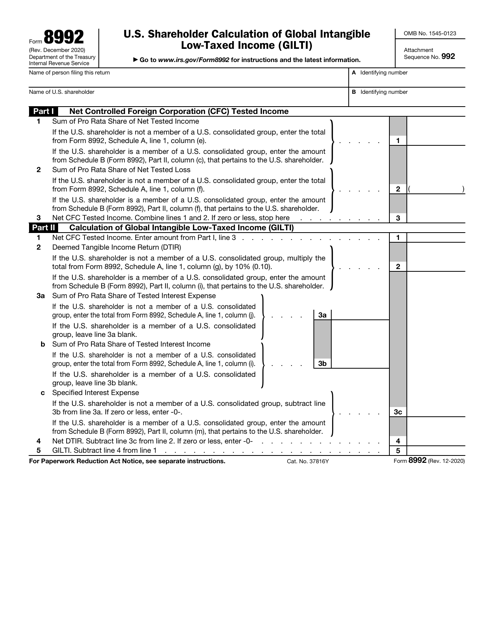

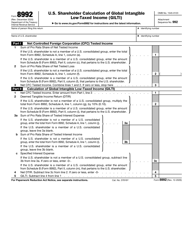

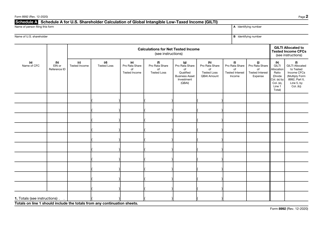

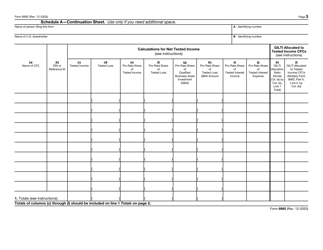

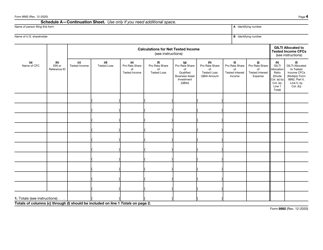

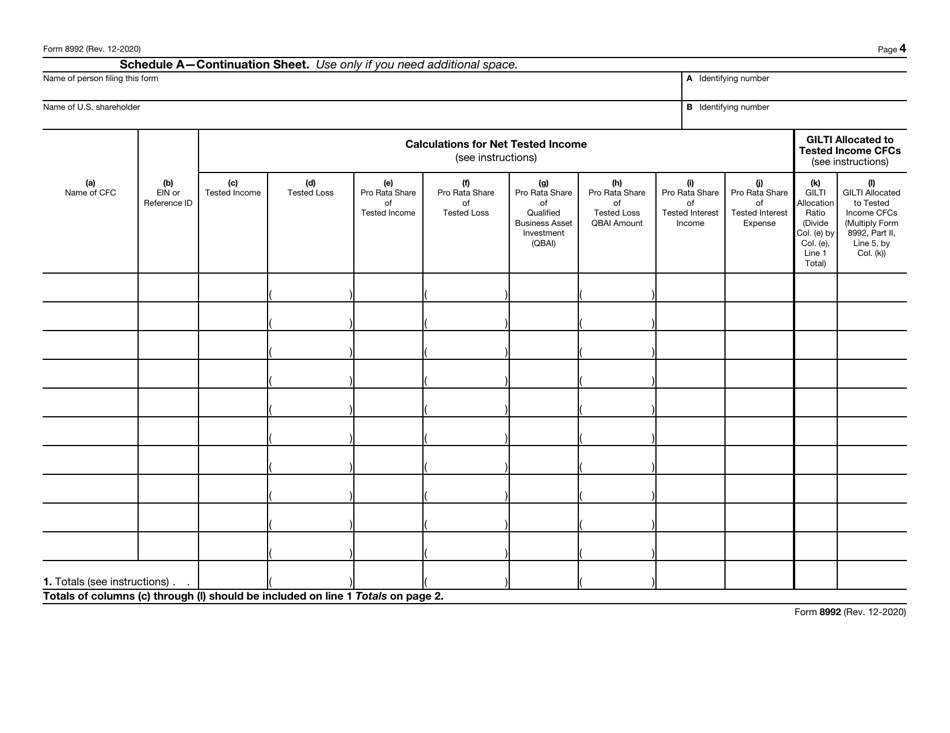

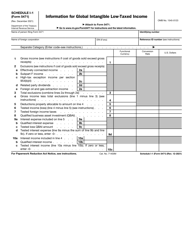

IRS Form 8992 U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti)

What Is IRS Form 8992?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8992?

