This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990 Schedule K

for the current year.

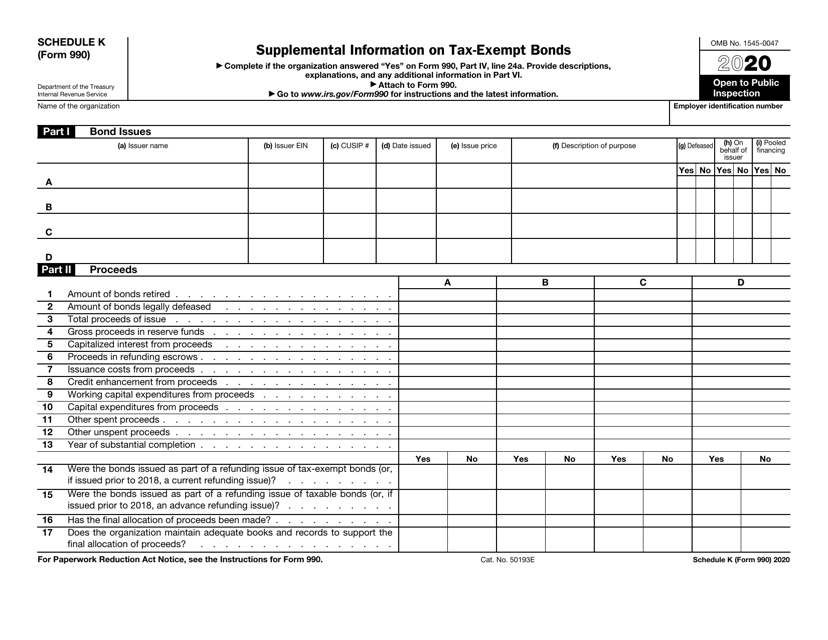

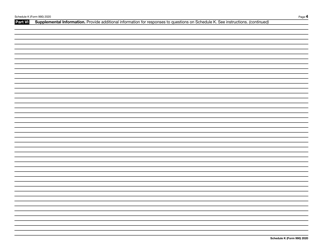

IRS Form 990 Schedule K Supplemental Information on Tax-Exempt Bonds

What Is IRS Form 990 Schedule K?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K is a form that provides supplemental information on tax-exempt bonds for tax-exempt organizations.

Q: Who needs to file IRS Form 990 Schedule K?

A: Tax-exempt organizations that have issued tax-exempt bonds or have outstanding tax-exempt bond liabilities must file IRS Form 990 Schedule K.

Q: What information does IRS Form 990 Schedule K require?

