This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 3

for the current year.

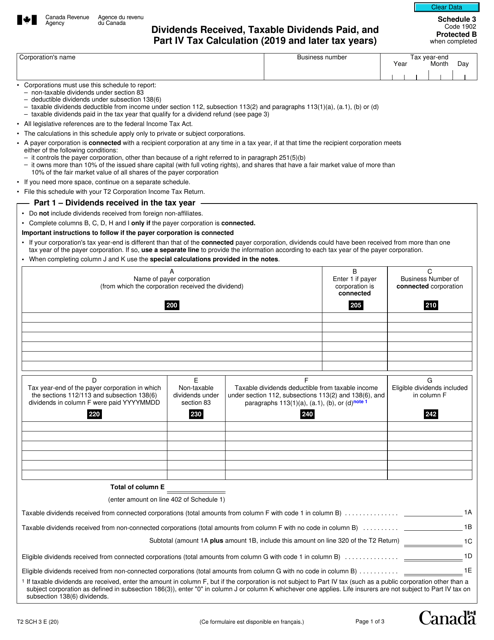

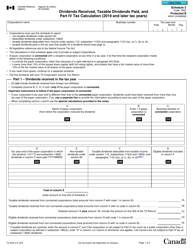

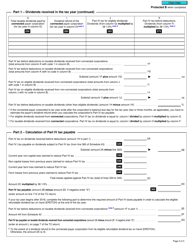

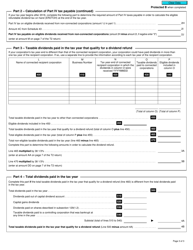

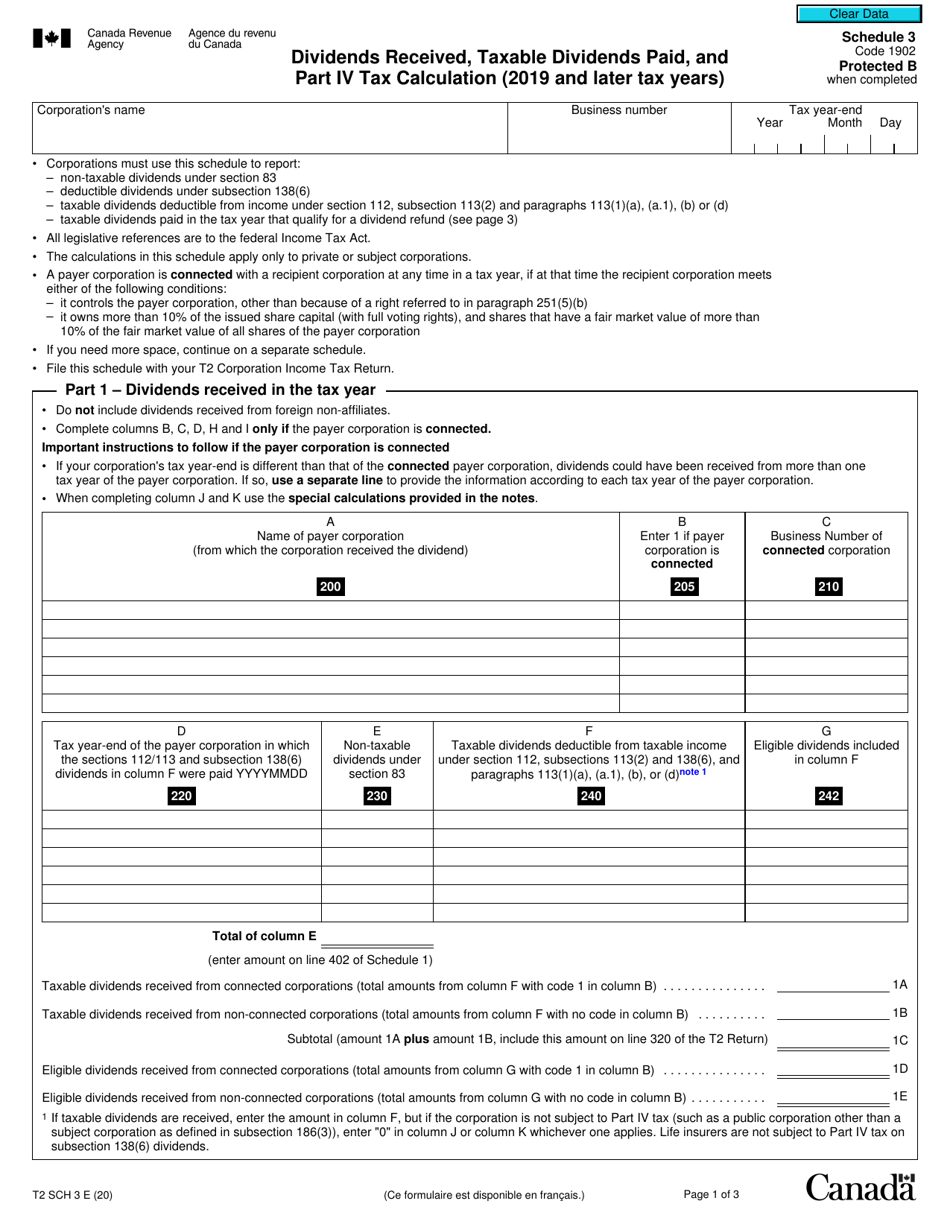

Form T2 Schedule 3 Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation (2019 and Later Tax Years) - Canada

