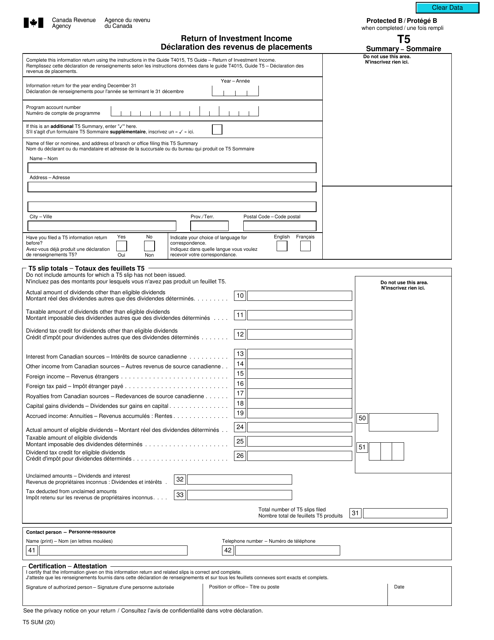

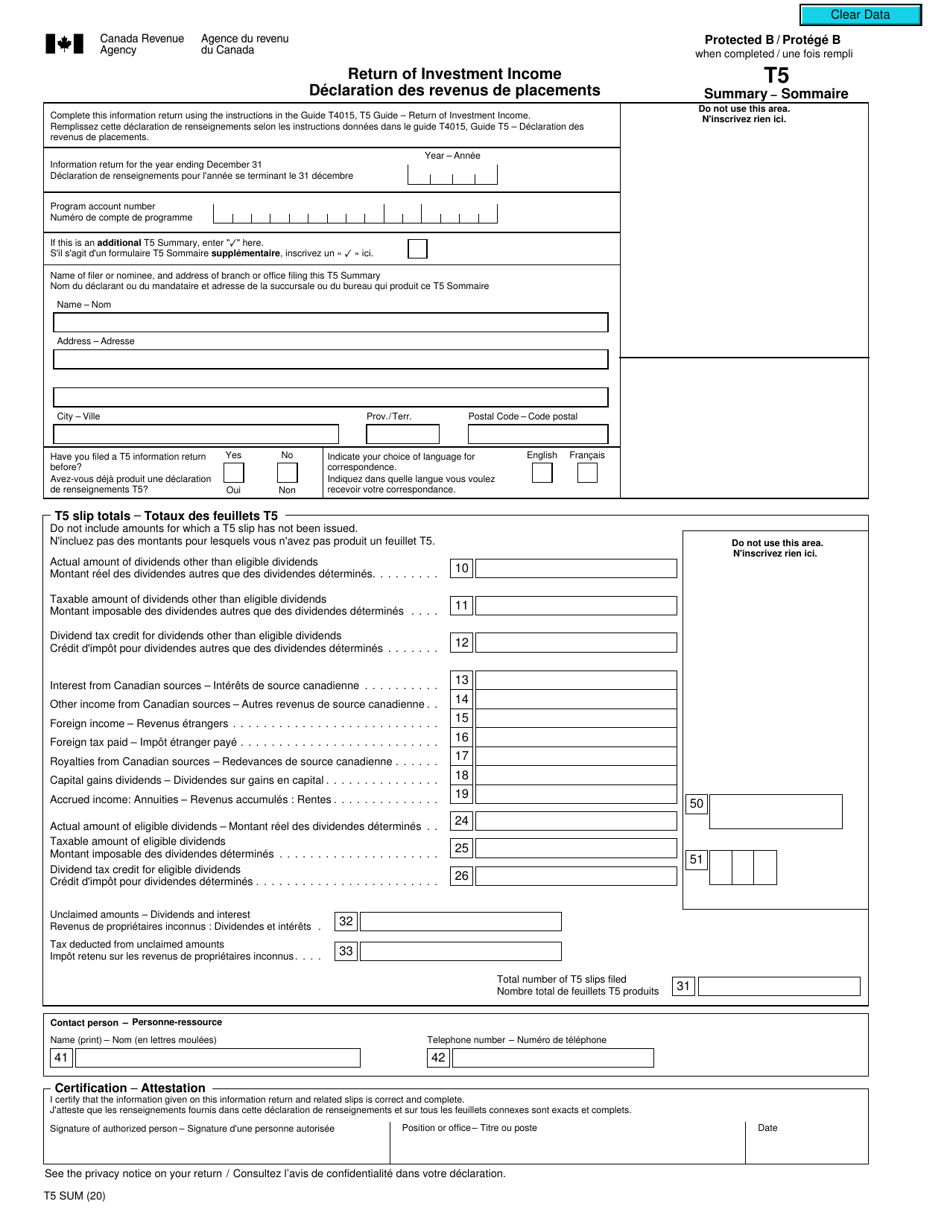

This version of the form is not currently in use and is provided for reference only. Download this version of

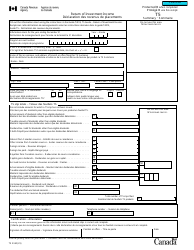

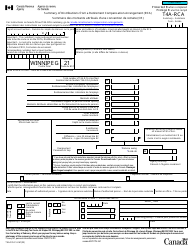

Form T5 SUM

for the current year.

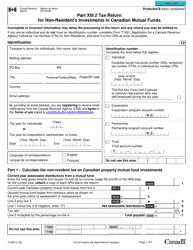

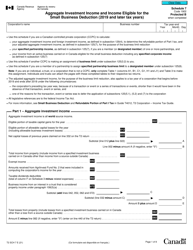

Form T5 SUM Return of Investment Income - Canada (English / French)

