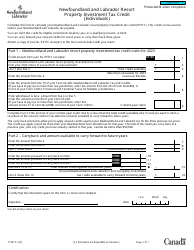

This version of the form is not currently in use and is provided for reference only. Download this version of

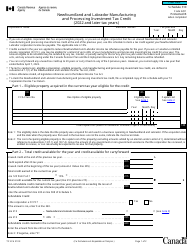

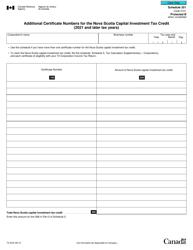

Form T2038(IND)

for the current year.

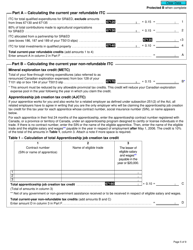

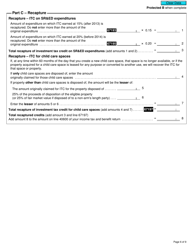

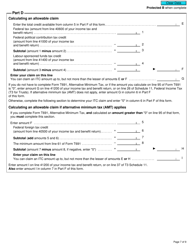

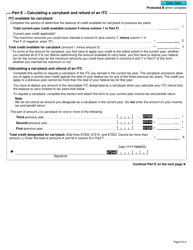

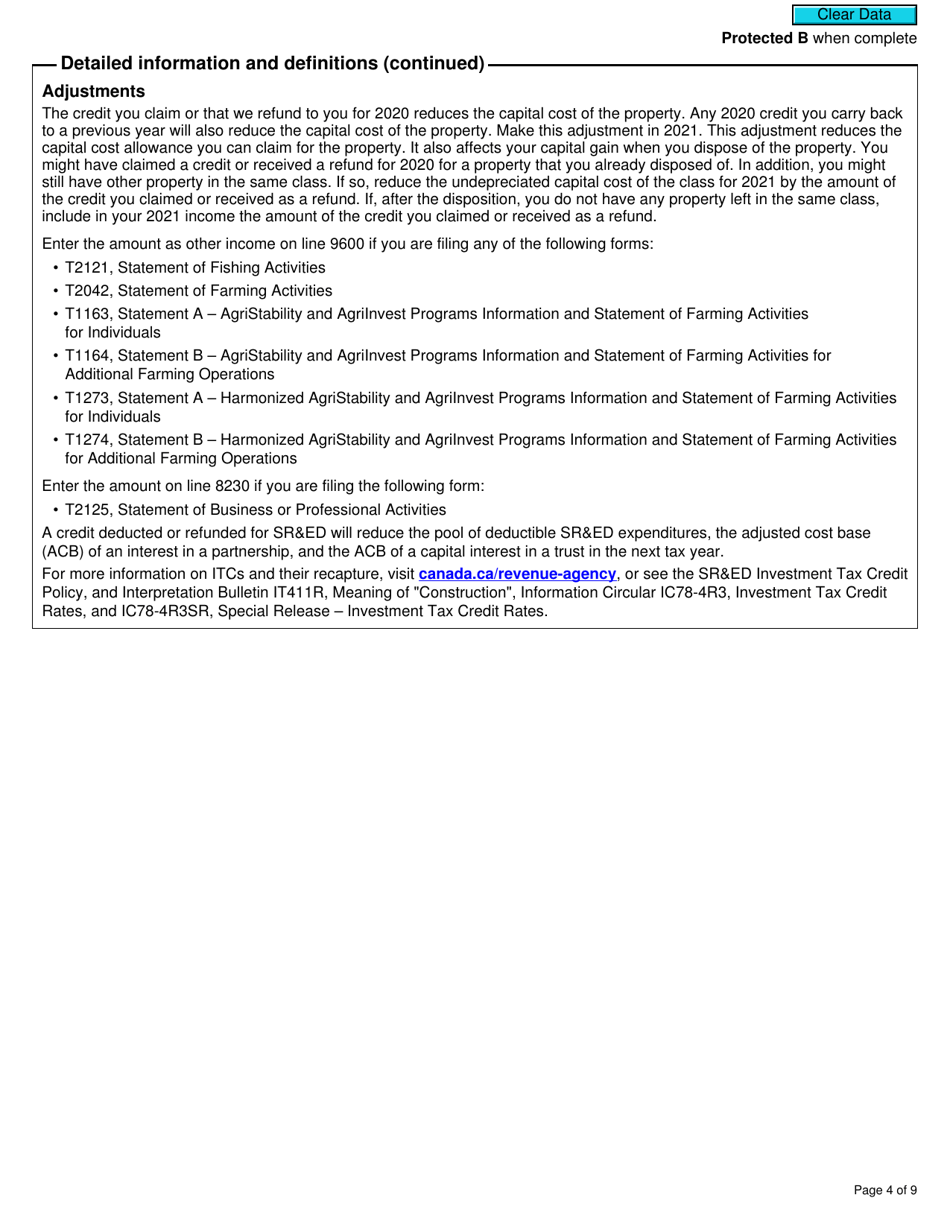

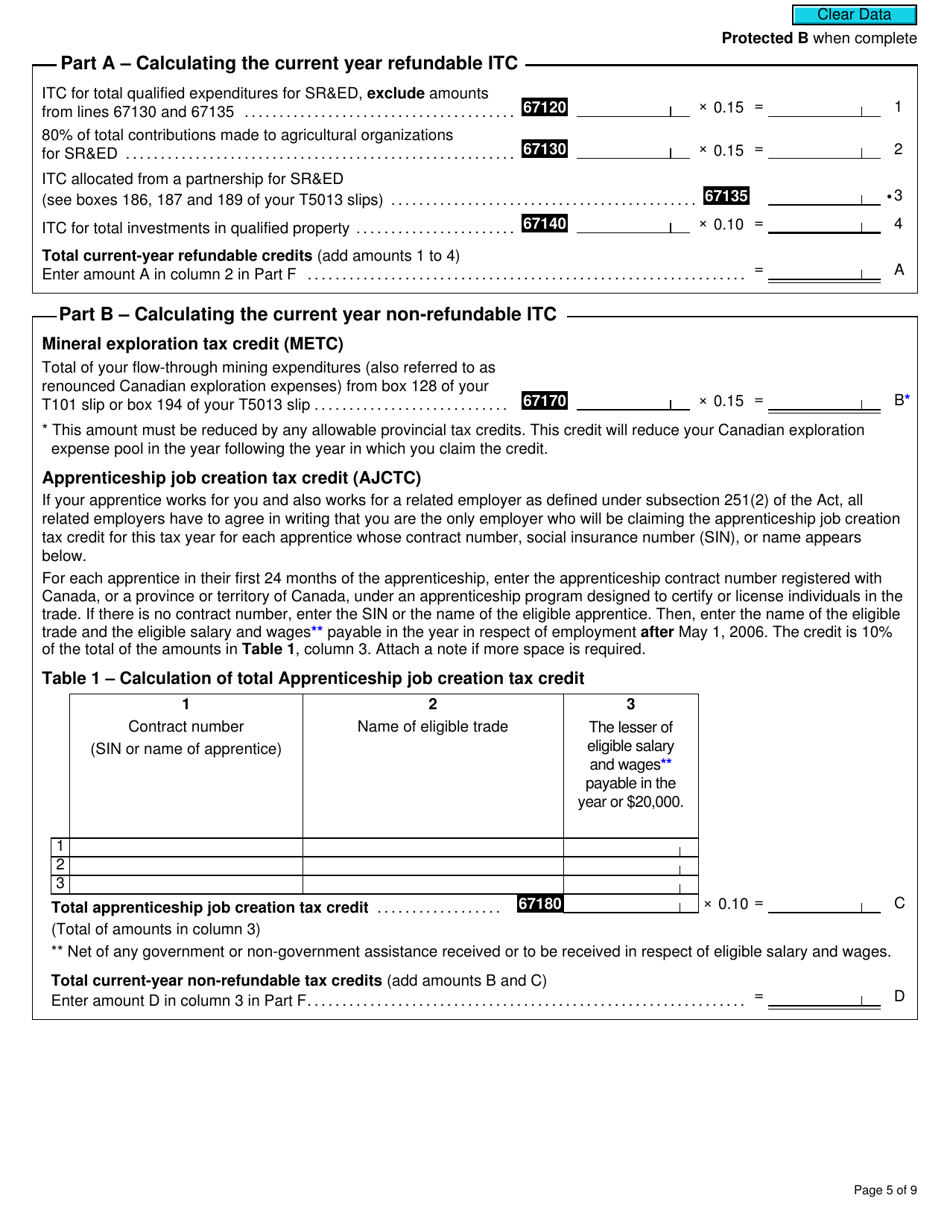

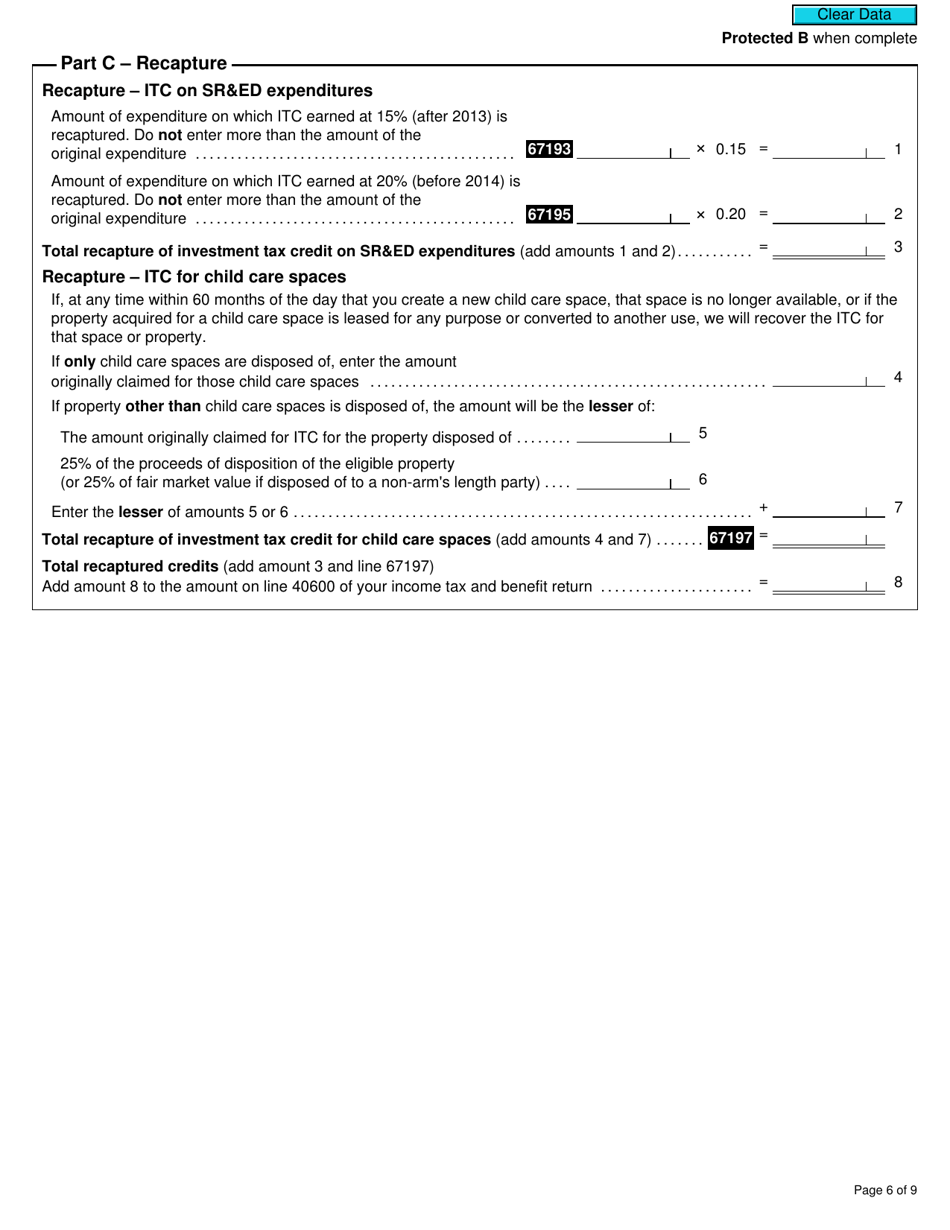

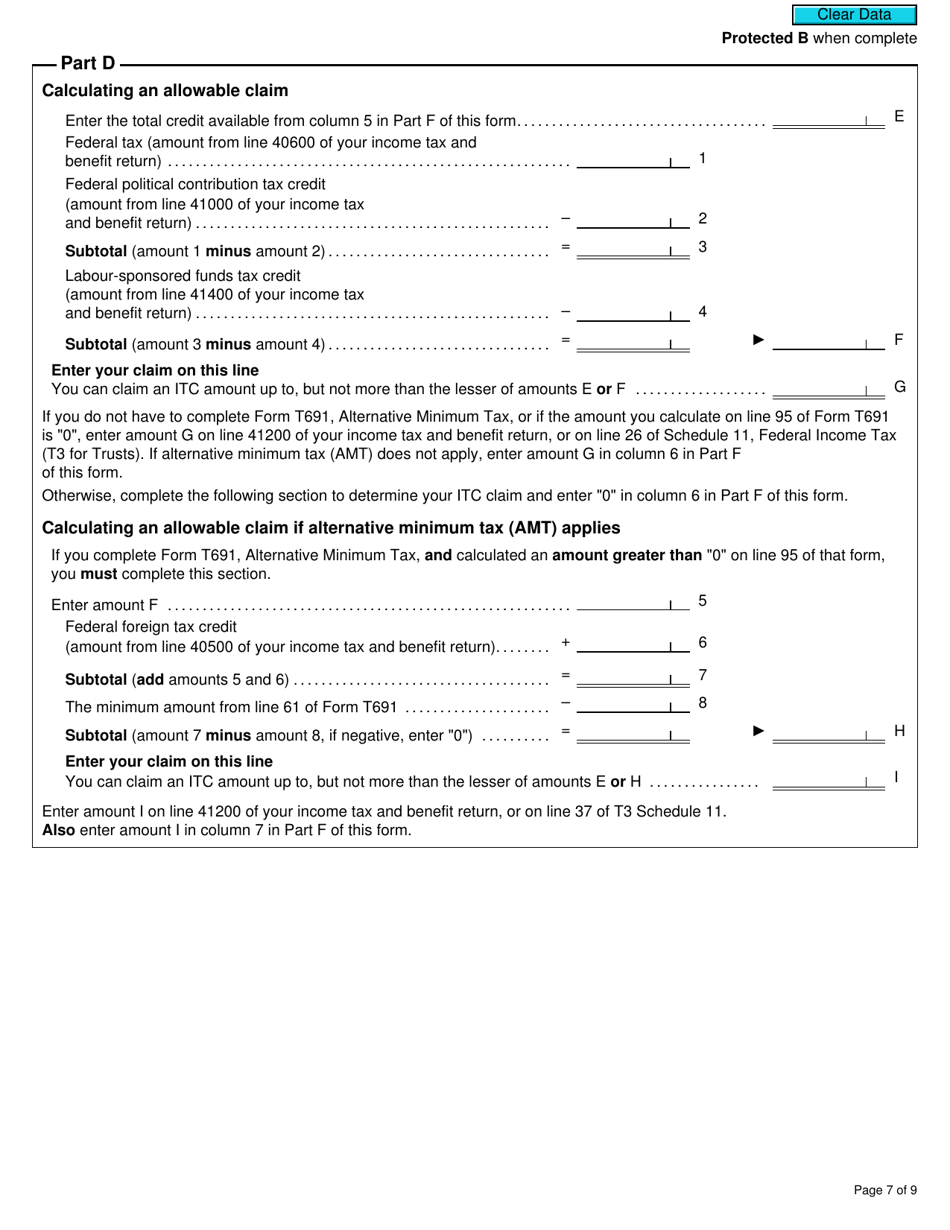

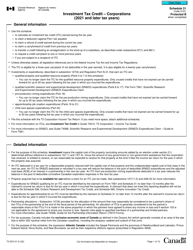

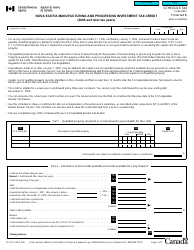

Form T2038(IND) Investment Tax Credit (Individuals) - Canada

Form T2038(IND) is used by individuals in Canada to claim the investment tax credit (ITC). This credit allows individuals to reduce the amount of tax they owe based on certain eligible investments they have made. It is a way to encourage investment and economic growth in Canada.

The Form T2038(IND) Investment Tax Credit (Individuals) in Canada is filed by individuals who are claiming the investment tax credit.

FAQ

Q: What is Form T2038(IND)?

A: Form T2038(IND) is a tax form used by individuals in Canada to claim the Investment Tax Credit.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a tax incentive provided by the Canadian government to encourage investment in certain industries.

Q: Who can use Form T2038(IND)?

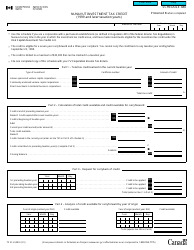

A: Individuals in Canada who have incurred eligible investment expenses can use Form T2038(IND) to claim the Investment Tax Credit.

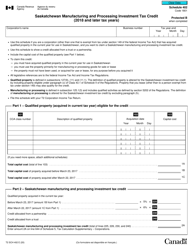

Q: What are eligible investment expenses?

