This version of the form is not currently in use and is provided for reference only. Download this version of

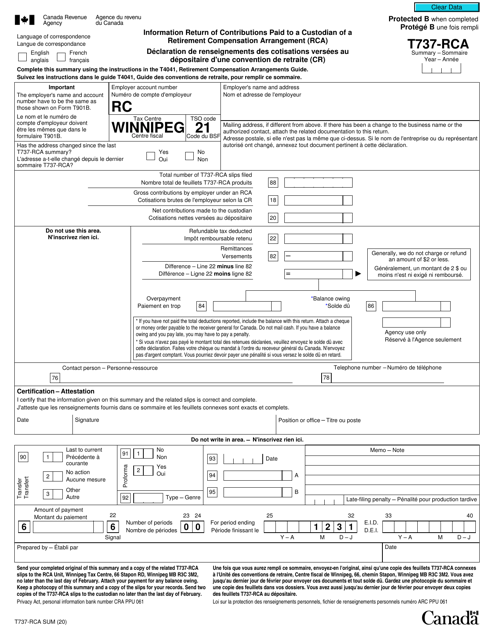

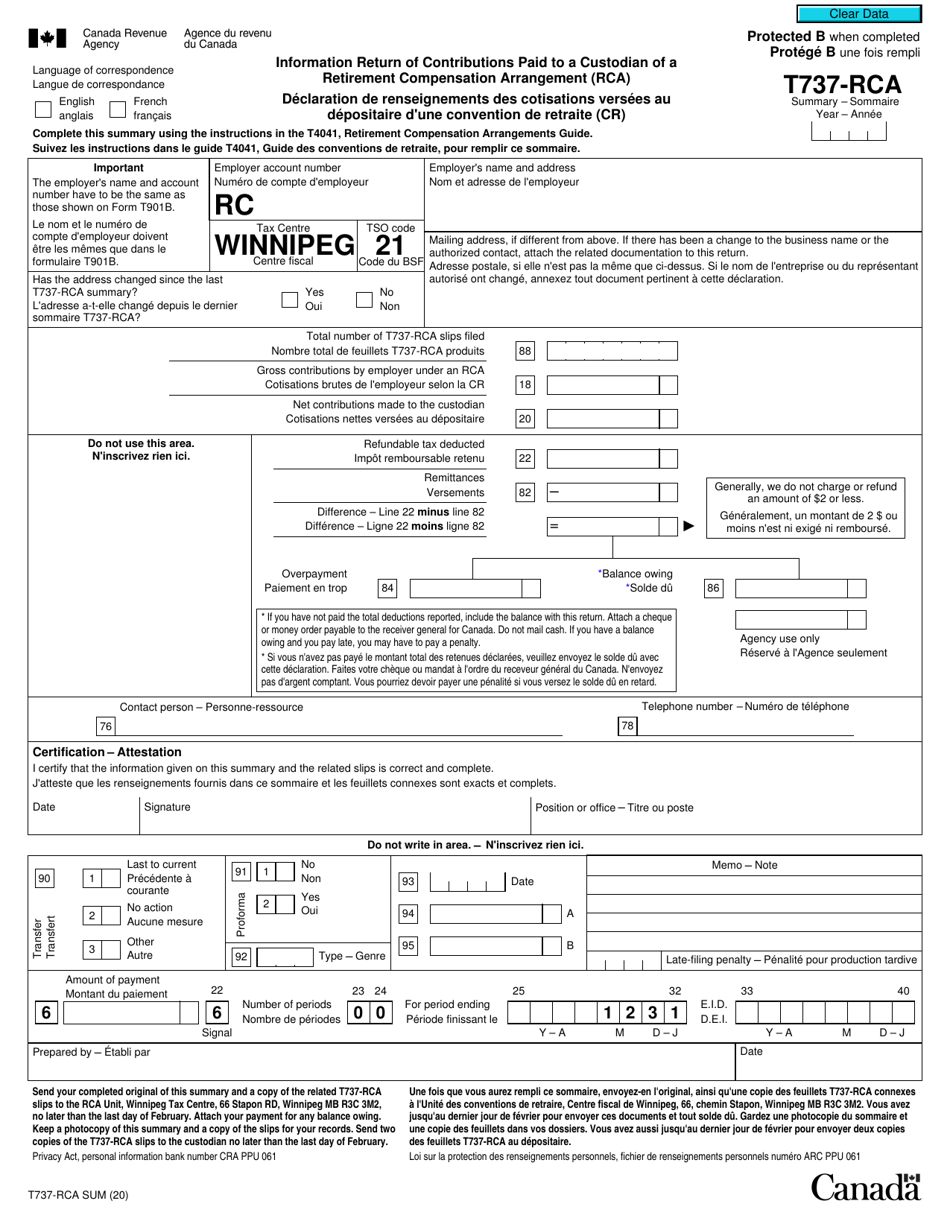

Form T737-RCA SUM

for the current year.

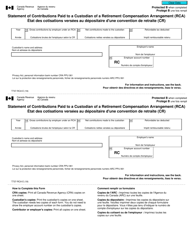

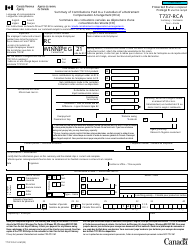

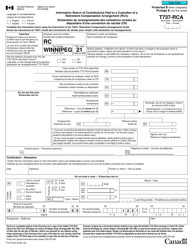

Form T737-RCA SUM Information Return of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (Rca) - Canada (English / French)

Form T737-RCA SUM is used in Canada to report the contributions made to a Custodian of a Retirement Compensation Arrangement (RCA). It provides information about the contributions paid to the RCA. This form is filed by the custodian of the RCA to fulfill the reporting requirements to the Canada Revenue Agency (CRA). The form is available in both English and French.

The form T737-RCA SUM Information Return of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (RCA) in Canada is filed by the custodian of the RCA.

FAQ

Q: What is the purpose of Form T737-RCA?

A: The purpose of Form T737-RCA is to report contributions paid to a custodian of a Retirement Compensation Arrangement (RCA) in Canada.

Q: Who needs to file Form T737-RCA?

A: Any individual or entity who has paid contributions to a custodian of an RCA in Canada needs to file Form T737-RCA.

Q: Is this form available in both English and French?

A: Yes, Form T737-RCA is available in both English and French.

Q: What information is required to be reported on Form T737-RCA?

A: Form T737-RCA requires the reporting of contributions paid to a custodian of an RCA, as well as the custodian's information and other relevant details.