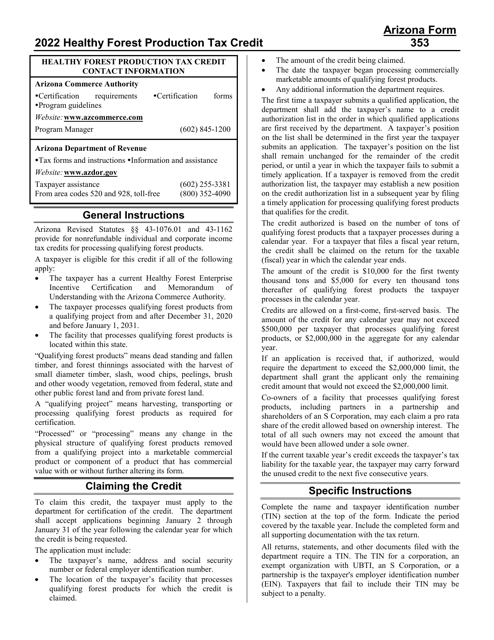

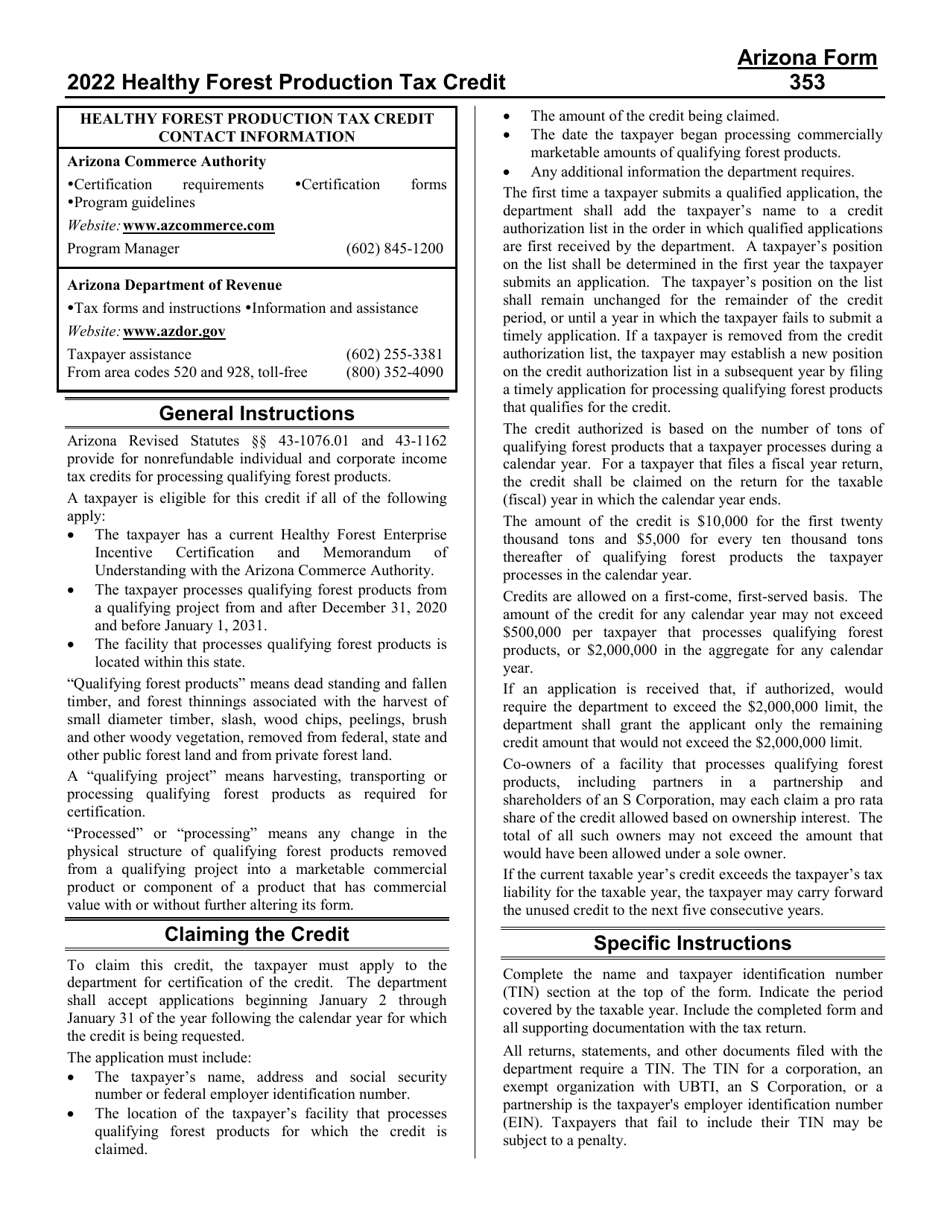

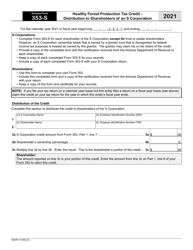

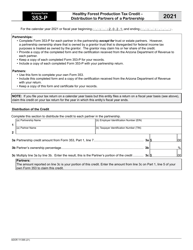

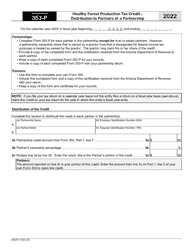

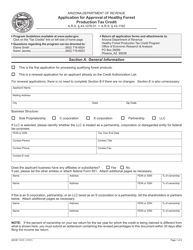

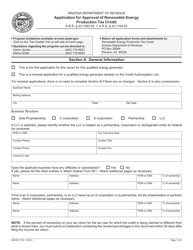

Instructions for Arizona Form 353, ADOR11394 Healthy Forest Production Tax Credit - Arizona