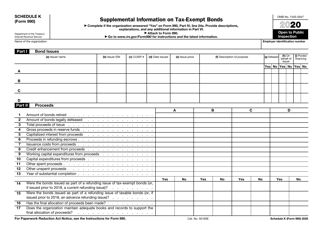

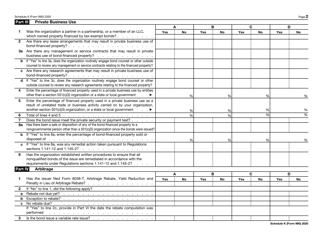

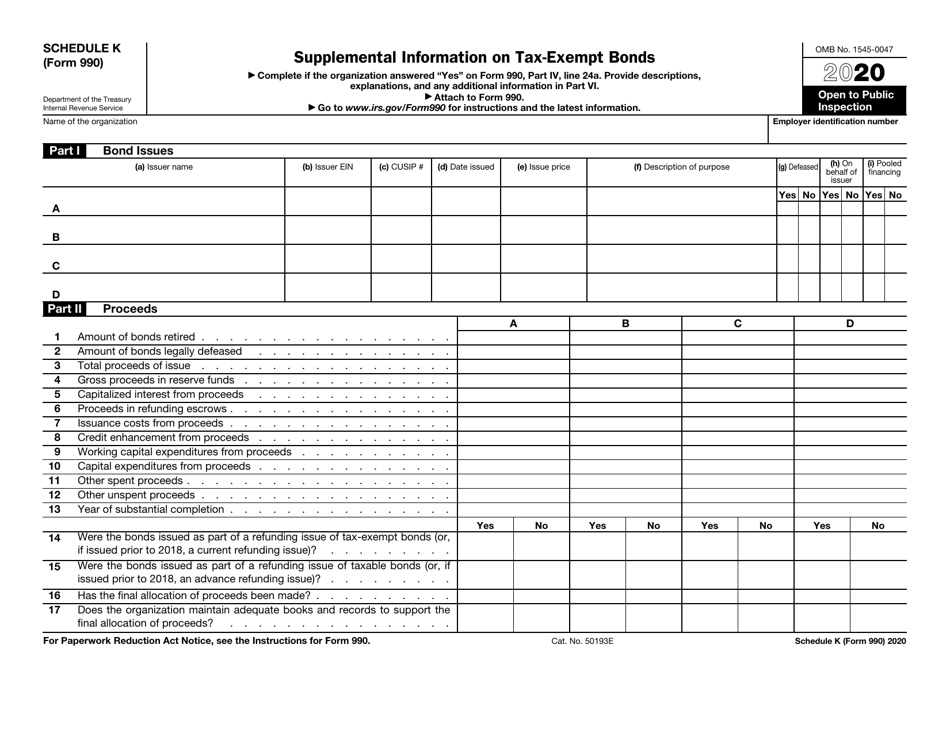

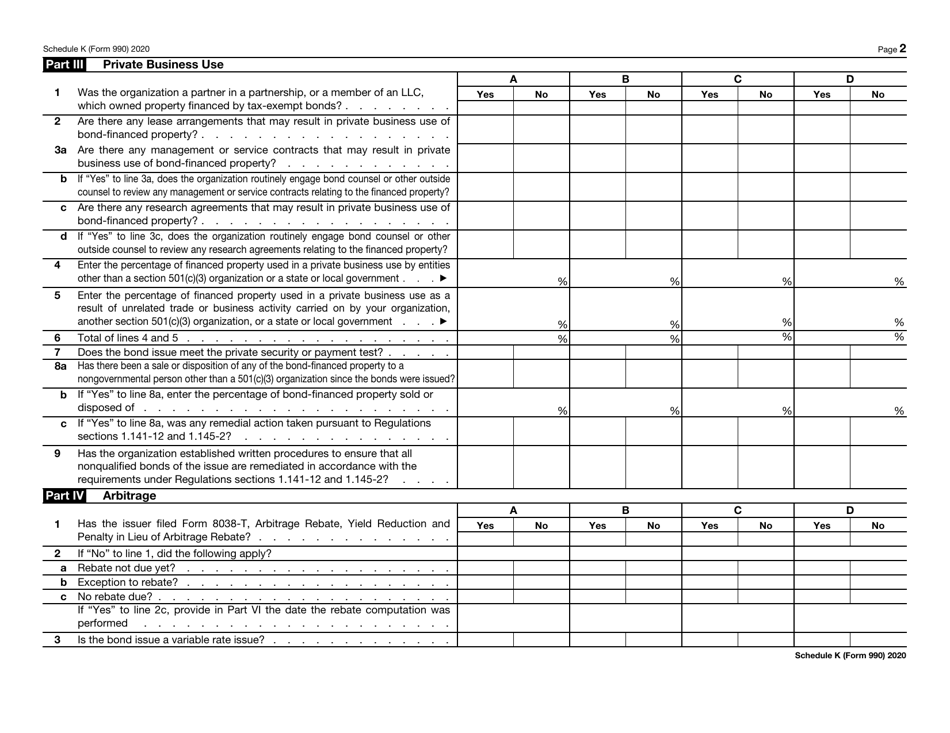

A: IRS Form 990 Schedule K requires information on the tax-exempt bonds issued by the organization, including bond proceeds, bond expenditures, and other relevant financial information.

Q: Why is IRS Form 990 Schedule K important?

A: IRS Form 990 Schedule K is important as it helps the IRS track and monitor the use of tax-exempt bonds by tax-exempt organizations to ensure compliance with tax laws.

Q: When is IRS Form 990 Schedule K due?

A: IRS Form 990 Schedule K is generally due with the filing of Form 990, 990-EZ, or 990-PF, which are the annual informational returns for tax-exempt organizations. The specific due date may vary depending on the organization's fiscal year-end.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule K through the link below or browse more documents in our library of IRS Forms.