This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST66

for the current year.

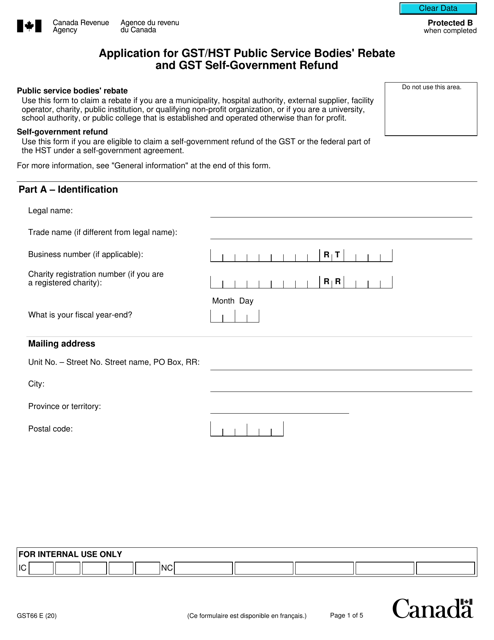

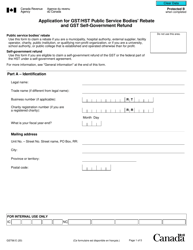

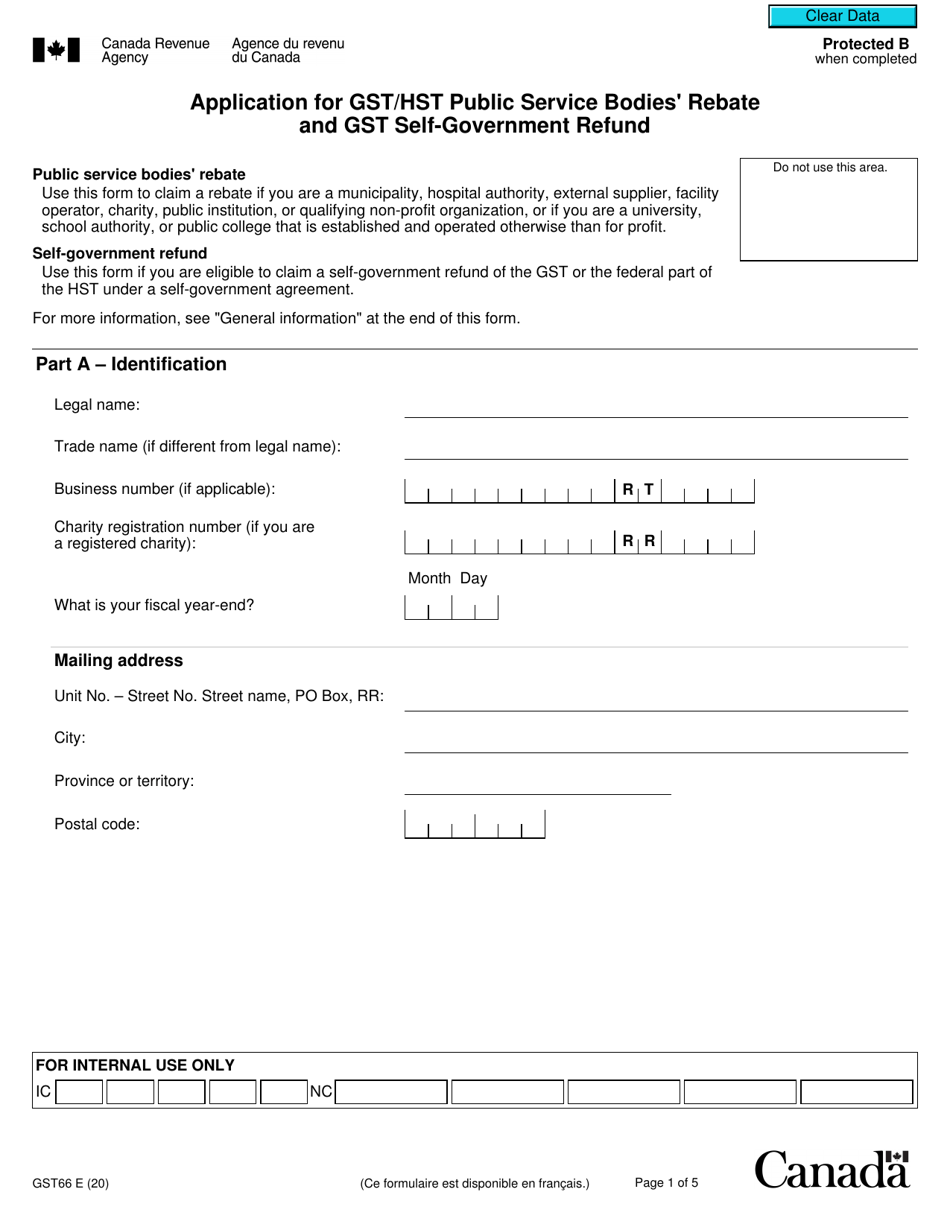

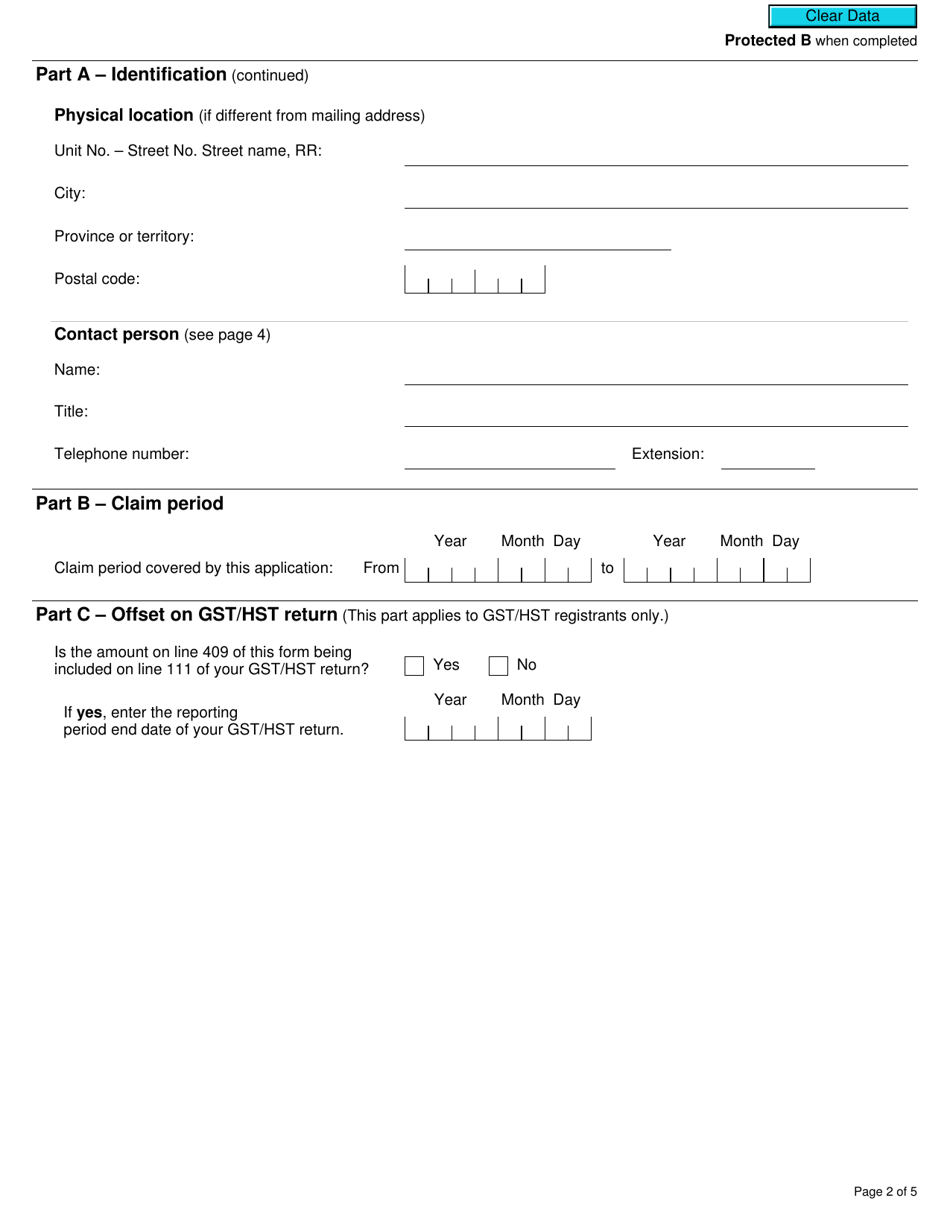

Form GST66 Application for Gst / Hst Public Service Bodies' Rebate and Gst Self-government Refund - Canada

