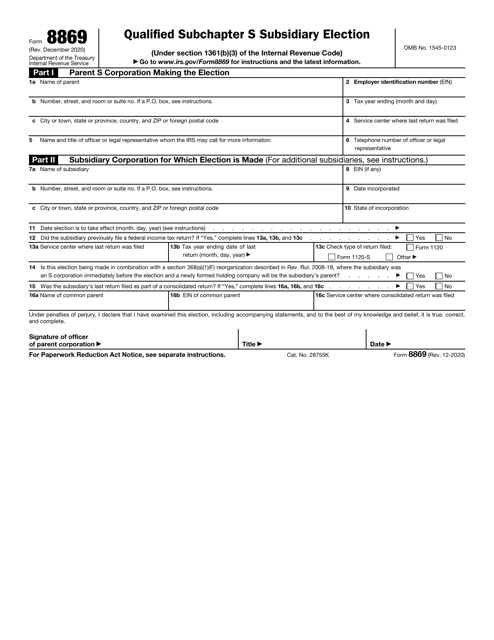

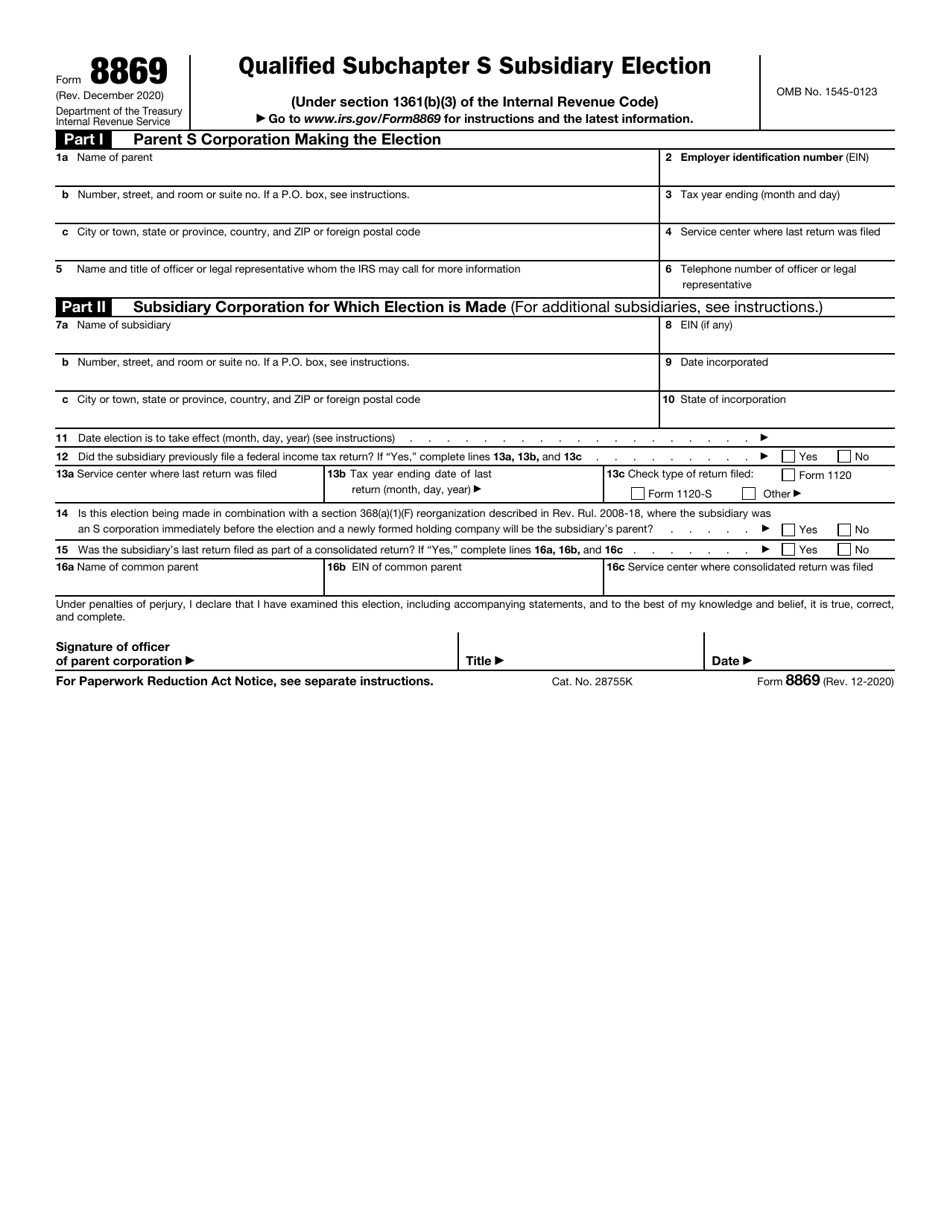

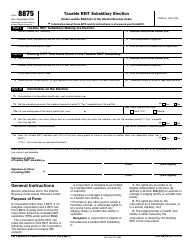

IRS Form 8869 Qualified Subchapter S Subsidiary Election

What Is IRS Form 8869?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8869?

A: IRS Form 8869 is used to make a Qualified Subchapter S Subsidiary election.

Q: What is a Qualified Subchapter S Subsidiary?

A: A Qualified Subchapter S Subsidiary, or QSub, is a type of corporation that is treated as a disregarded entity for federal tax purposes.

Q: Who should file IRS Form 8869?

A: Owners of a subsidiary corporation who want to elect for it to be treated as a QSub.

Q: What are the benefits of filing Form 8869?

A: By electing QSub status, the subsidiary's income, deductions, and credits are treated as if they were directly incurred by the parent S corporation.

Q: When should Form 8869 be filed?

A: Form 8869 should be filed within 2 months and 15 days after the date of the subsidiary's acquisition.

Q: Are there any fees associated with filing Form 8869?

A: There are no fees for filing Form 8869.

Q: Can Form 8869 be filed electronically?

A: Yes, Form 8869 can be filed electronically.

Q: Can Form 8869 be filed late?

A: Late filing of Form 8869 may result in penalties or the loss of QSub status, so it is important to file on time.

Q: Do I need to attach any other documents with Form 8869?

A: In most cases, no additional documents need to be attached with Form 8869.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8869 through the link below or browse more documents in our library of IRS Forms.