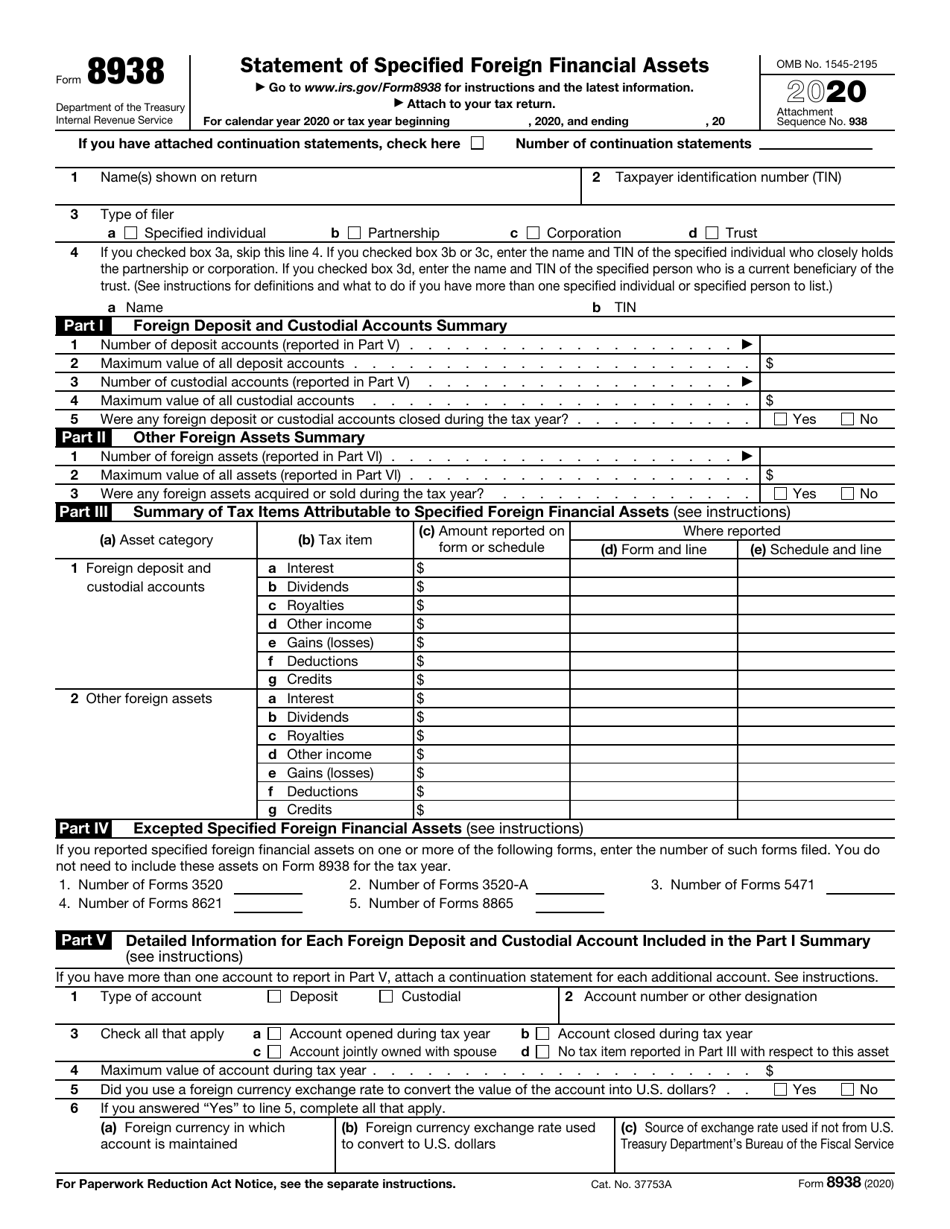

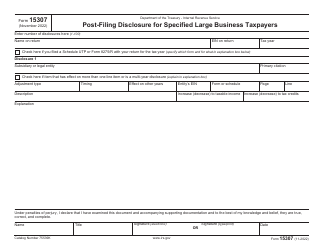

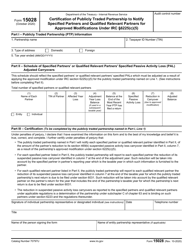

This version of the form is not currently in use and is provided for reference only. Download this version of

