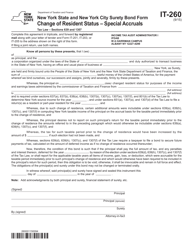

This version of the form is not currently in use and is provided for reference only. Download this version of

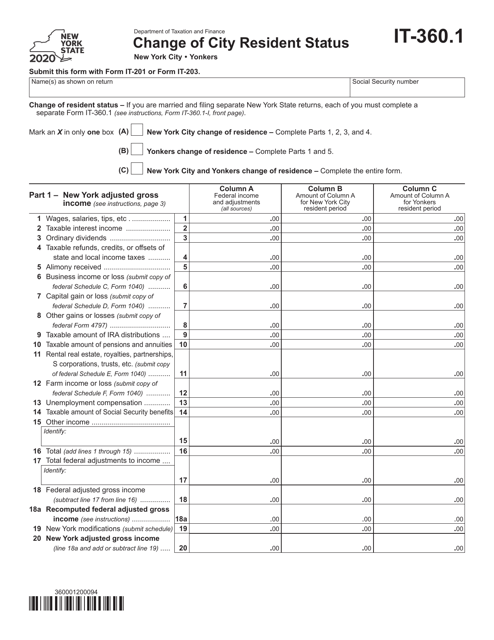

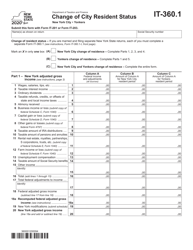

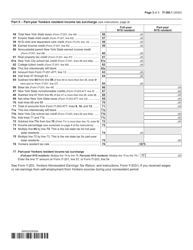

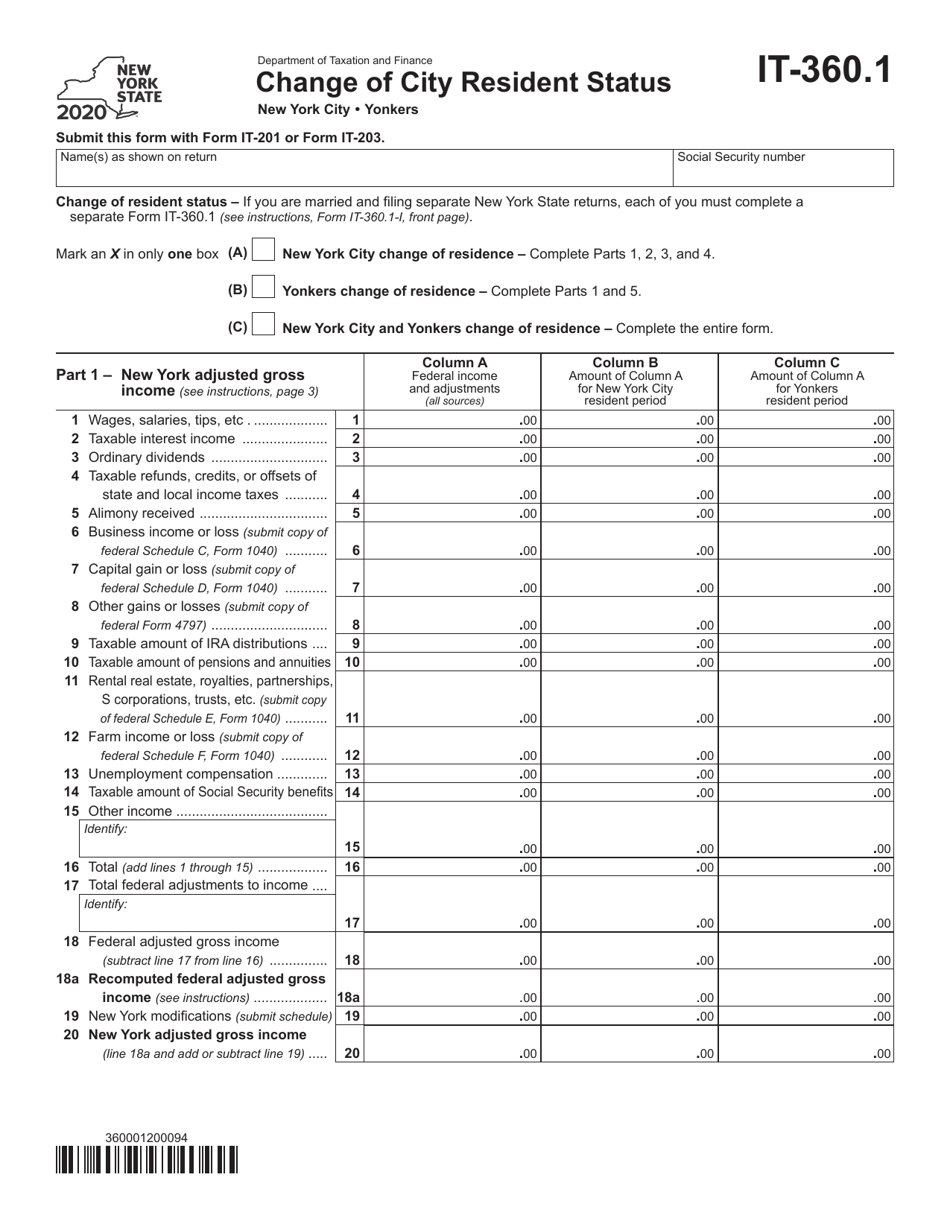

Form IT-360.1

for the current year.

