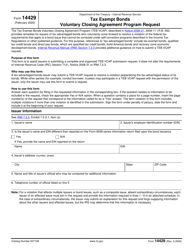

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule K

for the current year.

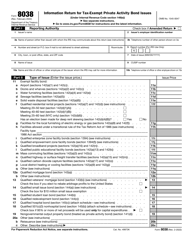

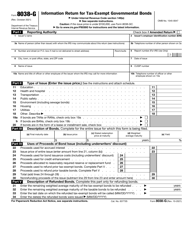

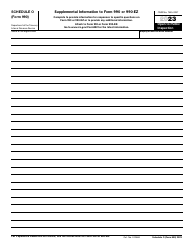

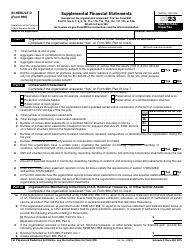

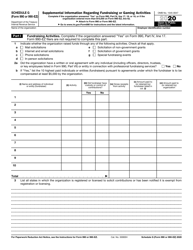

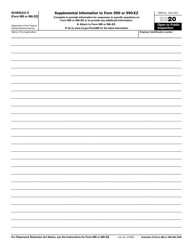

Instructions for IRS Form 990 Schedule K Supplemental Information on Tax-Exempt Bonds

This document contains official instructions for IRS Form 990 Schedule K, Supplemental Information on Tax-Exempt Bonds - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule K is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule K?

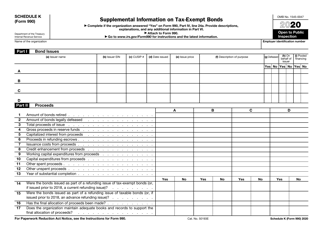

A: IRS Form 990 Schedule K is a form that tax-exempt organizations must file with their annual return to provide supplemental information on tax-exempt bonds.

Q: Who needs to file IRS Form 990 Schedule K?

A: Tax-exempt organizations that have issued tax-exempt bonds or received proceeds from tax-exempt bonds need to file IRS Form 990 Schedule K.

Q: What information is required on IRS Form 990 Schedule K?

A: IRS Form 990 Schedule K requires tax-exempt organizations to provide detailed information about their tax-exempt bond activities, including bond issues, bond proceeds, and bond refinancing.

Q: When is IRS Form 990 Schedule K due?

A: IRS Form 990 Schedule K is due at the same time as the organization's annual return, which is typically due on the 15th day of the 5th month after the end of the organization's tax year.

Q: Are there any penalties for not filing IRS Form 990 Schedule K?

A: Yes, failing to file IRS Form 990 Schedule K or providing incomplete or inaccurate information may result in penalties imposed by the IRS.

Q: Can I e-file IRS Form 990 Schedule K?

A: Yes, tax-exempt organizations can e-file IRS Form 990 Schedule K using IRS-approved software, or they can file a paper copy by mail.

Q: Do I need to attach any supporting documents to IRS Form 990 Schedule K?

A: It is generally not required to attach supporting documents to IRS Form 990 Schedule K. However, organizations should keep records and supporting documentation in case of an IRS audit.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.