A: IRS Form 8992 is a tax form used by U.S. shareholders to calculate their Global Intangible Low-Taxed Income (GILTI).

Q: Who is required to file IRS Form 8992?

A: U.S. shareholders of certain foreign corporations that meet the requirements for GILTI inclusion are required to file Form 8992.

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: GILTI is a category of income earned by certain foreign corporations that is subject to additional taxation for U.S. shareholders.

Q: What information is required to complete IRS Form 8992?

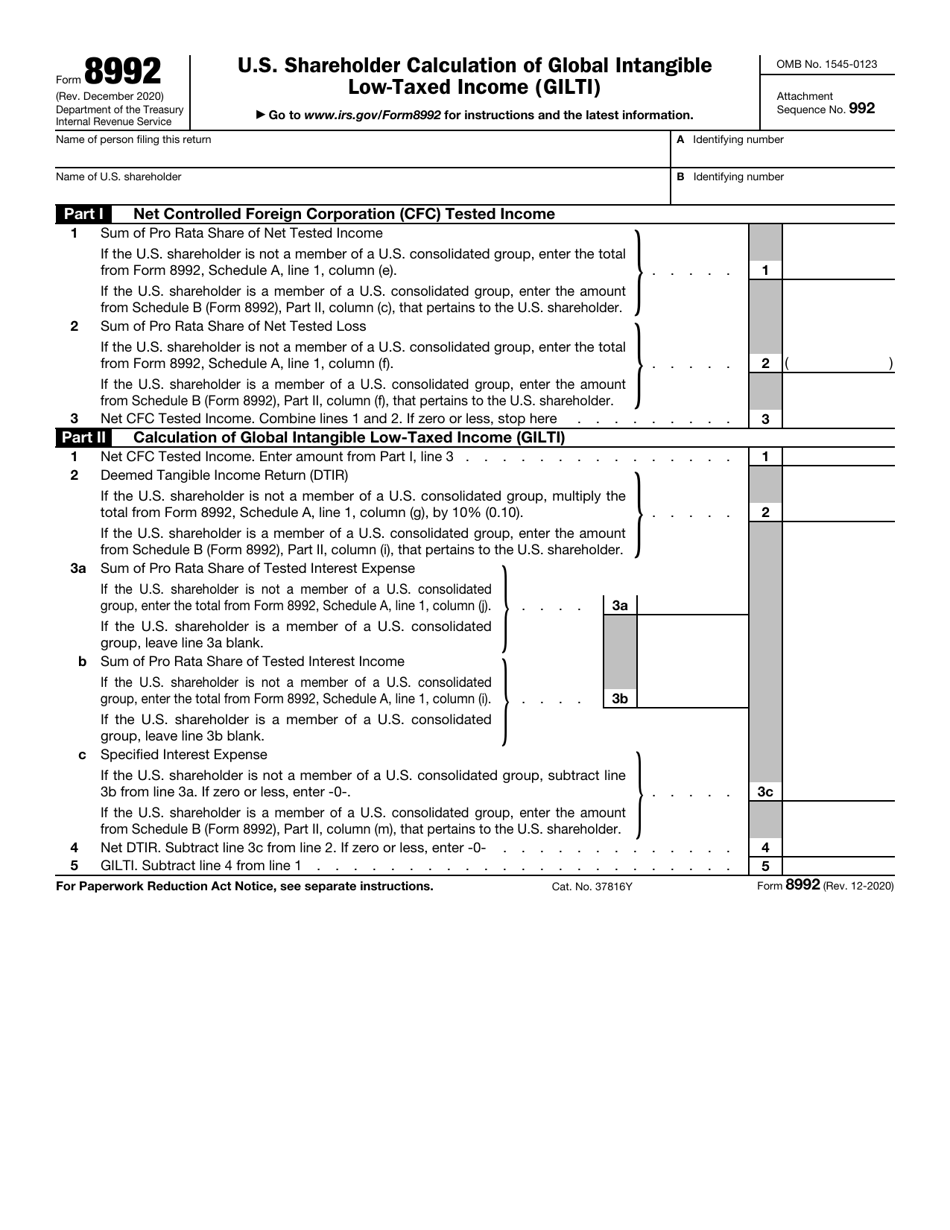

