This version of the form is not currently in use and is provided for reference only. Download this version of

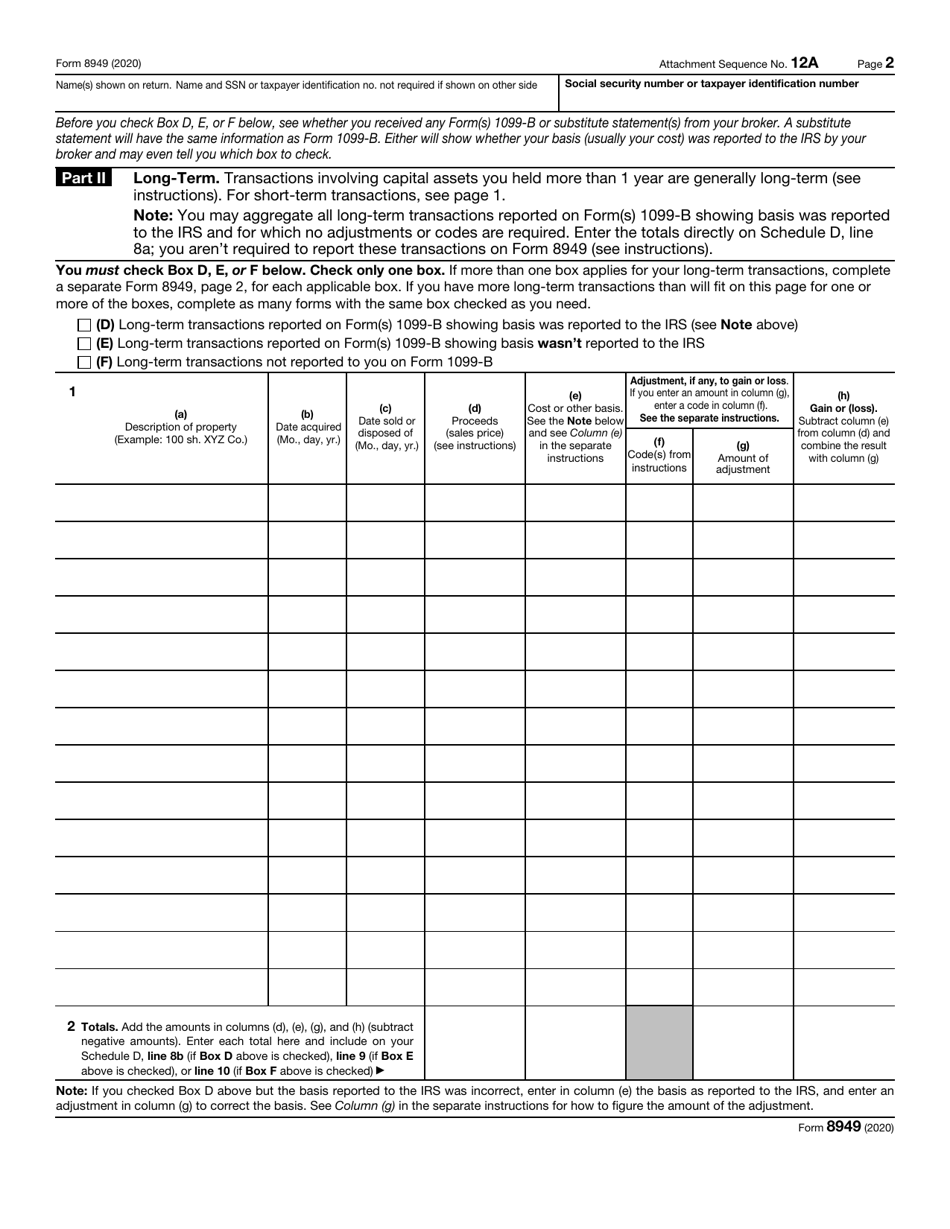

IRS Form 8949

for the current year.