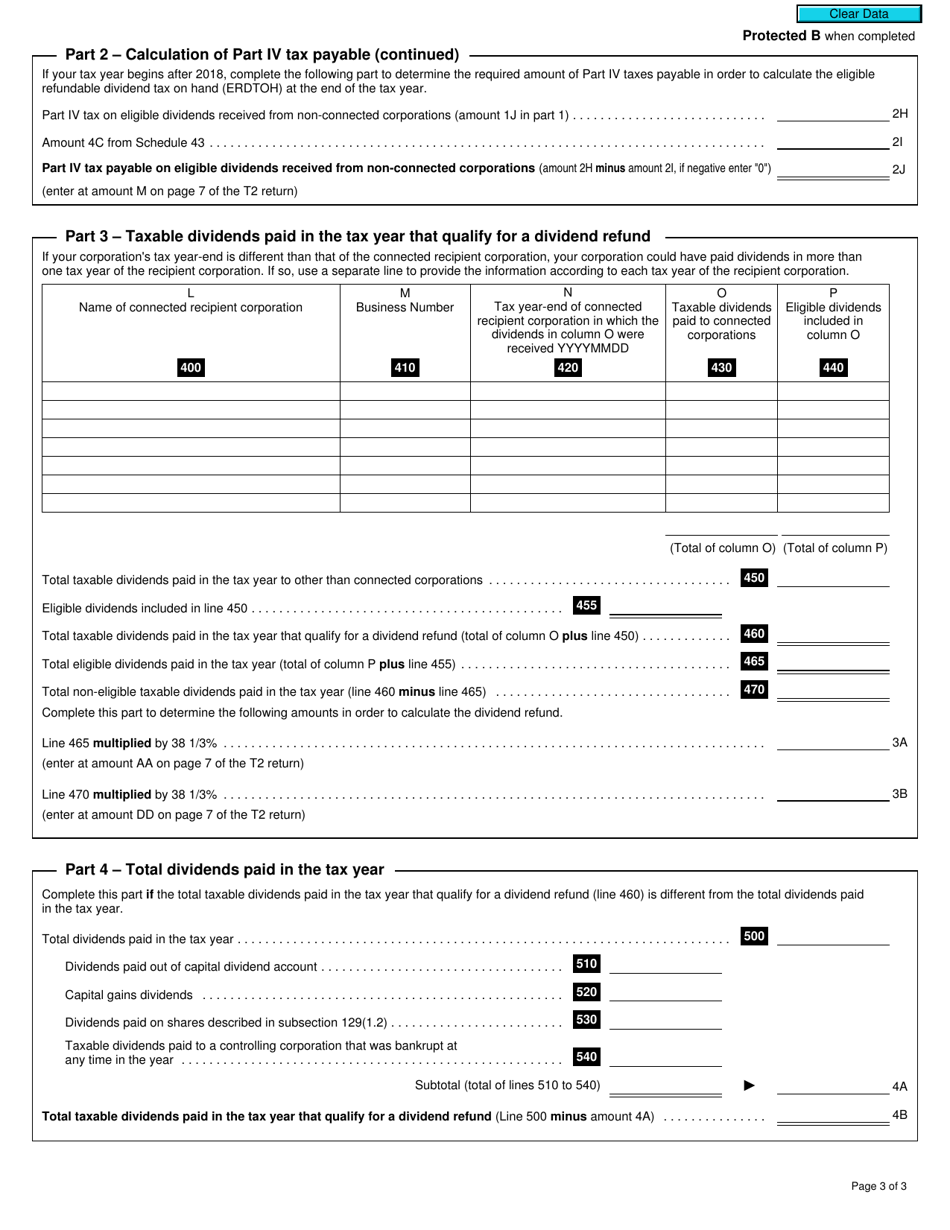

Form T2 Schedule 3, Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation, is used by Canadian corporations to report dividends received, taxable dividends paid, and calculate Part IV tax for the tax year 2019 and later. This form is filed along with the corporation's T2 corporate income tax return.

The Form T2 Schedule 3, Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation (2019 and later tax years), in Canada is typically filed by corporations.

