This version of the form is not currently in use and is provided for reference only. Download this version of

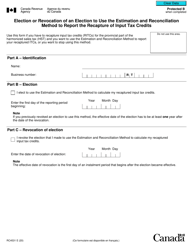

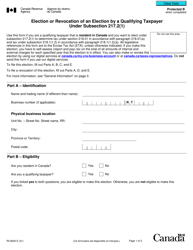

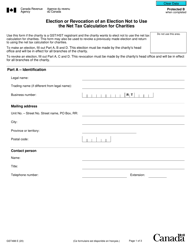

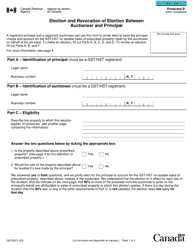

Form T1296

for the current year.

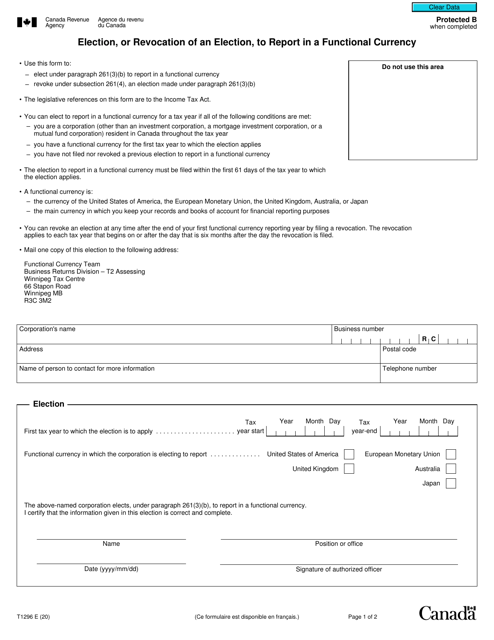

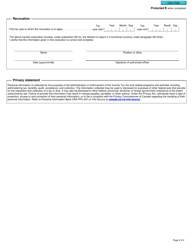

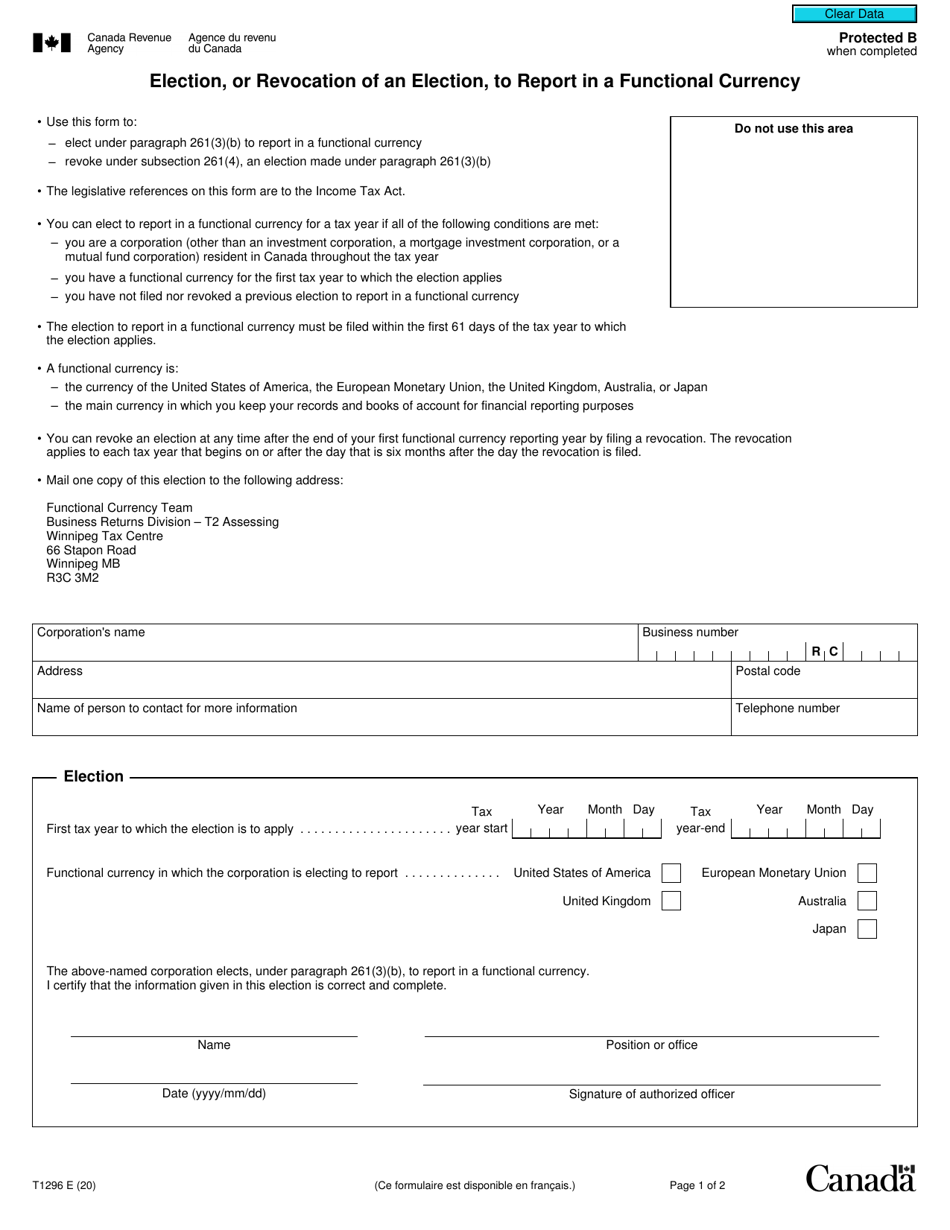

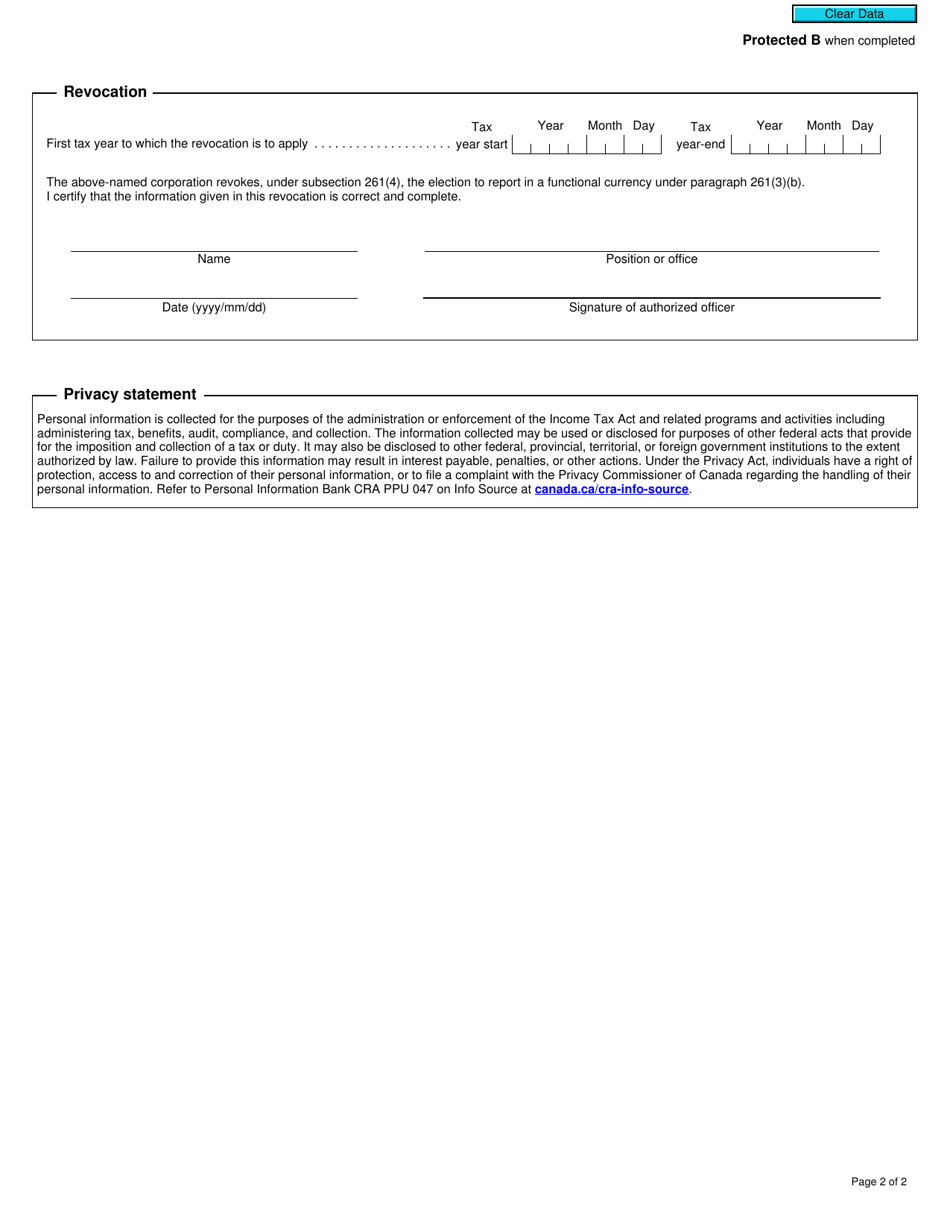

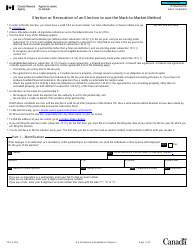

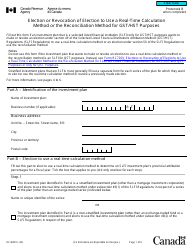

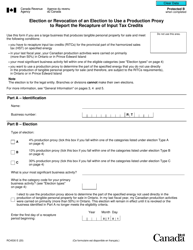

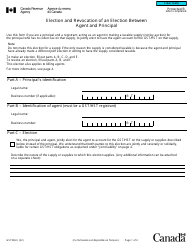

Form T1296 Election, or Revocation of an Election, to Report in a Functional Currency - Canada

Form T1296 Election, or Revocation of an Election, to Report in a Functional Currency is used in Canada for electing or revoking the election to report income, deductions, and tax payable in a functional currency other than the Canadian dollar.

