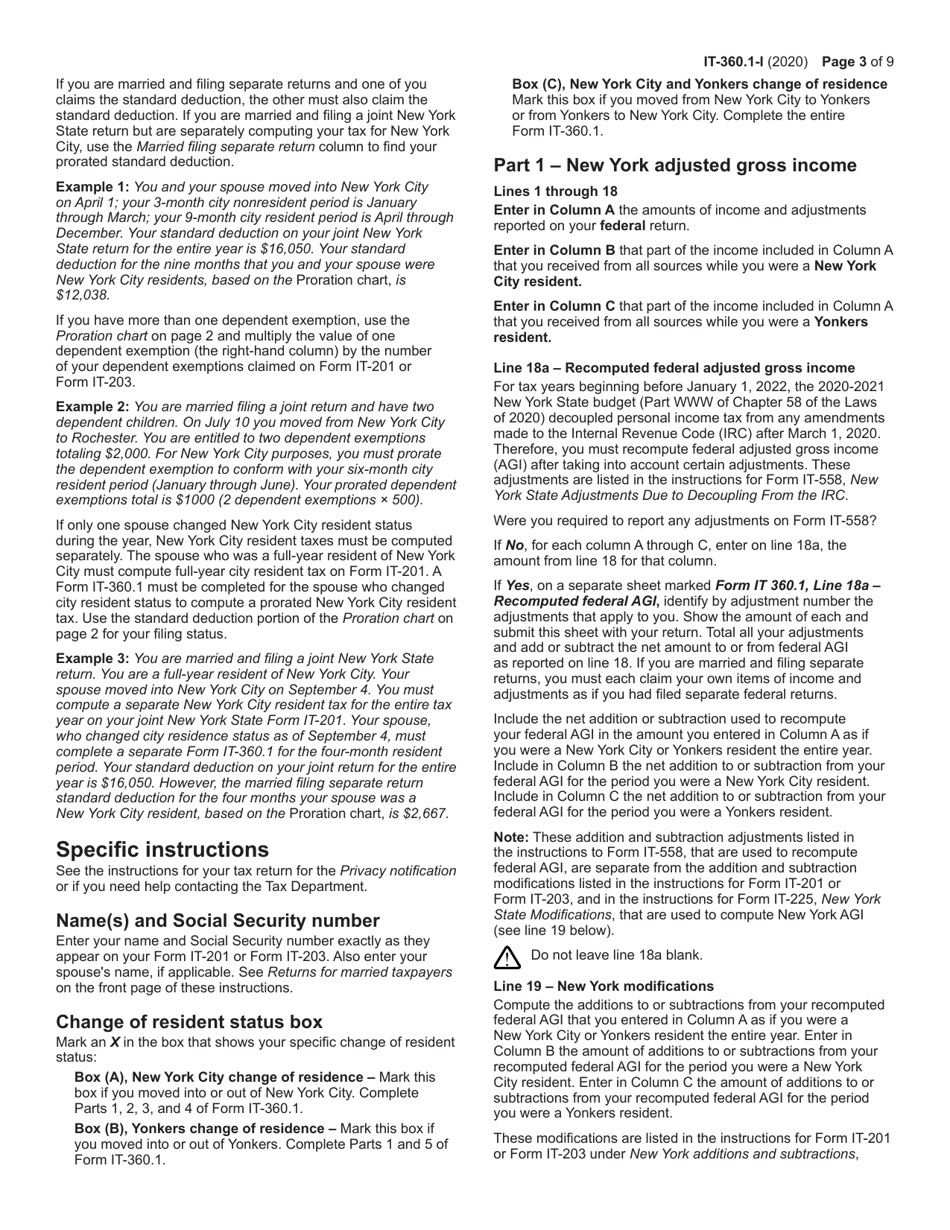

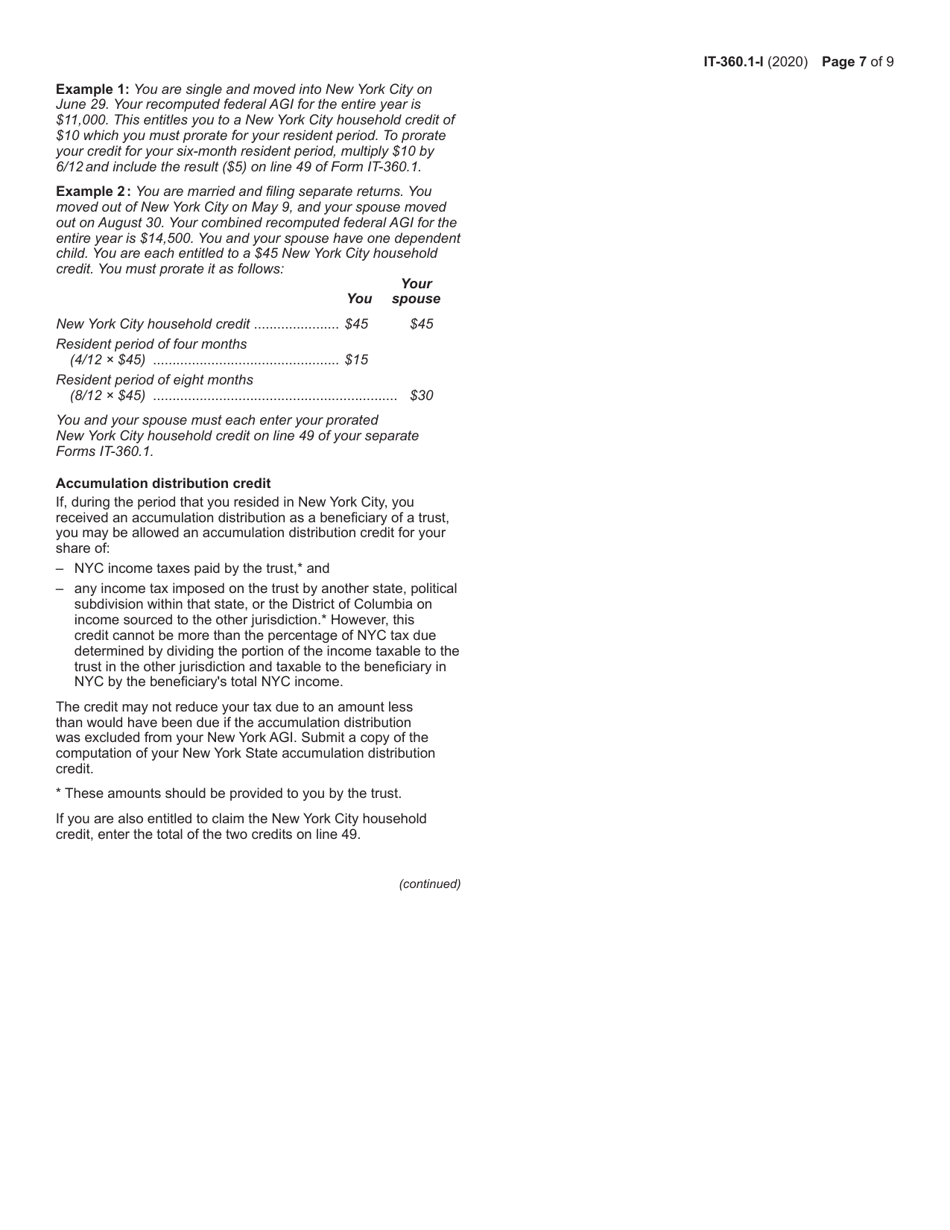

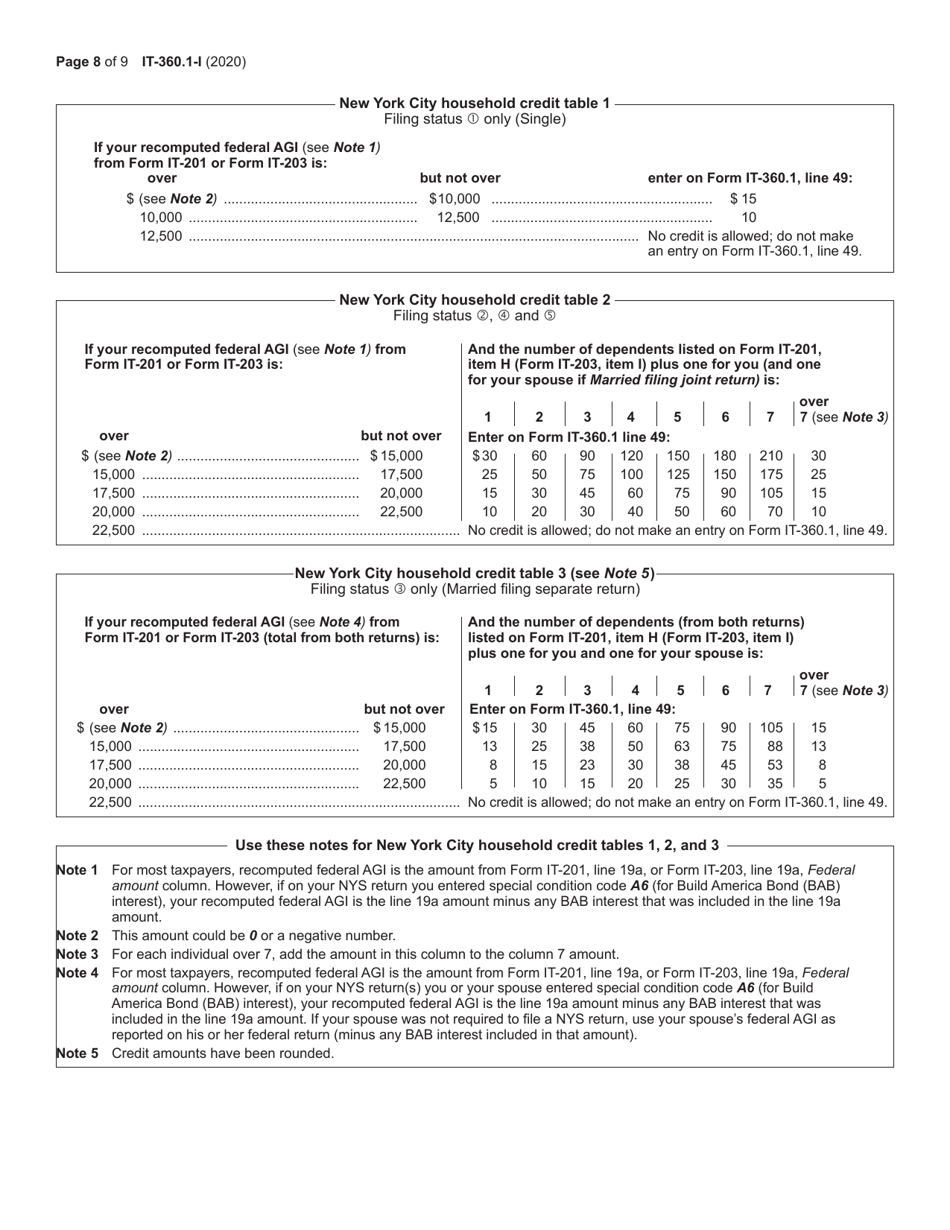

Instructions for Form IT-360.1 Change of City Resident Status - New York

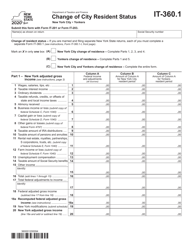

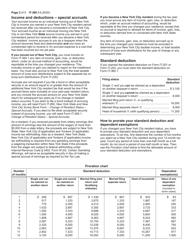

This document contains official instructions for Form IT-360.1 , Change of City Resident Status - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-360.1 is available for download through this link.

FAQ

Q: What is Form IT-360.1?

A: Form IT-360.1 is a form used in New York to request a change of city resident status.

Q: Who should use Form IT-360.1?

A: Form IT-360.1 should be used by individuals who have changed their city resident status in New York.

Q: What is the purpose of Form IT-360.1?

A: The purpose of Form IT-360.1 is to notify the New York Department of Taxation and Finance about a change in city resident status.

Q: When should I file Form IT-360.1?

A: Form IT-360.1 should be filed within 90 days of the change in city resident status.

Q: What information is required on Form IT-360.1?

A: Form IT-360.1 requires information such as personal details, previous and new city resident status, and supporting documentation.

Q: Is there a fee to file Form IT-360.1?

A: No, there is no fee to file Form IT-360.1.

Q: How long does it take to process Form IT-360.1?

A: Processing times for Form IT-360.1 may vary, but it typically takes several weeks.

Q: What happens after I file Form IT-360.1?

A: After filing Form IT-360.1, you will receive a confirmation and your city resident status will be updated accordingly.

Instruction Details:

- This 9-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.