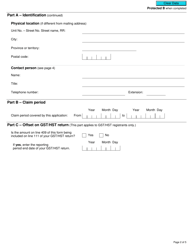

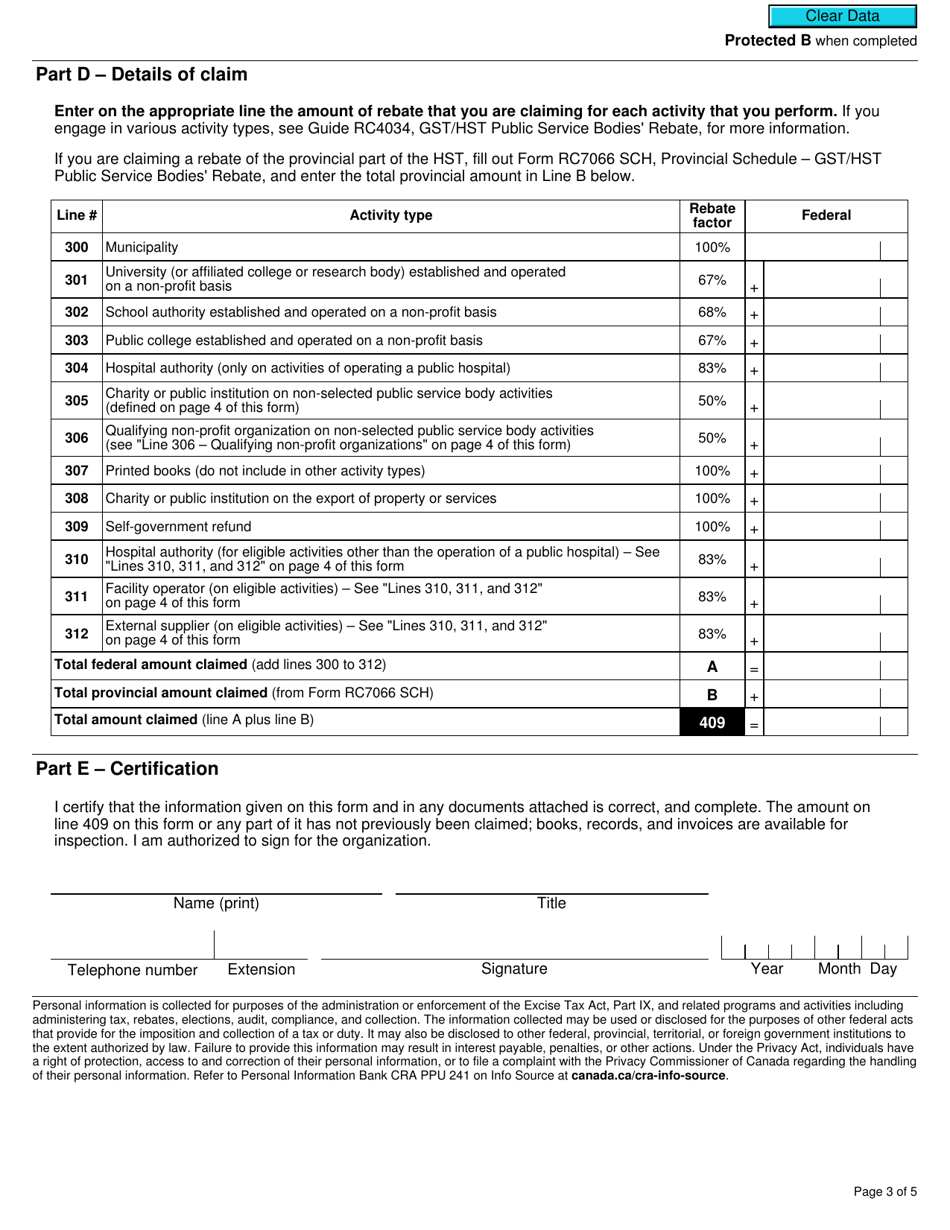

Form GST66 is used in Canada to make an application for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) public service bodies' rebate and GST self-government refund. It is used by eligible organizations to claim a rebate or refund of the GST/HST paid on eligible goods and services.

The Form GST66 Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund in Canada is typically filed by eligible public service bodies and self-governing Indigenous authorities.

FAQ

Q: What is GST66 form?

A: GST66 form is an application form for GST/HST Public Service Bodies' Rebate and GST self-government refund in Canada.

Q: Who can use the GST66 form?

A: Public service bodies and self-governing First Nations in Canada can use the GST66 form.

Q: What is the purpose of the GST/HST Public Service Bodies' Rebate?

A: The GST/HST Public Service Bodies' Rebate is a rebate for public service bodies to recover some of the GST/HST paid on their operating expenses.

Q: What is the GST Self-government Refund?

A: The GST Self-government Refund is a refund for self-governing First Nations to recover the GST paid on their purchases and expenses.

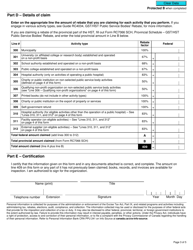

Q: What supporting documents are required with the GST66 form?

A: The required supporting documents include invoices, receipts, leases, contracts, and other relevant records that verify your eligibility for the rebate or refund.

Q: Is there a deadline for submitting the GST66 form?

A: Yes, the deadline for submitting the GST66 form is within four years from the end of the year to which the claim relates.

Q: How long does it take to process the GST66 form?

A: The processing time can vary, but it typically takes several weeks to months for the CRA to review and process the form.

Q: Can I file the GST66 form electronically?

A: Yes, you can submit the GST66 form electronically through the CRA's My Business Account or by using commercial software.

Q: Are there any fees associated with submitting the GST66 form?

A: No, there are no fees for submitting the GST66 form.