This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8804 Schedule A

for the current year.

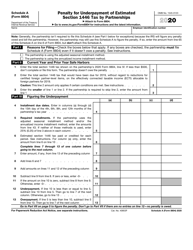

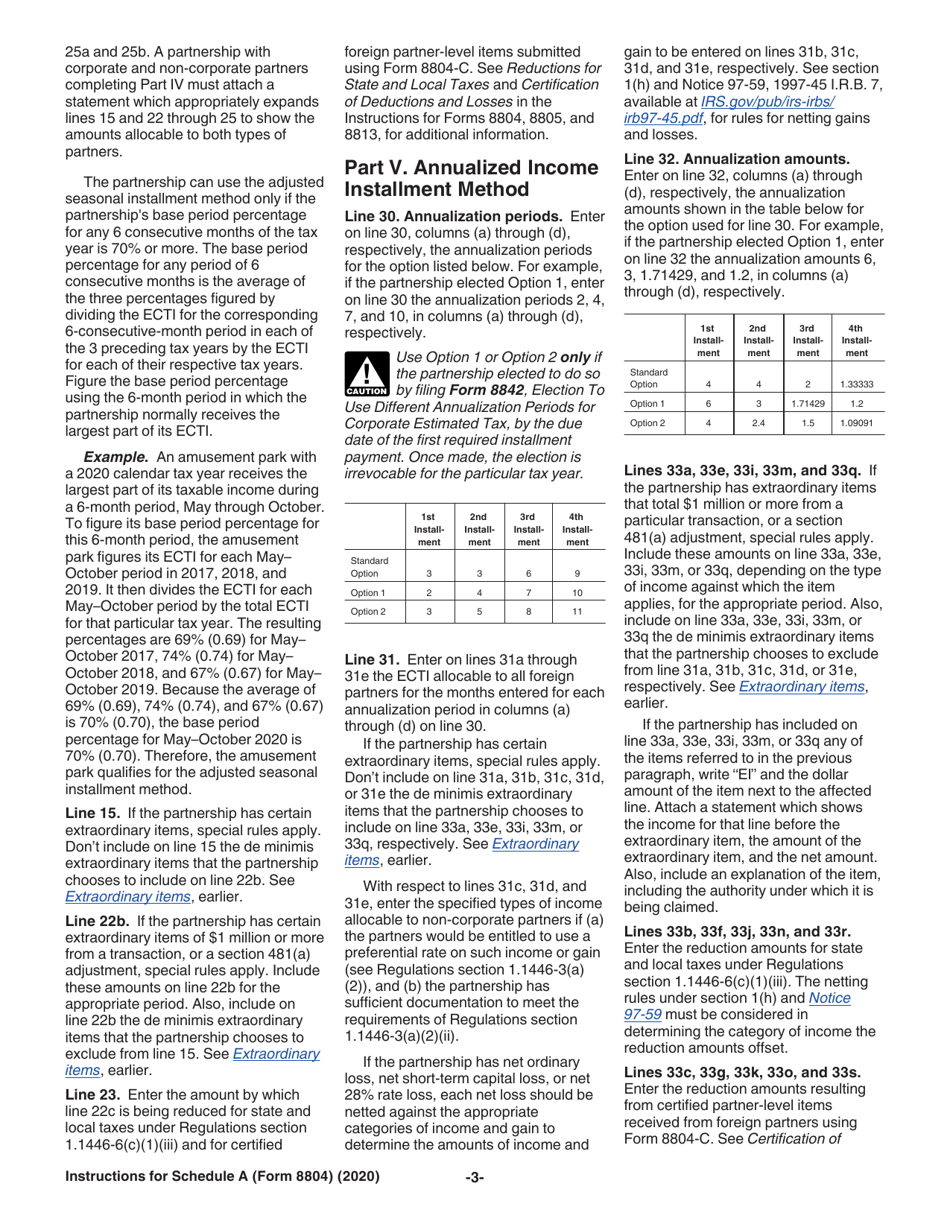

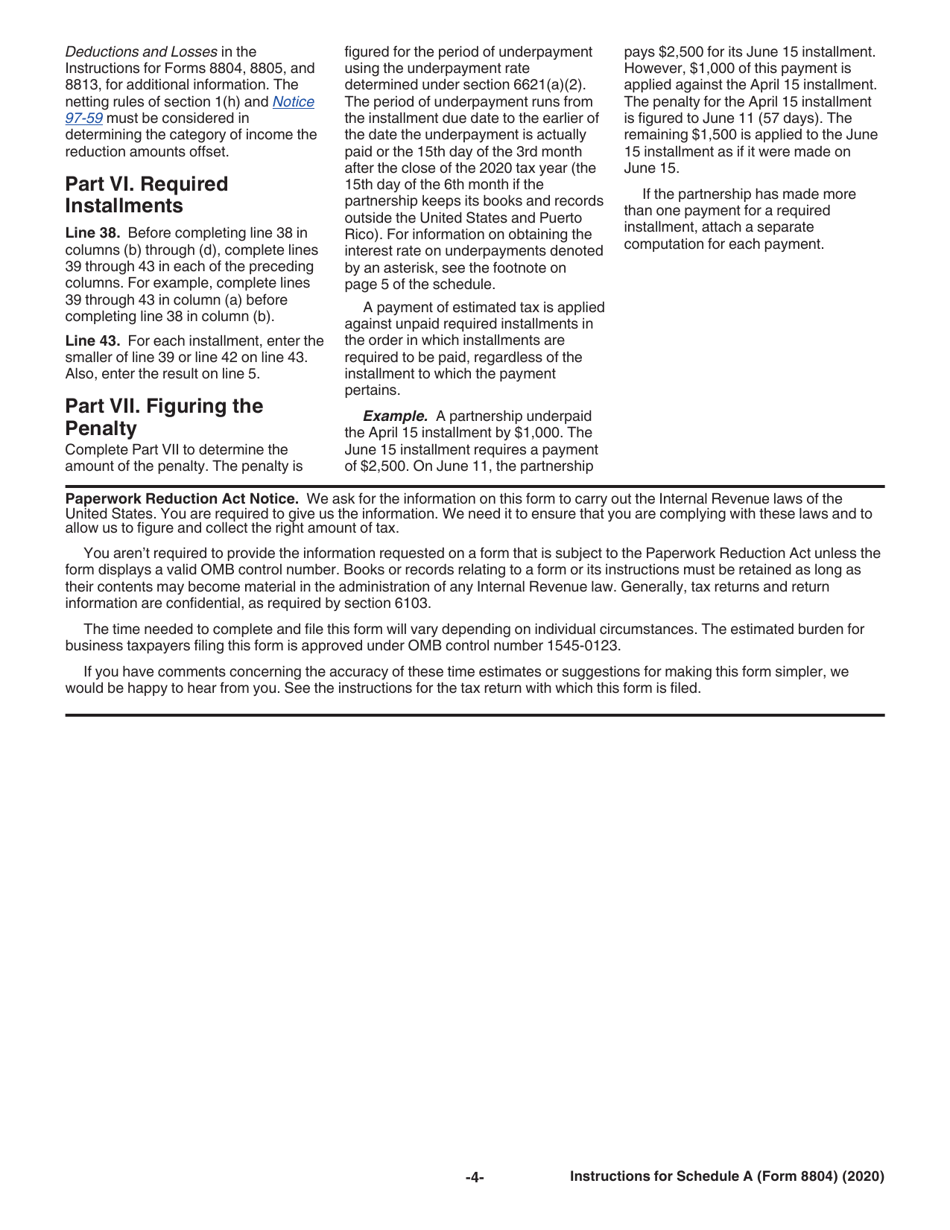

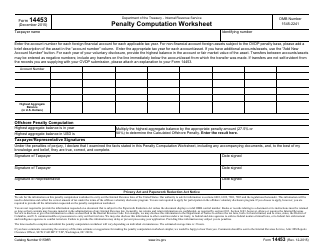

Instructions for IRS Form 8804 Schedule A Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships

This document contains official instructions for IRS Form 8804 Schedule A, Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8804 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 8804 Schedule A?

A: IRS Form 8804 Schedule A is a form used to report the penalty for underpayment of estimated Section 1446 tax by partnerships.

Q: What is Section 1446 tax?

A: Section 1446 tax refers to the tax withheld on foreign partners' share of effectively connected income.

Q: What is the penalty for underpayment of estimated Section 1446 tax?

A: The penalty for underpayment of estimated Section 1446 tax is reported and calculated on IRS Form 8804 Schedule A.

Q: Who is required to file IRS Form 8804 Schedule A?

A: Partnerships that have underpaid their estimated Section 1446 tax are required to file IRS Form 8804 Schedule A.

Q: Are there any exceptions or special rules for filing IRS Form 8804 Schedule A?

A: There may be exceptions or special rules depending on the specific circumstances, so it is recommended to consult the instructions or seek professional tax advice.

Q: What should I do if I have questions or need assistance with IRS Form 8804 Schedule A?

A: If you have questions or need assistance with IRS Form 8804 Schedule A, you can contact the IRS or consult with a professional tax advisor.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.