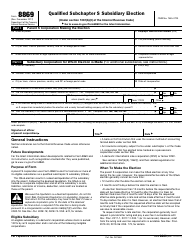

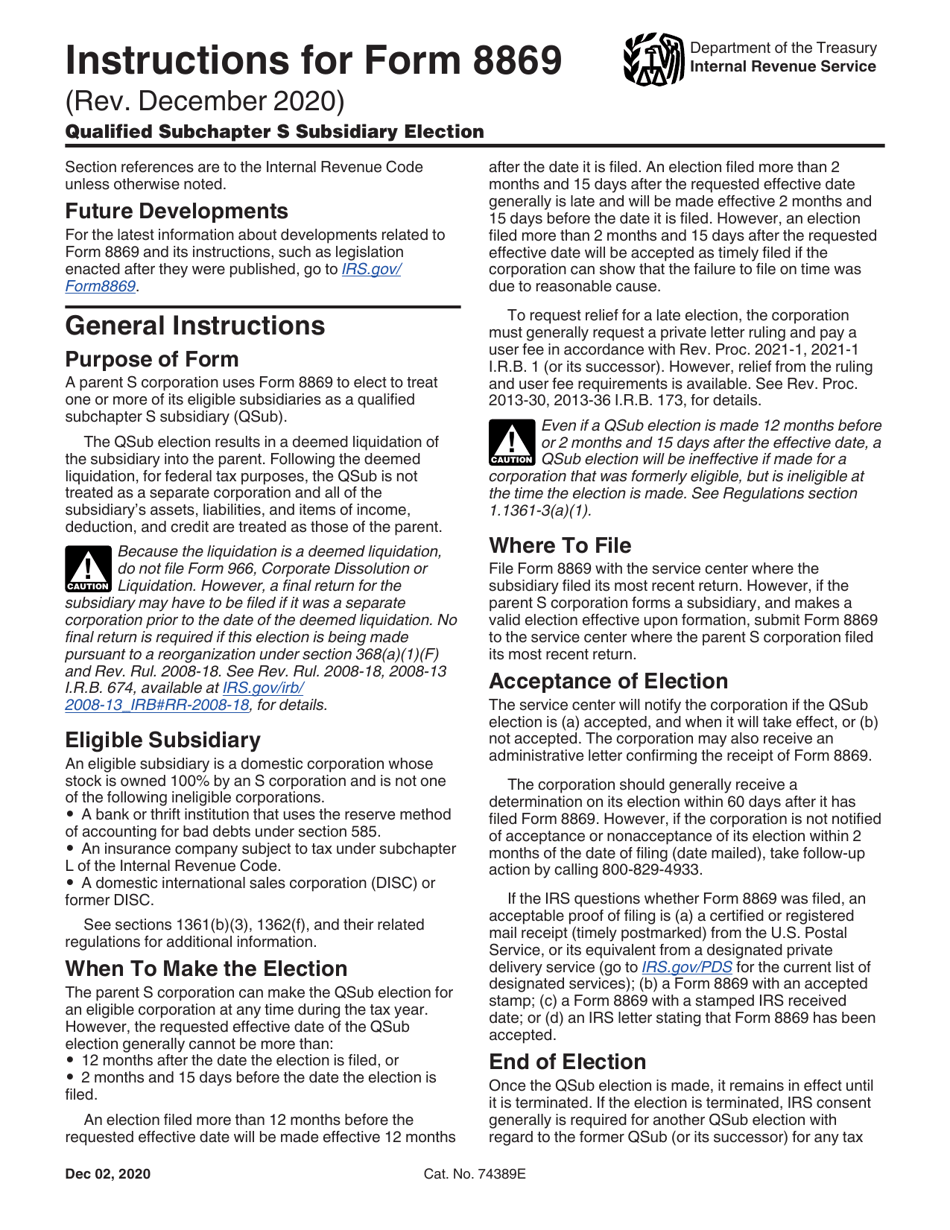

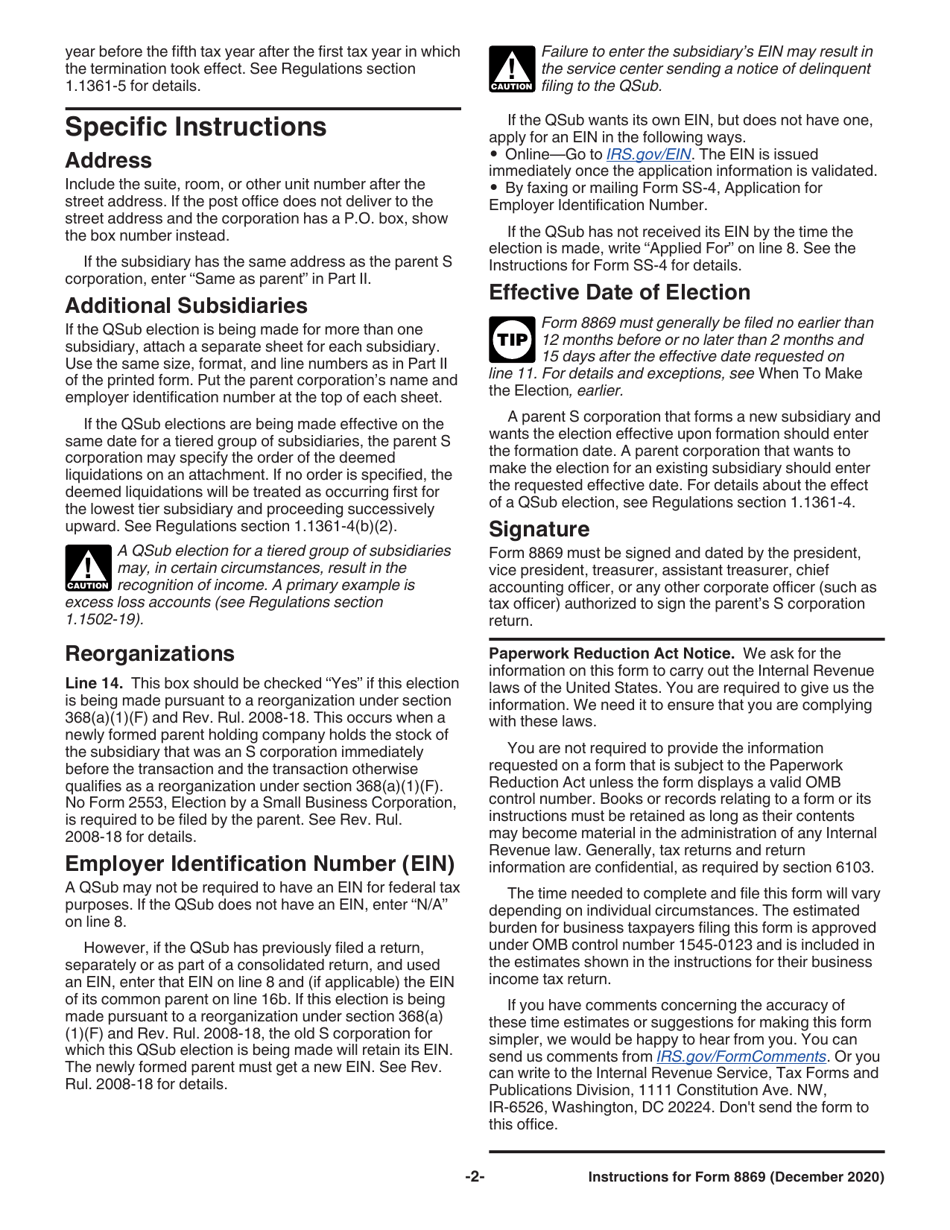

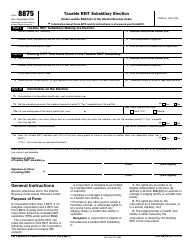

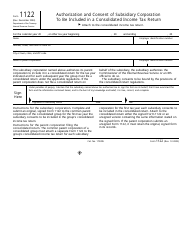

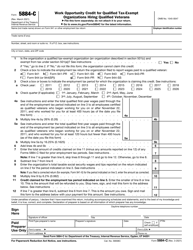

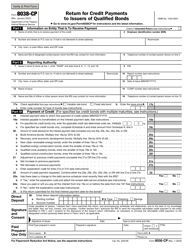

Instructions for IRS Form 8869 Qualified Subchapter S Subsidiary Election

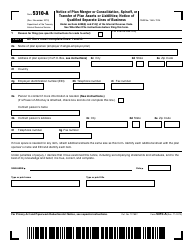

This document contains official instructions for IRS Form 8869 , Qualified Subchapter S Subsidiary Election - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8869 is available for download through this link.

FAQ

Q: What is IRS Form 8869?

A: IRS Form 8869 is a form used to make a Qualified Subchapter S Subsidiary (QSub) election.

Q: What is a Qualified Subchapter S Subsidiary (QSub) election?

A: A QSub election allows a subsidiary of an S corporation to be treated as a separate entity for tax purposes.

Q: Who can file IRS Form 8869?

A: S corporations that want to treat a subsidiary as a separate entity can file IRS Form 8869.

Q: What information is required on IRS Form 8869?

A: IRS Form 8869 requires information about the S corporation and the subsidiary being treated as a QSub, as well as details of the election.

Q: How do I file IRS Form 8869?

A: IRS Form 8869 should be filed with the S corporation's income tax return for the tax year in which the QSub election is being made.

Q: Are there any deadlines for filing IRS Form 8869?

A: Yes, IRS Form 8869 must be filed within 2 months and 15 days after the start of the tax year in which the QSub election is being made.

Q: What are the benefits of making a QSub election?

A: Making a QSub election allows the subsidiary to be treated as a separate entity for tax purposes, which can provide certain tax advantages to the S corporation and its shareholders.

Q: Can I revoke a QSub election?

A: Yes, a QSub election can be revoked, but it requires approval from the IRS.

Q: Do I need to include any additional documentation with IRS Form 8869?

A: The IRS may require additional documentation to support the QSub election, such as a consent statement from shareholders.

Q: Is there a fee for filing IRS Form 8869?

A: No, there is no fee for filing IRS Form 8869.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.