A: Eligible investment expenses include expenses related to the purchase of certain investments, such as shares of eligible small business corporations.

Q: How can I claim the Investment Tax Credit?

A: To claim the Investment Tax Credit, you need to complete Form T2038(IND) and include it with your income tax return.

Q: Is there a deadline to submit Form T2038(IND)?

A: Yes, Form T2038(IND) should be filed along with your income tax return by the tax filing deadline, which is usually April 30th for most individuals.

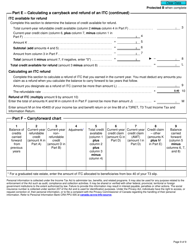

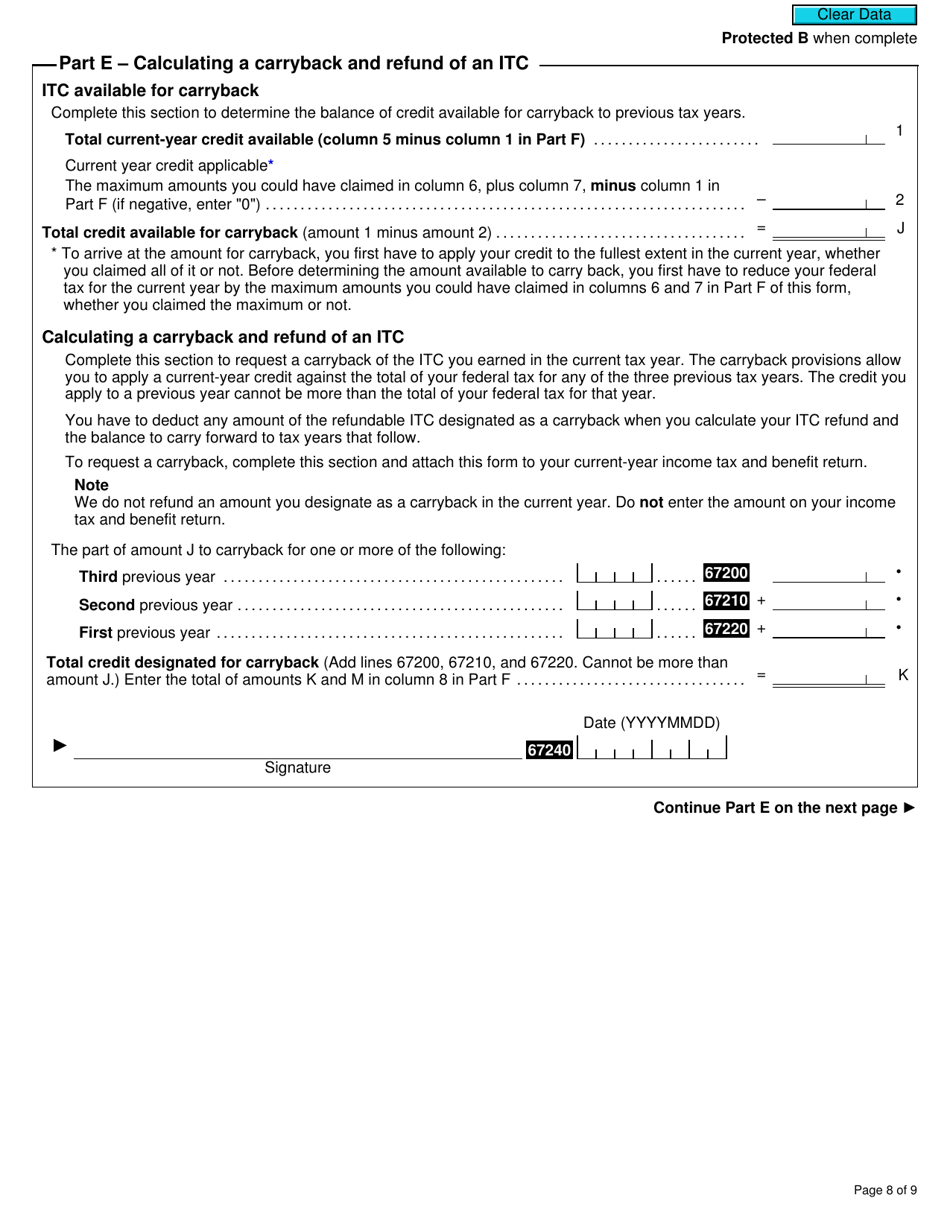

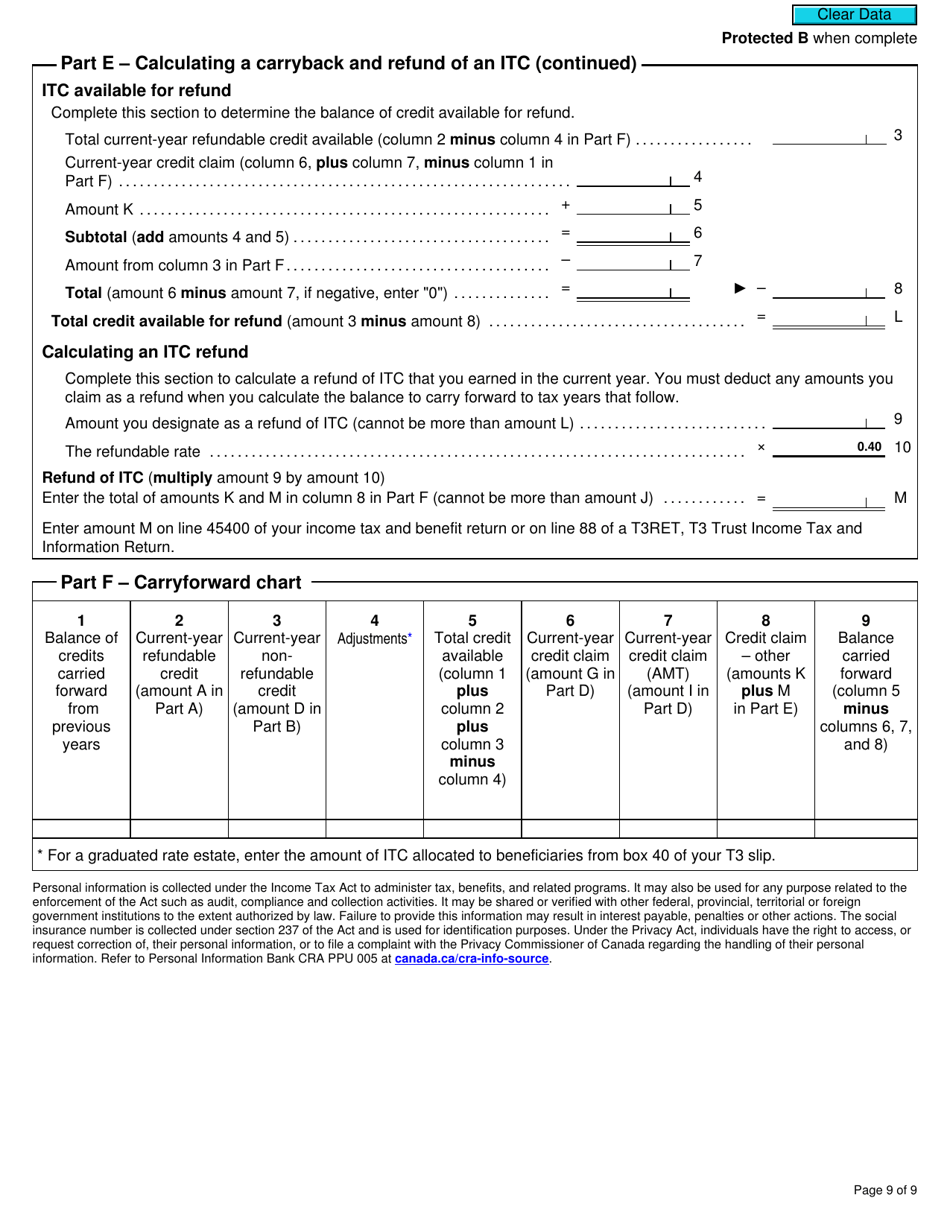

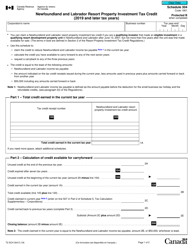

Q: Can the Investment Tax Credit be carried forward or back?

A: Yes, the Investment Tax Credit can be carried forward for up to 20 years or carried back for up to 3 years to reduce your tax liability.

Q: Are there any restrictions on claiming the Investment Tax Credit?

A: Yes, there are certain restrictions on claiming the Investment Tax Credit, such as a maximum credit limit and specific eligibility criteria for different types of investments.

Q: Do I need to keep records of my investment expenses?

A: Yes, it is important to keep records of your investment expenses and supporting documents, as the CRA may request them for verification purposes.