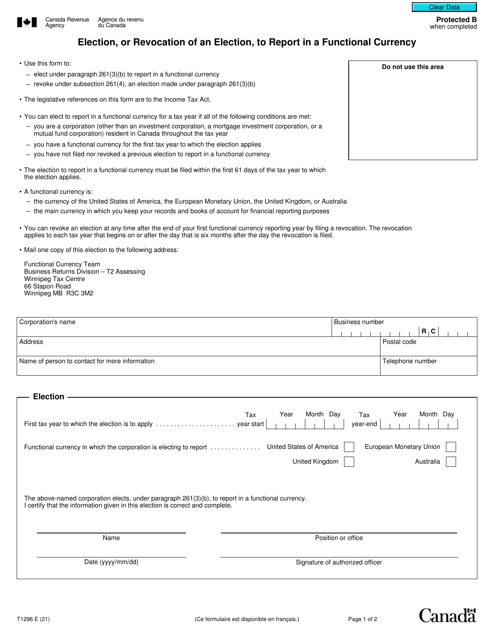

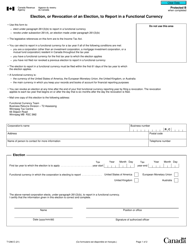

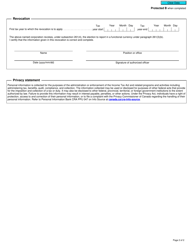

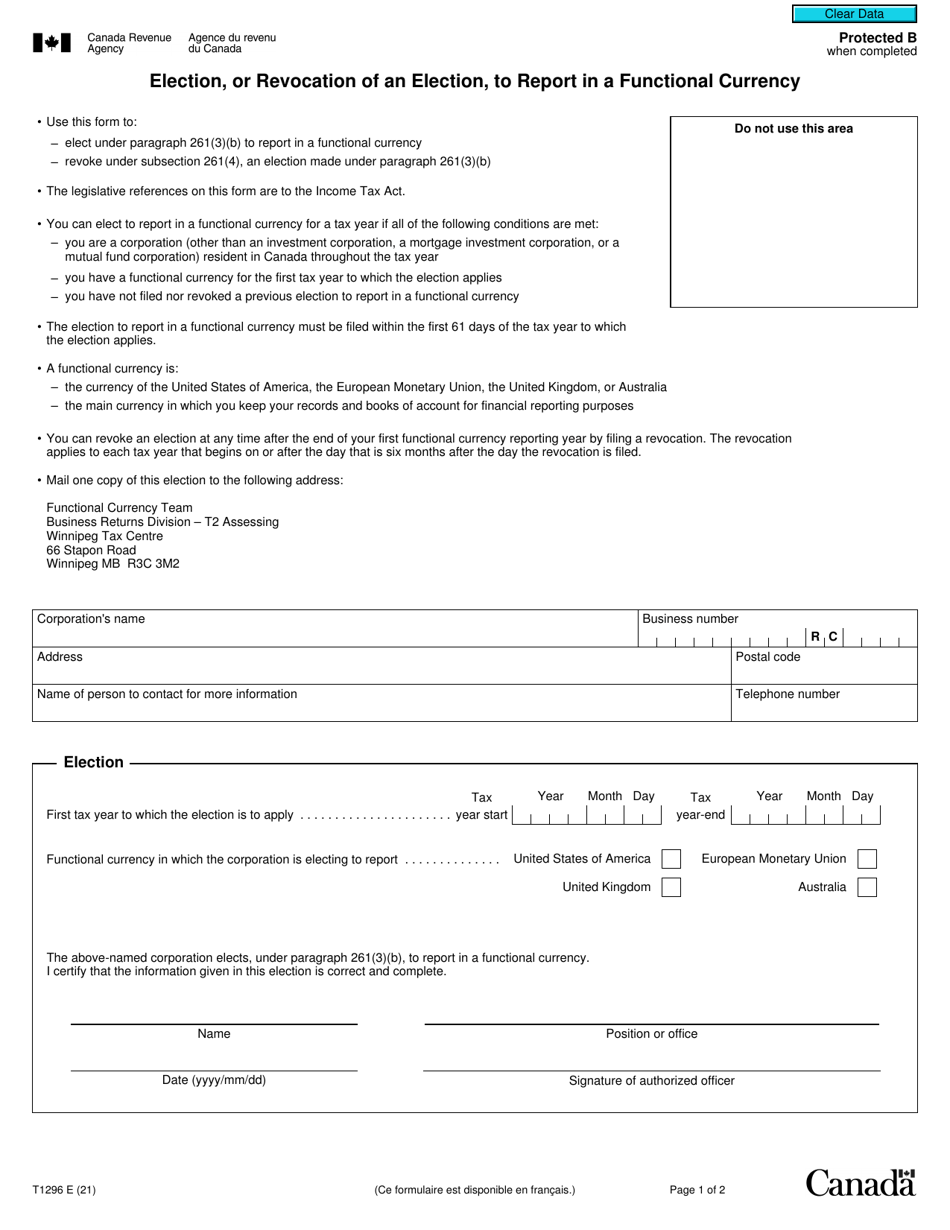

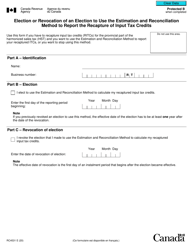

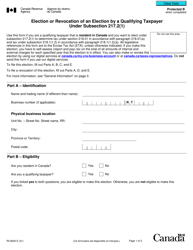

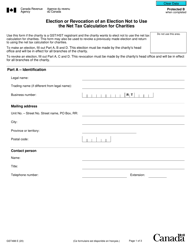

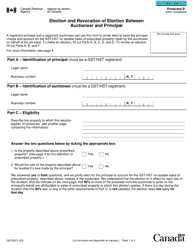

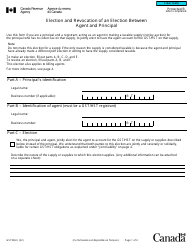

Form T1296 Election, or Revocation of an Election, to Report in a Functional Currency - Canada

