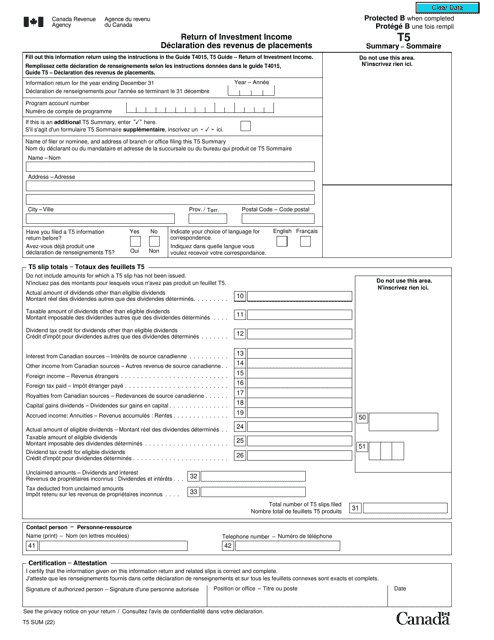

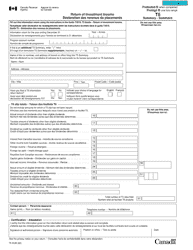

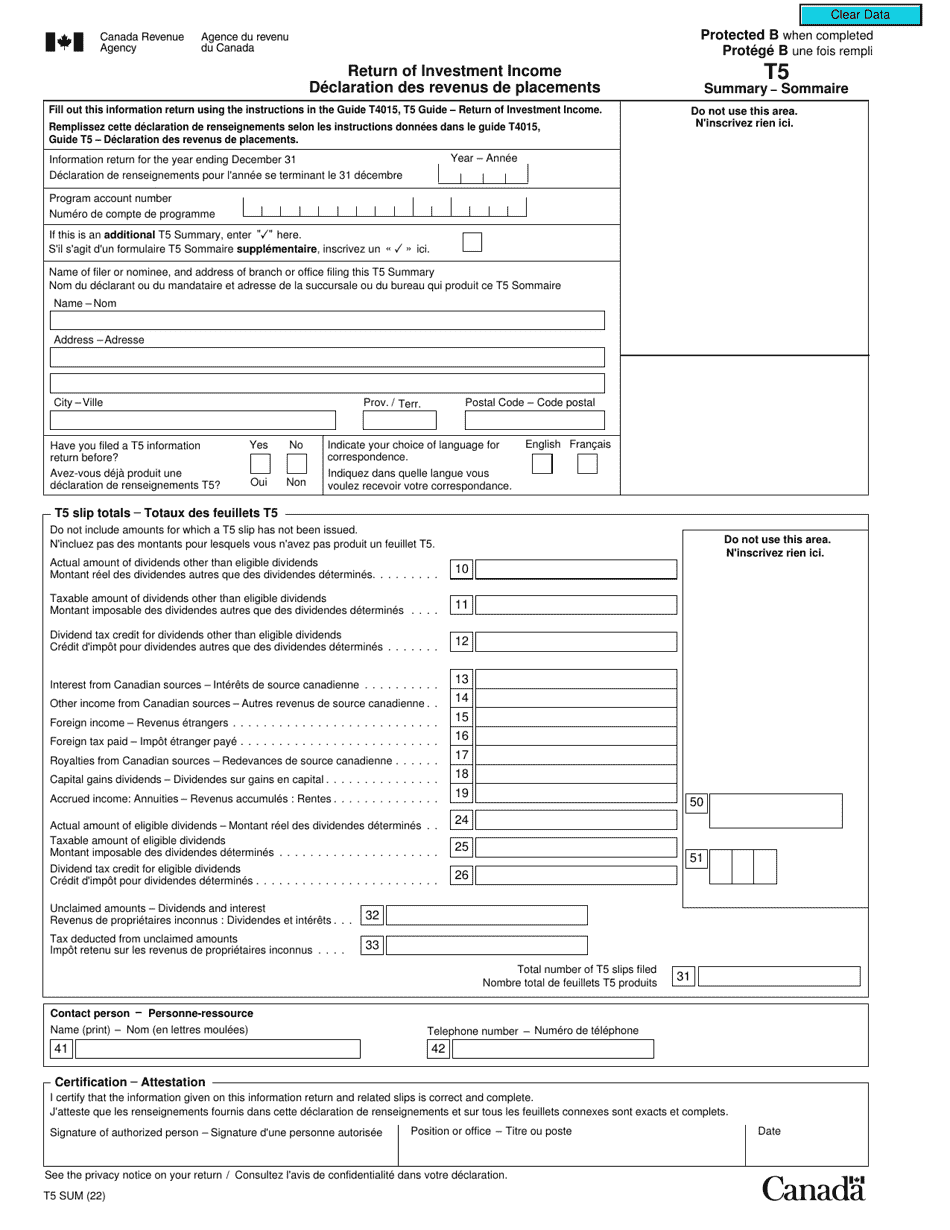

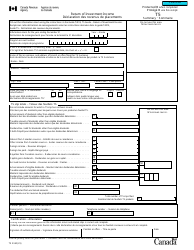

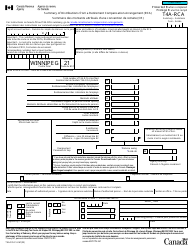

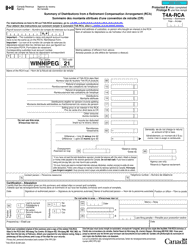

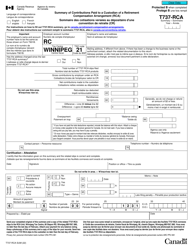

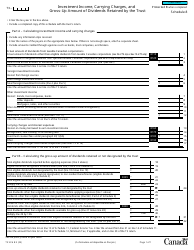

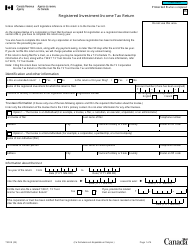

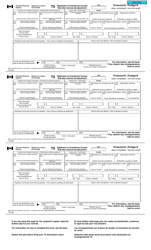

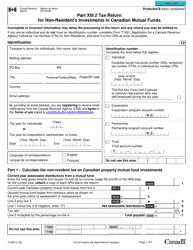

Form T5 SUM Return of Investment Income - Canada (English / French)

Form T5 SUM (Statement of Investment Income) is a tax form that is used in Canada to report investment income earned by individuals or corporations. This form is provided by banks, financial institutions, and other entities that pay out interest, dividends, or other investment income to the recipients. The purpose of Form T5 SUM is to summarize the investment income earned by an individual or corporation for a particular tax year. The form is available in both English and French.

The Form T5 SUM Return of Investment Income in Canada is typically filed by financial institutions or issuers who have paid investment income to individuals.

Form T5 SUM Return of Investment Income - Canada (English/French) - Frequently Asked Questions (FAQ)

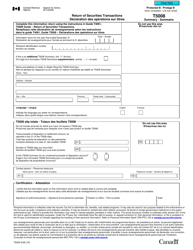

Q: What is Form T5? A: Form T5 is a tax form used in Canada for reporting investment income.

