This version of the form is not currently in use and is provided for reference only. Download this version of

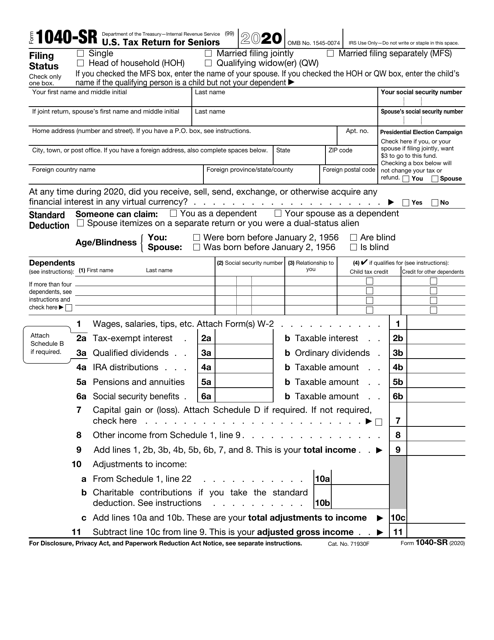

IRS Form 1040-SR

for the current year.

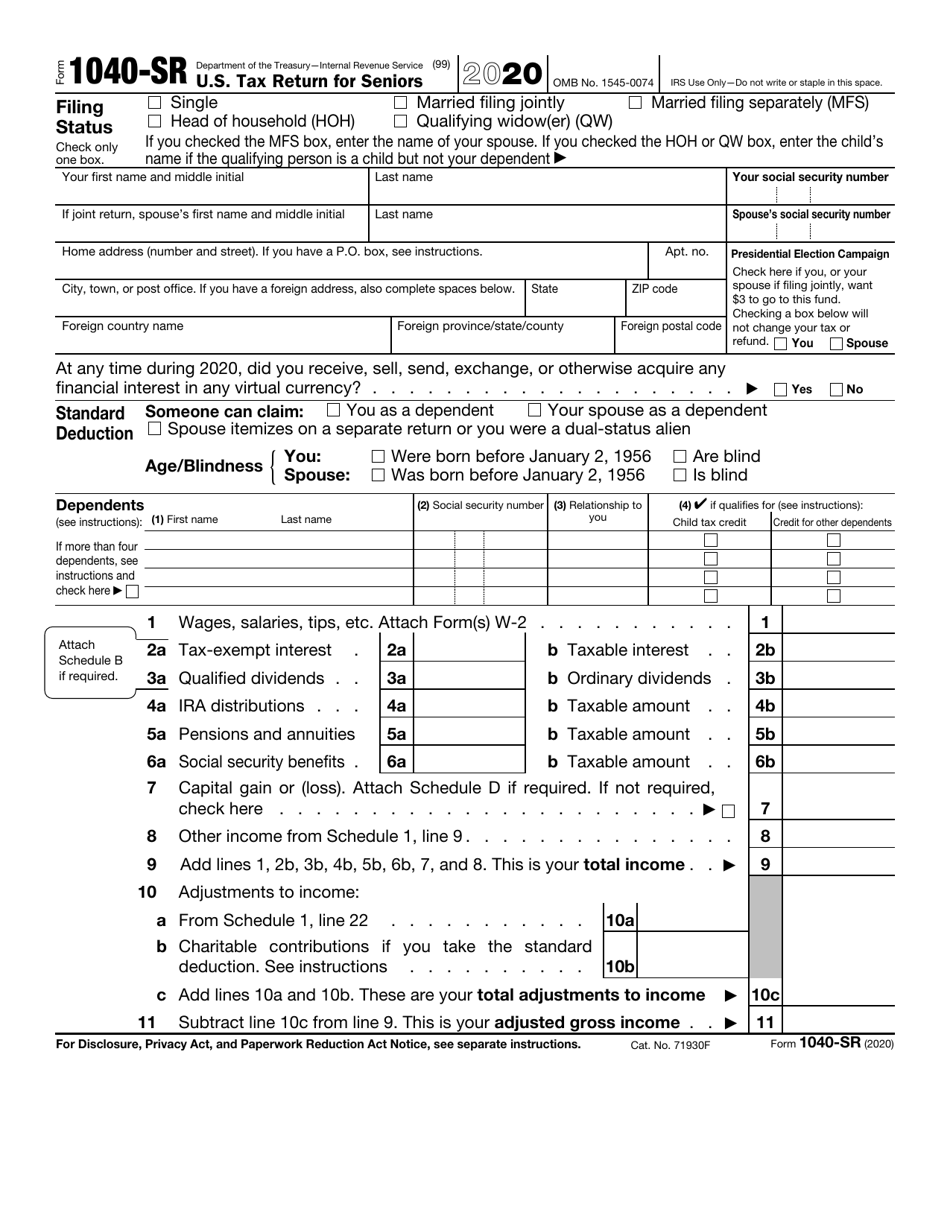

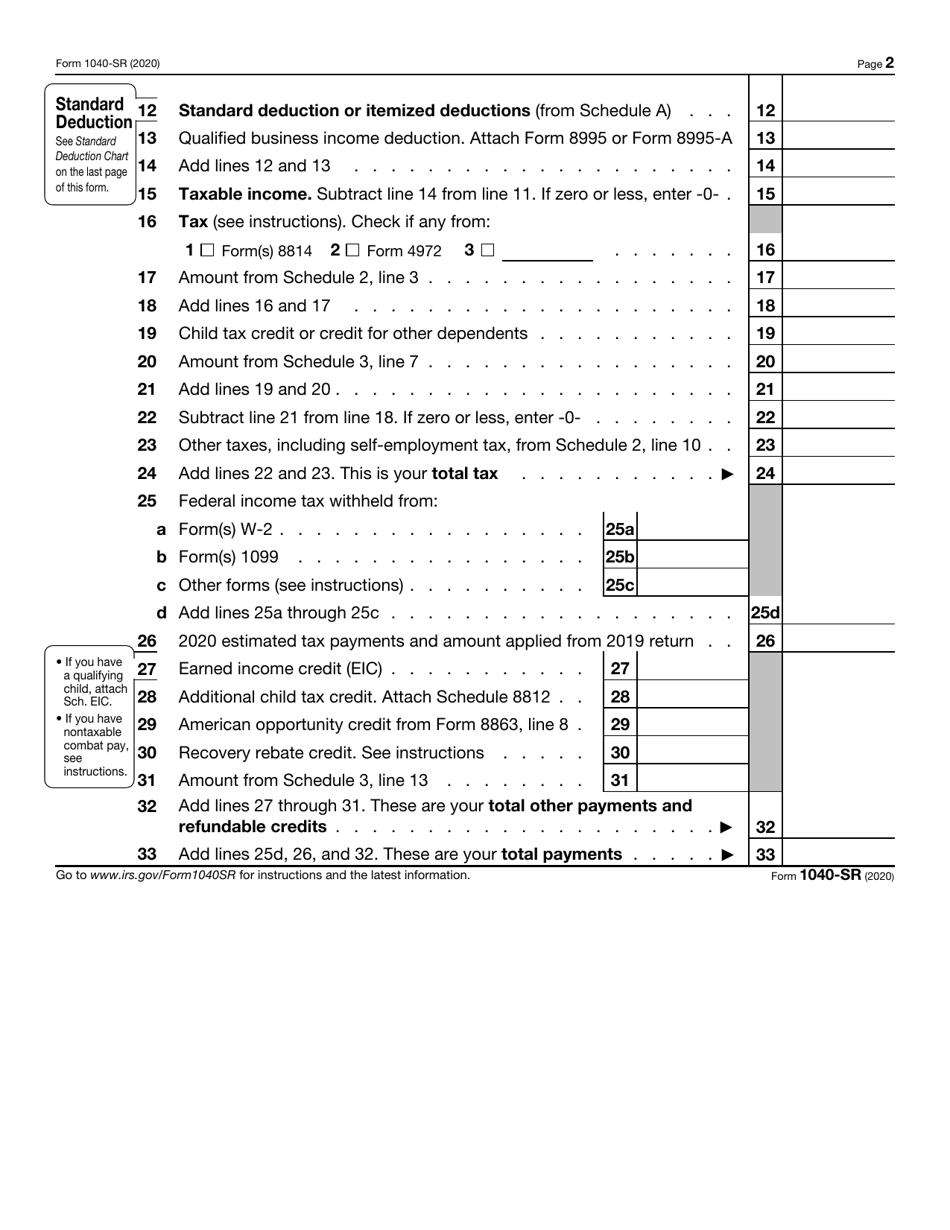

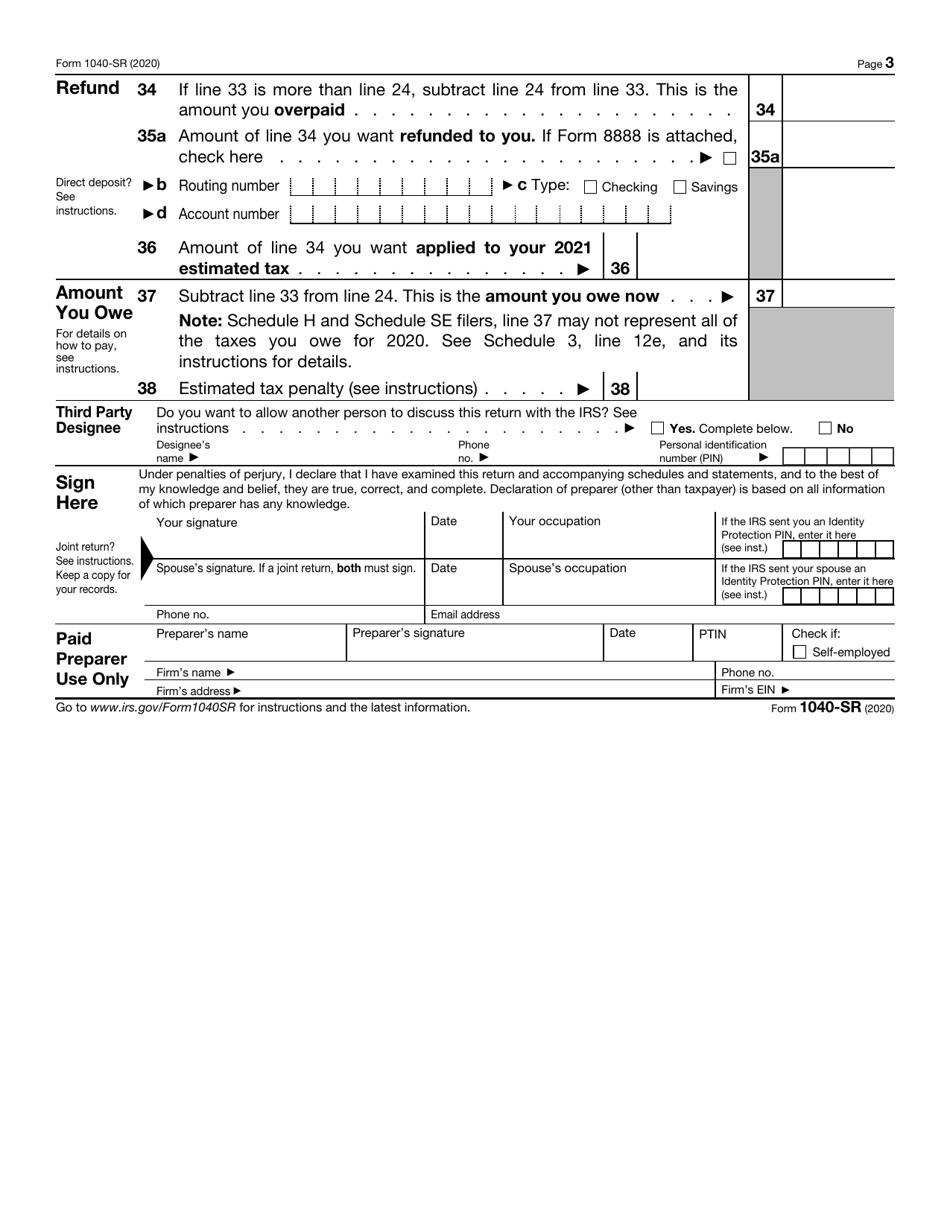

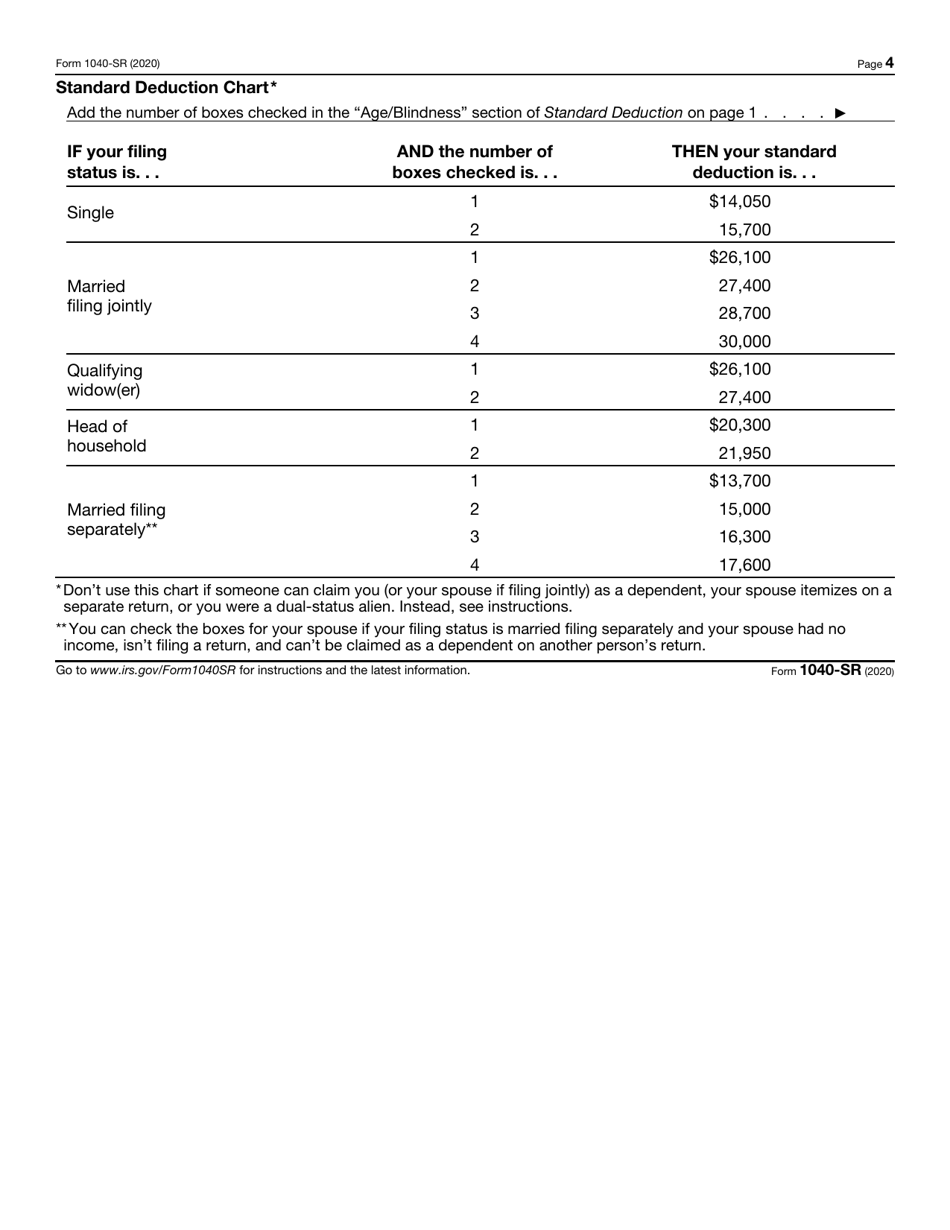

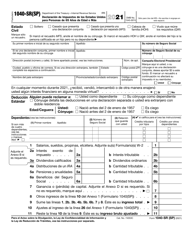

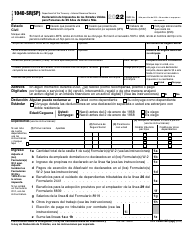

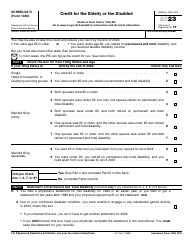

IRS Form 1040-SR U.S. Tax Return for Seniors