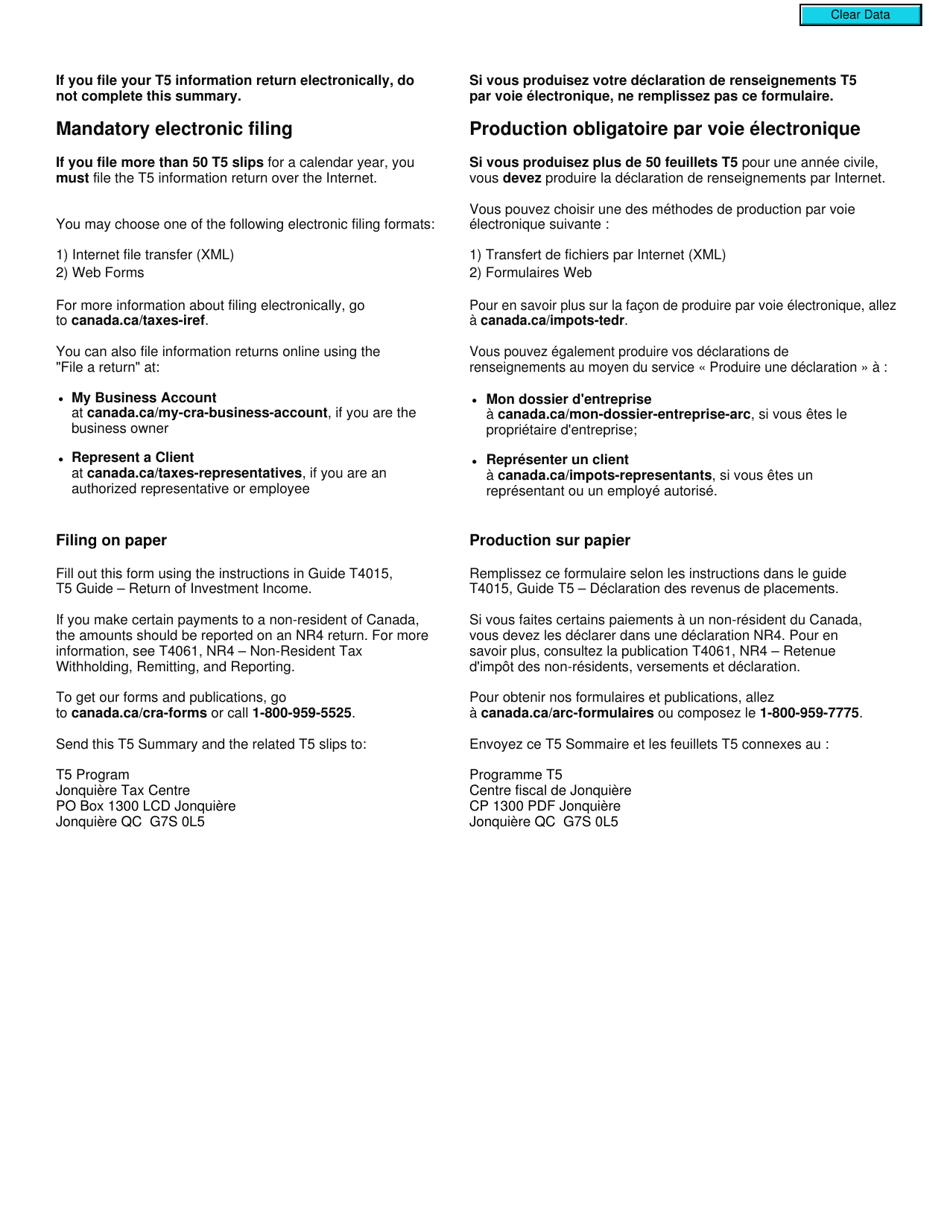

Form T5 is a tax document used in Canada to report income from investments, such as interest, dividends, and trust distributions. It is used to calculate and report the amount of investment income earned during the tax year. The form is available in both English and French.

The Form T5 is filed by the payer of investment income, such as a financial institution or a corporation, in Canada.

FAQ

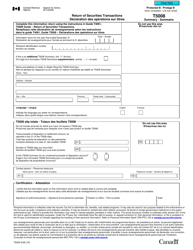

Q: What is Form T5 SUM?

A: Form T5 SUM is a return of investment income form in Canada.

Q: Who needs to file Form T5 SUM?

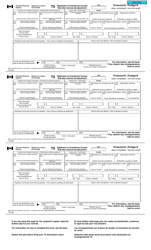

A: Individuals and corporations who have paid dividends or other investment income to Canadian residents need to file Form T5 SUM.

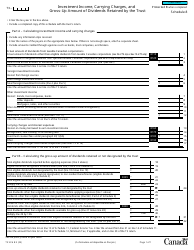

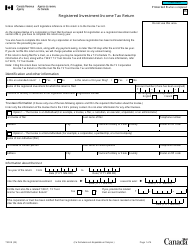

Q: What information is required on Form T5 SUM?

A: Form T5 SUM requires information about the recipient of the investment income, the type of income, and the amount paid.

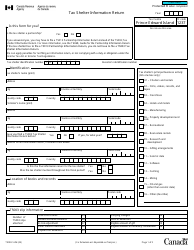

Q: Is Form T5 SUM available in both English and French?

A: Yes, Form T5 SUM is available in both English and French.

Q: When is the deadline to file Form T5 SUM?

A: The deadline to file Form T5 SUM is usually on or before February 28th of the year following the calendar year in which the payment was made.

Q: Do I need to include a copy of Form T5 SUM with my tax return?

A: No, you do not need to include a copy of Form T5 SUM with your tax return. However, you should keep a copy for your records.

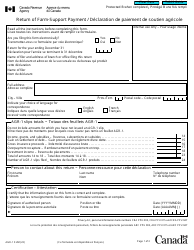

Q: What happens if I don't file Form T5 SUM?

A: Failure to file Form T5 SUM or providing incorrect information may result in penalties or fines from the CRA.

Q: What should I do if I made a mistake on Form T5 SUM?

A: If you made a mistake on Form T5 SUM, you should contact the CRA to request a correction or an amended form.