This version of the form is not currently in use and is provided for reference only. Download this version of

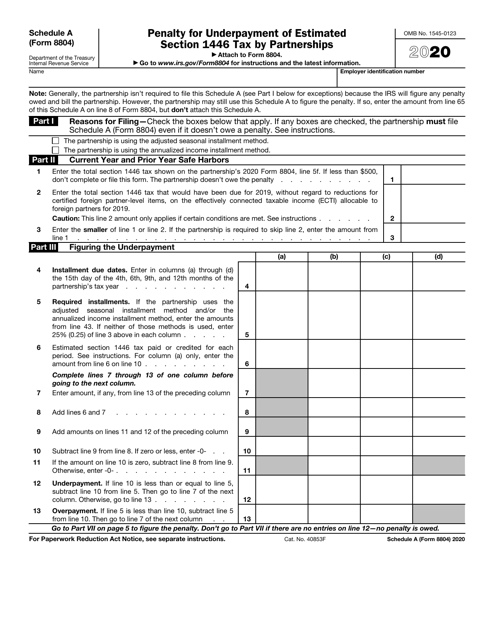

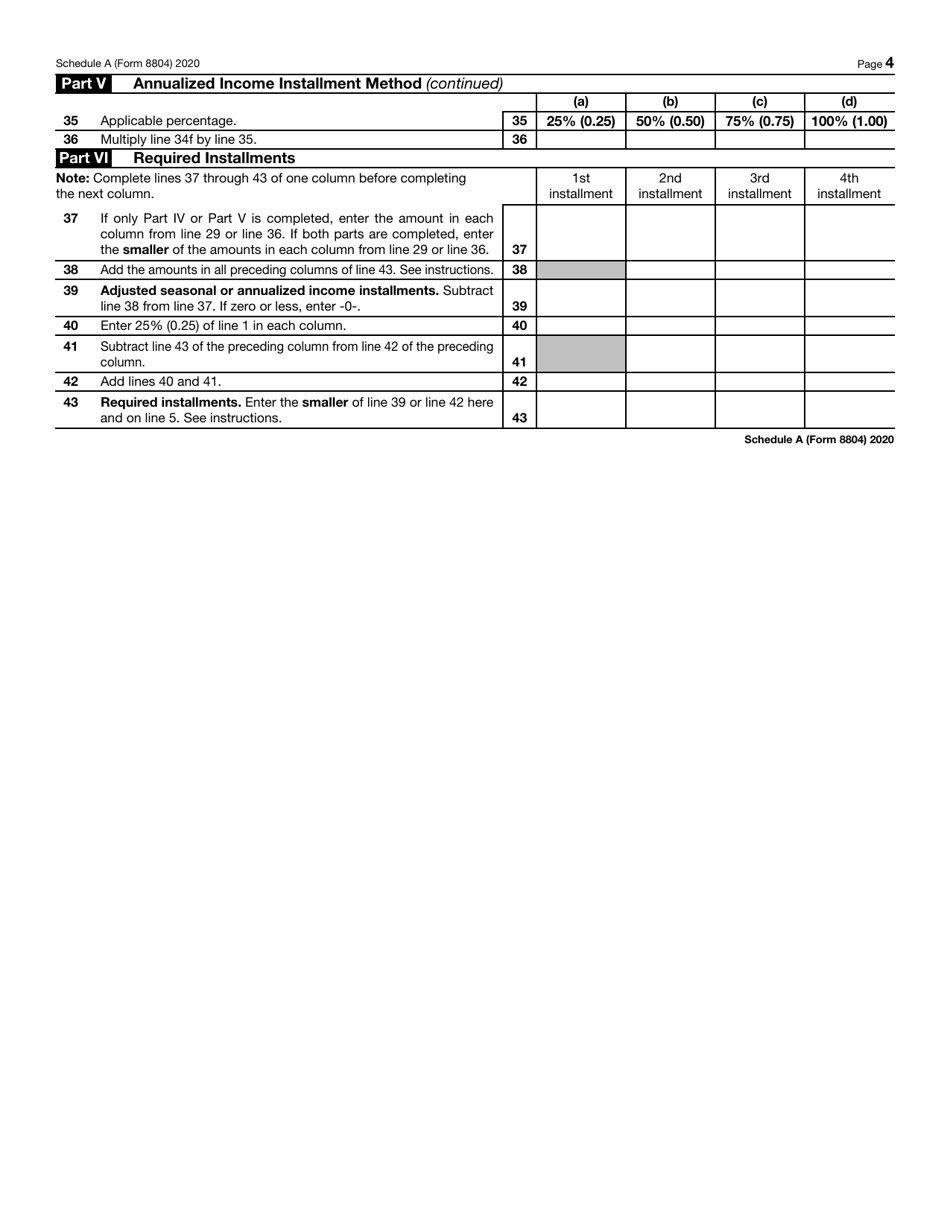

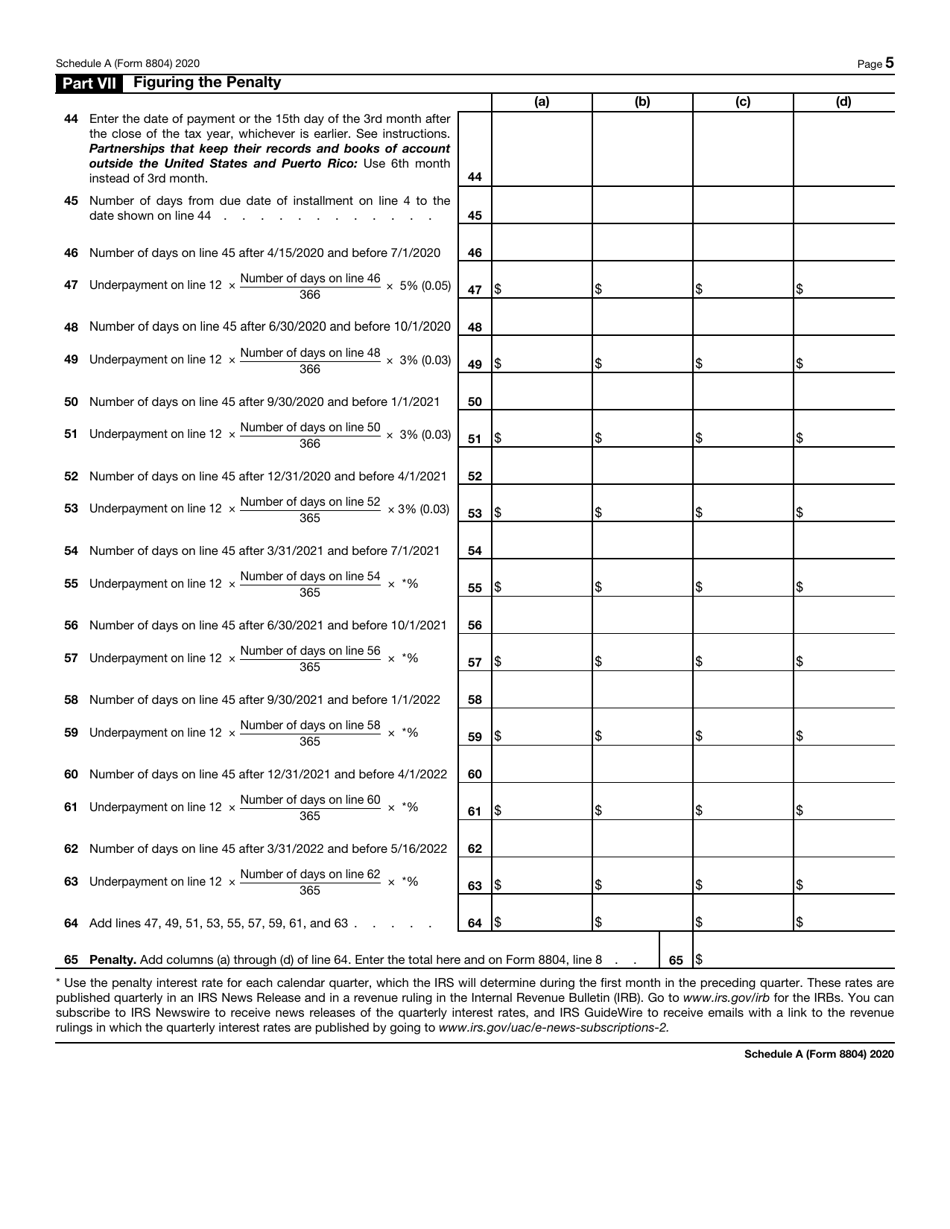

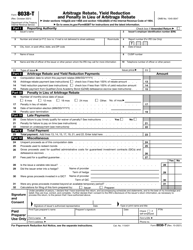

IRS Form 8804 Schedule A

for the current year.