FAQ

Q: What is Form T2 Schedule 3?

A: Form T2 Schedule 3 is a tax form used by corporations in Canada to report dividends received, taxable dividends paid, and calculate Part IV tax.

Q: Who needs to complete Form T2 Schedule 3?

A: Form T2 Schedule 3 needs to be completed by corporations in Canada.

Q: What information is reported on Form T2 Schedule 3?

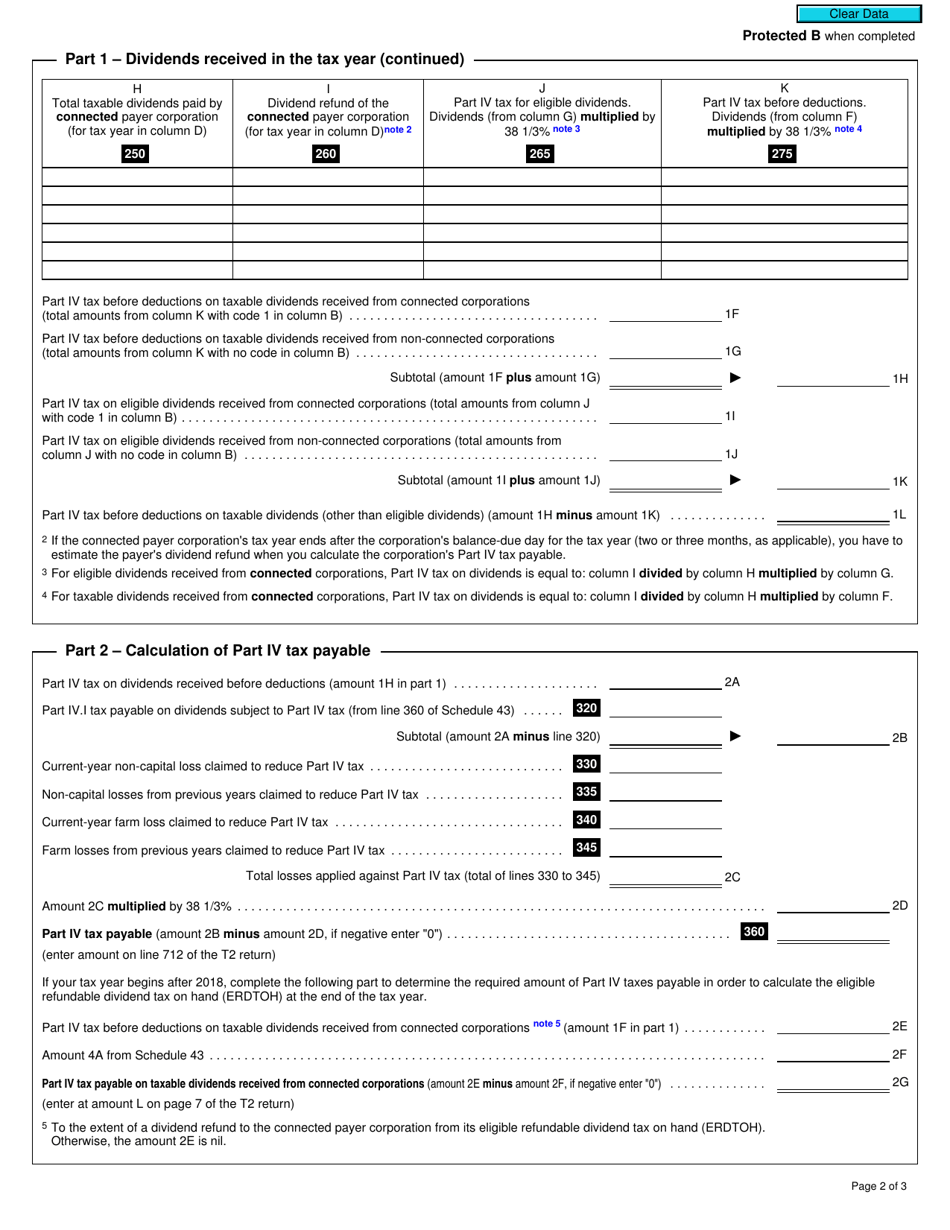

A: Form T2 Schedule 3 reports dividends received, taxable dividends paid, and calculates Part IV tax.

Q: What are dividends?

A: Dividends are payments made by a corporation to its shareholders, usually representing a share of the company's profits.

Q: What are taxable dividends?

A: Taxable dividends are dividends that are subject to income tax in Canada.

Q: What is Part IV tax?

A: Part IV tax is a tax imposed on Canadian corporations to prevent the income tax advantage of receiving dividends from certain corporations.

Q: Is Form T2 Schedule 3 applicable for all tax years?

A: Yes, Form T2 Schedule 3 is applicable for the 2019 and later tax years in Canada.