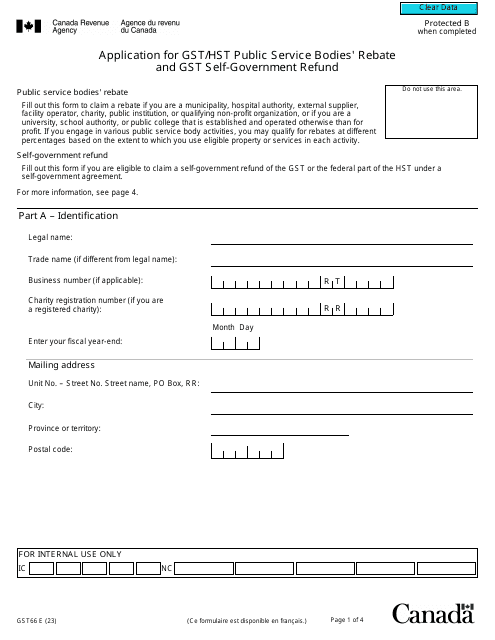

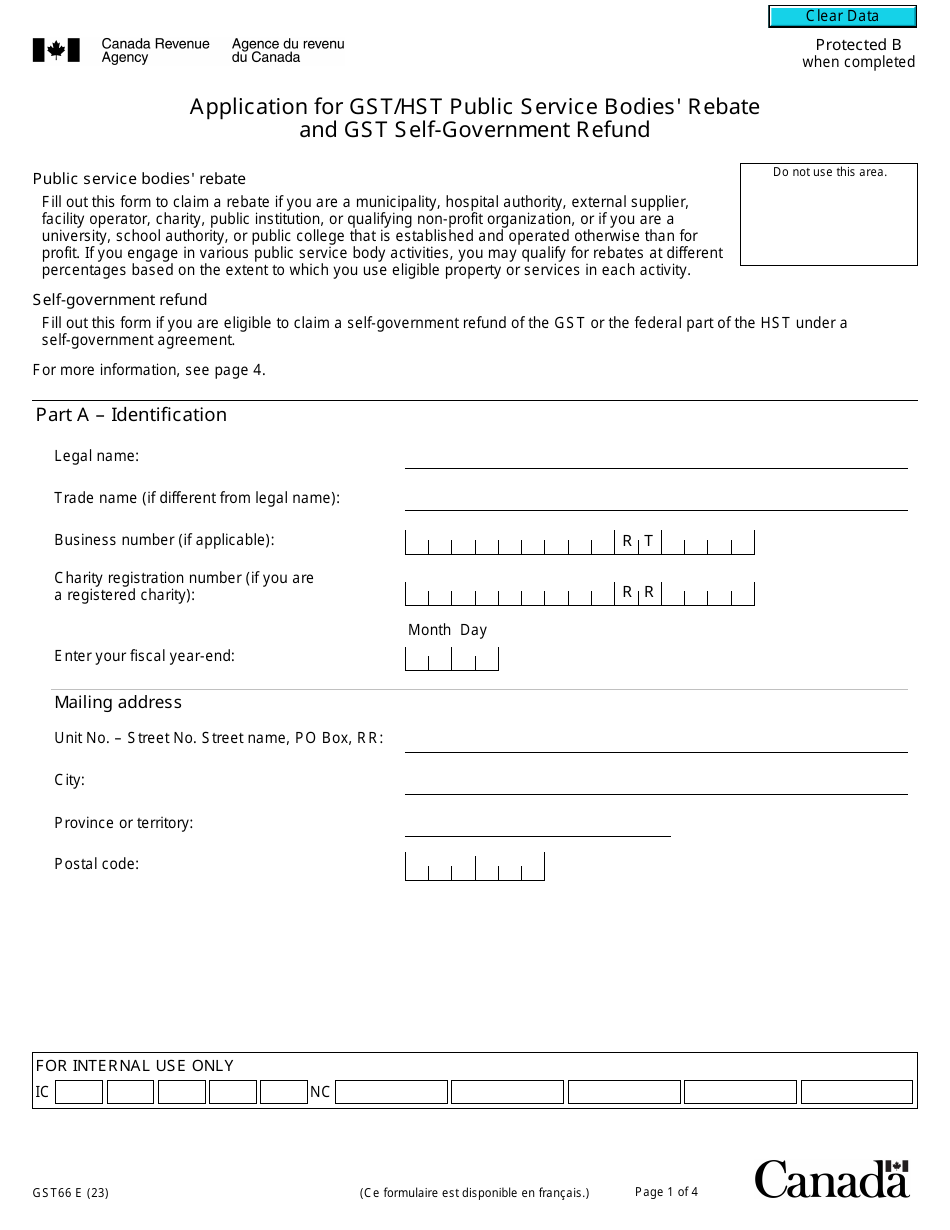

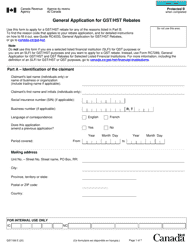

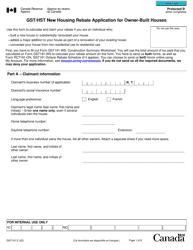

Form GST66 Application for Gst / Hst Public Service Bodies' Rebate and Gst Self-government Refund - Canada

