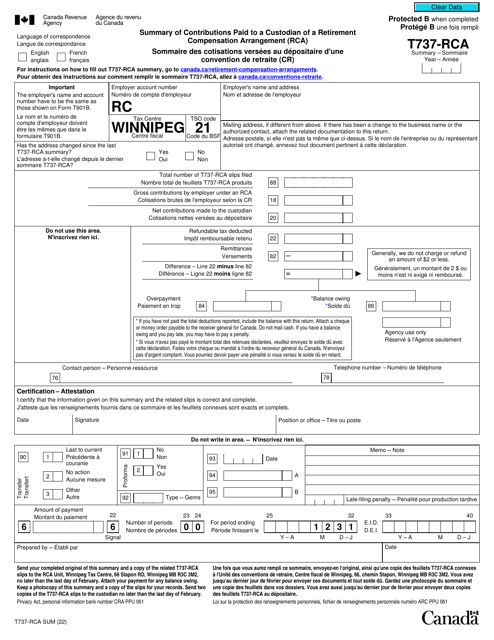

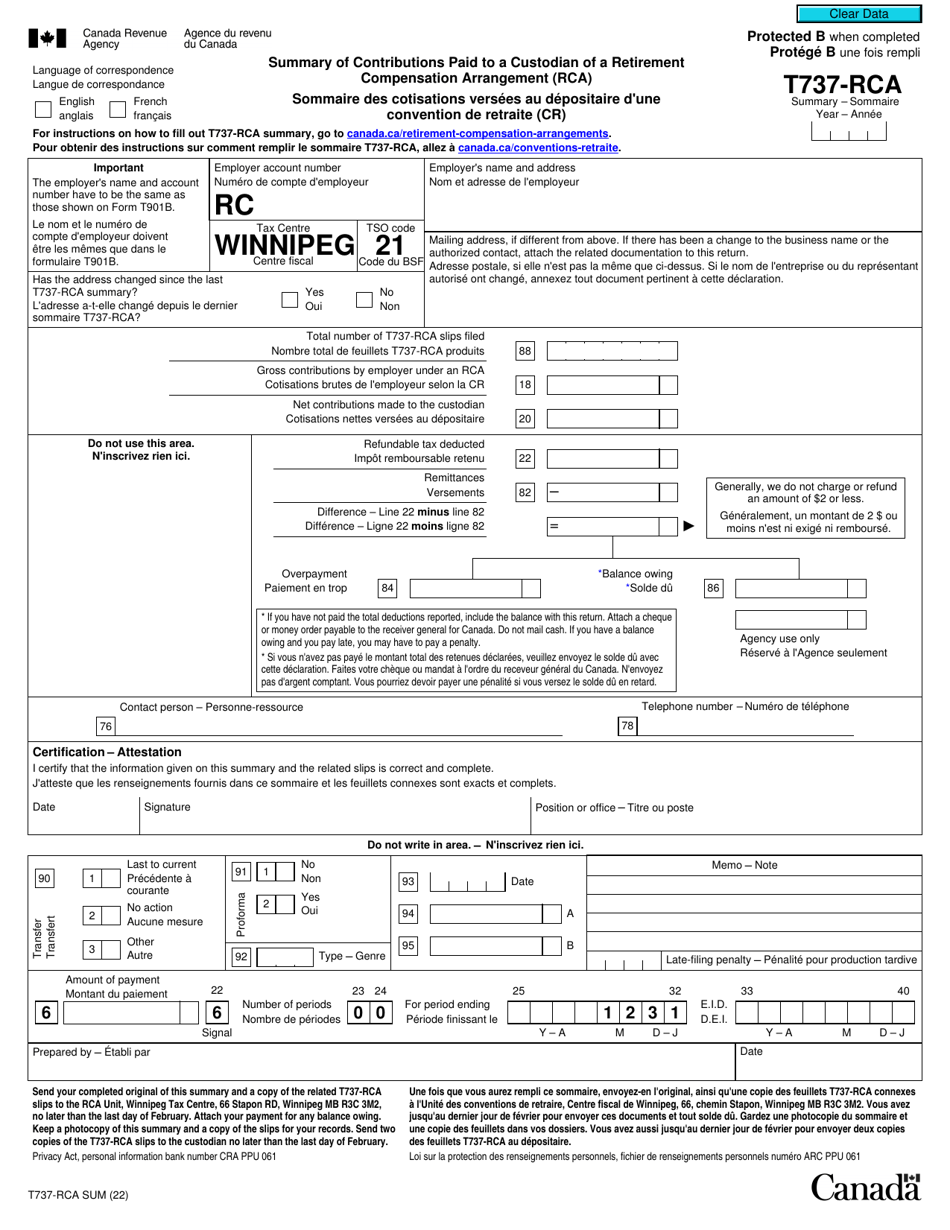

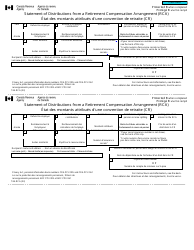

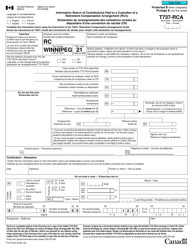

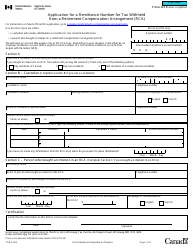

Form T737-RCA SUM Summary of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (Rca) - Canada (English / French)

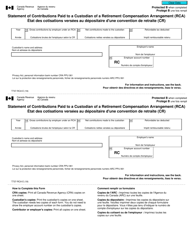

Form T737-RCA SUM Summary of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (RCA) is used in Canada to report the contributions made to a custodian of an RCA. The form is used to summarize the total amount of contributions made to the RCA during the reporting period. It is important for individuals and organizations to accurately report these contributions to ensure compliance with Canadian tax regulations. The form is available in both English and French to accommodate the bilingual nature of the country.

The Form T737-RCA SUM Summary of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (RCA) is filed by the custodian of the RCA in Canada. This form is used to summarize and report the contributions made to the RCA.

Form T737-RCA SUM Summary of Contributions Paid to a Custodian of a Retirement Compensation Arrangement (Rca) - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is Form T737-RCA SUM?

A: Form T737-RCA SUM is a form used in Canada to summarize the contributions that have been paid to a custodian of a Retirement Compensation Arrangement (RCA). It is used to report these contributions to the Canada Revenue Agency (CRA).

Q: Who needs to file Form T737-RCA SUM?

A: The custodian of a Retirement Compensation Arrangement (RCA) is responsible for filing Form T737-RCA SUM to report the contributions that have been paid to them.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of retirement plan in Canada that is designed for highly-compensated individuals. It allows them to set aside funds for retirement on a tax-deferred basis.

