This version of the form is not currently in use and is provided for reference only. Download this version of

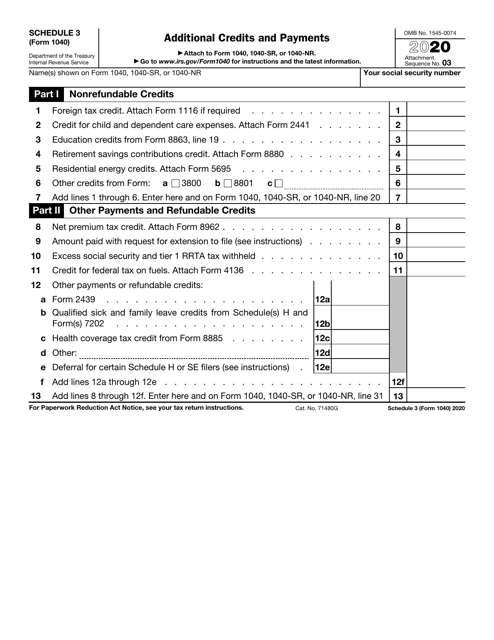

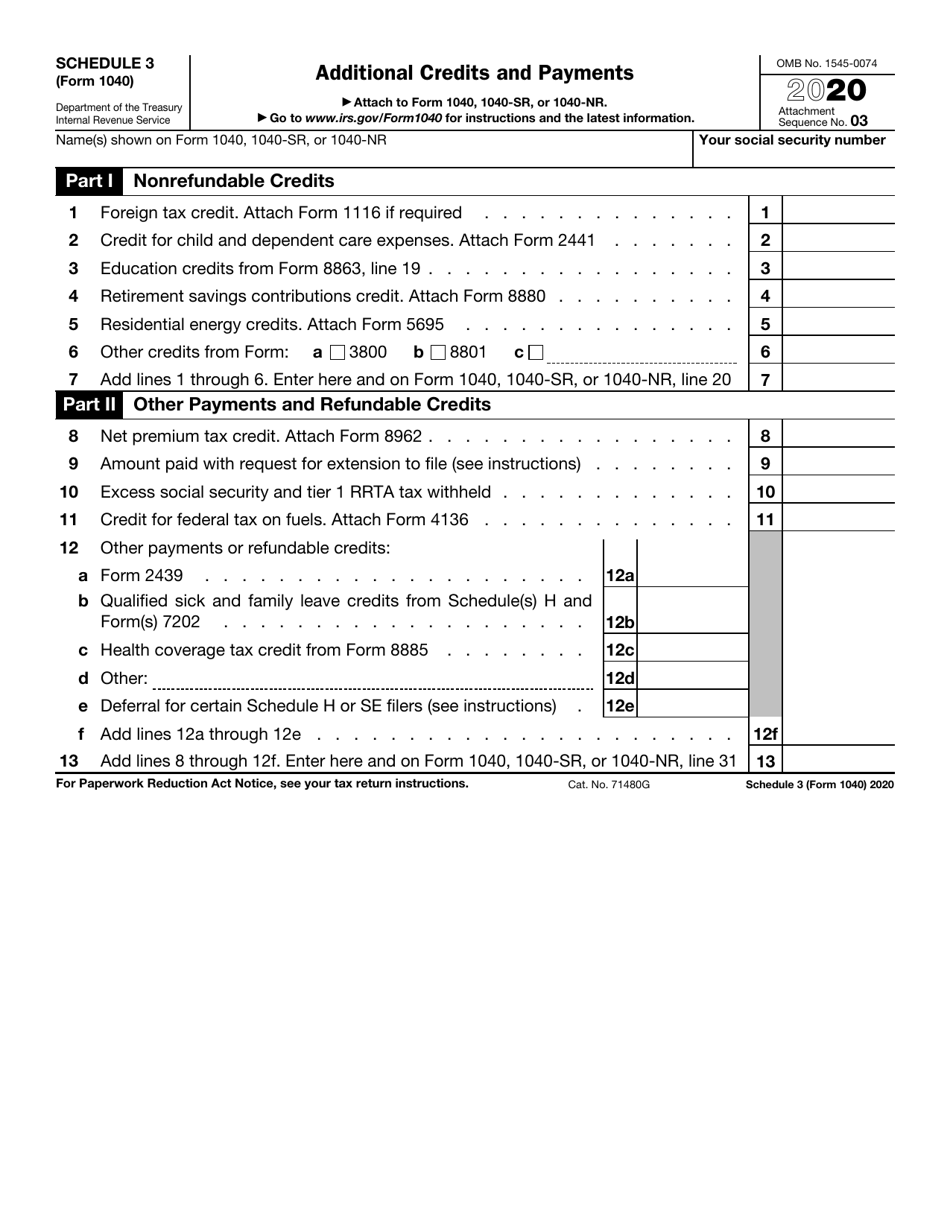

IRS Form 1040 Schedule 3

for the current year.

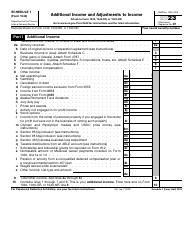

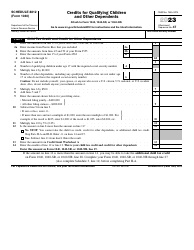

IRS Form 1040 Schedule 3 Additional Credits and Payments

What Is IRS Form 1040 Schedule 3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule 3?

A: IRS Form 1040 Schedule 3 is a form used to report additional credits and payments that can be applied to your tax liability.

Q: What is the purpose of IRS Form 1040 Schedule 3?

A: The purpose of IRS Form 1040 Schedule 3 is to provide a means for taxpayers to claim certain tax credits and report other payments that can affect their overall tax liability.

Q: What types of credits and payments are reported on IRS Form 1040 Schedule 3?

A: IRS Form 1040 Schedule 3 includes reporting of credits such as the foreign tax credit, the credit for child and dependent care expenses, and the residential energy efficient property credit. It also includes reporting of certain payments such as estimated tax payments, excess social security tax withheld, and the net premium tax credit.

Q: Who needs to file IRS Form 1040 Schedule 3?

A: Taxpayers who have eligible credits or payments to report that are not already included on their main Form 1040 need to file IRS Form 1040 Schedule 3.

Q: Is there a deadline for filing IRS Form 1040 Schedule 3?

A: The deadline for filing IRS Form 1040 Schedule 3 is the same as the deadline for filing your main Form 1040. Typically, this is April 15th of the following year, unless that date falls on a weekend or holiday, in which case the deadline is extended.

Q: Do I need to attach any documents to IRS Form 1040 Schedule 3?

A: In general, you don't need to attach any supporting documents to IRS Form 1040 Schedule 3. However, you should keep any necessary documents, such as receipts or proof of payments, in case the IRS requests them later.

Q: Can I amend IRS Form 1040 Schedule 3 if I made a mistake?

A: Yes, you can amend IRS Form 1040 Schedule 3 if you made a mistake or need to make changes. You can do this by filing an amended tax return using IRS Form 1040X.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 3 through the link below or browse more documents in our library of IRS Forms.