This document contains official instructions for Arizona Form 353 , and Form ADOR11394 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 353 (ADOR11394) is available for download through this link.

FAQ

Q: What is Arizona Form 353?

A: Arizona Form 353 is a tax form for claiming the Healthy Forest Production Tax Credit in Arizona.

Q: What is the ADOR11394?

A: ADOR11394 is the form number for Arizona Form 353.

Q: What is the Healthy Forest Production Tax Credit?

A: The Healthy Forest Production Tax Credit is a tax credit offered in Arizona for certain forest product activities.

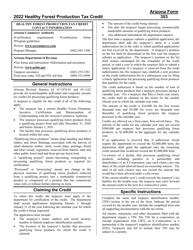

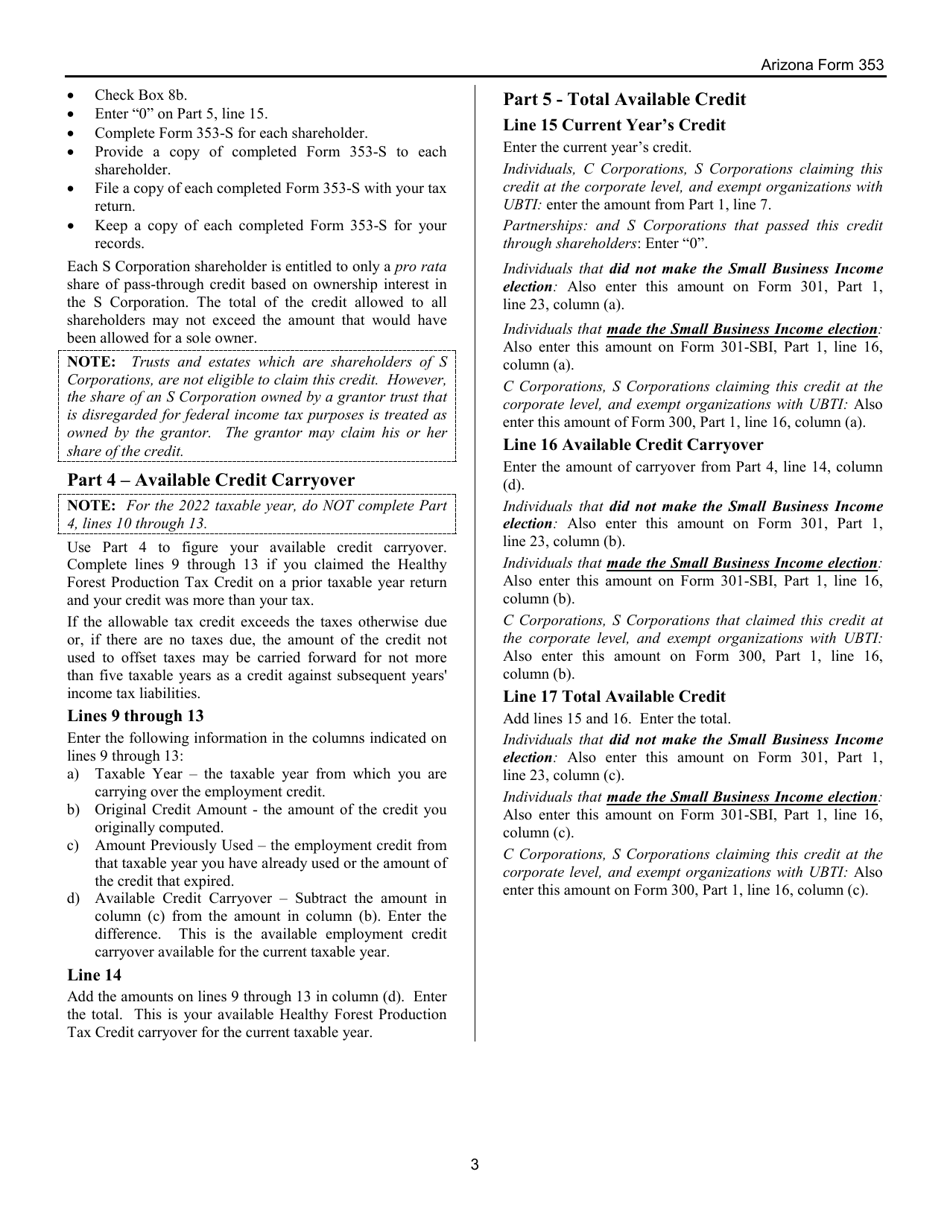

Q: Who can claim the Healthy Forest Production Tax Credit?