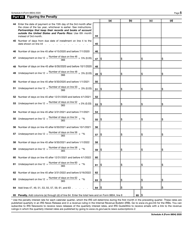

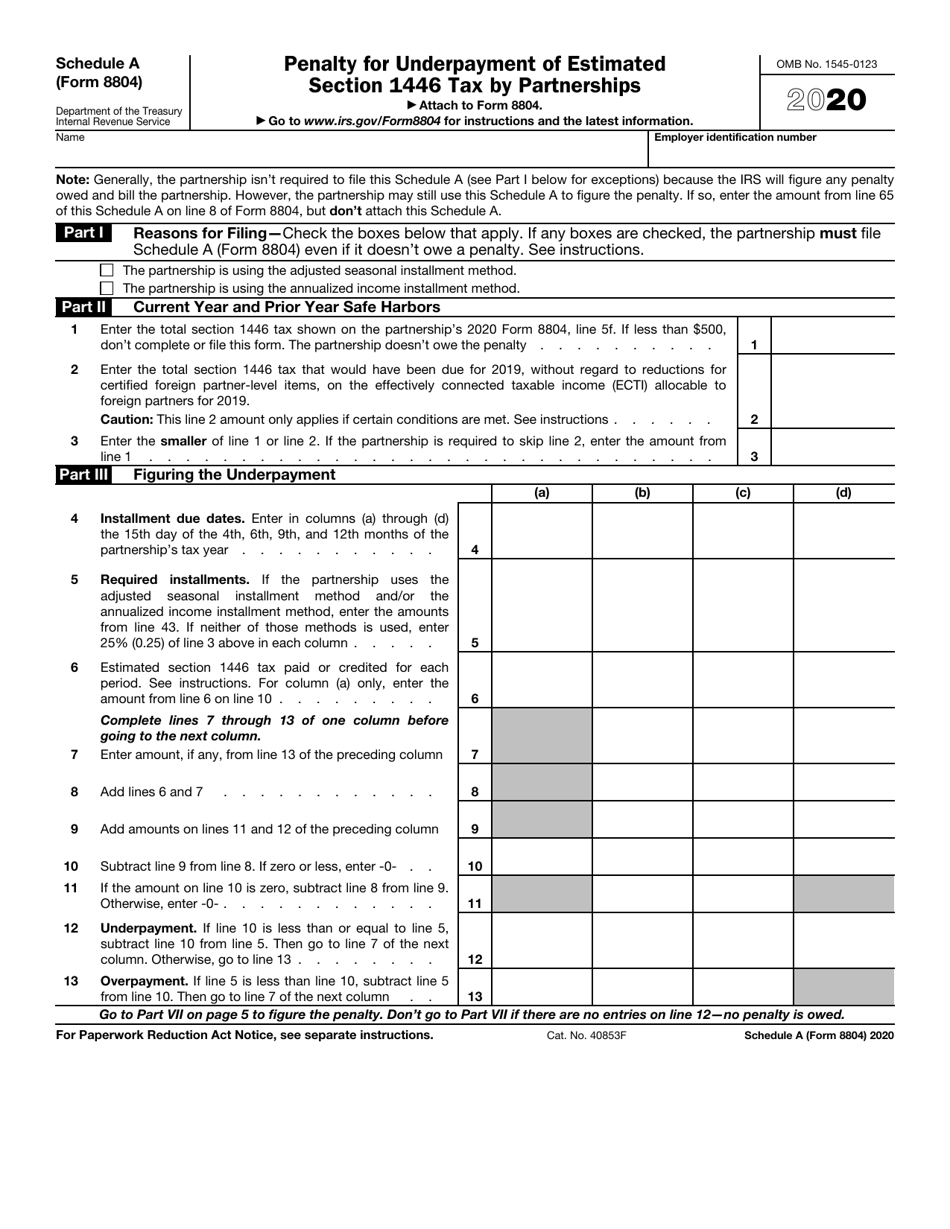

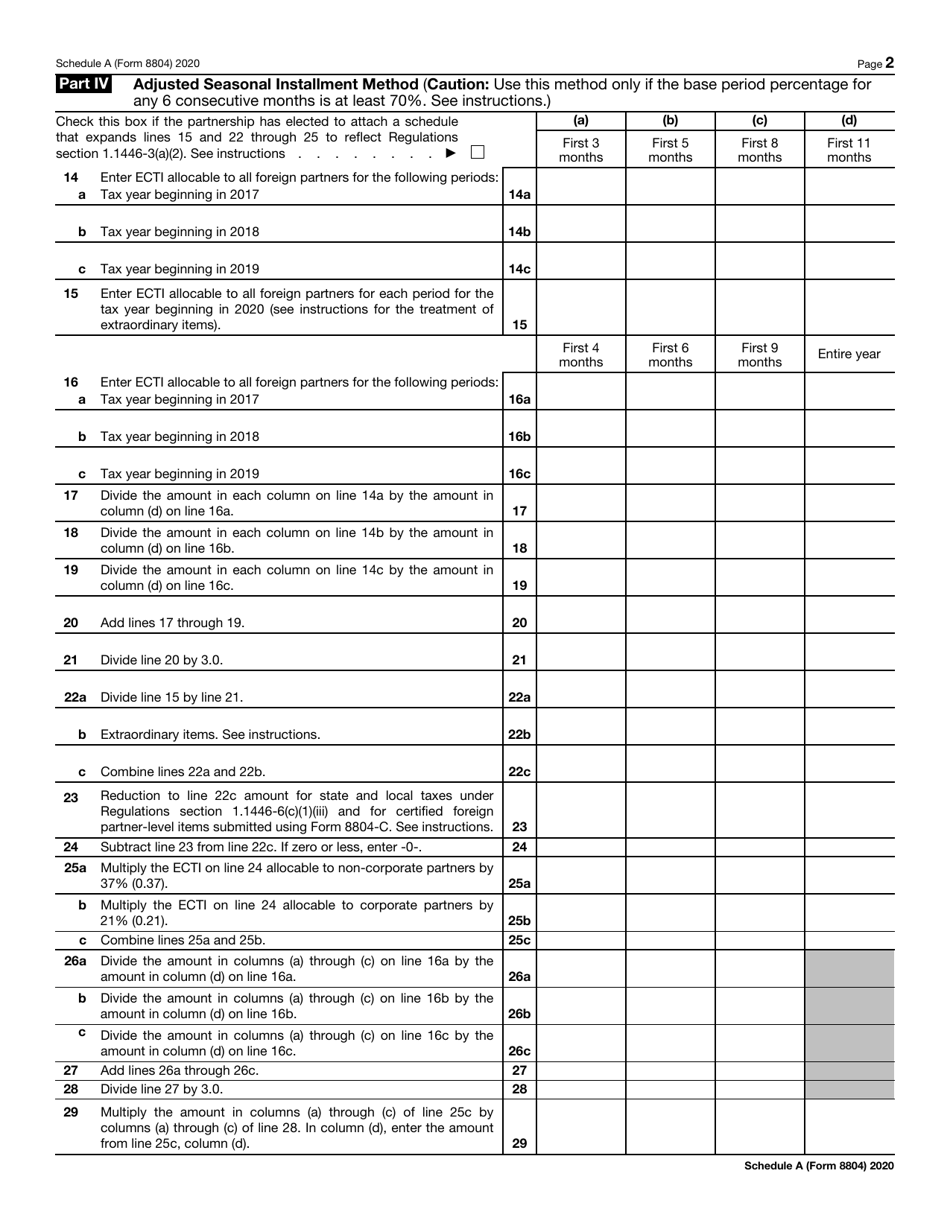

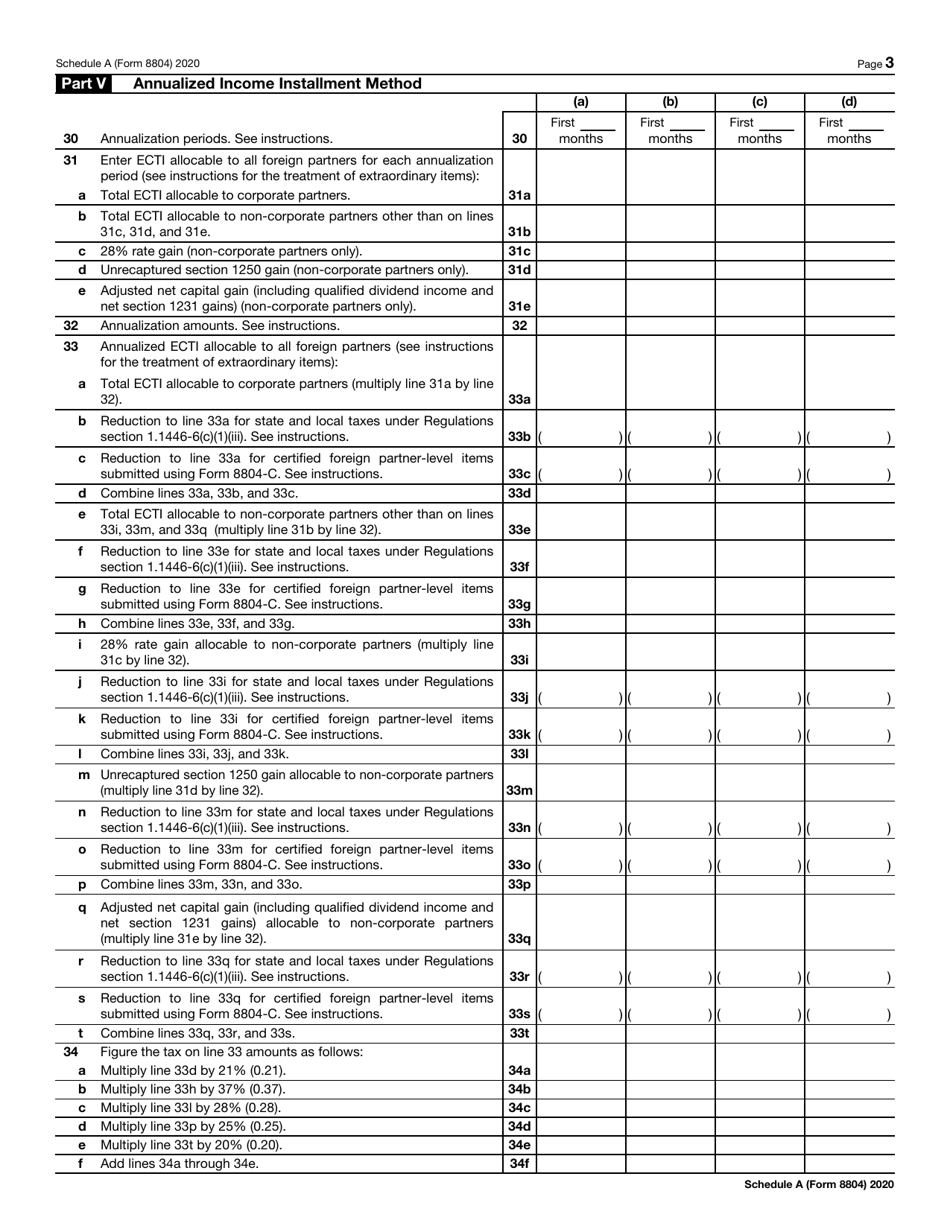

IRS Form 8804 Schedule A Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships

What Is IRS Form 8804 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8804, Annual Return for Partnership Withholding Tax (Section 1446). Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8804?

A: IRS Form 8804 is a tax form used by partnerships to report underpayment of estimated Section 1446 tax.

Q: What is Schedule A of IRS Form 8804?

