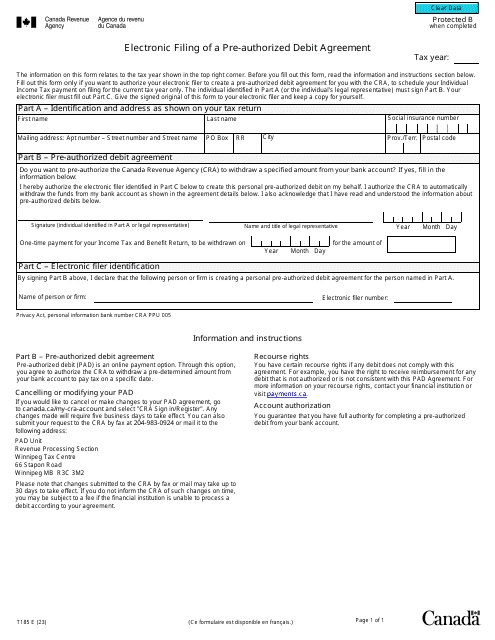

Form T185 Electronic Filing of a Pre-authorized Debit Agreement - Canada

Form T185 Electronic Filing of a Pre-authorized Debit Agreement in Canada is used for electronically submitting a pre-authorized debit agreement to the Canada Revenue Agency (CRA) for certain payments, such as income tax installments or other tax-related purposes.

The Form T185 for electronic filing of a pre-authorized debit agreement is typically filed by the payee or recipient of the funds in Canada.

Form T185 Electronic Filing of a Pre-authorized Debit Agreement - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T185? A: Form T185 is a document used for the electronic filing of a pre-authorized debit agreement in Canada.

Q: What is a pre-authorized debit agreement? A: A pre-authorized debit agreement is an arrangement between a payer and a payee in which the payer authorizes the payee to withdraw funds from their bank account on a regular basis.

Q: Why would I need to file Form T185? A: You would need to file Form T185 if you want to authorize a payee to withdraw funds from your bank account through pre-authorized debit.

Q: Is Form T185 specific to Canada? A: Yes, Form T185 is specific to Canada.

Q: Do I need to file Form T185 for every pre-authorized debit agreement? A: Yes, you need to file Form T185 for every pre-authorized debit agreement.

Q: Is there a fee for filing Form T185? A: No, there is no fee for filing Form T185.

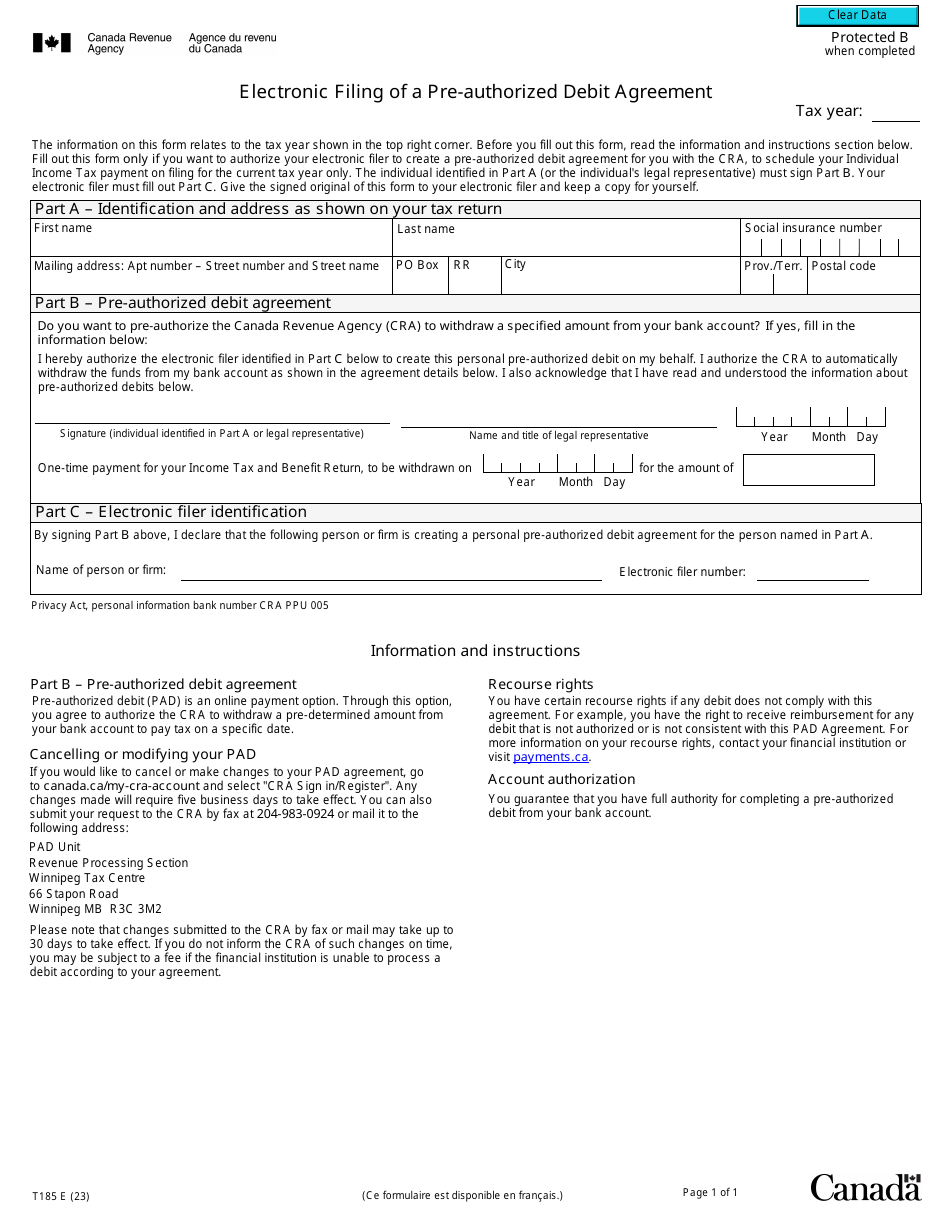

Q: Can I cancel a pre-authorized debit agreement? A: Yes, you can cancel a pre-authorized debit agreement by providing written notice to the payee and your financial institution.

Q: What happens if I don't file Form T185? A: If you don't file Form T185, the payee will not be authorized to withdraw funds from your bank account through pre-authorized debit.

Q: Can I make changes to a pre-authorized debit agreement after filing Form T185? A: Yes, you can make changes to a pre-authorized debit agreement after filing Form T185 by providing written notice to the payee.