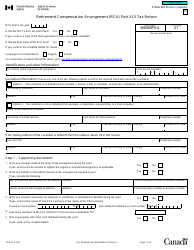

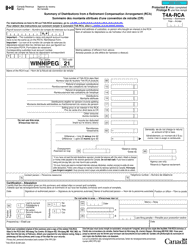

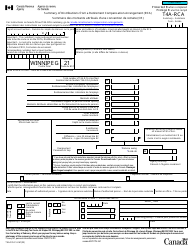

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T733

for the current year.

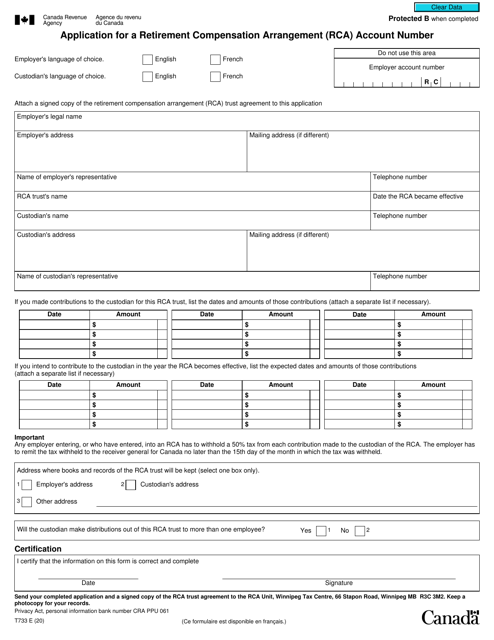

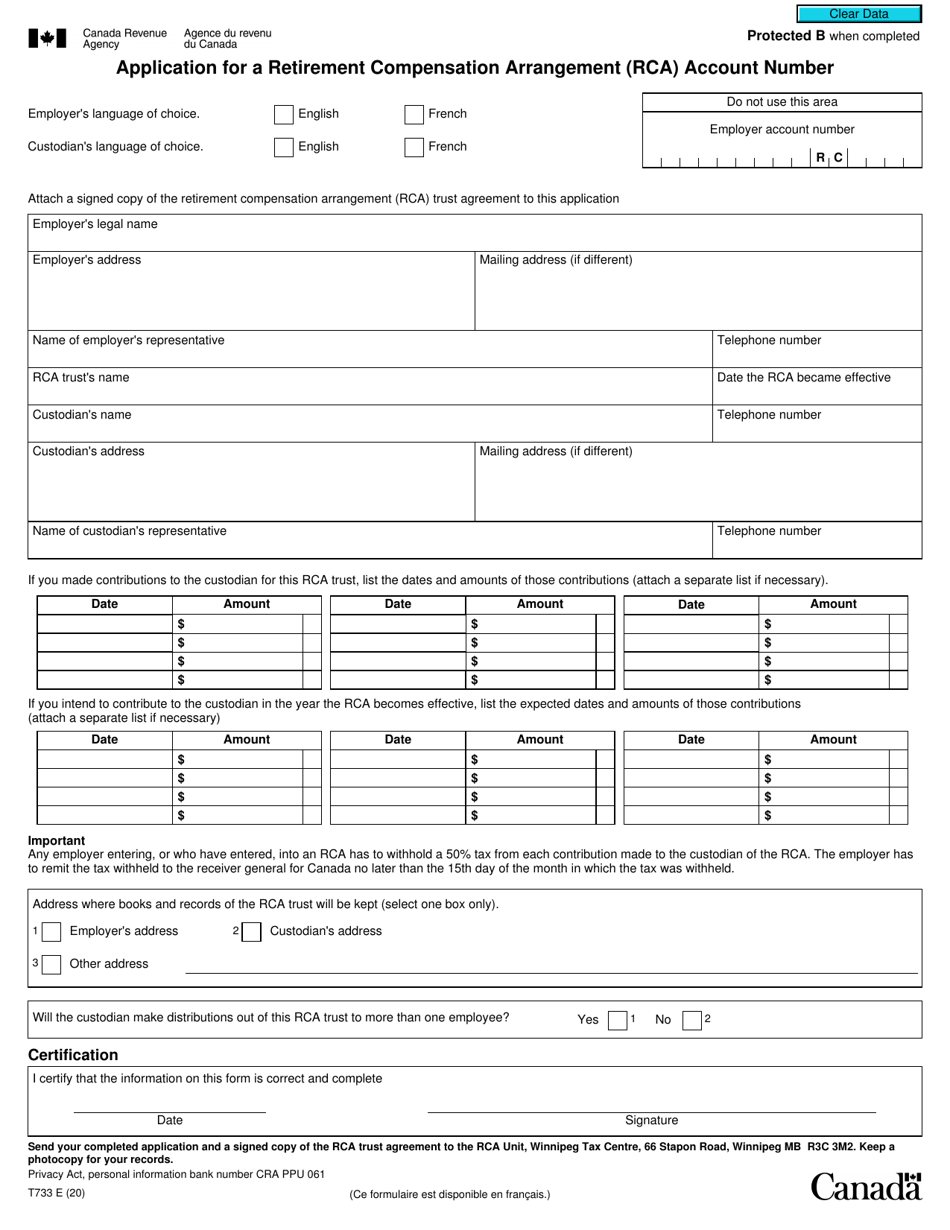

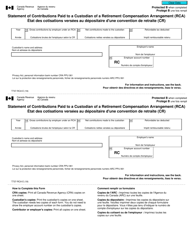

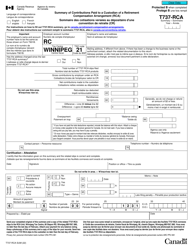

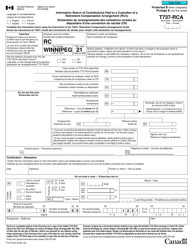

Form T733 Application for a Retirement Compensation Arrangement (Rca) Account Number - Canada

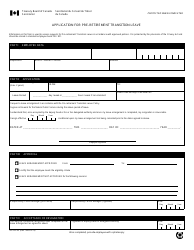

Form T733 Application for a Retirement Compensation Arrangement (RCA) Account Number in Canada is used to apply for an account number for a Retirement Compensation Arrangement. RCA is a type of registered pension plan designed specifically for high-income earners, providing them with additional retirement benefits.

In Canada, the employer or administrator of a Retirement Compensation Arrangement (RCA) is responsible for filing the Form T733 to apply for an RCA account number.

FAQ

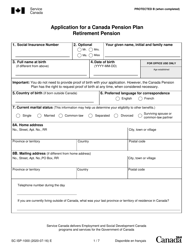

Q: What is Form T733?

A: Form T733 is an application form for obtaining a Retirement Compensation Arrangement (RCA) account number in Canada.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of pension plan for high-income individuals that allows for additional tax-deferred savings.

Q: Who needs to complete Form T733?

A: Individuals or entities that want to establish an RCA in Canada are required to complete Form T733.

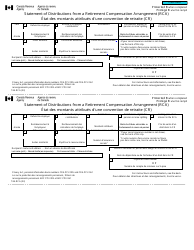

Q: Is there a fee for submitting Form T733?

A: As of the time of this document, there is no fee for submitting Form T733.