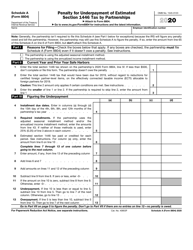

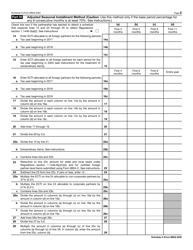

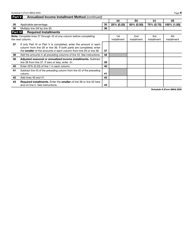

A: Schedule A of IRS Form 8804 is used to calculate the penalty for underpayment of estimated Section 1446 tax by partnerships.

Q: What is the penalty for underpayment of estimated Section 1446 tax?

A: The penalty for underpayment of estimated Section 1446 tax by partnerships is calculated using Schedule A of IRS Form 8804.

Q: Who is required to file IRS Form 8804?

A: Partnerships are required to file IRS Form 8804 if they have underpaid estimated Section 1446 tax.

Q: What is Section 1446 tax?

A: Section 1446 tax is a withholding tax on certain partnership income that is allocable to foreign partners.

Q: Are penalties assessed on partnerships that underpay Section 1446 tax?

A: Yes, penalties can be assessed on partnerships that underpay Section 1446 tax.

Q: Is there a deadline for filing IRS Form 8804?

A: Yes, partnerships must file IRS Form 8804 by the due date of their income tax return, including extensions.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8804 Schedule A through the link below or browse more documents in our library of IRS Forms.