This version of the form is not currently in use and is provided for reference only. Download this version of

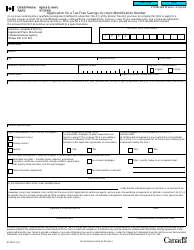

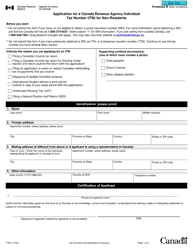

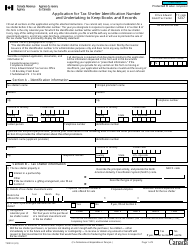

Form T735

for the current year.

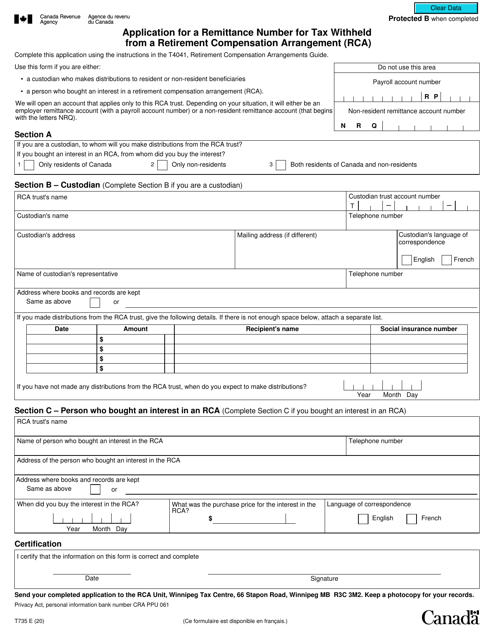

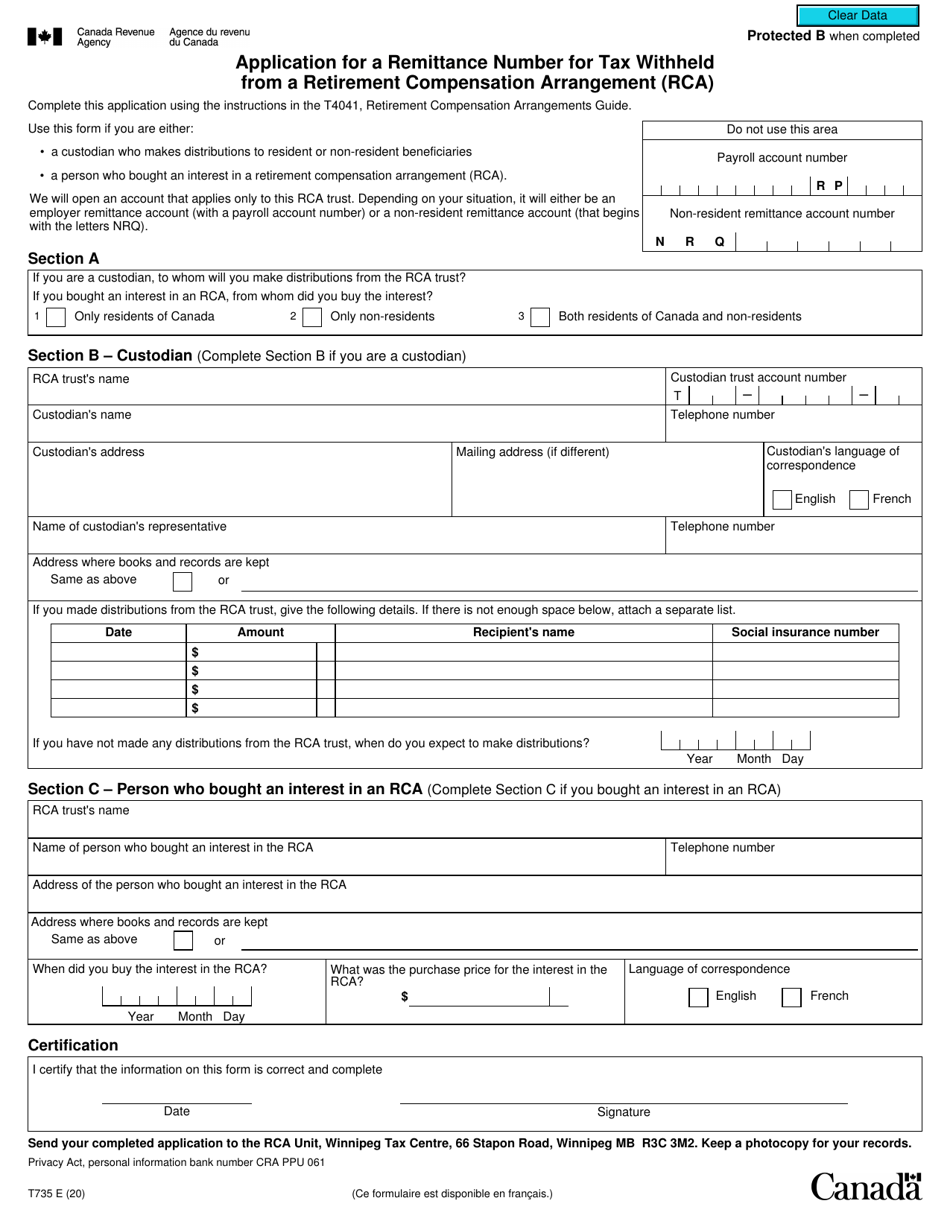

Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (Rca) - Canada

Form T735 Application for a Remittance Number for Tax Withheld from a Retirement Compensation Arrangement (RCA) in Canada is used to request a remittance number for tax withheld from a Retirement Compensation Arrangement. It is submitted to the Canada Revenue Agency (CRA) to ensure proper withholding and remittance of taxes on RCA payments.

The taxpayer, or their authorized representative, files the Form T735 Application for a Remittance Number for Tax Withheld From a Retirement Compensation Arrangement (RCA) in Canada.

FAQ

Q: What is Form T735?

A: Form T735 is an application for a remittance number for tax withheld from a retirement compensation arrangement (RCA) in Canada.

Q: What is a retirement compensation arrangement (RCA)?

A: A retirement compensation arrangement (RCA) is a type of pension plan or fund in Canada.

Q: Who needs to file Form T735?

A: Anyone who withholds tax from a retirement compensation arrangement (RCA) in Canada needs to file Form T735.

Q: How do I obtain a remittance number?

A: You can obtain a remittance number by completing and filing Form T735 with the Canada Revenue Agency (CRA).

Q: Is there a deadline for filing Form T735?

A: Yes, Form T735 must be filed on or before the 15th day of the month following the month in which the tax was withheld.