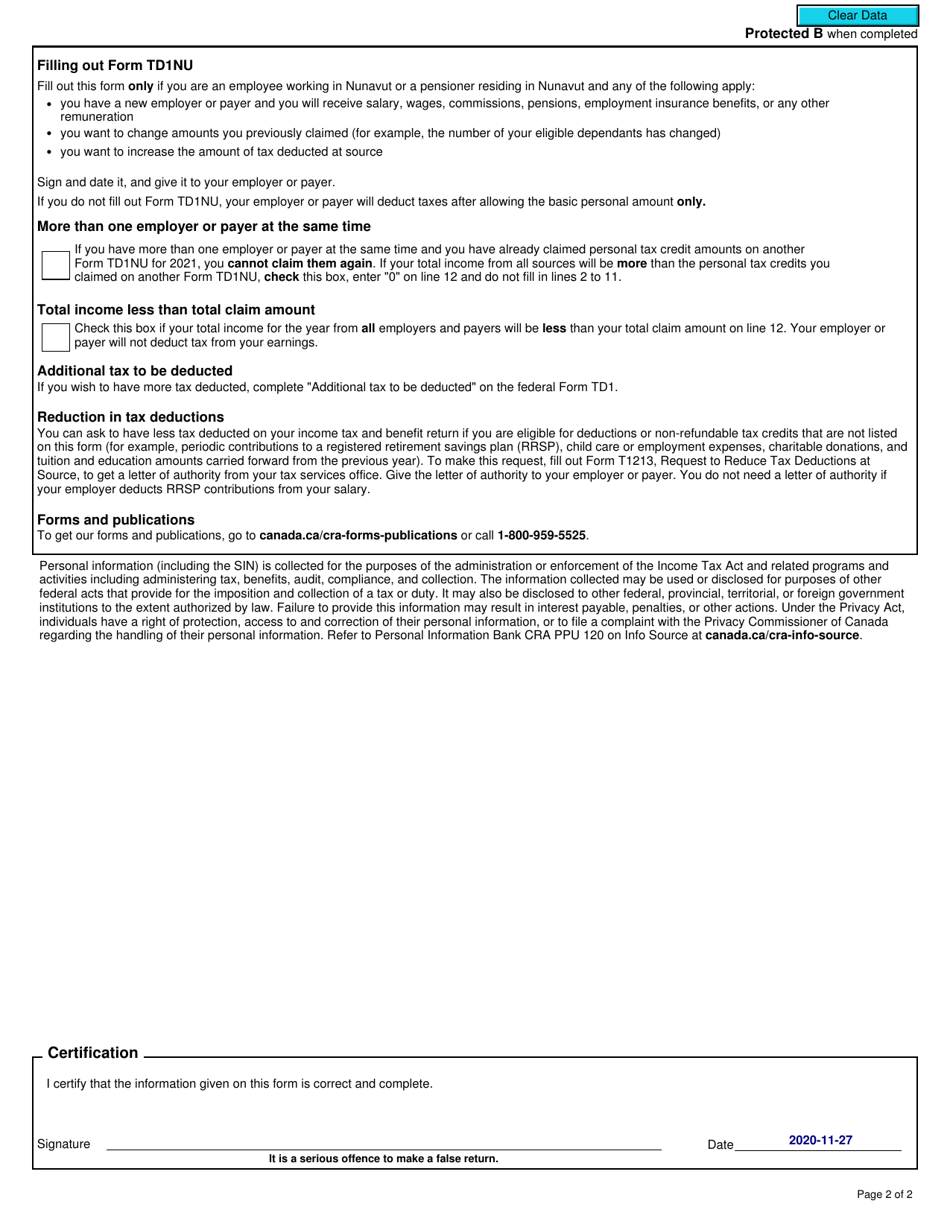

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1NU

for the current year.