What Is IRS Form 1040-SR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-SR?

A: IRS Form 1040-SR is a U.S. tax return specifically designed for seniors.

Q: Who is eligible to use Form 1040-SR?

A: Form 1040-SR is exclusively for taxpayers who are at least 65 years old.

Q: What are the benefits of filing Form 1040-SR?

A: Form 1040-SR allows taxpayers to report their retirement income and offers larger text and a more simplified format.

Q: Can I use Form 1040-SR if I am under 65?

A: No, Form 1040-SR is only for taxpayers who are 65 or older.

Q: Is Form 1040-SR the same as Form 1040?

A: Form 1040-SR is similar to Form 1040 but specifically tailored for seniors.

Q: Do I need to include all sources of income on Form 1040-SR?

A: Yes, you must include all sources of income, including retirement income, on Form 1040-SR.

Q: Can I e-file Form 1040-SR?

A: Yes, you can e-file Form 1040-SR if you prefer to file your taxes electronically.

Q: When is the deadline for filing Form 1040-SR?

A: The deadline for filing Form 1040-SR is typically April 15th, but it can vary depending on the tax year.

Q: Can I use tax software to complete Form 1040-SR?

A: Yes, you can use tax software to help you complete Form 1040-SR and file your taxes.

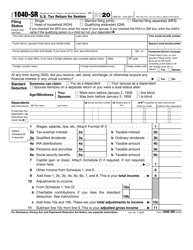

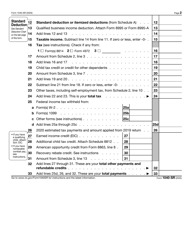

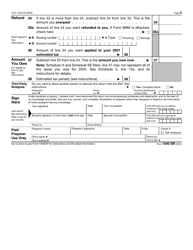

Form Details:

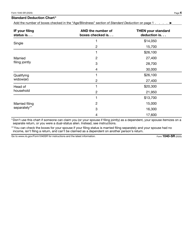

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-SR through the link below or browse more documents in our library of IRS Forms.