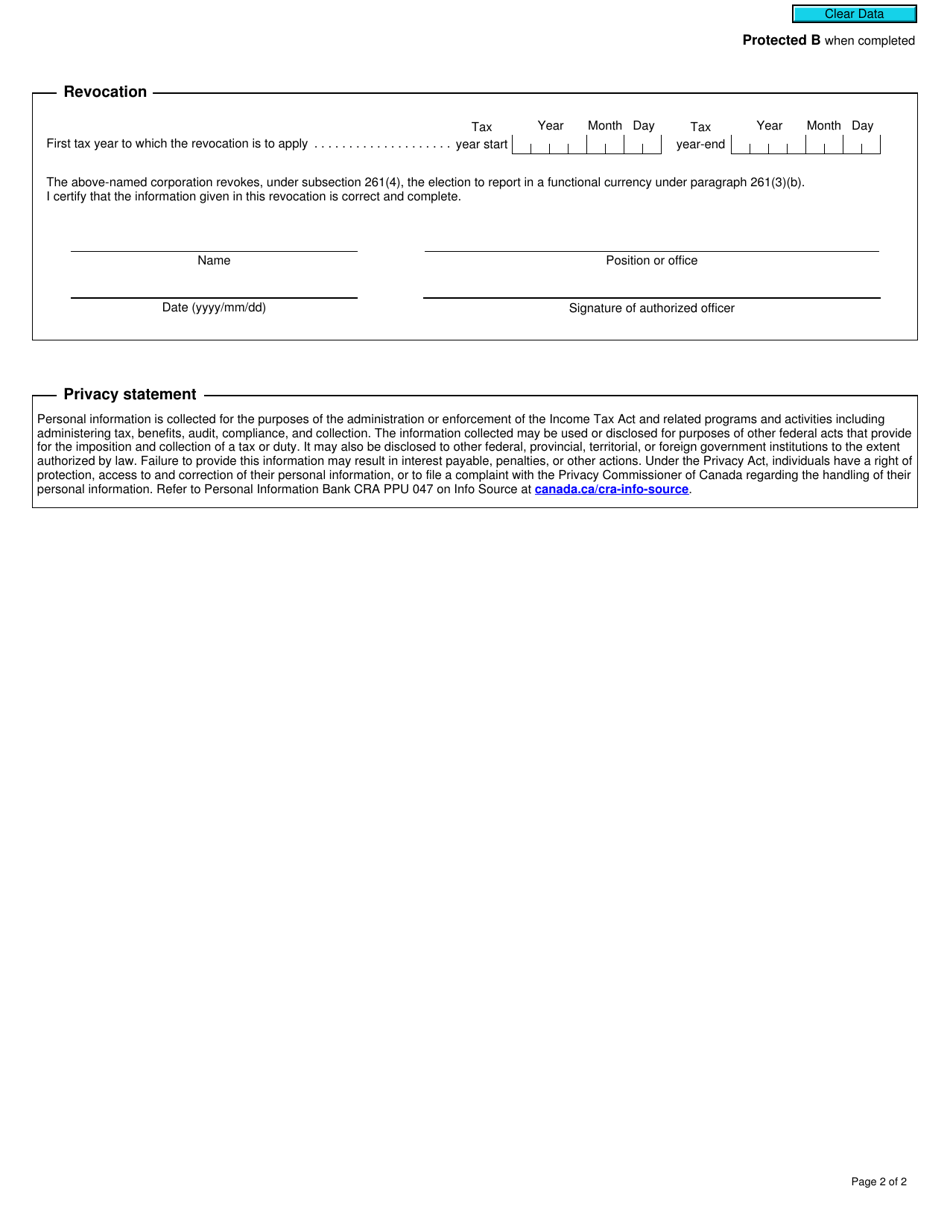

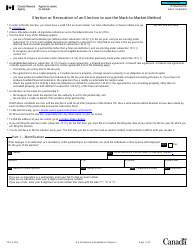

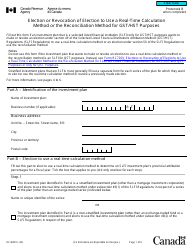

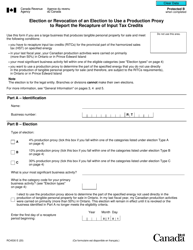

Form T1296 is used in Canada to make an election or revoke an election to report for tax purposes in a functional currency (other than Canadian dollars). This form is specifically for individuals or corporations who conduct business or generate income in a foreign currency.

In Canada, the Form T1296 Election, or Revocation of an Election, to Report in a Functional Currency is filed by taxpayers who want to report their income and expenses in a currency other than Canadian dollars for tax purposes.

Form T1296 Election, or Revocation of an Election, to Report in a Functional Currency - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1296?

A: Form T1296 is a form used in Canada to report in a functional currency.

Q: What is the purpose of Form T1296?

A: The purpose of Form T1296 is to elect or revoke an election to report in a functional currency.

Q: What is meant by reporting in a functional currency?

A: Reporting in a functional currency means reporting financial information in a currency other than Canadian dollars.

Q: Who needs to use Form T1296?

A: Any individual or corporation in Canada who wants to report in a functional currency needs to use Form T1296.

Q: How can Form T1296 be filed?

A: Form T1296 can be filed electronically or by mail with the Canada Revenue Agency.