Q: What is the purpose of Form T5? A: The purpose of Form T5 is to report investment income, such as interest, dividends, and royalties, to the Canada Revenue Agency (CRA).

Q: Who needs to file Form T5? A: Individuals and businesses who have paid or credited investment income to a resident of Canada need to file Form T5.

Q: What information is required on Form T5? A: Form T5 requires information on the payer, recipient, and details of the investment income.

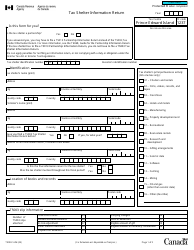

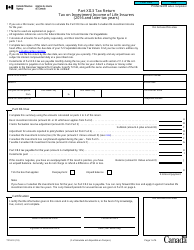

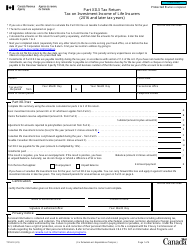

Q: When is the deadline for filing Form T5? A: The deadline for filing Form T5 is the last day of February following the calendar year in which the investment income was paid or credited.

Q: Are there any penalties for late filing of Form T5? A: Yes, there are penalties for late filing of Form T5. It is important to file the form on time to avoid penalties.

Q: Do I need to include supporting documents with Form T5? A: No, you generally do not need to include supporting documents with Form T5. However, you should keep them for your records in case the Canada Revenue Agency (CRA) requests them.

Q: Do I need to file Form T5 if I have not paid any investment income? A: No, you do not need to file Form T5 if you have not paid or credited any investment income to a resident of Canada.