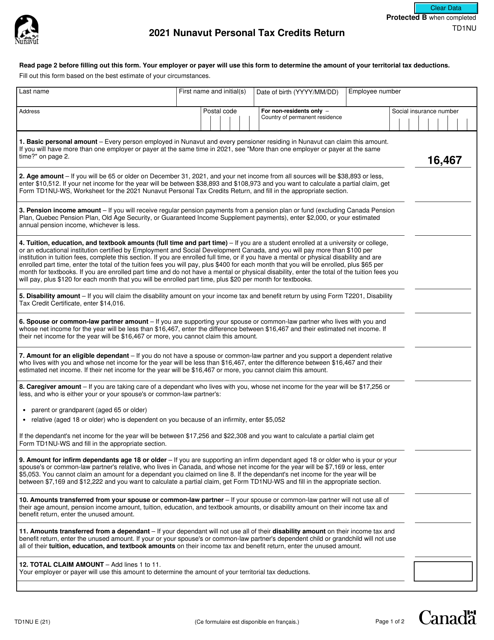

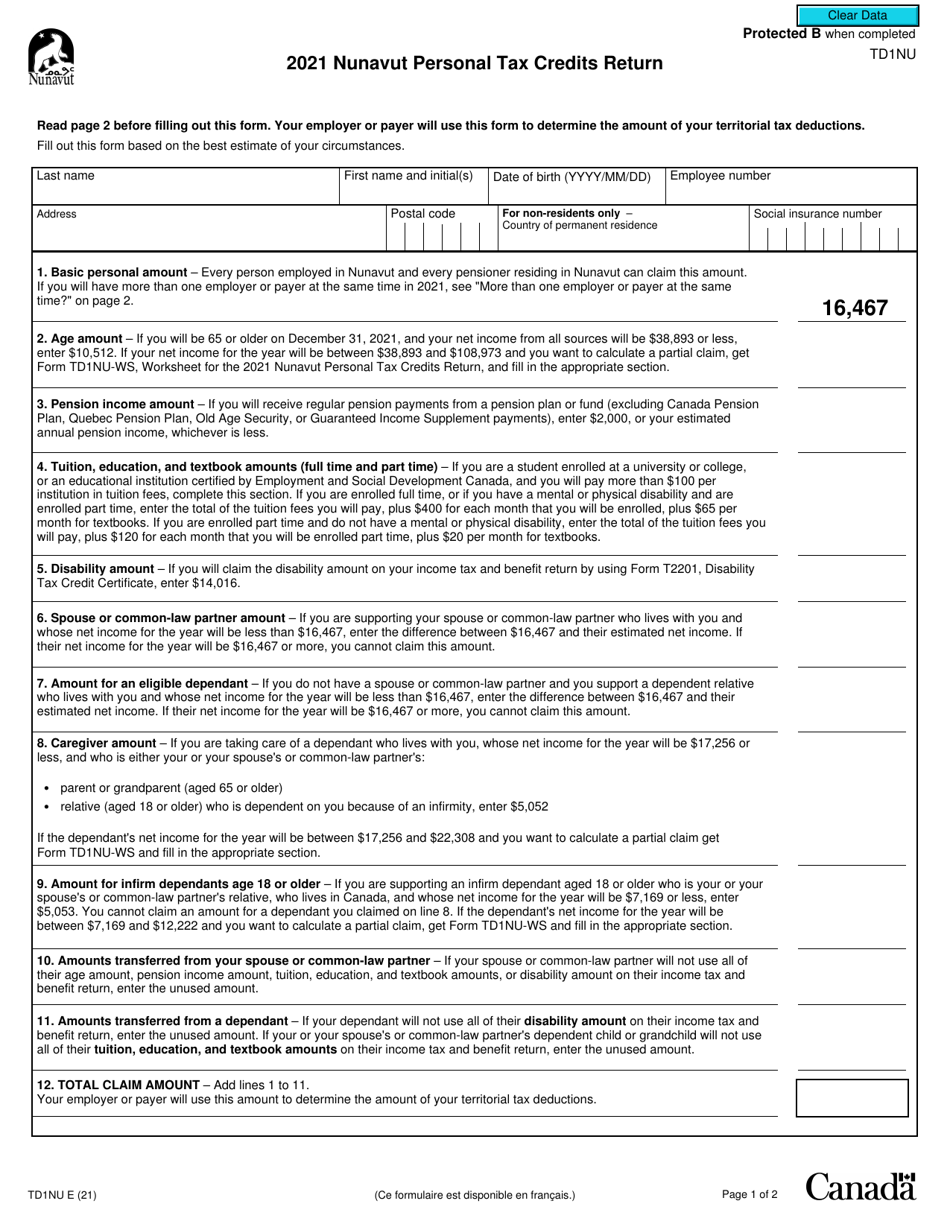

Form TD1NU Nunavut Personal Tax Credits Return - Canada

Form TD1NU, Nunavut Personal Tax Credits Return, is a form used in Canada for individuals who live in the territory of Nunavut. This form allows residents of Nunavut to claim various tax credits and deductions on their personal income tax return, which can help reduce the amount of income tax they owe.

The Form TD1NU Nunavut Personal Tax Credits Return in Canada is typically filed by individuals who are residents of Nunavut and want to claim various personal tax credits for the tax year.

FAQ

Q: What is Form TD1NU?

A: Form TD1NU is the Nunavut Personal Tax Credits Return for individuals in the Canadian province of Nunavut.

Q: Who should file Form TD1NU?

A: Form TD1NU should be filed by residents of Nunavut who want to claim specific tax credits on their income tax return.

Q: What are personal tax credits?

A: Personal tax credits are deductions that can be claimed to reduce the amount of tax owed. They can include credits for things like dependents, disabilities, and employment expenses.

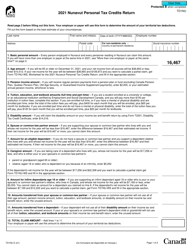

Q: When should I file Form TD1NU?

A: Form TD1NU should be filed when you start a new job or when there are changes to your personal or financial situation that affect your tax credits.

Q: Do I need to file Form TD1NU every year?

A: No, you only need to file Form TD1NU when there are changes to your personal or financial situation that affect your tax credits.

Q: What happens if I don't file Form TD1NU?

A: If you don't file Form TD1NU, your employer will deduct taxes based on the default tax credits, which may result in over or underpayment of taxes.