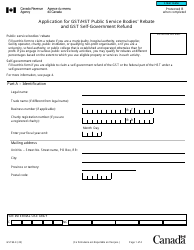

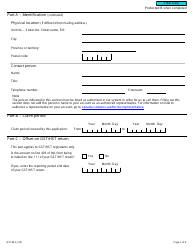

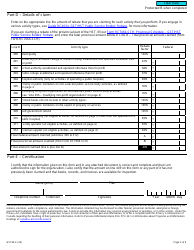

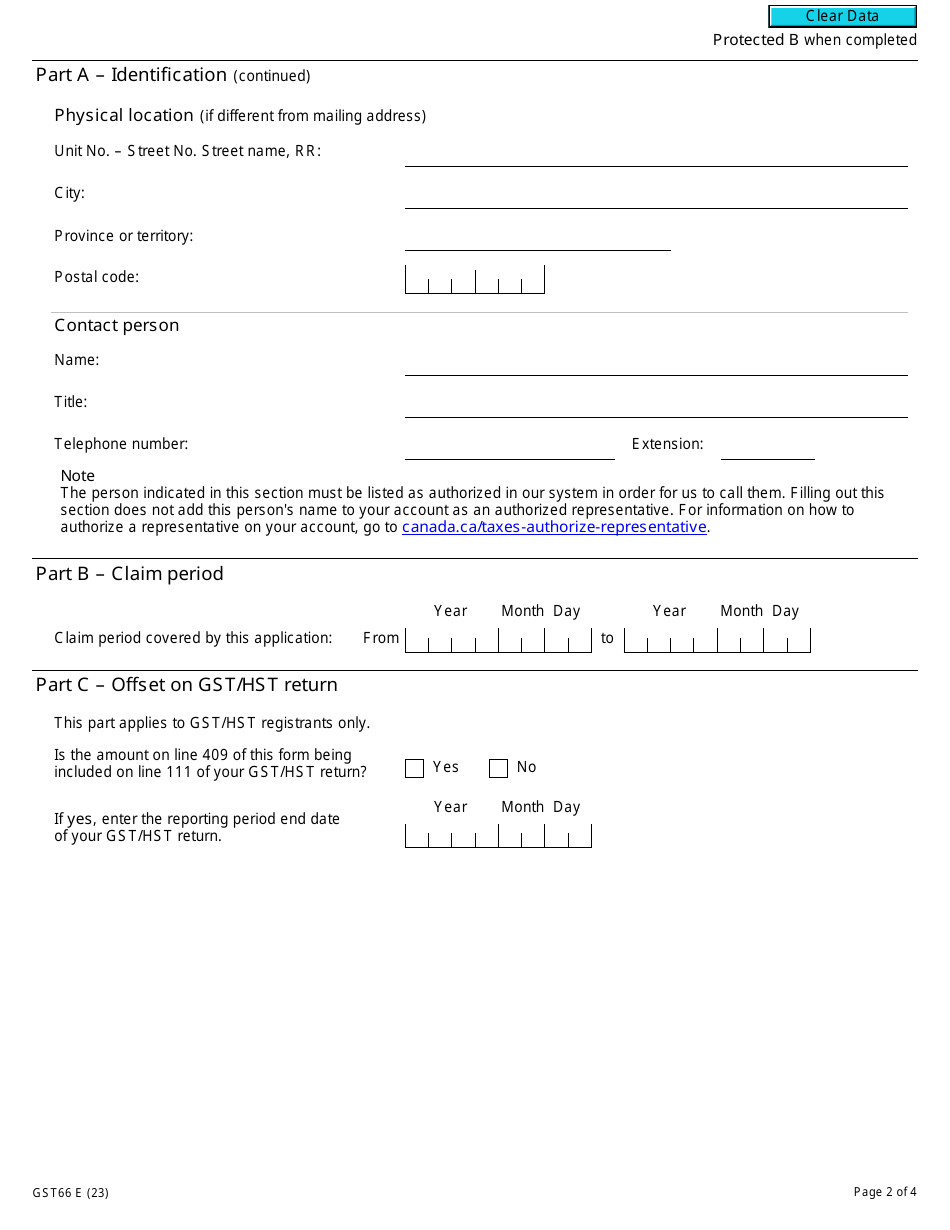

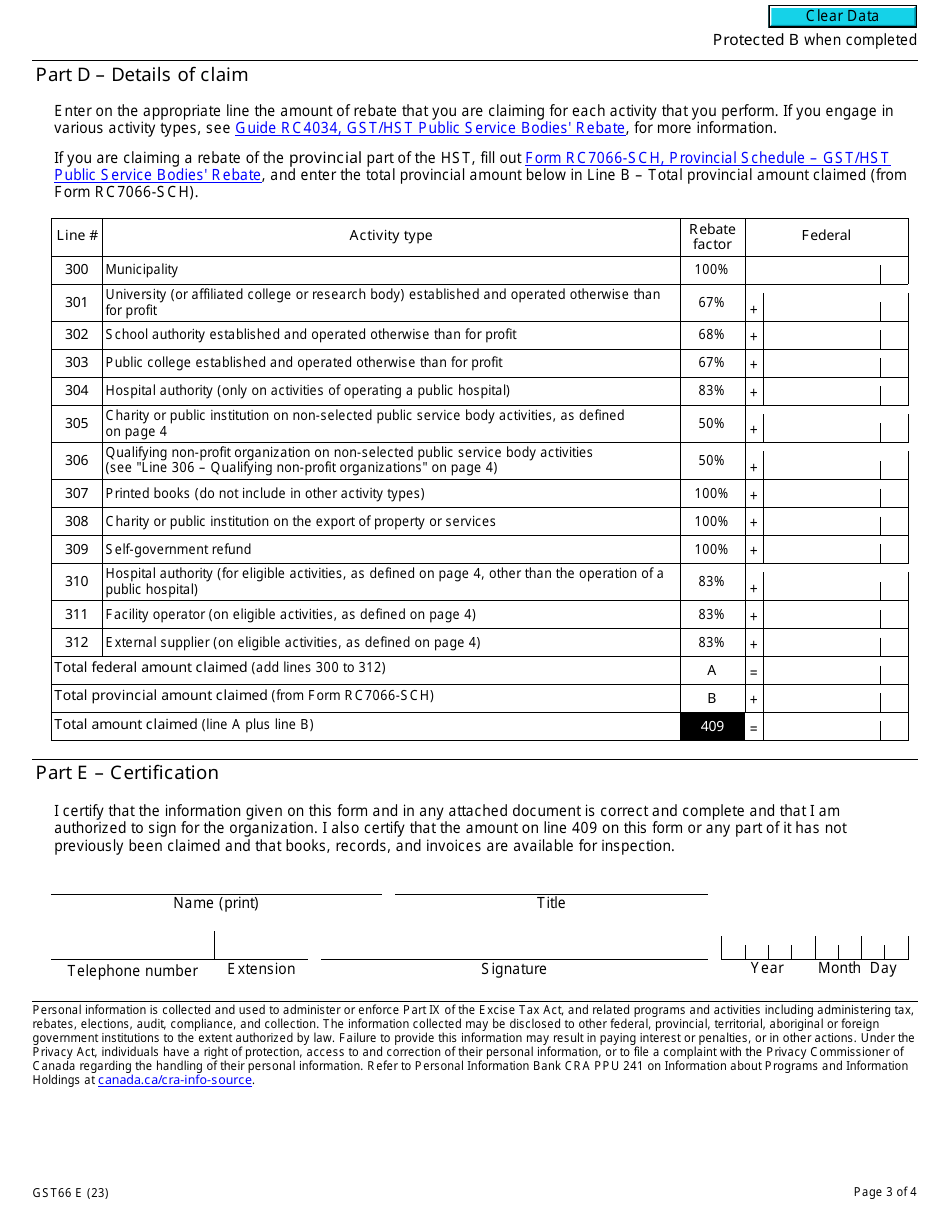

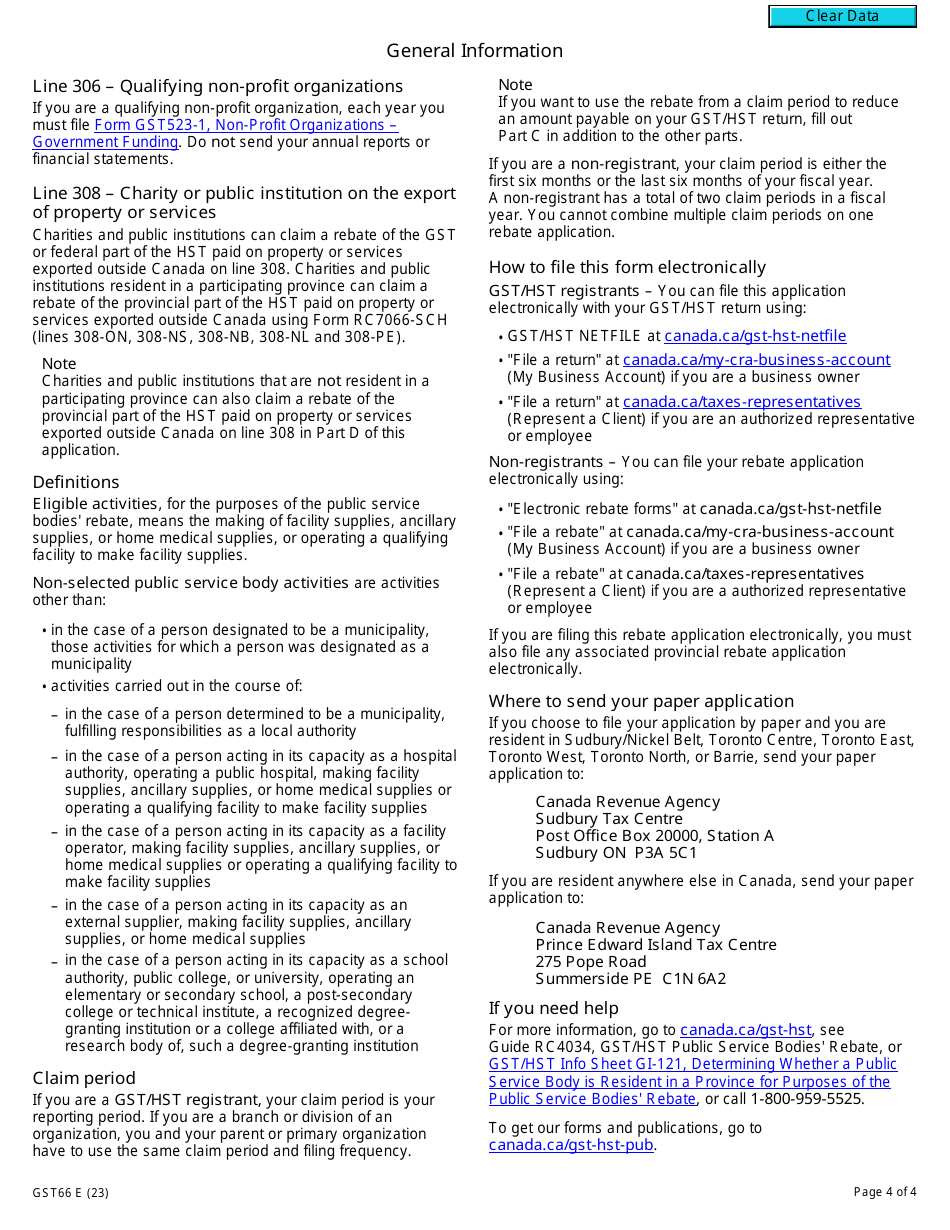

Form GST66 is used in Canada to claim the Goods and Services Tax/Harmonized Sales Tax (GST/HST) public service bodies' rebate and GST self-government refund. The rebate is for qualifying non-profit organizations and public service bodies to recover a part of the GST/HST paid on eligible expenses. The self-government refund is for eligible First Nations individuals or bands to recover the GST/HST paid on eligible purchases and expenses related to their self-government.

The Form GST66 is typically filed by GST/HST public service bodies and GST self-government entities in Canada.

Form GST66 Application for Gst/Hst Public Service Bodies' Rebate and Gst Self-government Refund - Canada - Frequently Asked Questions (FAQ)

Q: What is the GST66 application for?

A: The GST66 application is for claiming the GST/HST public service bodies' rebate and GST self-government refund in Canada.

Q: Who can use the GST66 application?

A: Public service bodies and self-governing Indigenous governments can use the GST66 application.

Q: What is the GST/HST public service bodies' rebate?

A: The GST/HST public service bodies' rebate is a refund of the GST/HST paid or payable by qualifying non-profit organizations, municipalities, universities, schools, and hospitals.

Q: What is the GST self-government refund?

A: The GST self-government refund is a refund of the GST paid or payable by self-governing Indigenous governments.