Form IT-360.1 Change of City Resident Status - New York

What Is Form IT-360.1?

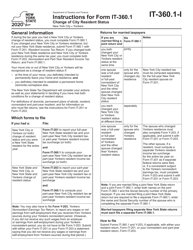

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-360.1?

A: Form IT-360.1 is a tax form used in New York to indicate a change in city resident status.

Q: Who needs to file Form IT-360.1?

A: You need to file Form IT-360.1 if you had a change in your New York City resident status during the tax year.

Q: What is considered a change in city resident status?

A: A change in city resident status refers to either becoming a New York City resident or ceasing to be a New York City resident during the tax year.

Q: When should Form IT-360.1 be filed?

A: Form IT-360.1 should be filed with your New York State income tax return, usually due on April 15th.

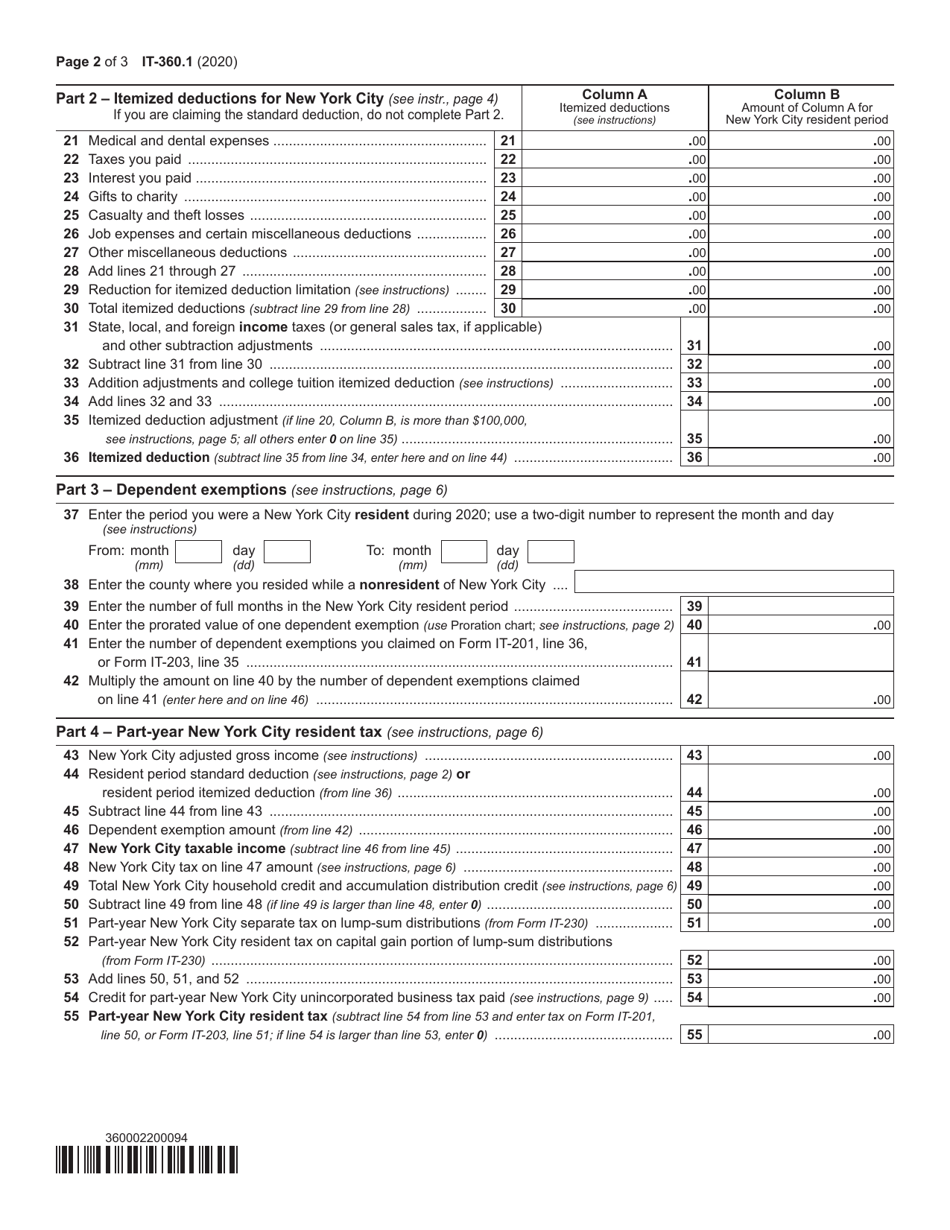

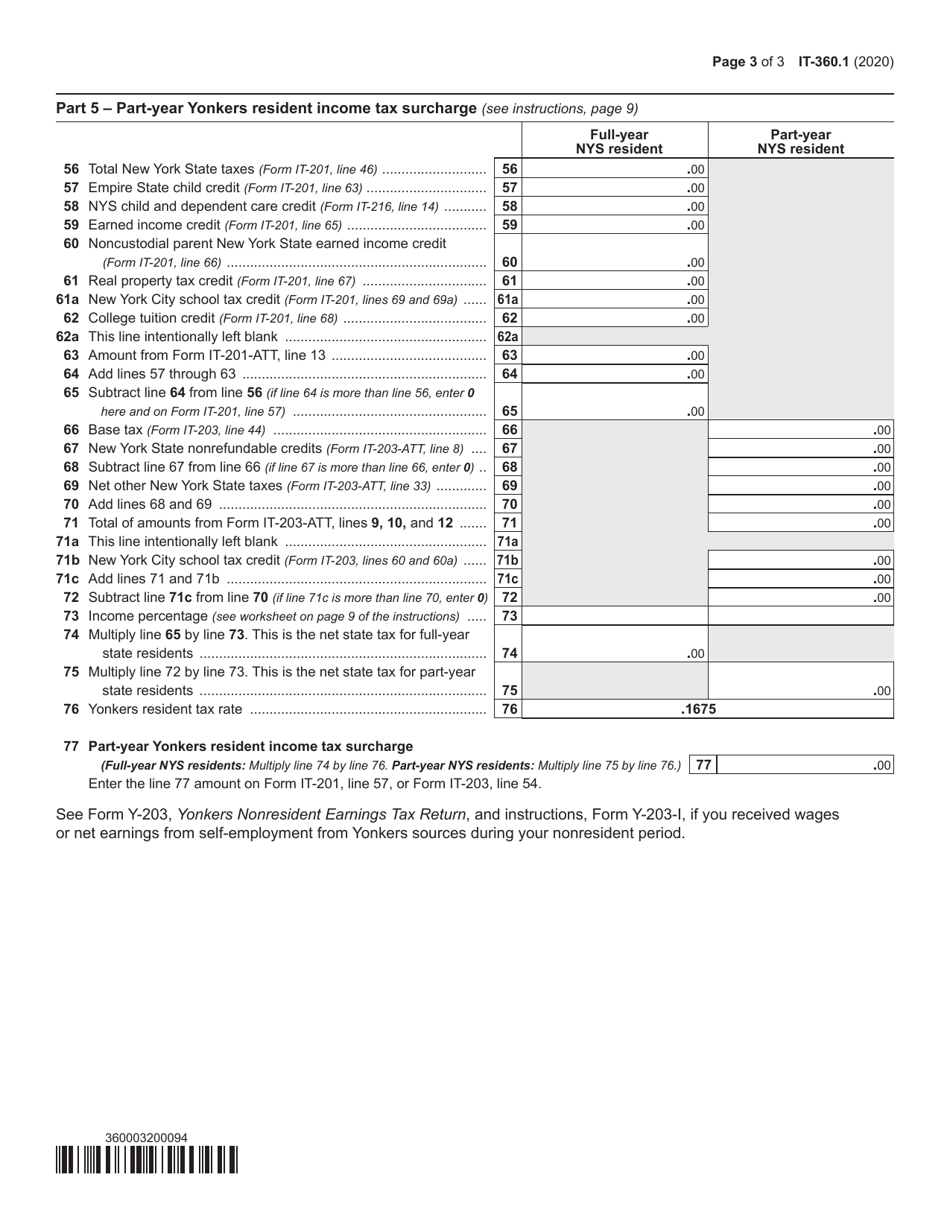

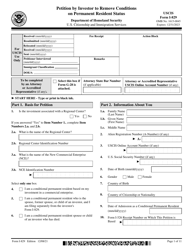

Q: What information is required on Form IT-360.1?

A: Form IT-360.1 requires information about your personal details, the dates of your New York City residency, and any supporting documentation.

Q: Are there any penalties for not filing Form IT-360.1?

A: Yes, failure to file Form IT-360.1 may result in penalties and interest on any unpaid tax owed.

Q: Can I file Form IT-360.1 electronically?

A: No, as of now, Form IT-360.1 cannot be filed electronically. It must be filed by mail with your New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-360.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.