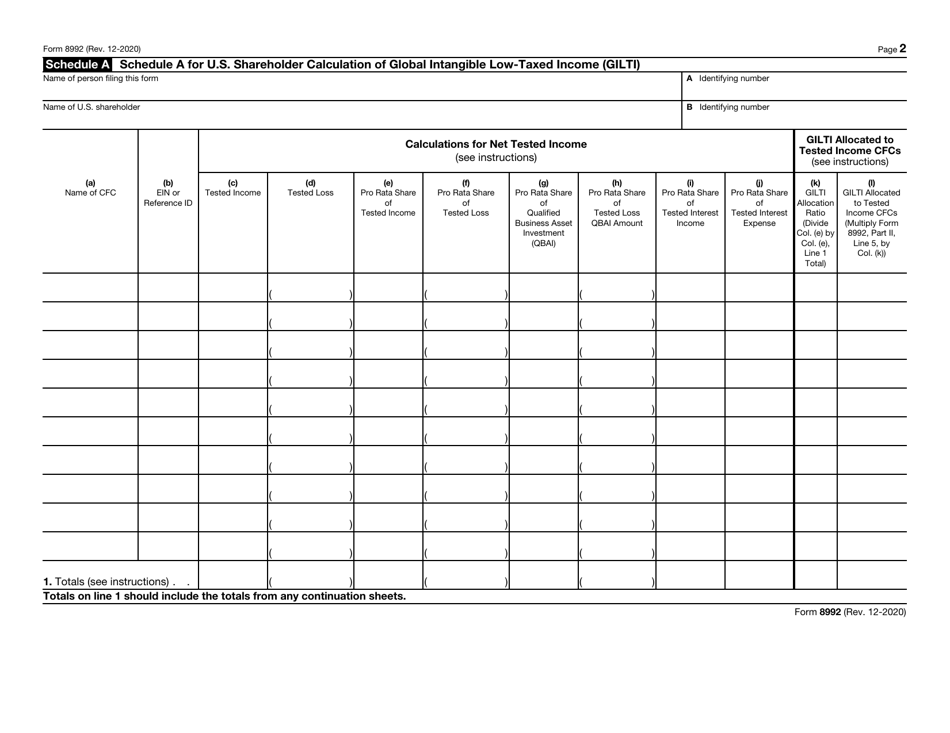

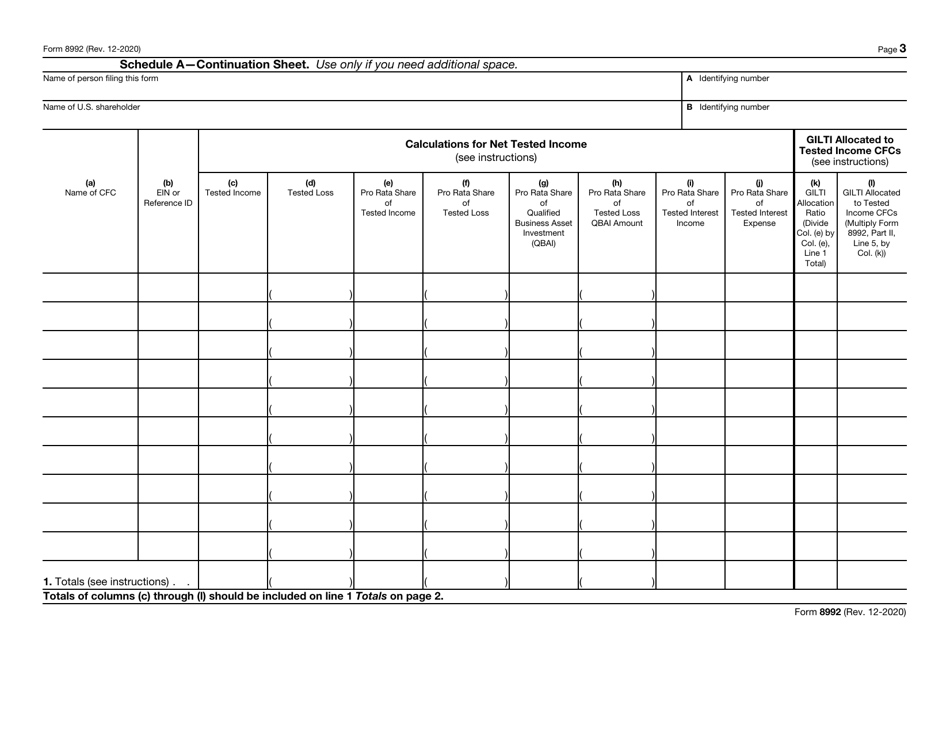

A: To complete Form 8992, you will need information about your ownership of certain foreign corporations, their income and deductions, and any GILTI previously calculated.

Q: What is the purpose of IRS Form 8992?

A: The purpose of Form 8992 is to calculate the amount of GILTI for U.S. shareholders, which is used to determine their tax liability.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8992 through the link below or browse more documents in our library of IRS Forms.