A: Any taxpayer engaged in eligible forest product activities in Arizona can claim the Healthy Forest Production Tax Credit.

Q: What are eligible forest product activities?

A: Eligible forest product activities include timber harvesting, milling, and manufacturing of certain forest products.

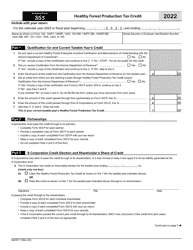

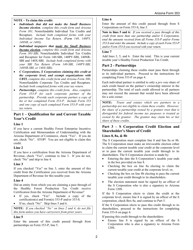

Q: What information do I need to complete Arizona Form 353?

A: To complete Arizona Form 353, you will need to provide information about your forest product activities, including income and expenses.

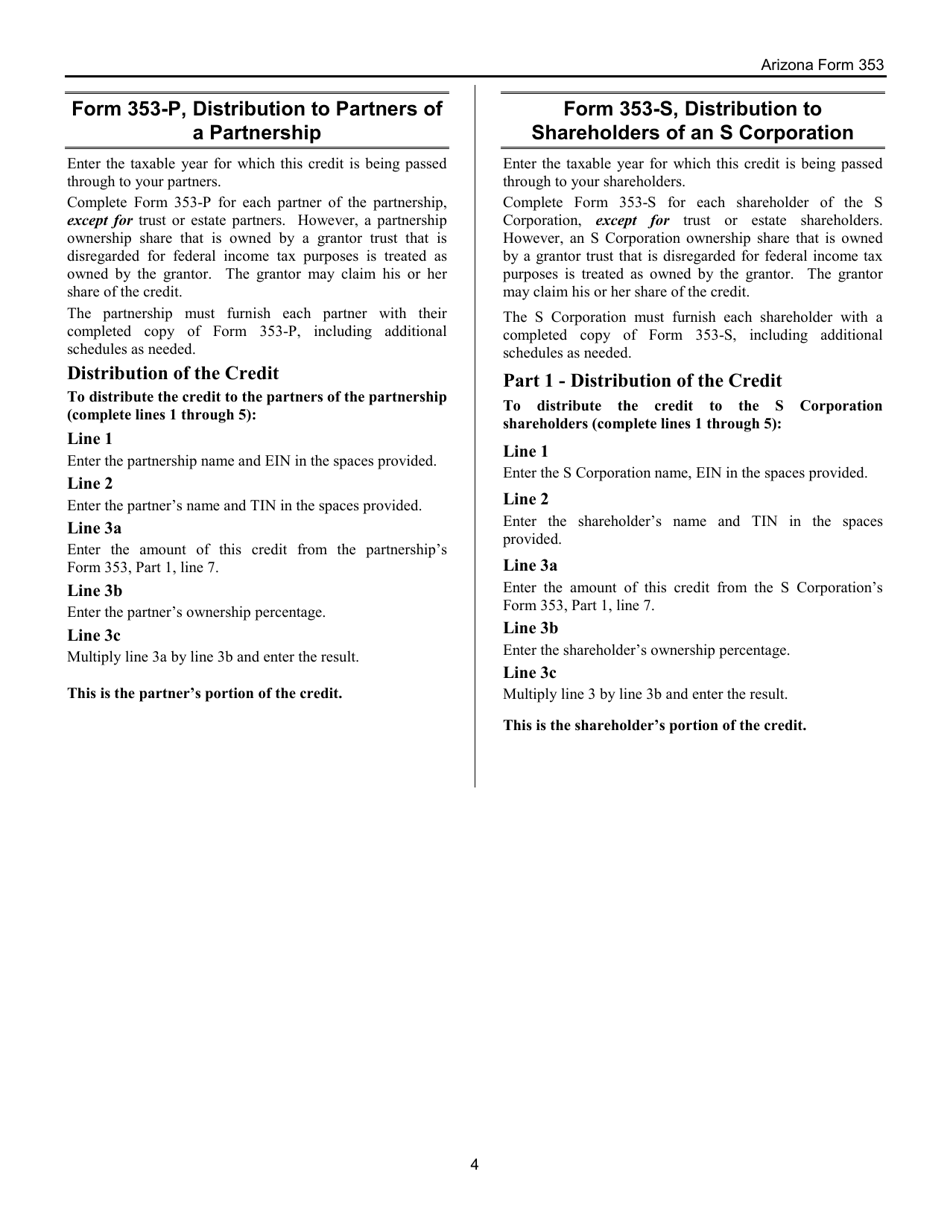

Q: What is the deadline for filing Arizona Form 353?

A: The deadline for filing Arizona Form 353 is typically April 15th of the following year, unless an extension has been granted.

Q: Are there any additional requirements or qualifications for claiming the Healthy Forest Production Tax Credit?

A: Yes, there may be additional requirements or qualifications depending on the specifics of your forest product activities. It is advisable to consult the instructions for Arizona Form 353 or seek professional tax advice.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.