This version of the form is not currently in use and is provided for reference only. Download this version of

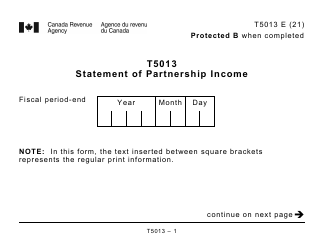

Form T5013

for the current year.

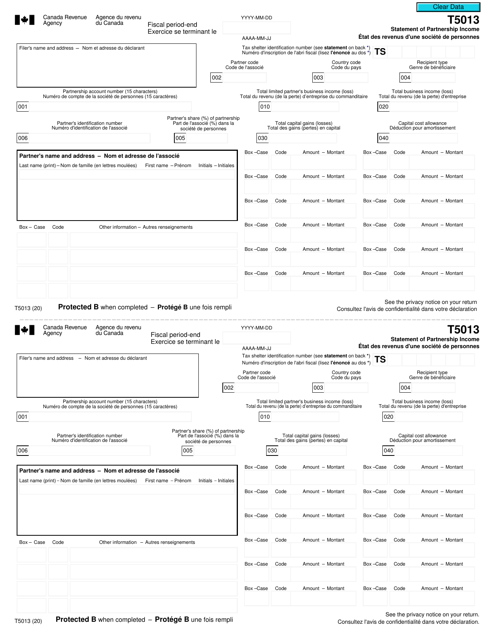

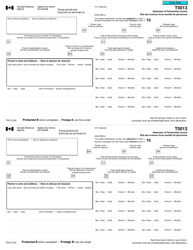

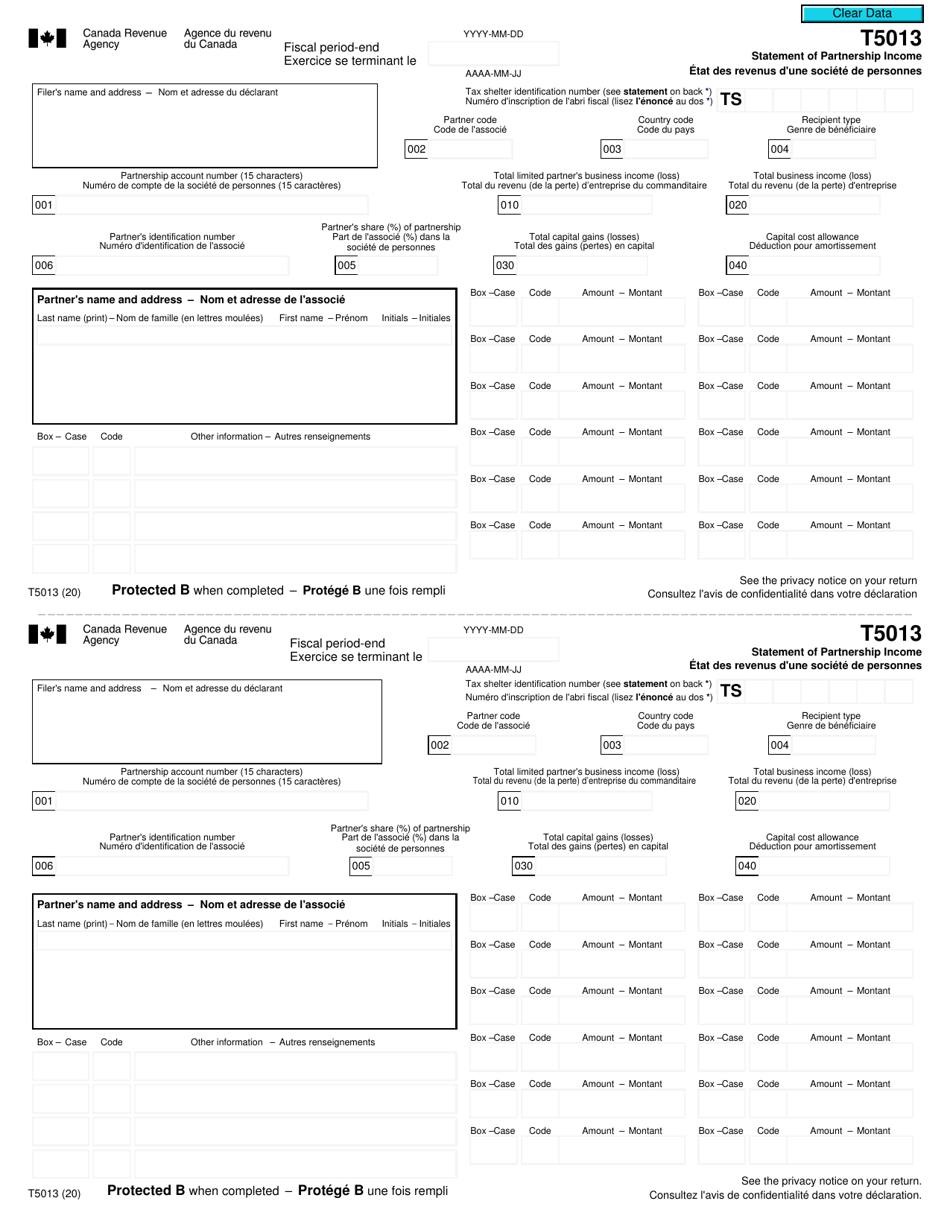

Form T5013 Statement of Partnership Income - Canada (English / French)

