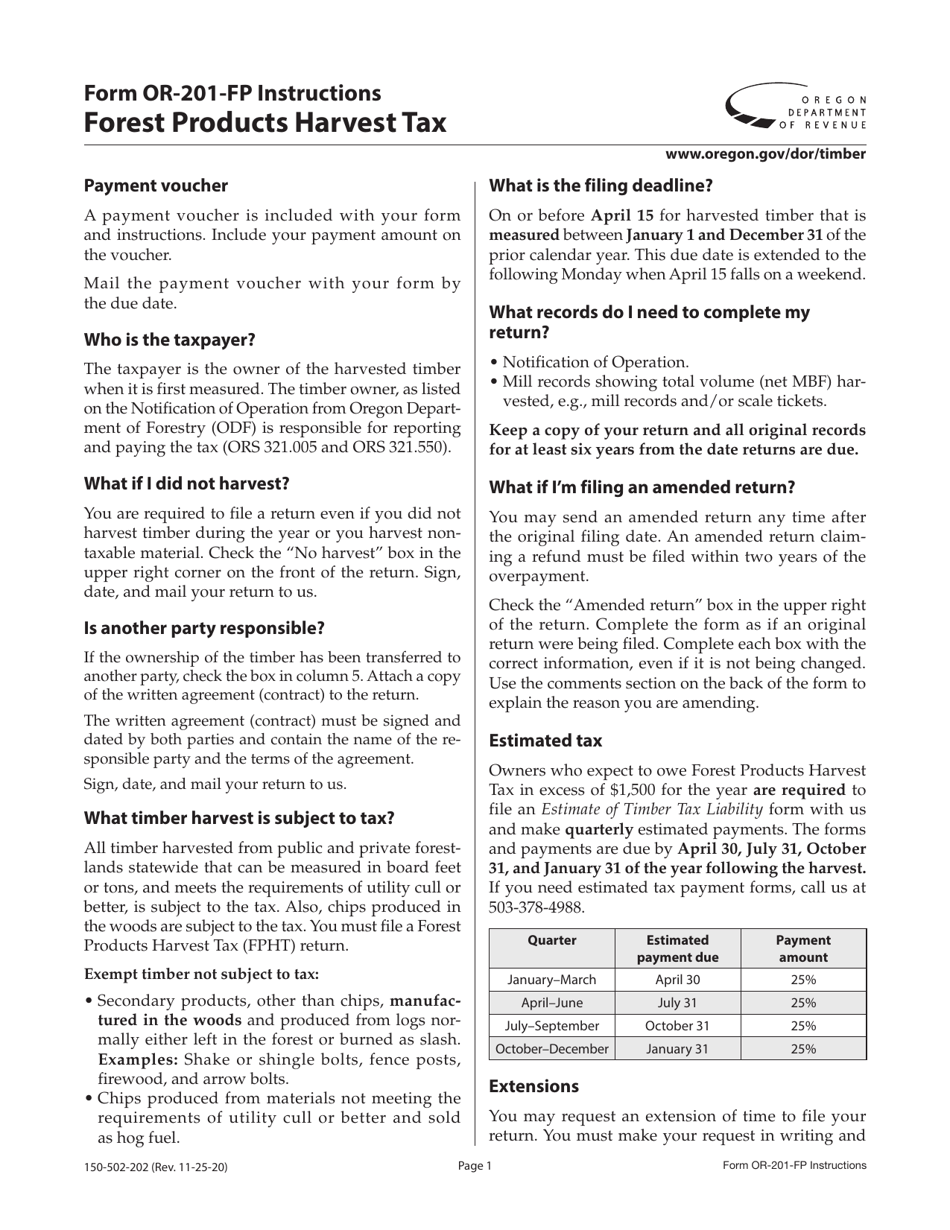

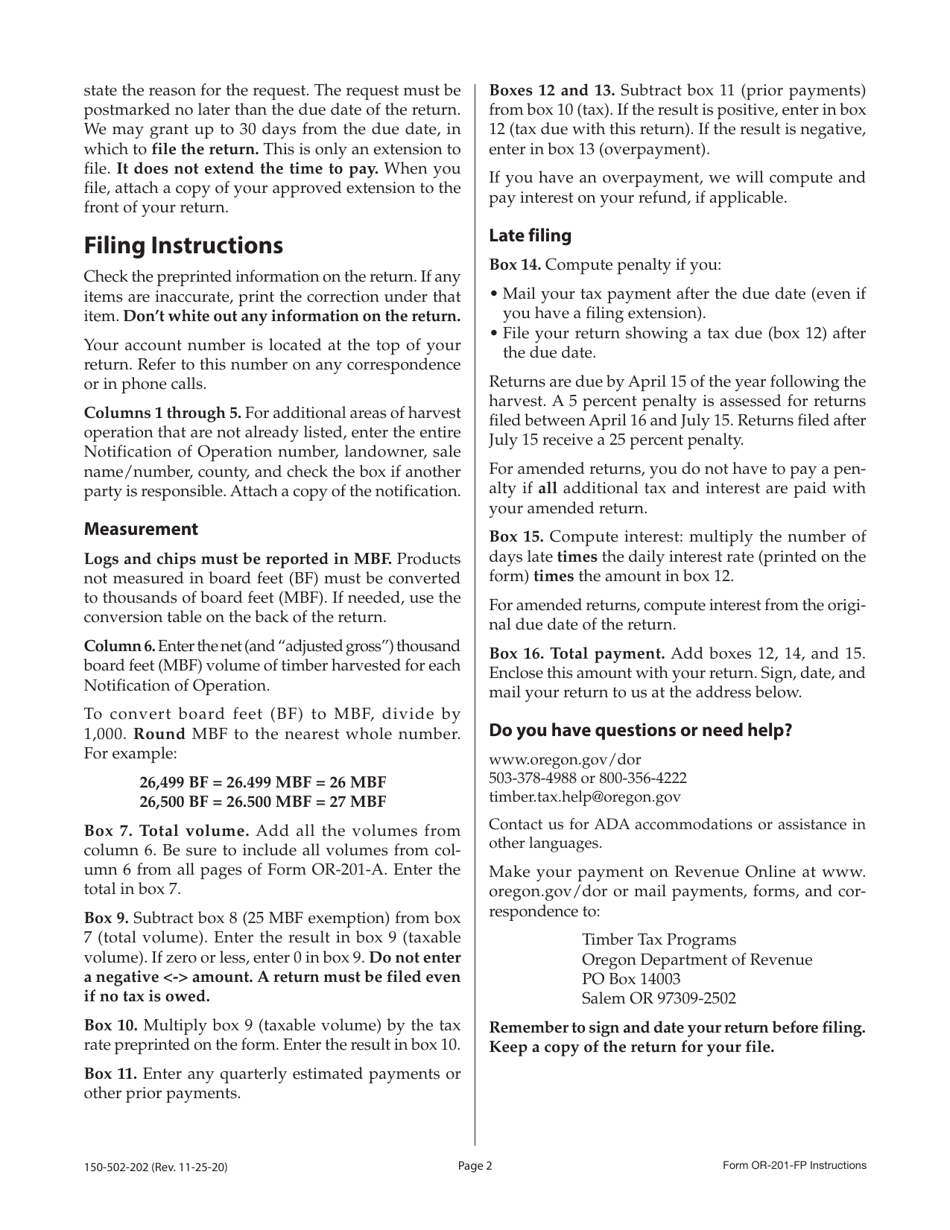

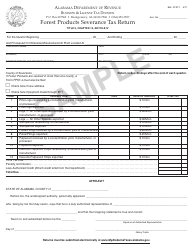

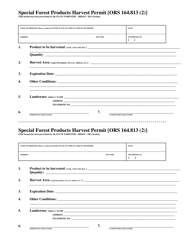

Instructions for Form OR-201-FP Forest Products Harvest Tax - Oregon

This document contains official instructions for Form OR-201-FP , Forest Products Harvest Tax - a form released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form OR-201-FP?

A: Form OR-201-FP is a tax form used in Oregon for reporting forest product harvests.

Q: Who needs to file Form OR-201-FP?

A: Anyone engaged in the harvest of forest products in Oregon needs to file Form OR-201-FP.

Q: What is the purpose of Form OR-201-FP?

A: Form OR-201-FP is used to report and pay the forest products harvest tax in Oregon.

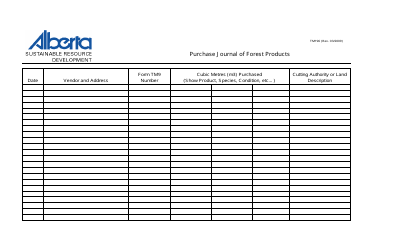

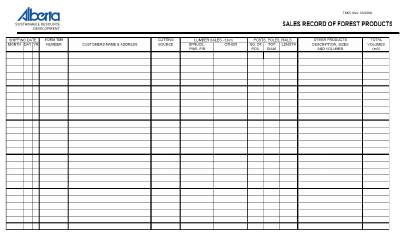

Q: What are forest products?

A: Forest products include logs, poles, posts, pilings, ties, cordwood, Christmas trees, and other products harvested from Oregon forests.

Q: When is Form OR-201-FP due?

A: Form OR-201-FP is due on or before the last day of the month following the close of the calendar quarter in which the harvest occurred.

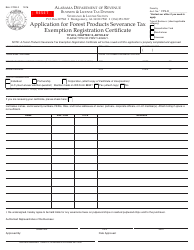

Q: Are there any exemptions from the forest products harvest tax?

A: Yes, certain exemptions may apply. You should refer to the instructions for Form OR-201-FP or consult with the Oregon Department of Revenue for more information.

Q: What happens if I don't file Form OR-201-FP?

A: Failure to file Form OR-201-FP or pay the forest products harvest tax may result in penalties and interest.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.