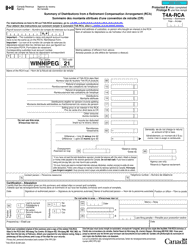

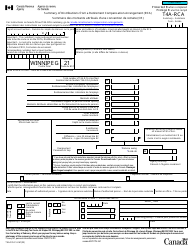

Q: What information is required to fill out Form T737-RCA SUM?

A: To complete Form T737-RCA SUM, you will need to provide details about the custodian of the RCA, such as their name, address, and business number. You will also need to include information about the contributions that have been paid, including the amount, date of payment, and the name of the plan member.

Q: When is the deadline for filing Form T737-RCA SUM?

A: The deadline for filing Form T737-RCA SUM is within 90 days after the end of the RCA's taxation year. For example, if the RCA's taxation year ends on December 31st, the form must be filed by March 31st of the following year.

Q: Are there any penalties for not filing Form T737-RCA SUM?

A: Yes, there can be penalties for failing to file Form T737-RCA SUM or for filing it late. The CRA may assess penalties and interest on any unpaid amounts.

Q: Are there any specific instructions or guidelines for completing Form T737-RCA SUM?

A: Yes, the CRA provides instructions with the form to help you complete it accurately. It is important to review these instructions and refer to any applicable guides or publications provided by the CRA.

Q: How long should I keep a copy of Form T737-RCA SUM?

A: It is recommended to keep a copy of Form T737-RCA SUM and all supporting documents for at least six years from the end of the taxation year to which they relate. This will ensure compliance with CRA requirements and allow for any future reference if needed.