Instructions for IRS Form 2553 Election by a Small Business Corporation

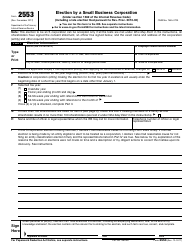

This document contains official instructions for IRS Form 2553 , Election by a Small Business Corporation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2553 is available for download through this link.

FAQ

Q: What is IRS Form 2553?

A: IRS Form 2553 is an election form used by a small business corporation to be treated as an S corporation for tax purposes.

Q: Who can file IRS Form 2553?

A: A small business corporation that wants to be treated as an S corporation can file Form 2553.

Q: What is the purpose of filing Form 2553?

A: The purpose of filing Form 2553 is to elect S corporation status for tax purposes.

Q: Are there any eligibility requirements for filing Form 2553?

A: Yes, there are certain eligibility requirements that must be met, including having no more than 100 shareholders and meeting the IRS's definition of a small business corporation.

Q: When should Form 2553 be filed?

A: Form 2553 must be filed by the 15th day of the 3rd month of the corporation's tax year for the election to be effective for that tax year.

Q: Can Form 2553 be filed electronically?

A: Yes, Form 2553 can be filed electronically or by mail.

Q: What is the penalty for late filing of Form 2553?

A: The penalty for late filing of Form 2553 is generally $195 for each month or part of a month the election is late.

Q: Is there a fee for filing Form 2553?

A: No, there is no fee for filing Form 2553.

Q: Can an LLC file Form 2553?

A: No, an LLC cannot file Form 2553. Only a small business corporation can file this form.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.