The Form T1296 Election, or Revocation of an Election, to Report in a Functional Currency in Canada is filed by individuals or corporations who want to report their income and expenses in a currency other than the Canadian dollar.

FAQ

Q: What is Form T1296?

A: Form T1296 is a form used in Canada to make an election, or revoke an election, to report in a functional currency.

Q: What is a functional currency?

A: A functional currency is the currency of the primary economic environment in which a business operates.

Q: When would I use Form T1296?

A: You would use Form T1296 if you want to make an election, or revoke an election, to report your income and expenses in a functional currency.

Q: Why would I make an election to report in a functional currency?

A: You may make an election to report in a functional currency if it is more practical or appropriate for your business operations.

Q: Can I change my election to report in a functional currency?

A: Yes, you can change your election to report in a functional currency by filing a new Form T1296.

Q: Do I need to submit any supporting documents with Form T1296?

A: In some cases, you may need to provide supporting documents to justify your election or revocation of an election to report in a functional currency. It is recommended to consult with a tax professional for guidance.

Q: Is Form T1296 applicable only to businesses?

A: No, Form T1296 can also be used by individuals who have elected to report their business income and expenses in a functional currency.

Q: What are the consequences of making an election to report in a functional currency?

A: Making an election to report in a functional currency may have tax implications and may require changes in your accounting practices. It is advisable to seek professional advice before making the election.