This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8992

for the current year.

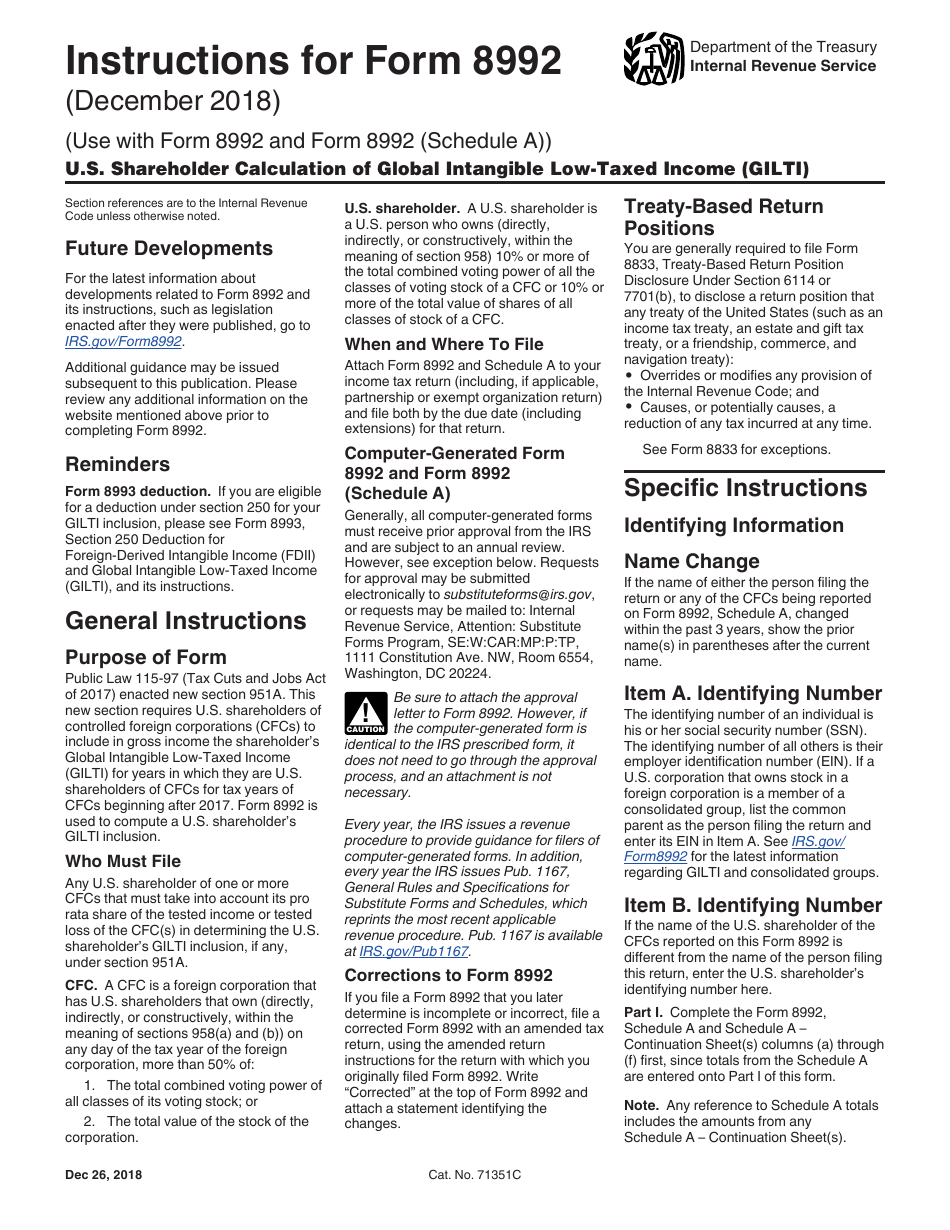

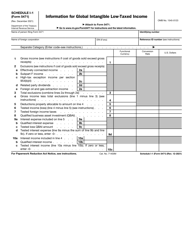

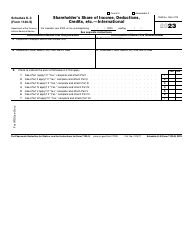

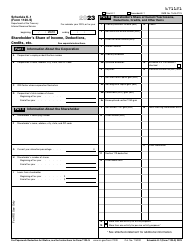

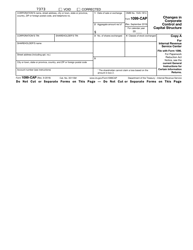

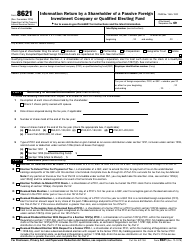

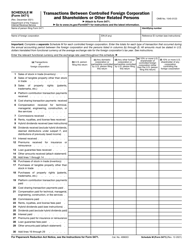

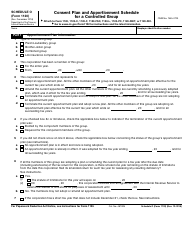

Instructions for IRS Form 8992 U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti)

This document contains official instructions for IRS Form 8992 , U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8992 is available for download through this link.

FAQ

Q: What is IRS Form 8992?

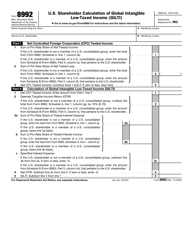

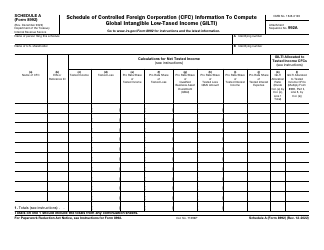

A: IRS Form 8992 is a form used by U.S. shareholders to calculate the Global Intangible Low-Taxed Income (GILTI) under the tax provisions of the Tax Cuts and Jobs Act.

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: GILTI is a provision under the Tax Cuts and Jobs Act that requires U.S. shareholders of controlled foreign corporations (CFCs) to include certain income in their taxable income.

Q: Who needs to file IRS Form 8992?

A: U.S. shareholders of controlled foreign corporations (CFCs) need to file IRS Form 8992 to calculate GILTI.

Q: What information is required on IRS Form 8992?

A: IRS Form 8992 requires U.S. shareholders to provide information about their ownership of CFCs and calculate their GILTI inclusion.

Q: Is IRS Form 8992 complex?

A: IRS Form 8992 can be complex and it is recommended to seek professional tax advice to ensure accurate completion.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.