This version of the form is not currently in use and is provided for reference only. Download this version of

Form T185

for the current year.

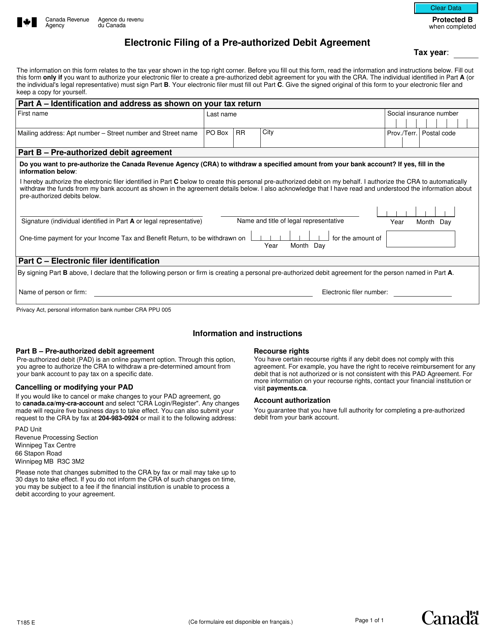

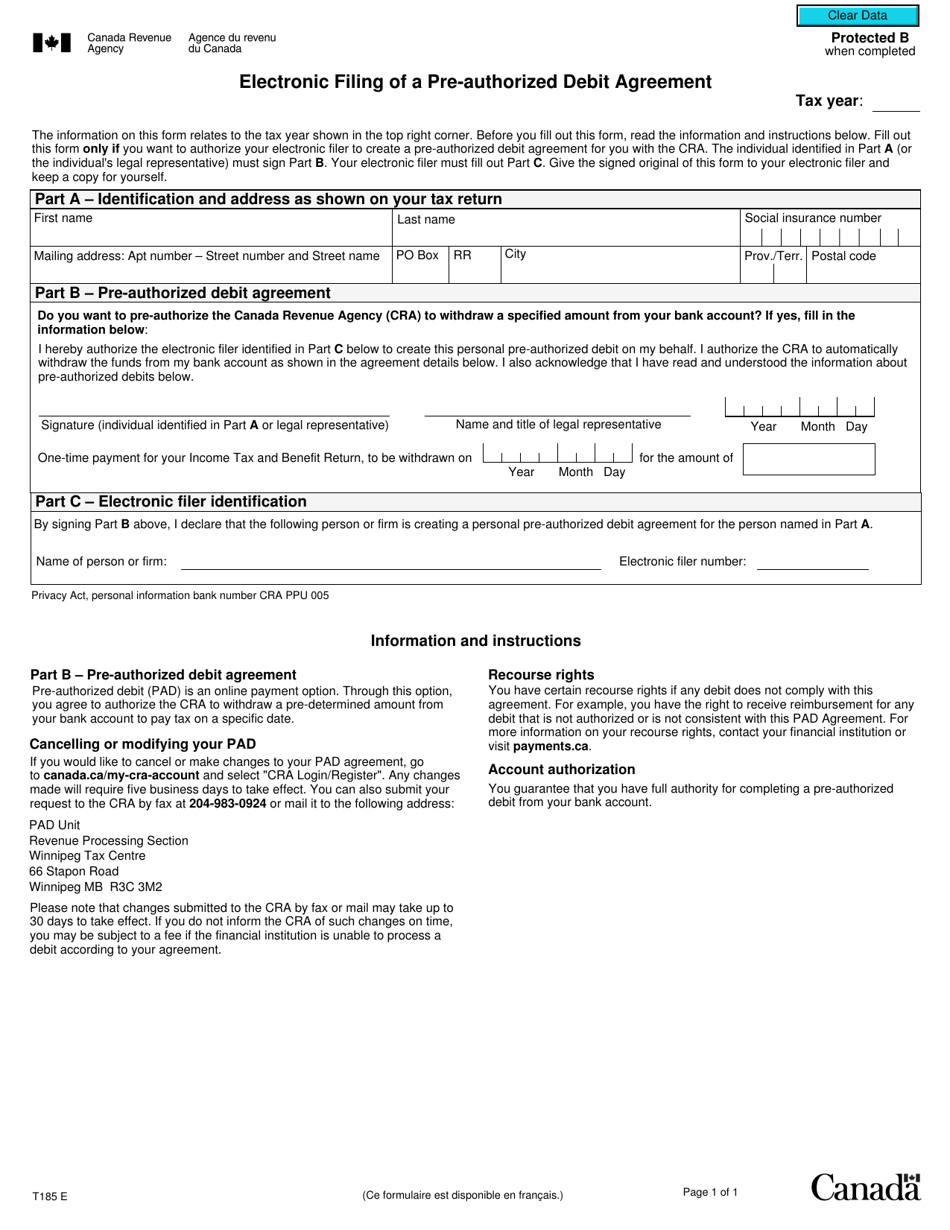

Form T185 Electronic Filing of a Pre-authorized Debit Agreement - Canada

Form T185 Electronic Filing of a Pre-authorized Debit Agreement is used in Canada for individuals or businesses to authorize the Canada Revenue Agency (CRA) to debit their bank accounts electronically. The form allows for the payment of taxes, such as income tax, through scheduled withdrawals from the authorized bank account.

The Form T185 for electronic filing of a pre-authorized debit agreement in Canada is filed by the person or business who will be debiting funds from the payee's account.

FAQ

Q: What is Form T185?

A: Form T185 is a form used in Canada for the Electronic Filing of a Pre-authorized Debit Agreement.

Q: What is a Pre-authorized Debit Agreement?

A: A Pre-authorized Debit Agreement is an arrangement where a person authorizes another party to withdraw money from their bank account on a regular basis.

Q: Who uses Form T185?

A: Form T185 is used by individuals or businesses who want to establish a pre-authorized debit agreement with another party.

Q: What information is required on Form T185?

A: Form T185 requires the name and contact information of both the account holder and the recipient of the pre-authorized debit, as well as the bank account details.

Q: Do I need to submit Form T185 to the CRA?

A: No, Form T185 does not need to be submitted to the CRA. It is for the purposes of establishing a pre-authorized debit agreement between the account holder and the recipient.

Q: Can Form T185 be used for international transfers?

A: No, Form T185 is specifically for electronic transfers within Canada. It cannot be used for international transfers.