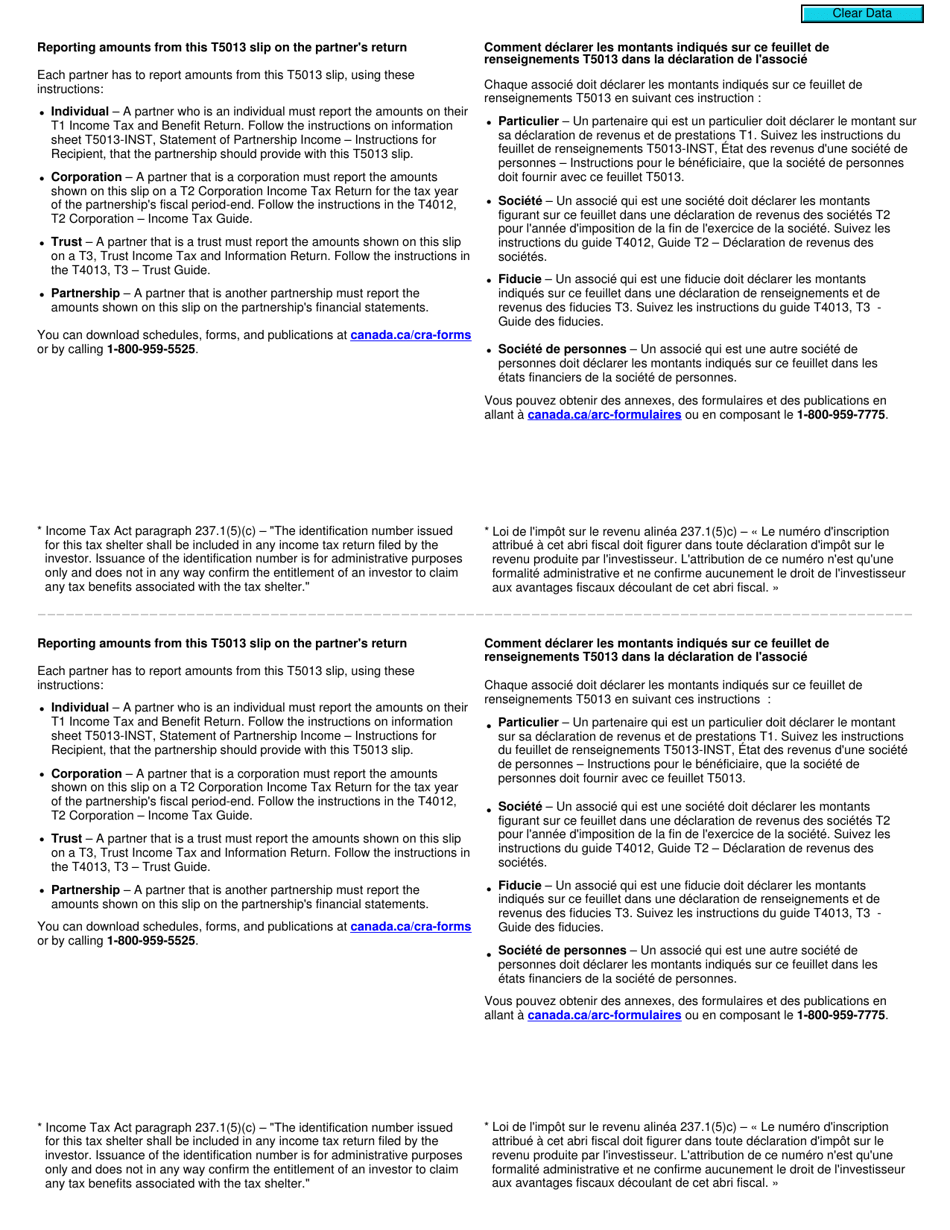

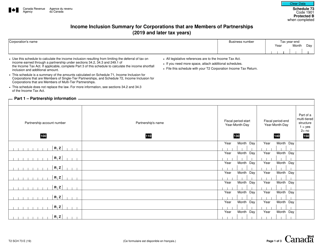

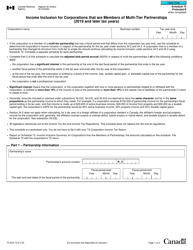

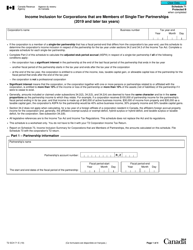

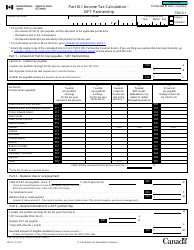

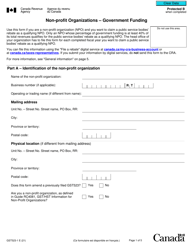

Form T5013, also known as the Statement of Partnership Income, is used in Canada to report the income, expenses, and other financial information of partnerships. This form is filed by partnerships to provide the Canada Revenue Agency (CRA) with details about their partnership's income, deductions, and credits. It helps the CRA assess the tax liability of the partnership and its partners. The form is available in both English and French to accommodate both official languages in Canada.

The Form T5013 Statement of Partnership Income in Canada (English/French) is typically filed by partnerships.

FAQ

Q: What is Form T5013?

A: Form T5013 is a statement of partnership income filed in Canada.

Q: Who needs to file Form T5013?

A: Partnerships and limited partnerships in Canada need to file Form T5013.

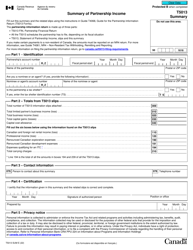

Q: What information is included in Form T5013?

A: Form T5013 includes information about the partnership's income, expenses, and distribution of income to partners.

Q: When is Form T5013 due?

A: Form T5013 is due on or before the 15th day of the sixth month following the end of the partnership's fiscal period.

Q: Is Form T5013 available in both English and French?

A: Yes, Form T5013 is available in both English and French.

Q: What happens if I don't file Form T5013?

A: If you don't file Form T5013, you may be subject to penalties and interest charges.

Q: Is Form T5013 the same as Form 1065 in the United States?

A: No, Form T5013 is specific to partnerships in Canada. Form 1065 is used for partnerships in the United States.

Q: Do I need to provide copies of Form T5013 to the partners?

A: Yes, you need to provide copies of Form T5013 to all partners in the partnership.