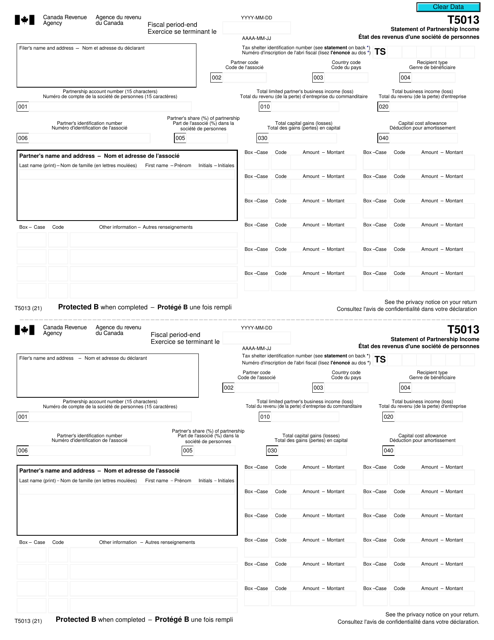

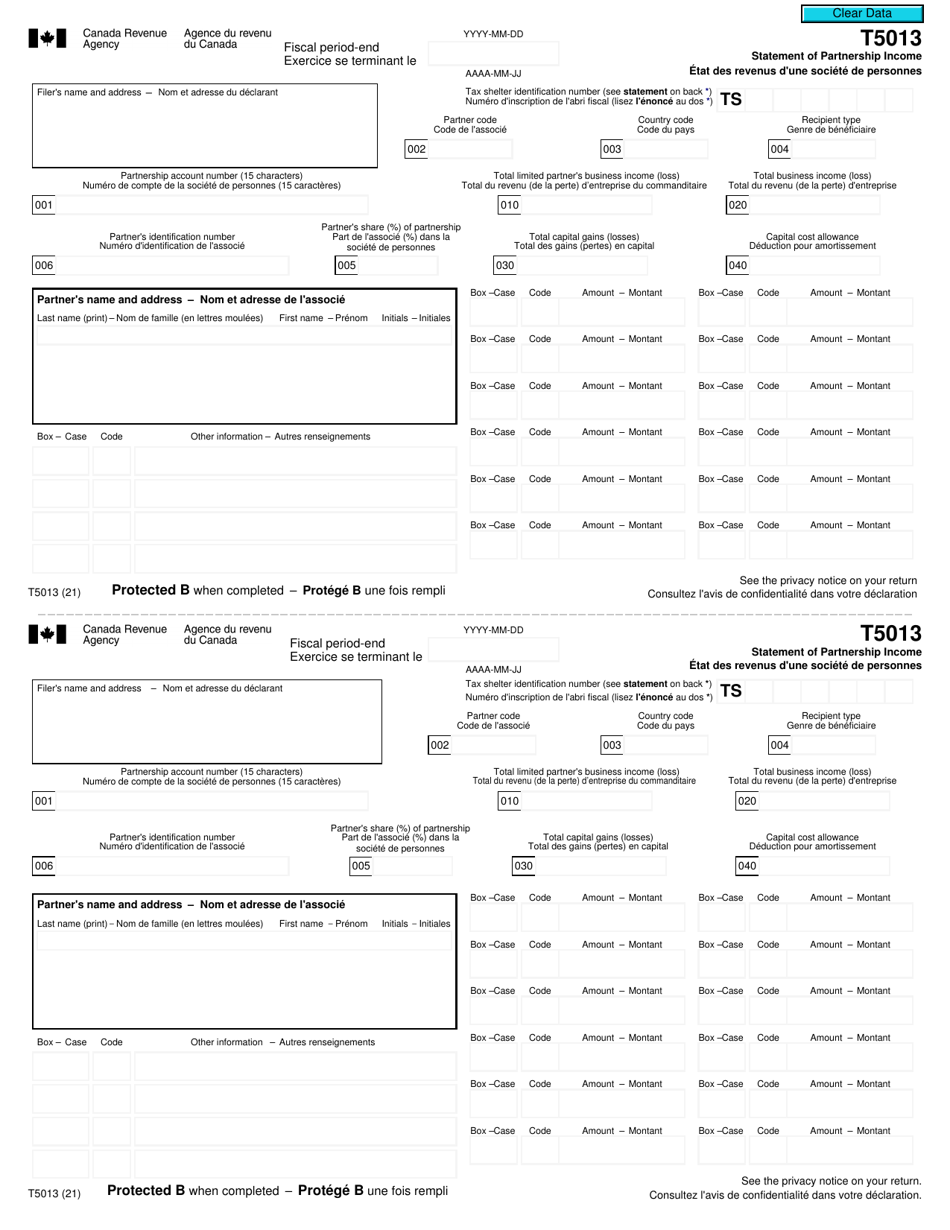

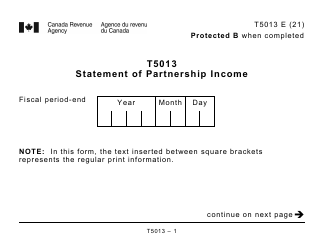

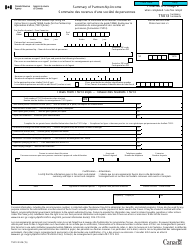

Form T5013 Statement of Partnership Income - Canada (English / French)

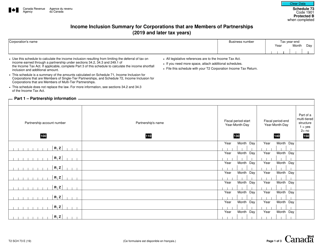

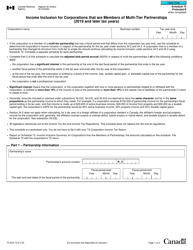

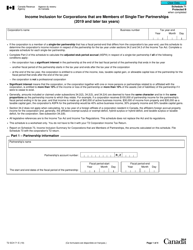

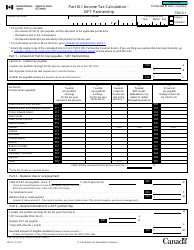

Form T5013 is a statement that partnerships in Canada use to report their income, expenses, and other tax information to the Canada Revenue Agency (CRA). It is used to calculate the amount of tax that the partnership is responsible for paying. The form is available in both English and French.

The Form T5013 Statement of Partnership Income in Canada is filed by partnerships themselves. They provide information about their income, expenses, and other relevant details.

Form T5013 Statement of Partnership Income - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is Form T5013?

A: Form T5013 is a statement of partnership income for Canadian tax purposes.

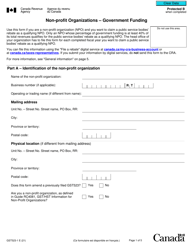

Q: Who needs to file Form T5013?

A: Partnerships in Canada are required to file Form T5013.

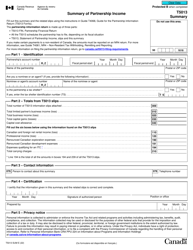

Q: What information is required on Form T5013?

A: Form T5013 requires information about the partnership's income, expenses, and tax deductions.

Q: Is Form T5013 available in both English and French?

A: Yes, Form T5013 is available in both English and French.

Q: What is the deadline for filing Form T5013?

A: The deadline for filing Form T5013 is generally the same as the deadline for filing individual tax returns in Canada.

Q: What happens if I don't file Form T5013?

A: Failure to file Form T5013 can result in penalties and interest charges from the Canada Revenue Agency.

Q: Can I file Form T5013 electronically?

A: Yes, partnerships in Canada can file Form T5013 electronically if they meet the requirements.

Q: Are there any special rules for foreign partnerships filing Form T5013?

A: Yes, foreign partnerships may have additional reporting requirements when filing Form T5013 in Canada.