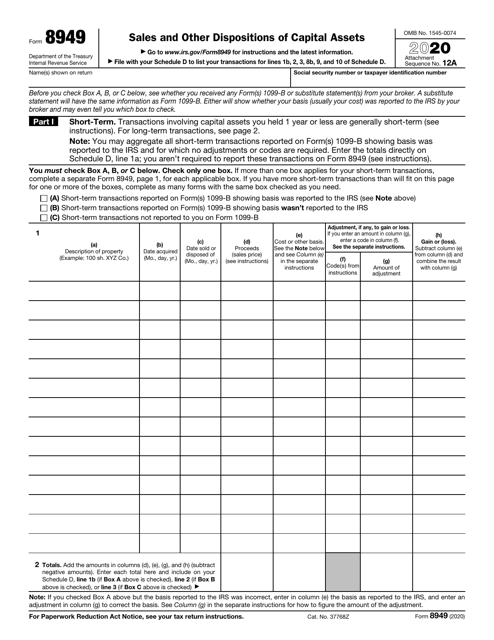

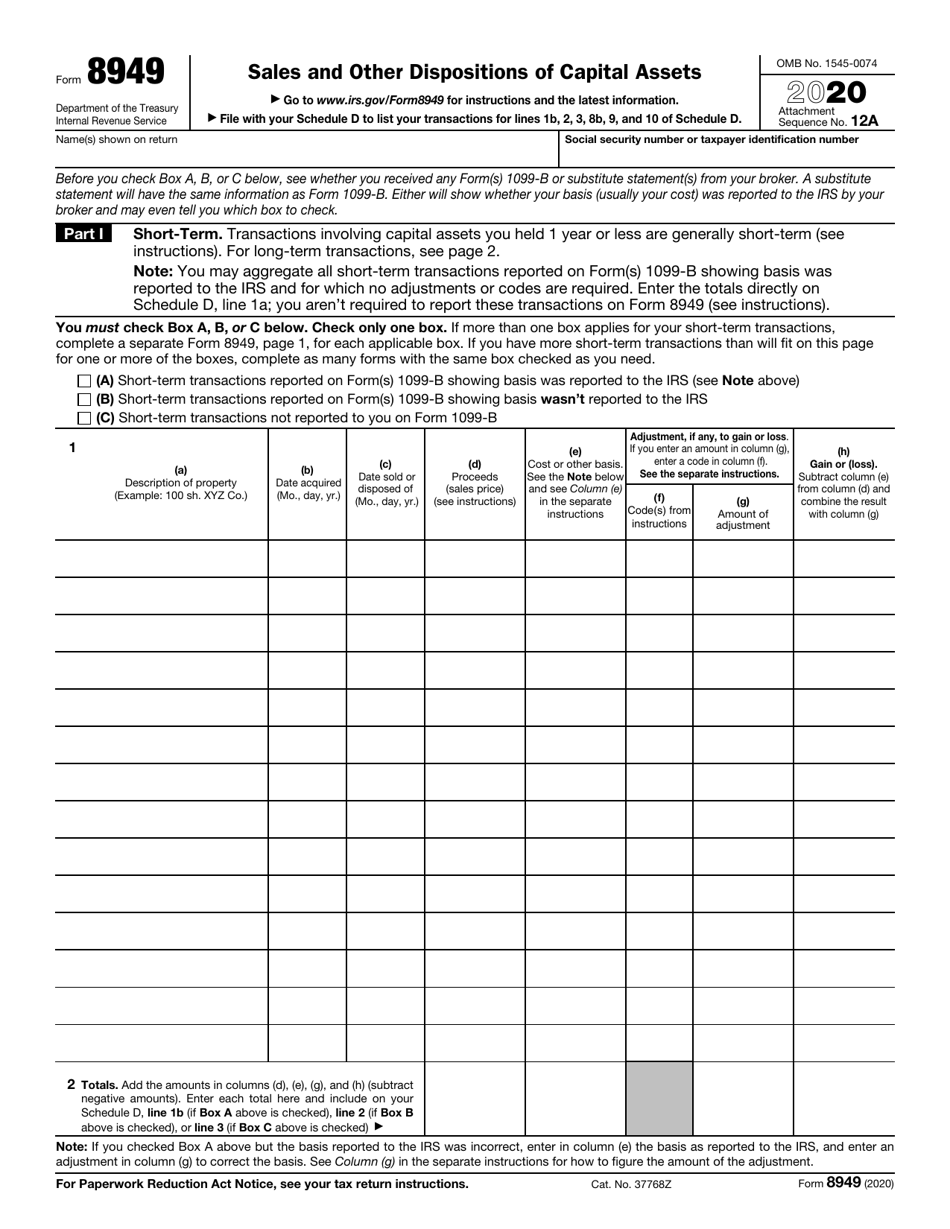

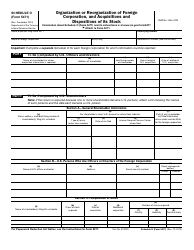

IRS Form 8949 Sales and Other Dispositions of Capital Assets

What Is IRS Form 8949?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8949?

A: IRS Form 8949 is used to report sales and other dispositions of capital assets for tax purposes.

Q: What are capital assets?

A: Capital assets are usually long-term investments or property that have the potential to increase in value, such as stocks, bonds, real estate, and certain collectibles.

Q: When do I need to use IRS Form 8949?

A: You need to use IRS Form 8949 if you sold or disposed of capital assets during the tax year.

Q: What information do I need to complete Form 8949?

A: You will need to provide details about the asset you sold, including the date of acquisition, date of sale, cost basis, and sale proceeds.

Q: Do I need to attach Form 8949 to my tax return?

A: Yes, you need to attach Form 8949 to your tax return, along with Schedule D, if you have any capital gains or losses to report.

Q: Are there any exceptions to using Form 8949?

A: Yes, if you only have short-term capital gains and losses from the sale of stocks, you can report them directly on Schedule D without using Form 8949.

Q: Is there a deadline to file Form 8949?

A: Form 8949 must be filed along with your tax return by the April tax filing deadline, unless you file for an extension.

Q: What happens if I make a mistake on Form 8949?

A: If you make a mistake on Form 8949, you may need to file an amended tax return using Form 1040X to correct the error.

Q: Can I e-file Form 8949?

A: Yes, you can e-file Form 8949 along with your tax return using tax software or a qualified tax preparer.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8949 through the link below or browse more documents in our library of IRS Forms.