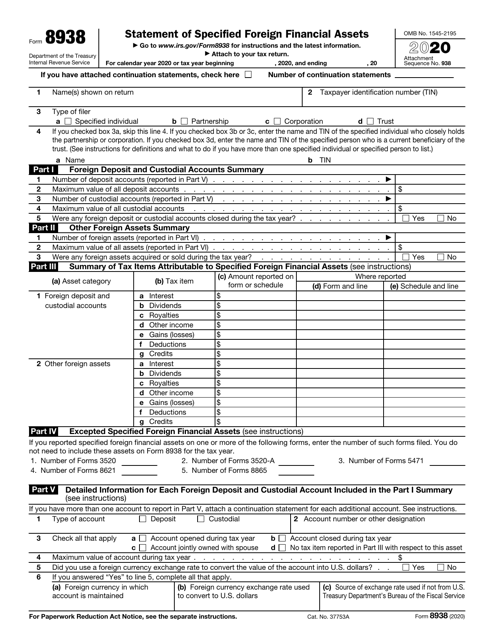

IRS Form 8938

for the current year.

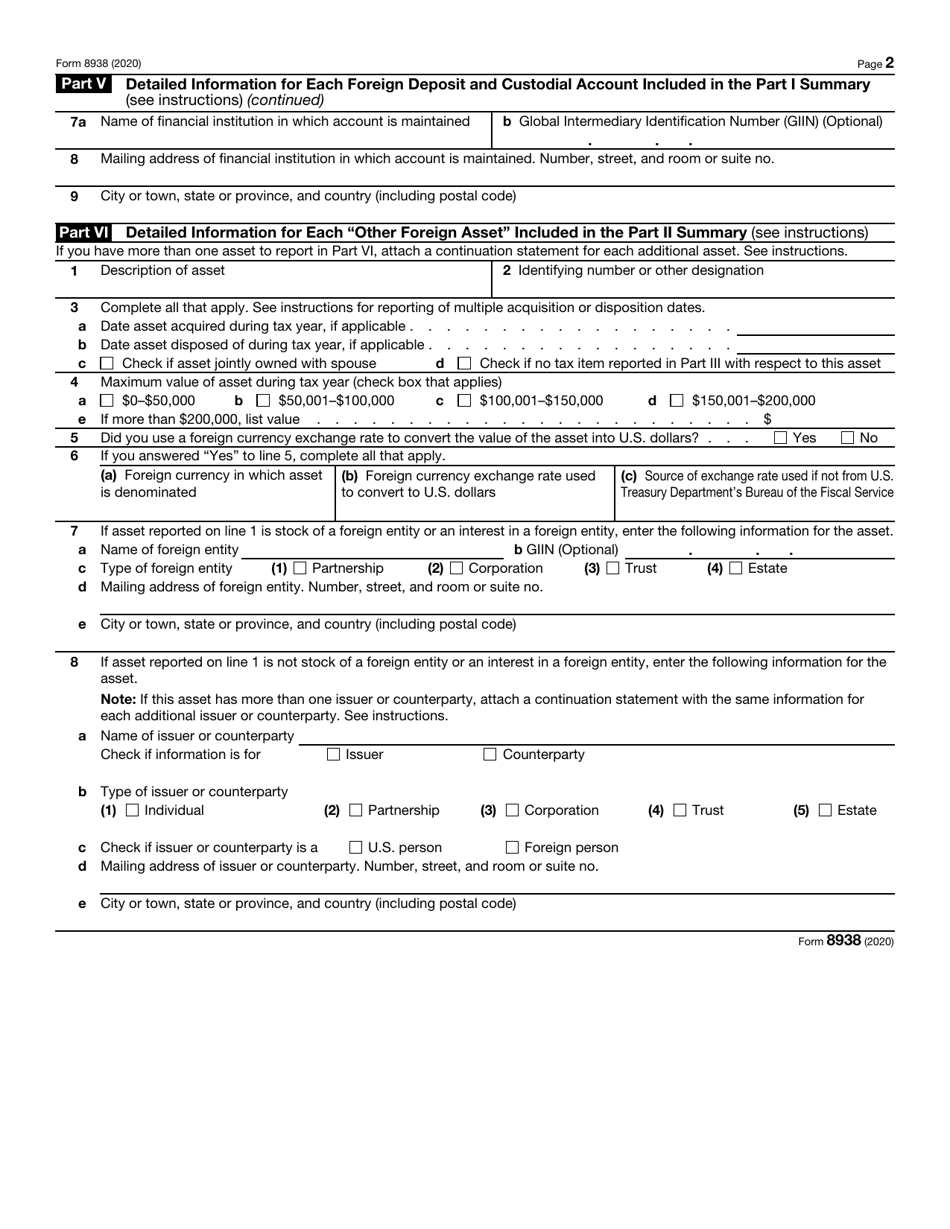

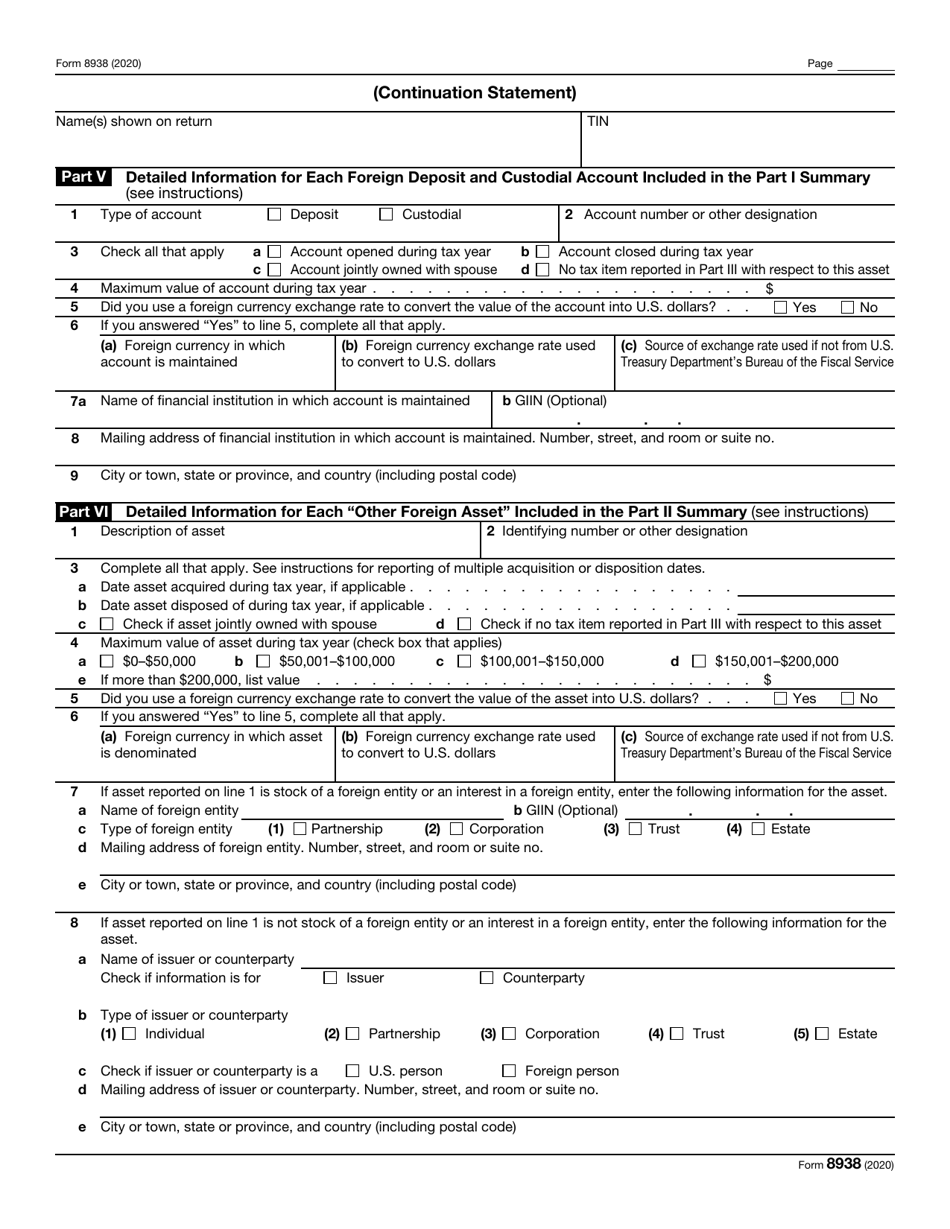

IRS Form 8938 Statement of Specified Foreign Financial Assets

What Is IRS Form 8938?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8938?

A: IRS Form 8938 is a Statement of Specified Foreign Financial Assets.

Q: Who needs to file IRS Form 8938?

A: US taxpayers who have specified foreign financial assets above a certain threshold must file IRS Form 8938.

Q: What are specified foreign financial assets?

A: Specified foreign financial assets include things like bank accounts, brokerage accounts, and certain foreign investments.

Q: What is the threshold for filing IRS Form 8938?

A: The threshold for filing IRS Form 8938 varies depending on marital status and residency.

Q: Is IRS Form 8938 required for foreign bank accounts?

A: Yes, foreign bank accounts are included in the specified foreign financial assets that require filing IRS Form 8938.

Q: Are there penalties for not filing IRS Form 8938?

A: Yes, there can be penalties for failing to file IRS Form 8938 or for filing it incorrectly.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8938 through the link below or browse more documents in our library of IRS Forms.